New Hampshire Coaching Services Contract - Self-Employed

Description

How to fill out Coaching Services Contract - Self-Employed?

Are you presently in the position where you require documents for occasional business or particular purposes nearly every day? There are numerous valid document templates accessible online, but finding those you can trust is not straightforward.

US Legal Forms offers thousands of template designs, such as the New Hampshire Coaching Services Contract - Self-Employed, which are crafted to comply with state and federal requirements.

If you are currently acquainted with the US Legal Forms site and possess an account, just Log In. After that, you can download the New Hampshire Coaching Services Contract - Self-Employed template.

Find all of the document templates you have purchased in the My documents menu. You can download an additional copy of the New Hampshire Coaching Services Contract - Self-Employed at any time if needed. Click the necessary form to download or print the document template.

Utilize US Legal Forms, the largest collection of authentic forms, to save time and minimize mistakes. The service provides properly crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- Locate the document you need and ensure it corresponds to the correct city/region.

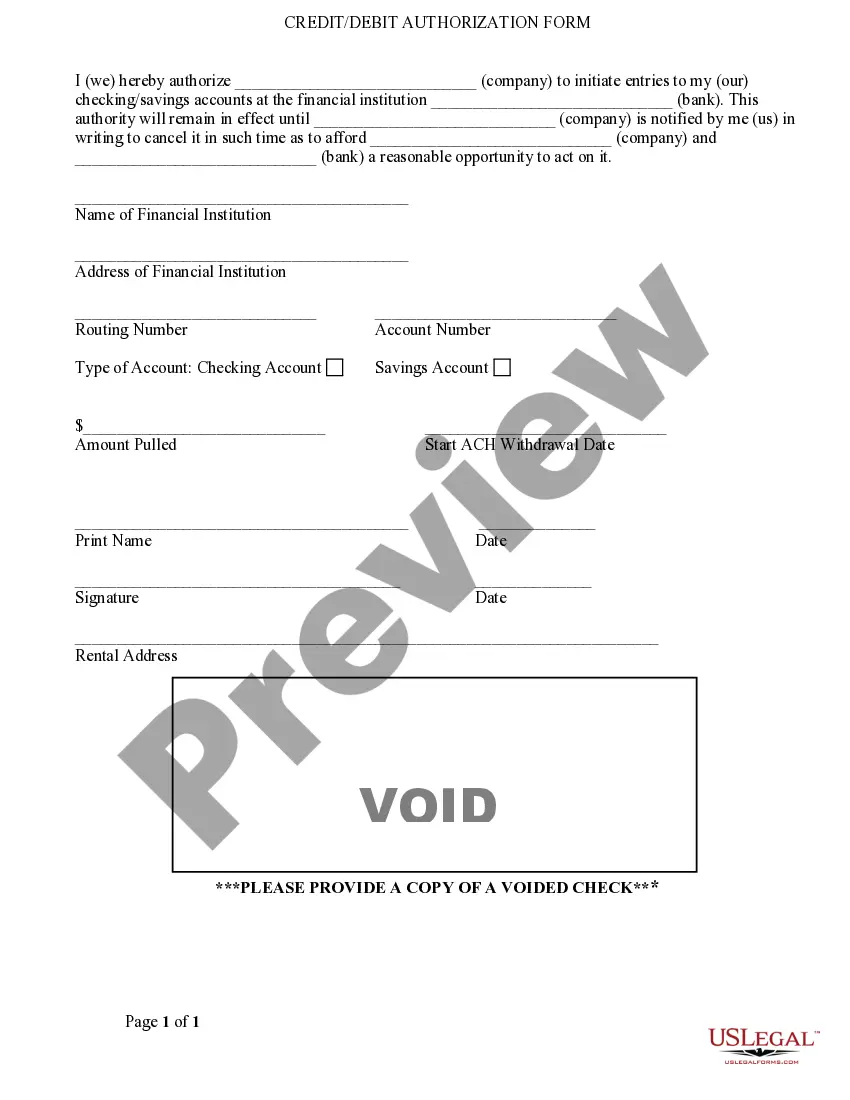

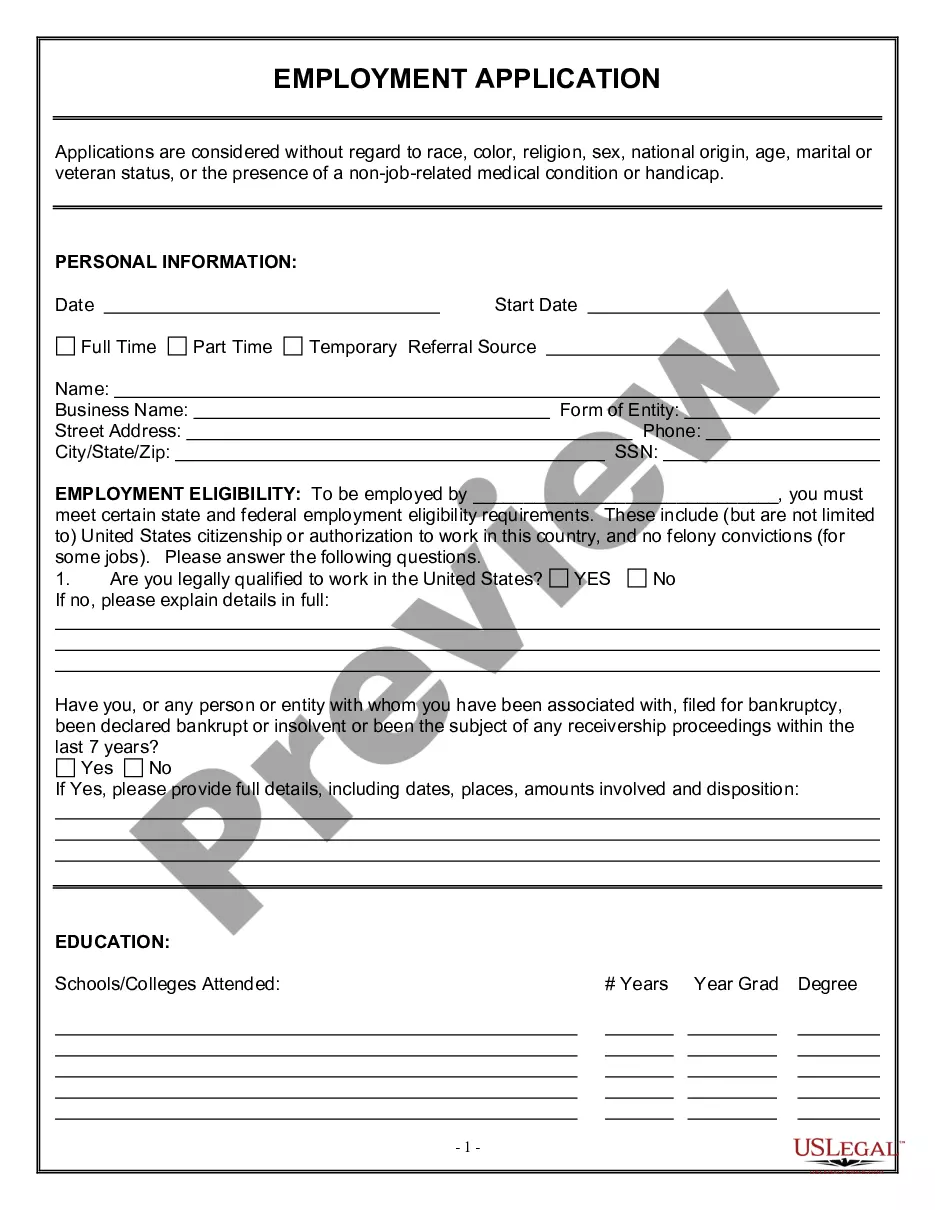

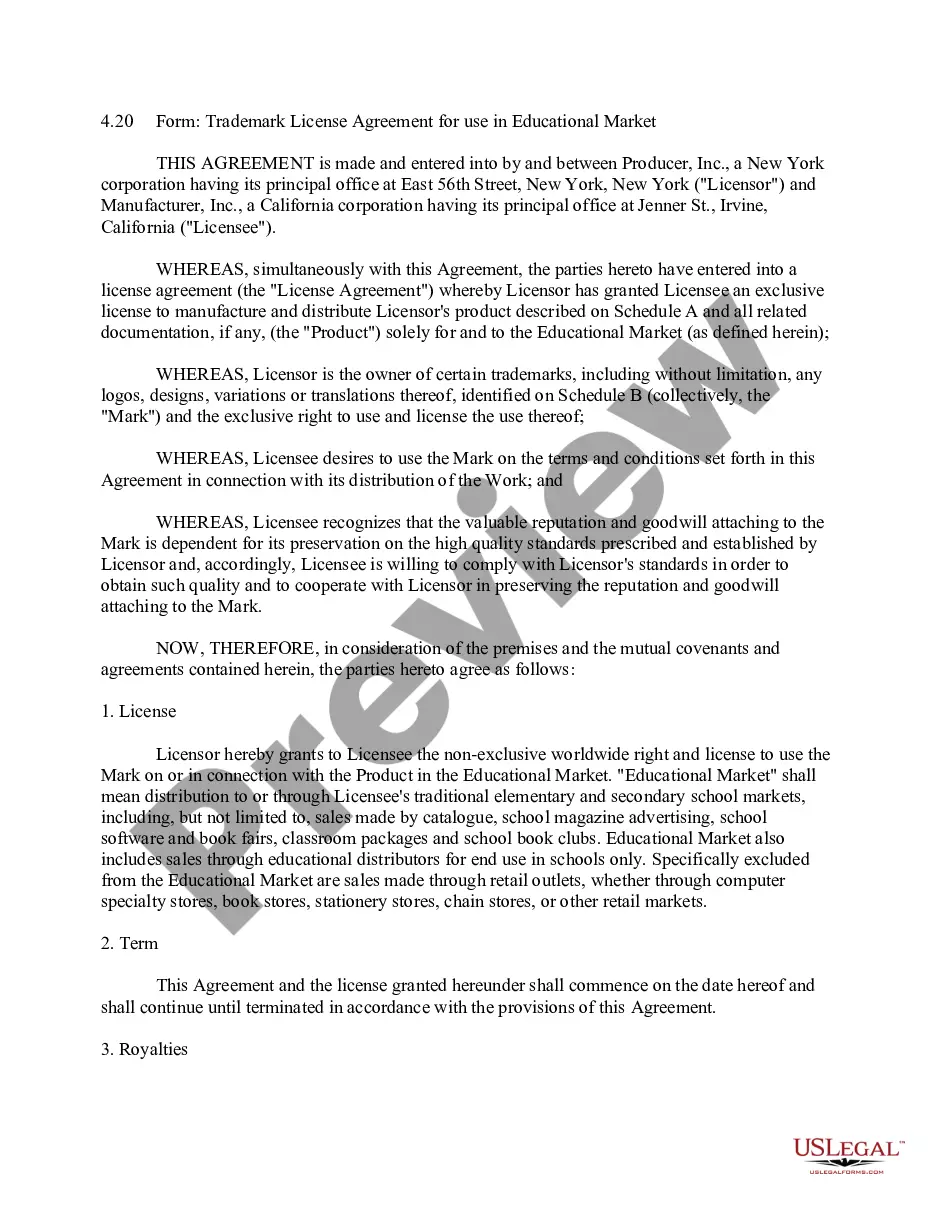

- Use the Preview button to review the form.

