New Hampshire Shared Earnings Agreement between Fund & Company

Description

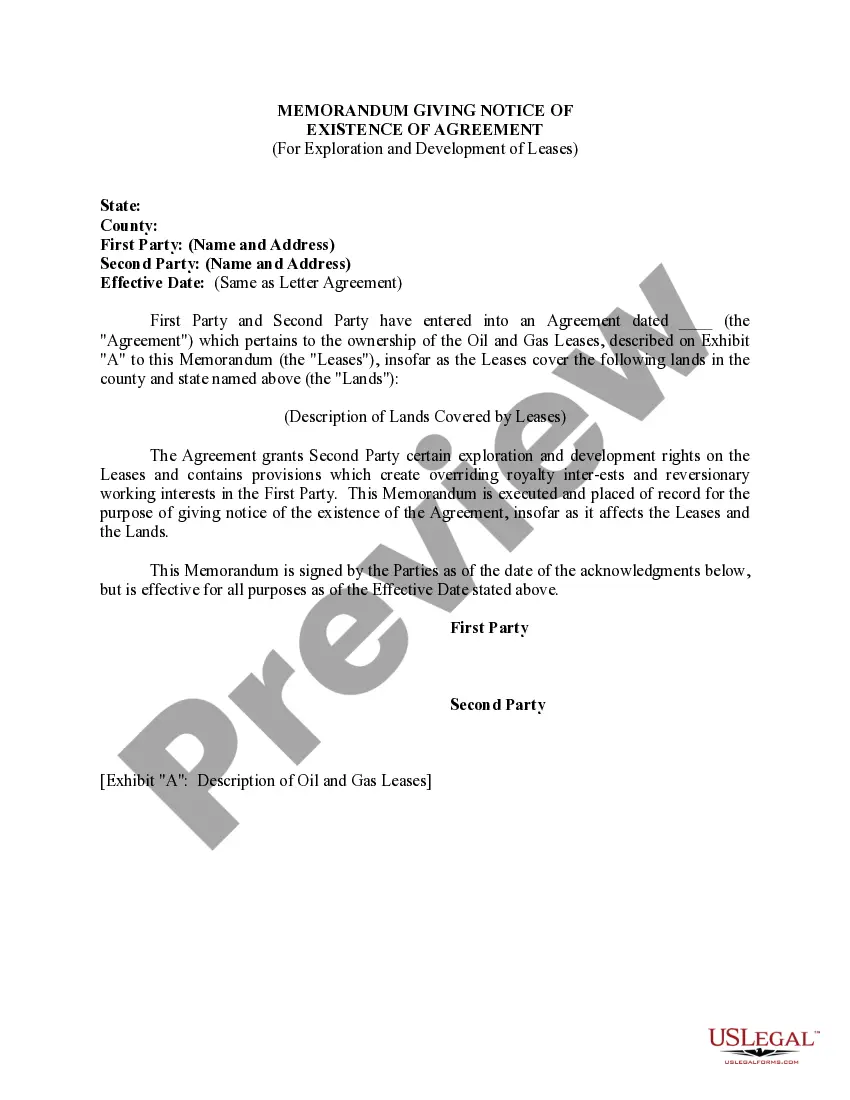

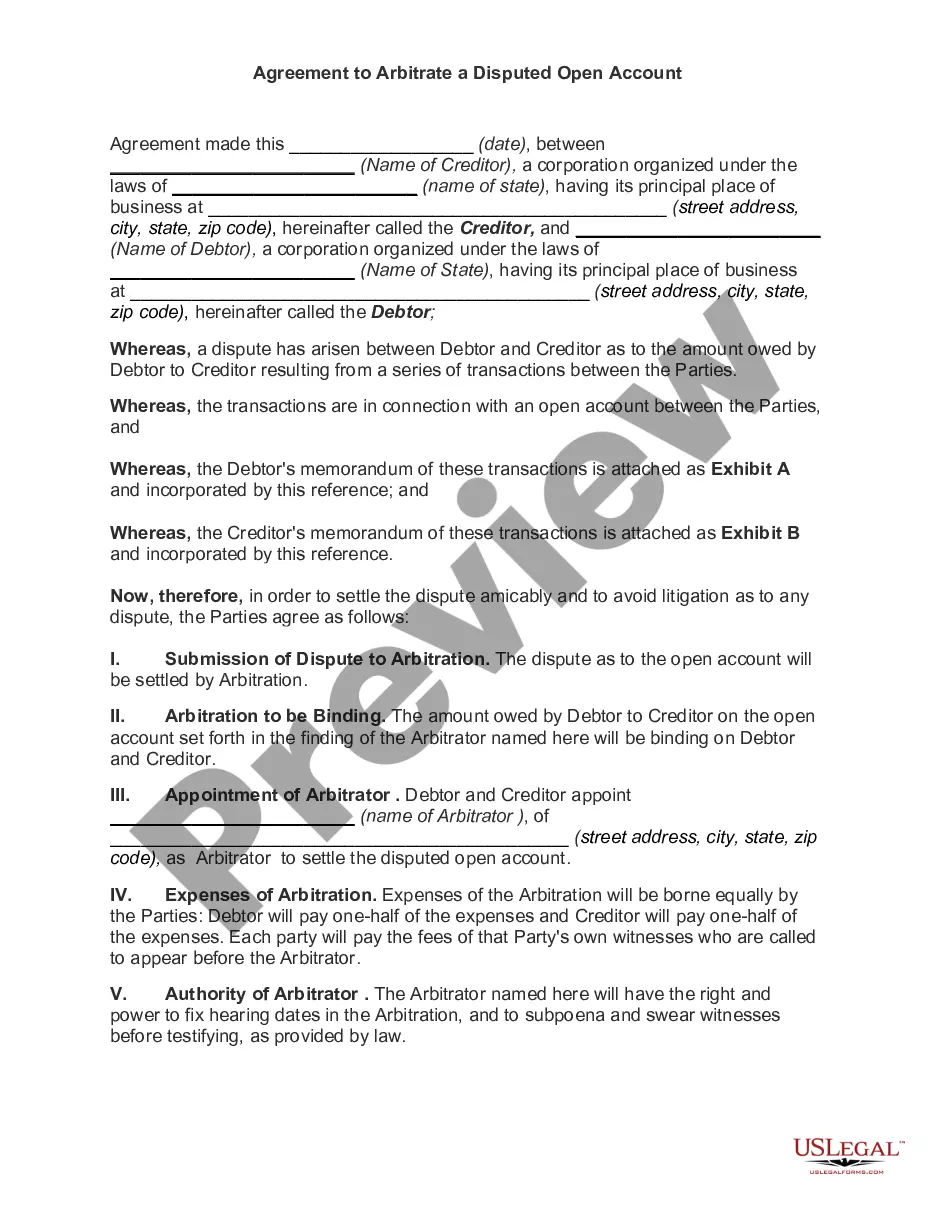

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

How to fill out Shared Earnings Agreement Between Fund & Company?

Finding the right authorized papers template could be a have a problem. Of course, there are a lot of themes available on the net, but how can you discover the authorized develop you need? Use the US Legal Forms web site. The services gives thousands of themes, like the New Hampshire Shared Earnings Agreement between Fund & Company, which you can use for organization and personal needs. All the forms are inspected by specialists and meet up with federal and state specifications.

Should you be currently authorized, log in in your bank account and then click the Down load key to get the New Hampshire Shared Earnings Agreement between Fund & Company. Utilize your bank account to search through the authorized forms you have purchased formerly. Go to the My Forms tab of your own bank account and get one more copy from the papers you need.

Should you be a whole new consumer of US Legal Forms, here are simple directions that you can adhere to:

- Initial, ensure you have selected the appropriate develop to your city/area. It is possible to examine the form making use of the Review key and study the form outline to make certain this is the right one for you.

- In case the develop does not meet up with your preferences, take advantage of the Seach area to obtain the proper develop.

- Once you are sure that the form is proper, click on the Get now key to get the develop.

- Opt for the rates prepare you need and enter in the required info. Create your bank account and pay money for an order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the data file formatting and obtain the authorized papers template in your gadget.

- Complete, change and printing and indication the received New Hampshire Shared Earnings Agreement between Fund & Company.

