New Hampshire Self-Employed Supplier Services Contract

Description

How to fill out Self-Employed Supplier Services Contract?

Have you found yourself in a scenario where you require documents for potential business or specific purposes almost every time? There are numerous legal document templates accessible online, but locating forms you can trust is not simple.

US Legal Forms provides a vast array of form templates, including the New Hampshire Self-Employed Supplier Services Contract, which can be tailored to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms site and possess an account, simply Log In. After that, you can download the New Hampshire Self-Employed Supplier Services Contract template.

Access all of the document templates you have purchased in the My documents menu. You can download an additional copy of the New Hampshire Self-Employed Supplier Services Contract at any time if needed. Click the required form to download or print the document template.

Utilize US Legal Forms, the most comprehensive selection of legal forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- Obtain the form you need and ensure it is for the correct city/state.

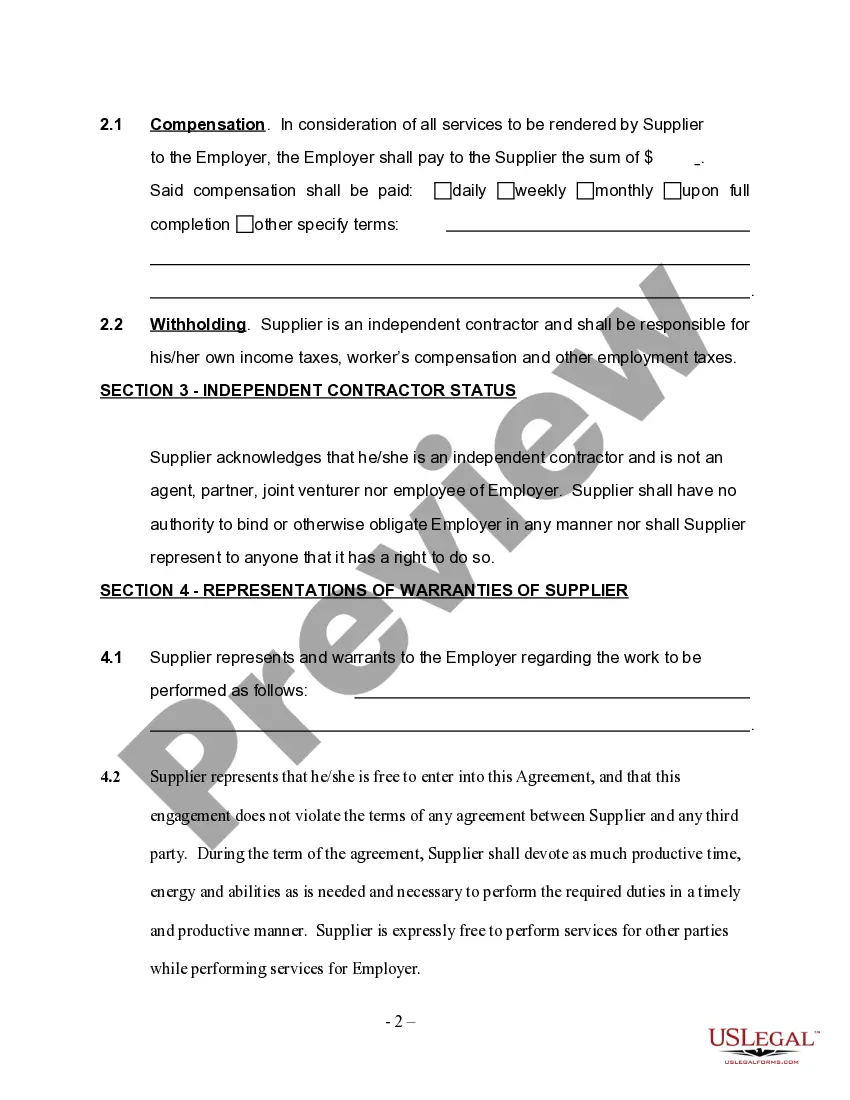

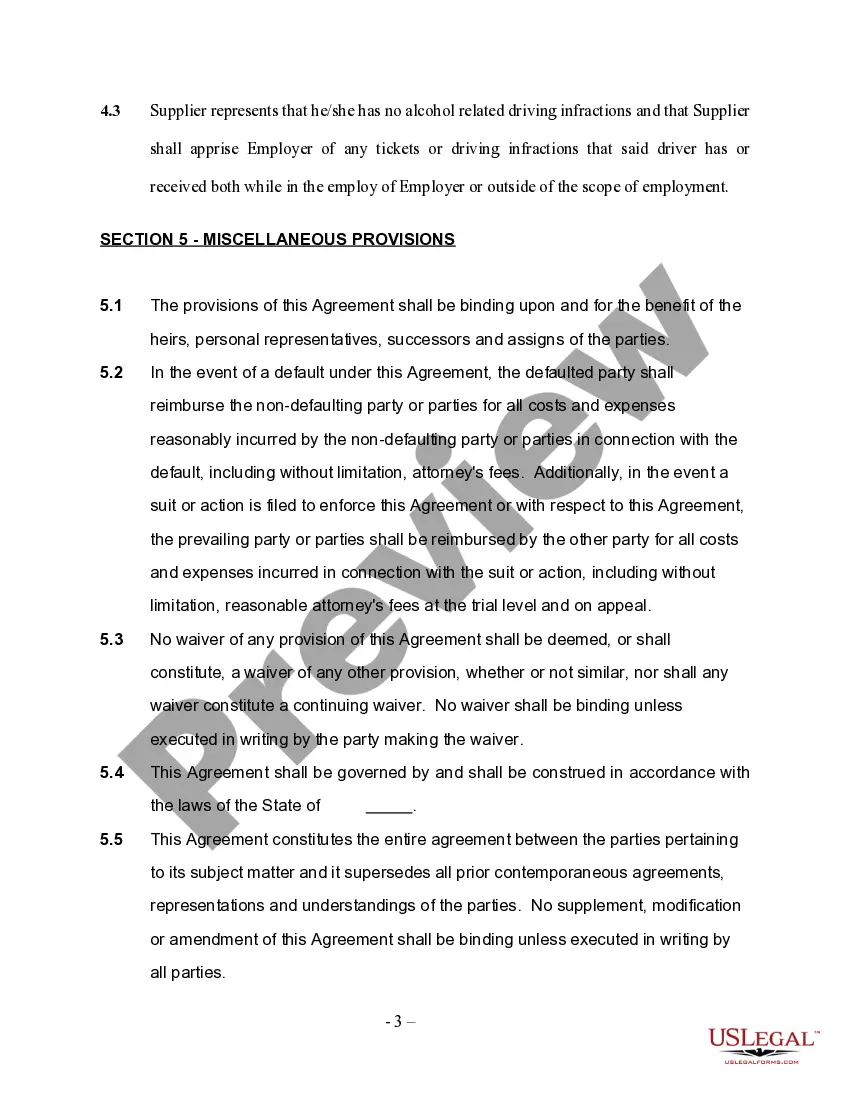

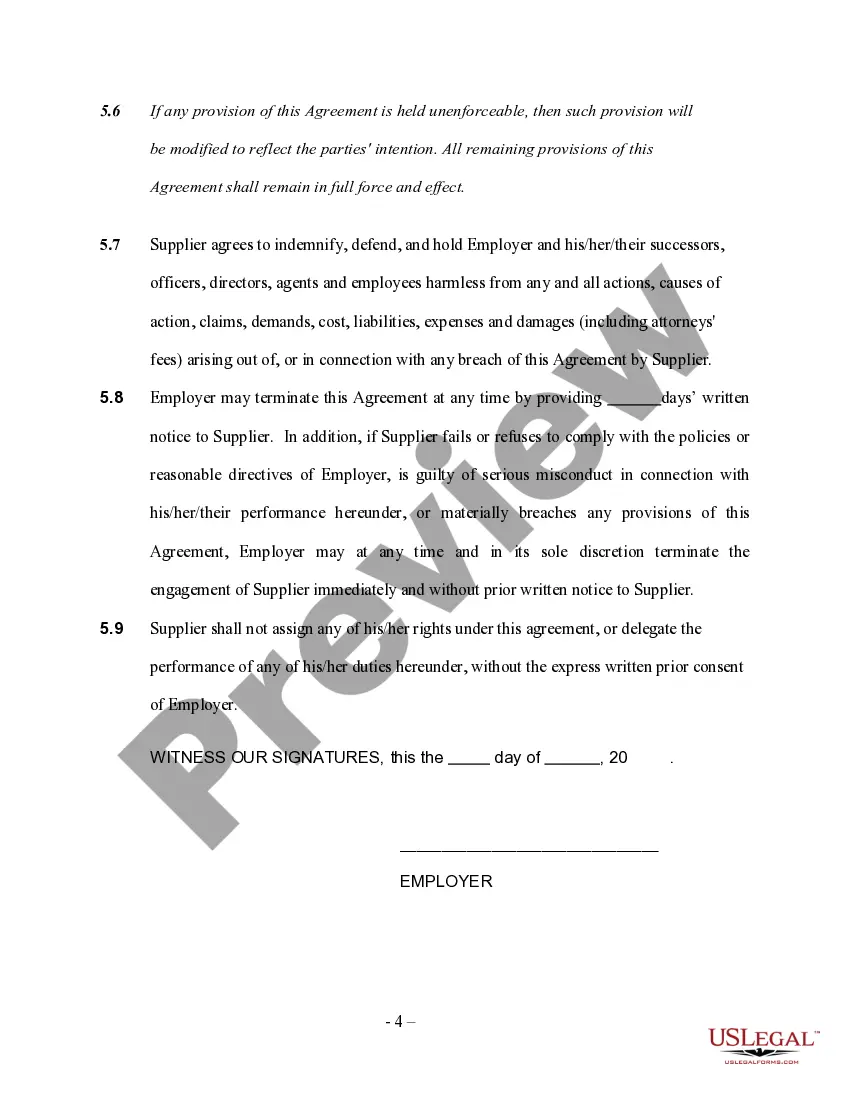

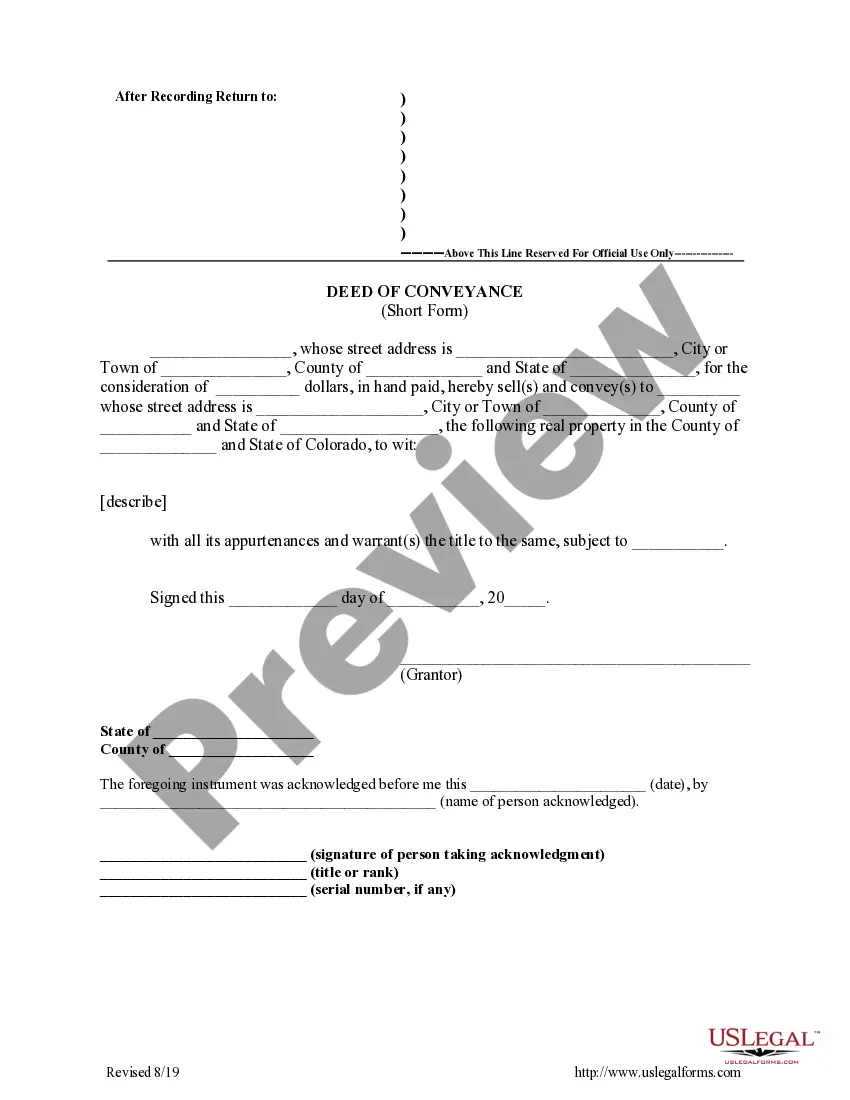

- Utilize the Preview button to review the form.

