New Hampshire Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

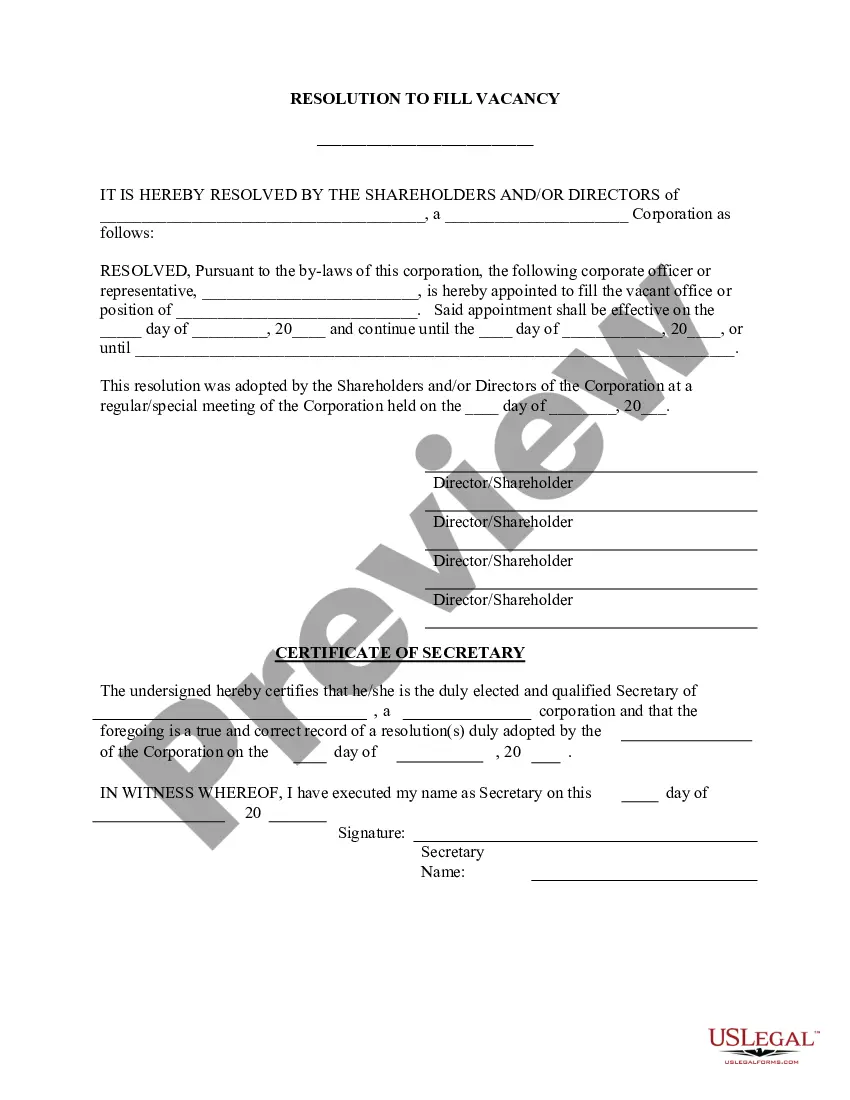

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Discovering the right legal record design could be a battle. Of course, there are a lot of templates available on the net, but how do you obtain the legal kind you want? Take advantage of the US Legal Forms website. The service gives a huge number of templates, like the New Hampshire Assignment of Overriding Royalty Interest (No Proportionate Reduction), which you can use for company and private needs. All the types are inspected by experts and fulfill federal and state requirements.

In case you are presently listed, log in to your account and click the Obtain key to get the New Hampshire Assignment of Overriding Royalty Interest (No Proportionate Reduction). Make use of your account to look with the legal types you might have ordered in the past. Check out the My Forms tab of your own account and obtain one more backup in the record you want.

In case you are a new customer of US Legal Forms, listed below are basic recommendations that you should stick to:

- Initial, be sure you have chosen the proper kind for the city/state. You may check out the shape using the Review key and look at the shape description to guarantee this is the best for you.

- When the kind fails to fulfill your preferences, use the Seach field to find the proper kind.

- Once you are certain the shape is proper, click the Get now key to get the kind.

- Opt for the rates program you want and enter in the necessary information. Build your account and pay for the order utilizing your PayPal account or Visa or Mastercard.

- Opt for the file structure and obtain the legal record design to your system.

- Complete, edit and produce and signal the attained New Hampshire Assignment of Overriding Royalty Interest (No Proportionate Reduction).

US Legal Forms may be the most significant library of legal types that you will find numerous record templates. Take advantage of the service to obtain appropriately-created files that stick to state requirements.

Form popularity

FAQ

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.