New Hampshire Lien and Tax Search Checklist

Description

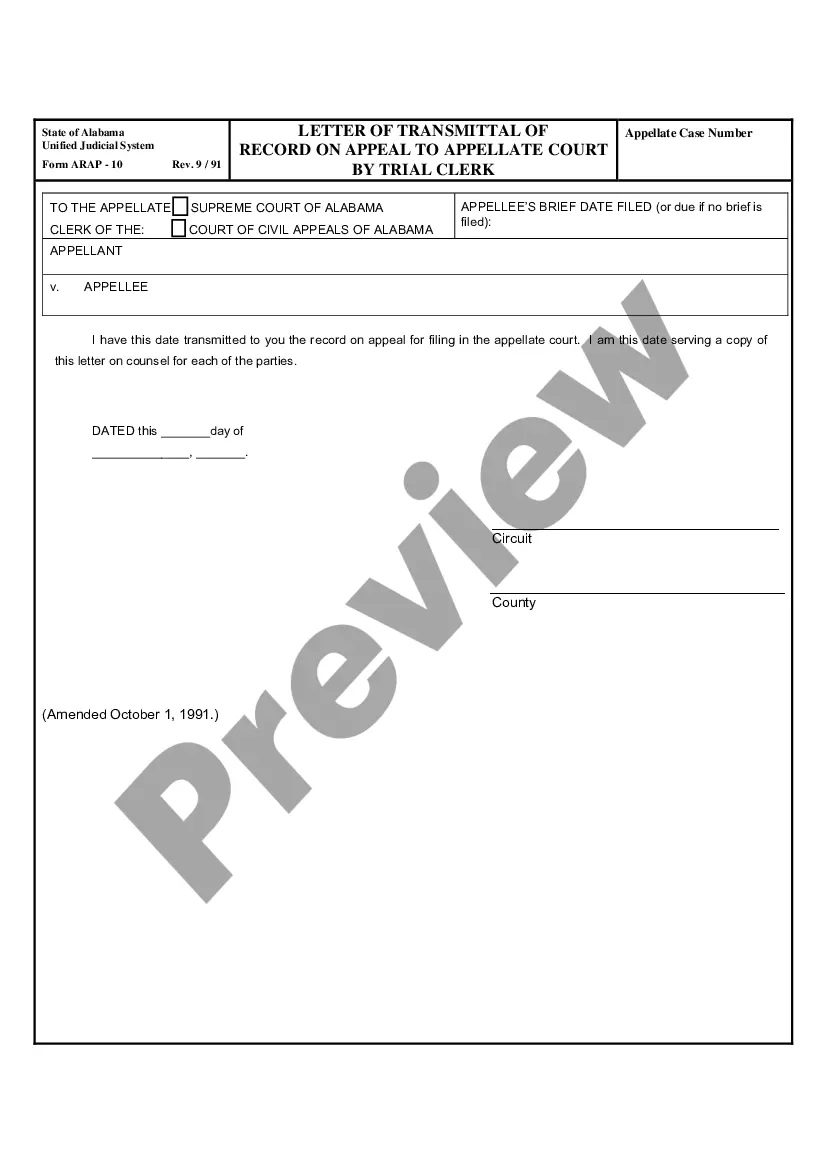

How to fill out Lien And Tax Search Checklist?

Finding the right legal document design can be quite a have a problem. Of course, there are tons of templates available online, but how do you obtain the legal develop you want? Take advantage of the US Legal Forms internet site. The service provides a huge number of templates, for example the New Hampshire Lien and Tax Search Checklist, which can be used for organization and personal demands. All of the kinds are checked by specialists and satisfy federal and state needs.

Should you be presently listed, log in to the bank account and click on the Down load key to have the New Hampshire Lien and Tax Search Checklist. Use your bank account to look throughout the legal kinds you have ordered previously. Proceed to the My Forms tab of the bank account and get another duplicate from the document you want.

Should you be a brand new user of US Legal Forms, listed here are straightforward recommendations for you to adhere to:

- Initial, make certain you have chosen the appropriate develop for your personal city/county. You can look over the shape utilizing the Preview key and browse the shape information to make sure this is basically the right one for you.

- In case the develop fails to satisfy your needs, take advantage of the Seach discipline to discover the appropriate develop.

- When you are positive that the shape is suitable, click on the Buy now key to have the develop.

- Opt for the prices program you desire and enter in the required info. Design your bank account and purchase the order using your PayPal bank account or credit card.

- Select the submit format and acquire the legal document design to the product.

- Complete, edit and print and indicator the acquired New Hampshire Lien and Tax Search Checklist.

US Legal Forms is the greatest library of legal kinds where you can find numerous document templates. Take advantage of the service to acquire expertly-manufactured papers that adhere to status needs.

Form popularity

FAQ

Overview of New Hampshire Taxes New Hampshire is known as a low-tax state. But while the state has no personal income tax and no sales tax, it has the fourth-highest property tax rates of any U.S. state, with an average effective rate of 1.77%. Consequently, the median annual property tax payment here is $6,097.

Which NH towns have the lowest property taxes? Windsor ($3.39) New Castle ($4.48) Moultonborough ($4.78) Bartlett ($4.97) Tuftonboro ($6.44)

Metros with the lowest property taxes Birmingham, Ala. Median property taxes paid ? all homes: $995. Median property taxes paid ? homes with a mortgage: $1,152. ... New Orleans. Median property taxes paid ? all homes: $1,506. Median property taxes paid ? homes with a mortgage: $1,733. ... Memphis, Tenn.

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

A tax lien is placed on any property with an overdue tax balance. The process is completely regulated by NH State Laws (aka RSAs). The process begins any time after the 30 day due date of the notice of taxes. It is a very time consuming process for the tax collector's office and ultimately very costly to the taxpayer.

Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security interests, and similar items. Also, the liened property may be subjected to tax sale.

Requirements: Must be a New Hampshire resident for 3 consecutive years. Must be 65 on or before April 1st (or spouse) The property for which the exemption is applied must be the legal residence of applicant(s) Property Transfers: the property cannot be transferred within the last 5 years from a blood relative or marriage.