- Examine the description to confirm that you have chosen the right document.

- If the form is not what you’re looking for, use the Lookup area to find the document that fits your needs and requirements.

- Once you find the suitable form, click Buy now.

- Select the pricing plan you prefer, enter the necessary information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

You can certainly write your own service agreement, but it's important to ensure that it covers all necessary legal aspects. Consider including details such as payment terms, deliverables, and termination clauses. A New Hampshire Self-Employed Supplier Services Contract template from uslegalforms can provide you with a solid foundation, ensuring that you include all critical elements in your agreement.

Yes, having a contract is highly recommended for self-employed individuals. A contract helps define the terms of your work, payment schedules, and other essential details that can prevent disputes. By using a New Hampshire Self-Employed Supplier Services Contract, you ensure that you and your clients are on the same page, fostering a successful working relationship.

While you can freelance without a contract, doing so may expose you to risks such as non-payment or miscommunication about the project scope. A contract serves as a critical tool for establishing clear expectations and protecting your rights. Utilizing a New Hampshire Self-Employed Supplier Services Contract can help you engage clients with confidence and professionalism.

Yes, it is legal to work without a signed contract; however, this can lead to complications regarding payment and expectations. Without a clear agreement, misunderstandings can arise, potentially harming your professional relationships. To safeguard your interests, consider drafting a New Hampshire Self-Employed Supplier Services Contract, which formalizes your agreements and provides clarity.

Self-employed individuals in New Hampshire must adhere to certain legal requirements, including registering their business and obtaining necessary permits or licenses. Additionally, they must comply with tax regulations and ensure proper record-keeping. A New Hampshire Self-Employed Supplier Services Contract can help outline these requirements, ensuring you operate within the law while providing services.

If you are employed without a contract, you may face uncertainties regarding your rights and obligations. This lack of clarity can lead to disputes over payment, scope of work, and termination conditions. To avoid these issues, consider implementing a New Hampshire Self-Employed Supplier Services Contract, which clearly defines your terms and protects your interests.

Contract law in New Hampshire focuses on the legal obligations created when parties enter into an agreement. It requires that contracts meet specific criteria to be enforceable, including clarity and mutual agreement. If you're drafting a New Hampshire Self-Employed Supplier Services Contract, familiarize yourself with these legal principles to ensure your contract is valid and protects your interests.

In New Hampshire, the approval process for an LLC typically takes about 1-2 weeks, depending on the method of filing. Online submissions generally result in faster processing times. Once your LLC is established, you can confidently enter into a New Hampshire Self-Employed Supplier Services Contract, knowing your business is officially recognized.

Contract law in New Hampshire is governed by the principles established in common law and statutory law. It emphasizes the importance of the elements of a contract, such as mutual consent and consideration. When creating a New Hampshire Self-Employed Supplier Services Contract, understanding these legal foundations is crucial to ensure your contract is enforceable.

The 72-hour rule in New Hampshire allows consumers to cancel certain contracts within three days of signing. This rule is especially relevant for contracts involving home improvements or sales made in a consumer's home. If you're a supplier drafting a New Hampshire Self-Employed Supplier Services Contract, being aware of this rule helps ensure compliance and protects your business interests.