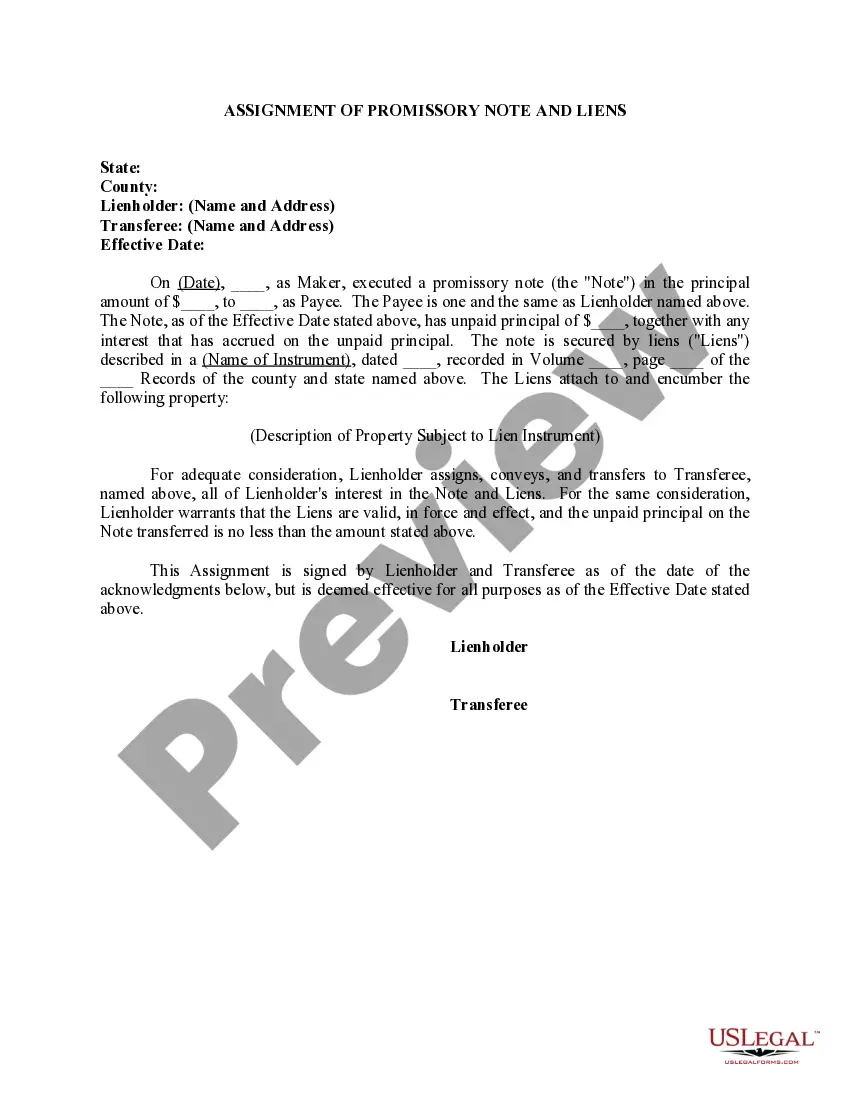

New Hampshire Assignment of Promissory Note & Liens

Description

How to fill out Assignment Of Promissory Note & Liens?

Are you inside a position that you will need files for either enterprise or specific purposes just about every working day? There are a lot of legal file web templates available on the net, but locating kinds you can rely on isn`t effortless. US Legal Forms provides a large number of type web templates, much like the New Hampshire Assignment of Promissory Note & Liens, that are written to meet federal and state needs.

When you are already familiar with US Legal Forms web site and have an account, simply log in. After that, you may obtain the New Hampshire Assignment of Promissory Note & Liens template.

If you do not come with an account and would like to begin to use US Legal Forms, abide by these steps:

- Find the type you will need and make sure it is for the right city/county.

- Take advantage of the Review key to review the shape.

- Read the explanation to ensure that you have chosen the proper type.

- In the event the type isn`t what you`re seeking, take advantage of the Search discipline to discover the type that fits your needs and needs.

- If you get the right type, just click Get now.

- Choose the prices prepare you desire, complete the required information and facts to make your account, and pay for your order with your PayPal or charge card.

- Pick a hassle-free data file formatting and obtain your duplicate.

Locate each of the file web templates you have purchased in the My Forms menu. You can obtain a additional duplicate of New Hampshire Assignment of Promissory Note & Liens whenever, if needed. Just click the needed type to obtain or produce the file template.

Use US Legal Forms, the most considerable variety of legal kinds, to save some time and avoid blunders. The assistance provides expertly produced legal file web templates which can be used for a selection of purposes. Create an account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

A Standard Document used for transferring an interest in an unsecured promissory note to a revocable trust that can be customized for use in any US jurisdiction. This Standard Document contains integrated notes and drafting tips.

A promissory note is a legally binding promise to repay a debt. These agreements could be used for personal loans, student loans, mortgages and more. Promissory note laws vary by state, but they typically include the loan amount, loan terms and signatures from both the lending and borrowing party.

For instance, if the terms of the note are unclear or if there is evidence that the maker did not intend to repay the debt, a court may find that the note is invalid. Additionally, if the payee knew that the maker could not repay the debt when they signed the promissory note, this may also render the agreement invalid.

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.