US Legal Forms is definitely the largest local library of authorized forms in which you can discover a variety of papers themes. Use the service to obtain expertly-manufactured papers that adhere to condition specifications.

Form popularity

FAQ

Every business organization with gross business income from all business activities of more than $50,000 must file a BPT return.

The I&D Tax rate is 5% for taxable periods ending before December 31, 2023. That rate is 4% for taxable periods ending on or after December 31, 2023, and 3% for taxable periods ending on or after December 31, 2024. The I&D Tax shall be repealed for taxable periods beginning after December 31, 2024. Who pays it?

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

New Hampshire, however, is different: it does not treat partnerships as pass-through entities, and instead requires them to pay both the business profits tax and the business enterprise tax.

All domestic business partnerships headquartered in the United States must file Form 1065 each year, including general partnerships, limited partnerships, and limited liability companies (LLCs) classified as partnerships with at least two members.

All business organizations, including Limited Liability Companies (LLC), taxed as a partnership federally must file Form NH-1065 return provided they have conducted business activity in New Hampshire and their gross business income from everywhere is in excess of $92,000.

?S? Corporations All actual and constructive receipt of distributions (including non-cash distributions) from an ?S? corporation are taxable to NH regardless of the original source of the income.

Under the American Rescue Plan Act of 2021 (ARPA), the State will receive a total of $112 million in Local Fiscal Recovery Funds to distribute to New Hampshire non-metropolitan cities and towns (so-called Non-Entitlement Units or NEUs), this includes all NH municipalities except for Dover, Manchester, Nashua, ...