New Hampshire Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool

Description

How to fill out Assignment Of Overriding Royalty Interest With Multiple Leases That Are Non Producing With Reservation Of The Right To Pool?

Are you in a placement where you require papers for both enterprise or personal uses virtually every day time? There are tons of legitimate papers layouts accessible on the Internet, but locating versions you can rely isn`t straightforward. US Legal Forms offers a huge number of develop layouts, just like the New Hampshire Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool, which can be published in order to meet state and federal needs.

When you are previously knowledgeable about US Legal Forms internet site and also have a free account, simply log in. Following that, you can down load the New Hampshire Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool web template.

Unless you have an profile and wish to begin using US Legal Forms, follow these steps:

- Get the develop you require and make sure it is for that appropriate area/region.

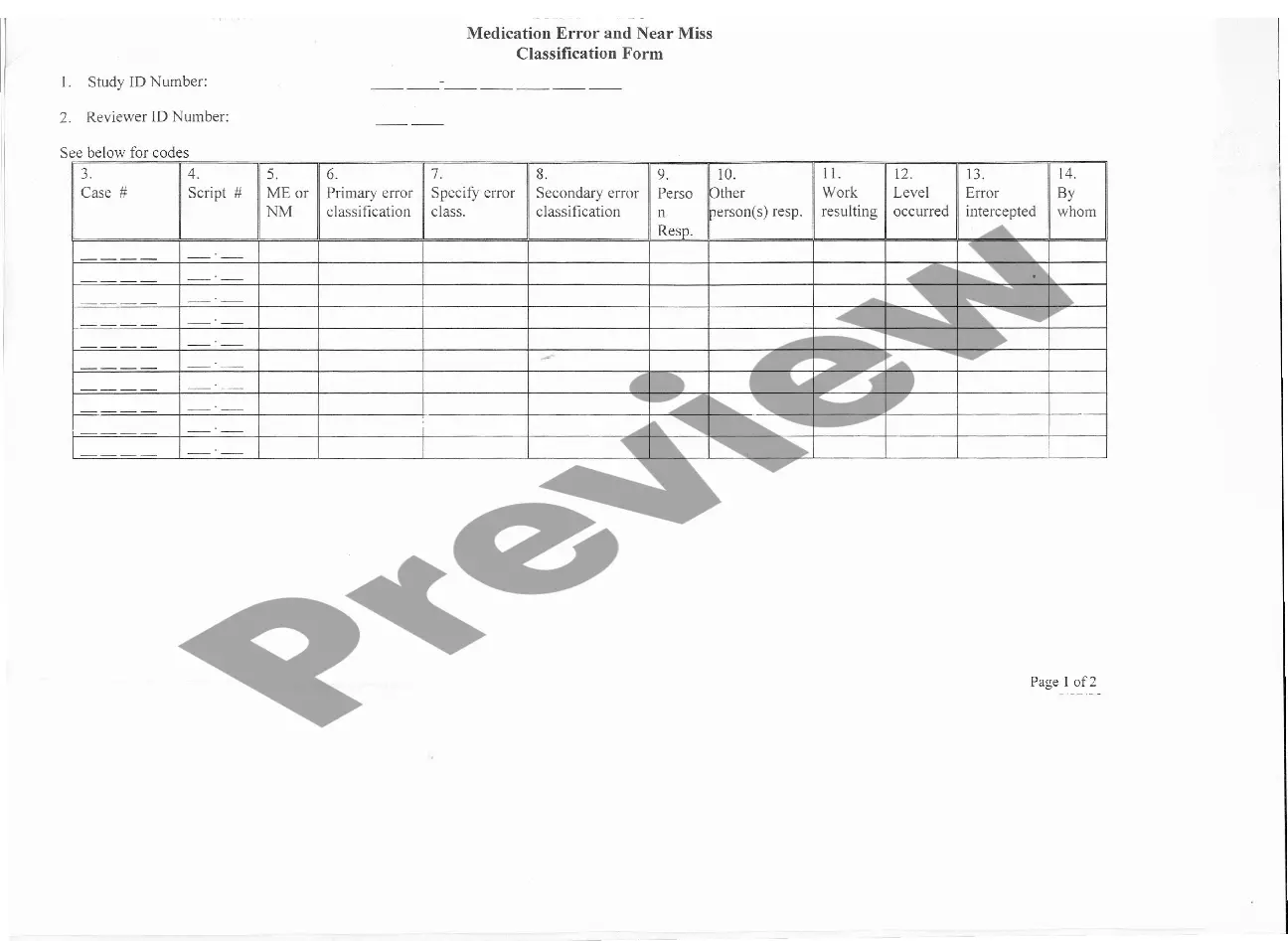

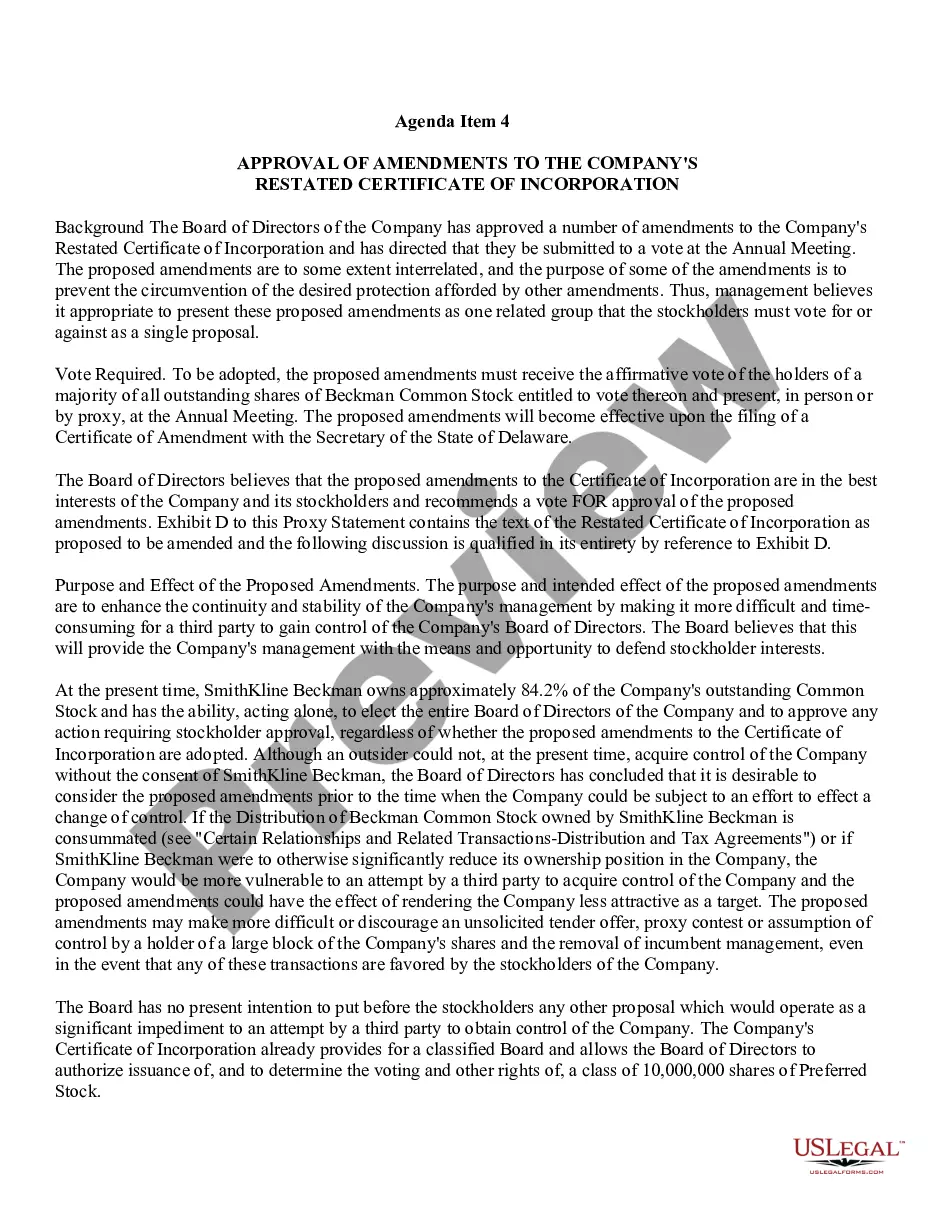

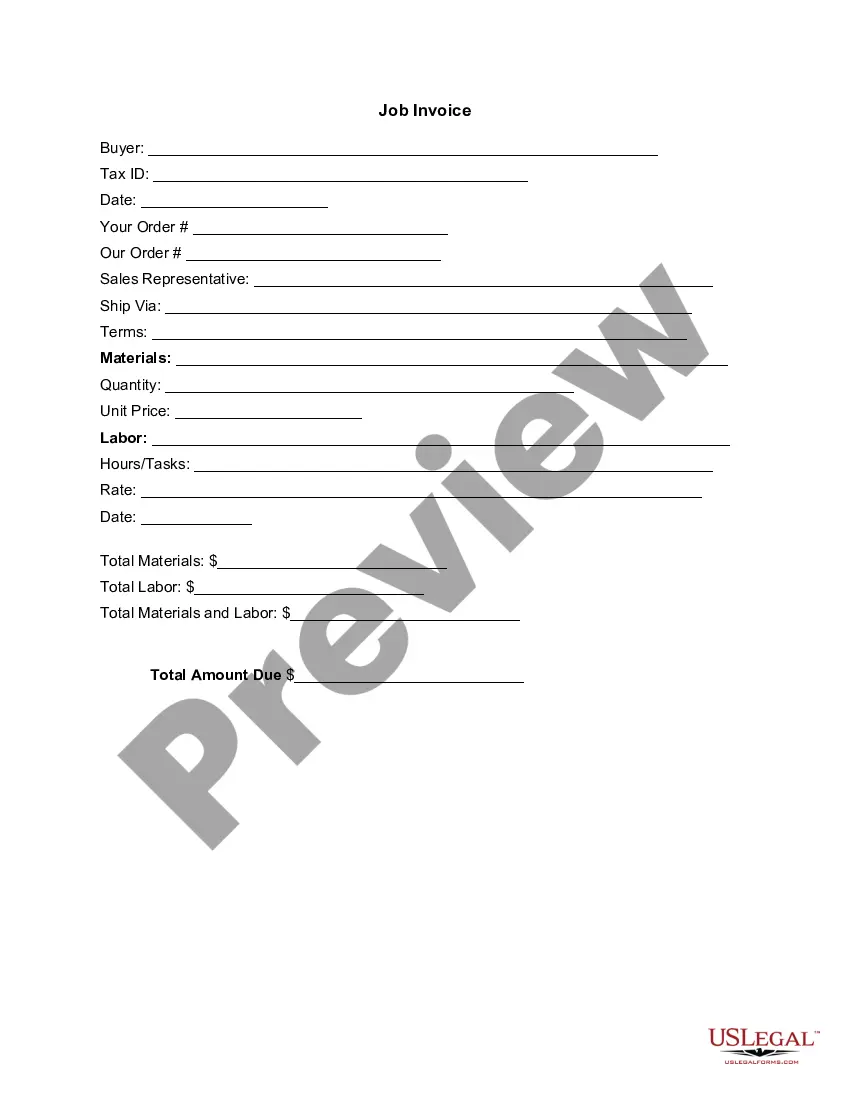

- Make use of the Preview switch to analyze the shape.

- Browse the explanation to ensure that you have selected the proper develop.

- When the develop isn`t what you are looking for, make use of the Look for discipline to obtain the develop that meets your requirements and needs.

- If you discover the appropriate develop, click on Purchase now.

- Select the prices prepare you desire, fill out the specified details to produce your money, and pay money for an order utilizing your PayPal or charge card.

- Decide on a practical data file file format and down load your duplicate.

Locate every one of the papers layouts you might have bought in the My Forms menus. You can obtain a extra duplicate of New Hampshire Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool at any time, if needed. Just select the essential develop to down load or print out the papers web template.

Use US Legal Forms, the most extensive assortment of legitimate varieties, to conserve time and steer clear of blunders. The service offers skillfully produced legitimate papers layouts that you can use for a range of uses. Make a free account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to.

Overriding Royalty Interest Conveyance means an assignment, in the form attached hereto as Exhibit F, pursuant to which Subsidiary Borrower grants to Lender a cost-free overriding royalty interest equal to a percentage determined pursuant to Section 8.5 of the Hydrocarbons and other minerals attributable to Subsidiary ...