- Examine the details to confirm that you have selected the correct document.

- If the form is not what you're looking for, use the Search field to find the document that meets your needs and criteria.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you desire, fill in the required information for payment, and complete the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

In New Hampshire, only interest and dividends are subject to taxation. This unique tax structure means most forms of earned income, including wages and self-employment income, are not taxed. Coaches using a New Hampshire Coaching Services Contract - Self-Employed can benefit from understanding these tax implications, allowing them to allocate resources effectively.

Yes, a coach generally operates as an independent contractor, providing services under their own terms. This status allows for flexibility and autonomy in the coaching process. By utilizing a New Hampshire Coaching Services Contract - Self-Employed, coaches can establish clear boundaries and expectations with their clients.

Several states do not impose a self-employment tax, with examples including Florida and Texas. These states can be appealing for self-employed individuals, including coaches. While New Hampshire is not a self-employment tax state either, having a solid New Hampshire Coaching Services Contract - Self-Employed can further solidify your financial and legal standing.

In New Hampshire, there is no tax on self-employment income specifically. Instead, the state focuses on taxing interest and dividends. If you're self-employed under a New Hampshire Coaching Services Contract - Self-Employed, you can focus on your business growth without worrying about state income tax on your earnings.

New Hampshire does not impose a state income tax; however, it does tax interest and dividends. For self-employed individuals receiving 1099 income, it's important to track earnings carefully. A New Hampshire Coaching Services Contract - Self-Employed can provide clear documentation of payments received, which is useful when reporting taxes.

A coaching contract should clearly outline the services provided, payment terms, and duration of the agreement. Additionally, it should include confidentiality clauses and any relevant disclaimers. With a well-structured New Hampshire Coaching Services Contract - Self-Employed, both coach and client can avoid misunderstandings and ensure a productive partnership.

The 72 hour rule in New Hampshire refers to the requirement that a self-employed individual must provide a written contract to a client for services rendered. Specifically, if the agreement involves coaching services, it becomes necessary to document the terms within this time frame. This requirement ensures clarity for both parties and protects your interests under the New Hampshire Coaching Services Contract - Self-Employed. By adhering to this rule and using platforms like USLegalForms, you can easily create legally binding contracts that meet all state requirements.