New Hampshire Self-Employed Animal Exercise Services Contract

Description

How to fill out Self-Employed Animal Exercise Services Contract?

If you wish to finish, obtain, or print legal document templates, utilize US Legal Forms, the most comprehensive assortment of legal documents available online.

Take advantage of the site's straightforward and user-friendly search feature to locate the forms you need. A range of templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the New Hampshire Self-Employed Animal Exercise Services Contract in just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the New Hampshire Self-Employed Animal Exercise Services Contract. Every legal document template you acquire is yours indefinitely. You have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again. Compete and acquire, and print the New Hampshire Self-Employed Animal Exercise Services Contract with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to receive the New Hampshire Self-Employed Animal Exercise Services Contract.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/region.

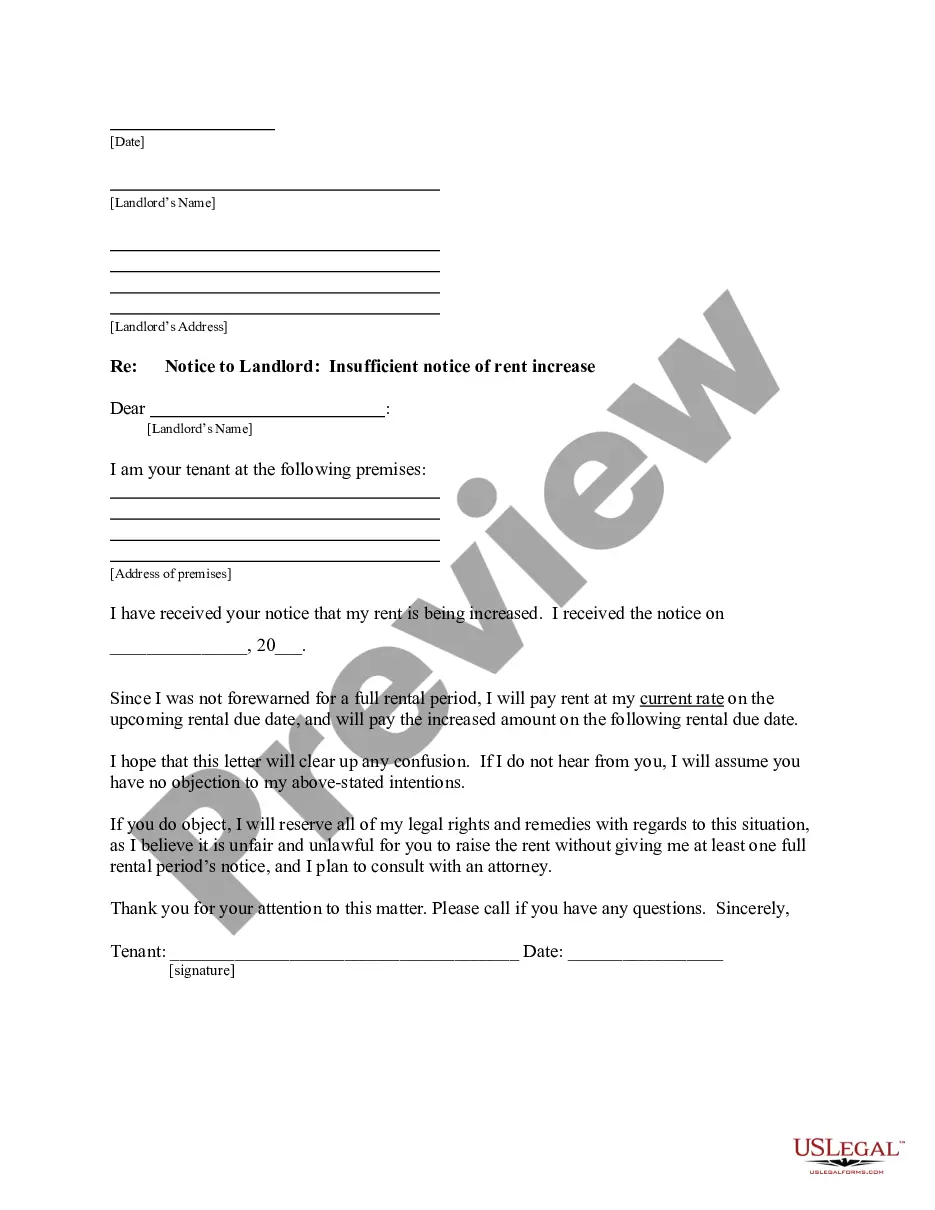

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

Connecticut law mandates that service dogs must be allowed in public spaces, ensuring access for individuals with disabilities. While this law is specific to Connecticut, it reflects the broader principles found in the ADA. If you're in New Hampshire and considering a New Hampshire Self-Employed Animal Exercise Services Contract, being aware of laws from neighboring states can provide useful insights into best practices.

Emotional Support Animal (ESA) owners have certain rights, primarily related to housing. Under the Fair Housing Act, landlords must make reasonable accommodations for ESAs, even in no-pet policies. If you are establishing a business around animal services, like a New Hampshire Self-Employed Animal Exercise Services Contract, being informed about ESA rights can enhance your service offerings and customer trust.

Service dogs must be trained to perform specific tasks that assist individuals with disabilities. Additionally, the dog must be under the control of its handler at all times. When developing a New Hampshire Self-Employed Animal Exercise Services Contract, it's important to understand these requirements to ensure compliance and to offer the best services to your clients.

Private businesses must allow service animals as mandated by the ADA. This requirement fosters an inclusive environment for individuals with disabilities. If you're creating a New Hampshire Self-Employed Animal Exercise Services Contract, considering the inclusion of service animal policies will help your business align with legal obligations.

Yes, under the Americans with Disabilities Act (ADA), you must allow service dogs in your business. This law applies to all public accommodations, ensuring individuals with disabilities can access services and facilities. If you are drafting a New Hampshire Self-Employed Animal Exercise Services Contract, it's essential to include provisions regarding the acceptance of service animals to comply with legal standards.

In New Hampshire, there is no statewide limit on the number of dogs you can own. However, local ordinances may impose restrictions, so it's crucial to check your town or city regulations. If you are considering starting a business related to dog ownership, such as offering services under a New Hampshire Self-Employed Animal Exercise Services Contract, understanding these local laws is vital.

The number of dogs allowed on one property in New Hampshire can depend on local zoning laws and ordinances. Some municipalities may have specific limits, while others may not. Therefore, it's crucial to verify the rules relevant to your area. If you intend to start a business, a New Hampshire Self-Employed Animal Exercise Services Contract can help you navigate these regulations effectively.

In New Hampshire, there is no specific limit on the number of dogs you can own at the state level. However, local laws may set restrictions. It’s essential to be aware of these local regulations to avoid any legal issues. When drafting a New Hampshire Self-Employed Animal Exercise Services Contract, recognizing these limits can ensure compliance and peace of mind.

Yes, you can legally ask for proof of service for a dog in New Hampshire. This proof helps ensure that the animal is properly trained and meets any necessary service requirements. If you are entering into a New Hampshire Self-Employed Animal Exercise Services Contract, including clauses about proof of service can protect both you and your clients.

The number of dogs allowed per household can vary by town or city in New Hampshire. While some areas impose limits, others do not. Therefore, it’s wise to research your local regulations. If you plan to provide services, a New Hampshire Self-Employed Animal Exercise Services Contract can help clarify any responsibilities regarding the number of animals.