This form is used when an Assignor transfers, assigns, and conveys to Assignee an overriding royalty interest in the Leases and all oil, gas, and other minerals produced, saved, and marketed from the Lands and Leases equal to a percentage of 8/8 (the Override ).

New Hampshire Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form

Description

How to fill out Assignment Of Overriding Royalty Interest For Multiple Leases With No Proportionate Reduction - Long Form?

Have you been inside a placement where you will need files for possibly company or person functions nearly every day? There are a lot of legal record themes accessible on the Internet, but discovering versions you can trust isn`t simple. US Legal Forms offers a huge number of kind themes, just like the New Hampshire Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form, that are composed to meet state and federal needs.

In case you are presently informed about US Legal Forms web site and also have a merchant account, simply log in. Next, it is possible to download the New Hampshire Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form web template.

Unless you provide an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you require and ensure it is for your appropriate area/region.

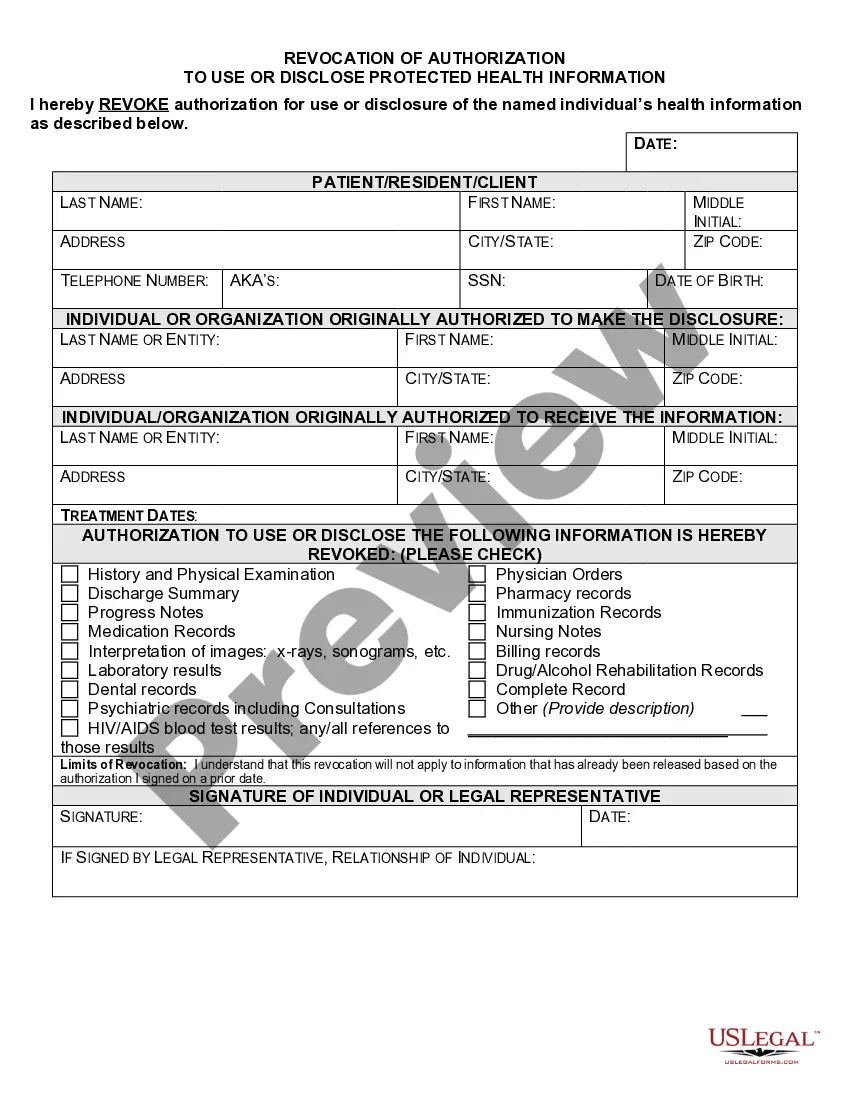

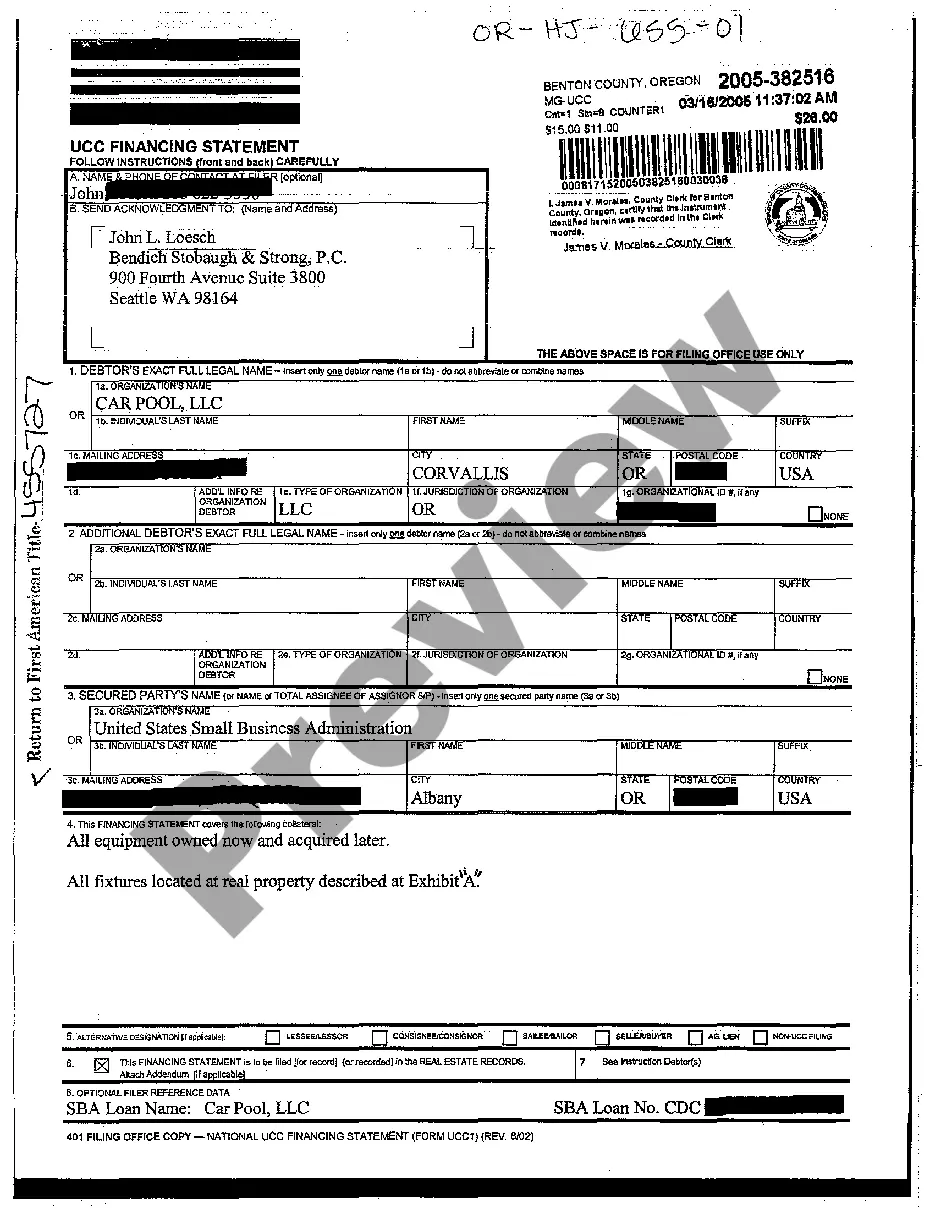

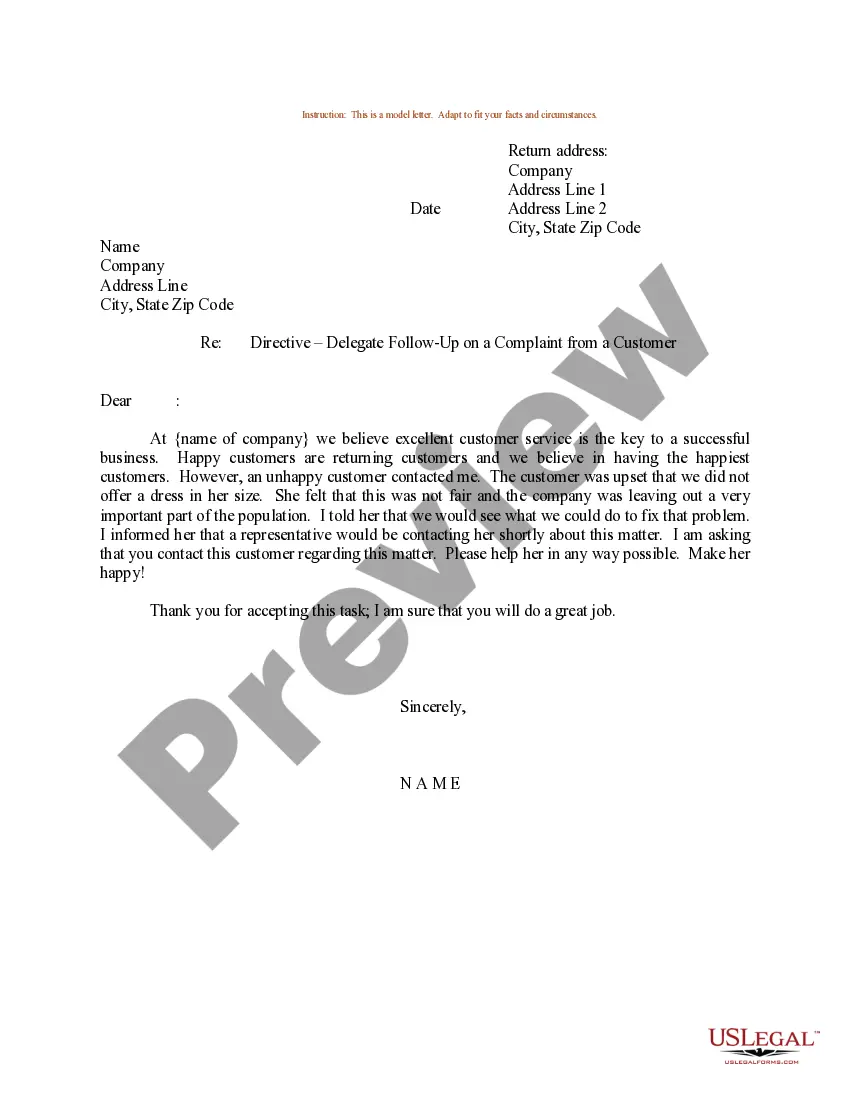

- Utilize the Review option to analyze the shape.

- Look at the information to actually have selected the proper kind.

- In the event the kind isn`t what you are looking for, make use of the Look for field to find the kind that suits you and needs.

- When you find the appropriate kind, click on Purchase now.

- Select the rates plan you want, fill in the necessary info to produce your bank account, and purchase your order making use of your PayPal or credit card.

- Select a handy document structure and download your backup.

Find all the record themes you might have purchased in the My Forms food list. You may get a more backup of New Hampshire Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form at any time, if required. Just go through the necessary kind to download or printing the record web template.

Use US Legal Forms, one of the most extensive assortment of legal varieties, to conserve some time and avoid errors. The services offers expertly made legal record themes which you can use for a variety of functions. Make a merchant account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...