New Hampshire Convertible Secured Promissory Note

Description

How to fill out Convertible Secured Promissory Note?

Finding the right legitimate record web template might be a have difficulties. Needless to say, there are a lot of web templates available online, but how will you find the legitimate kind you will need? Make use of the US Legal Forms site. The service provides 1000s of web templates, such as the New Hampshire Convertible Secured Promissory Note, which can be used for business and personal requires. All of the forms are checked out by professionals and meet up with federal and state requirements.

If you are presently registered, log in to the profile and click the Obtain button to have the New Hampshire Convertible Secured Promissory Note. Make use of profile to appear through the legitimate forms you may have acquired earlier. Visit the My Forms tab of the profile and have one more copy in the record you will need.

If you are a brand new consumer of US Legal Forms, allow me to share easy recommendations for you to follow:

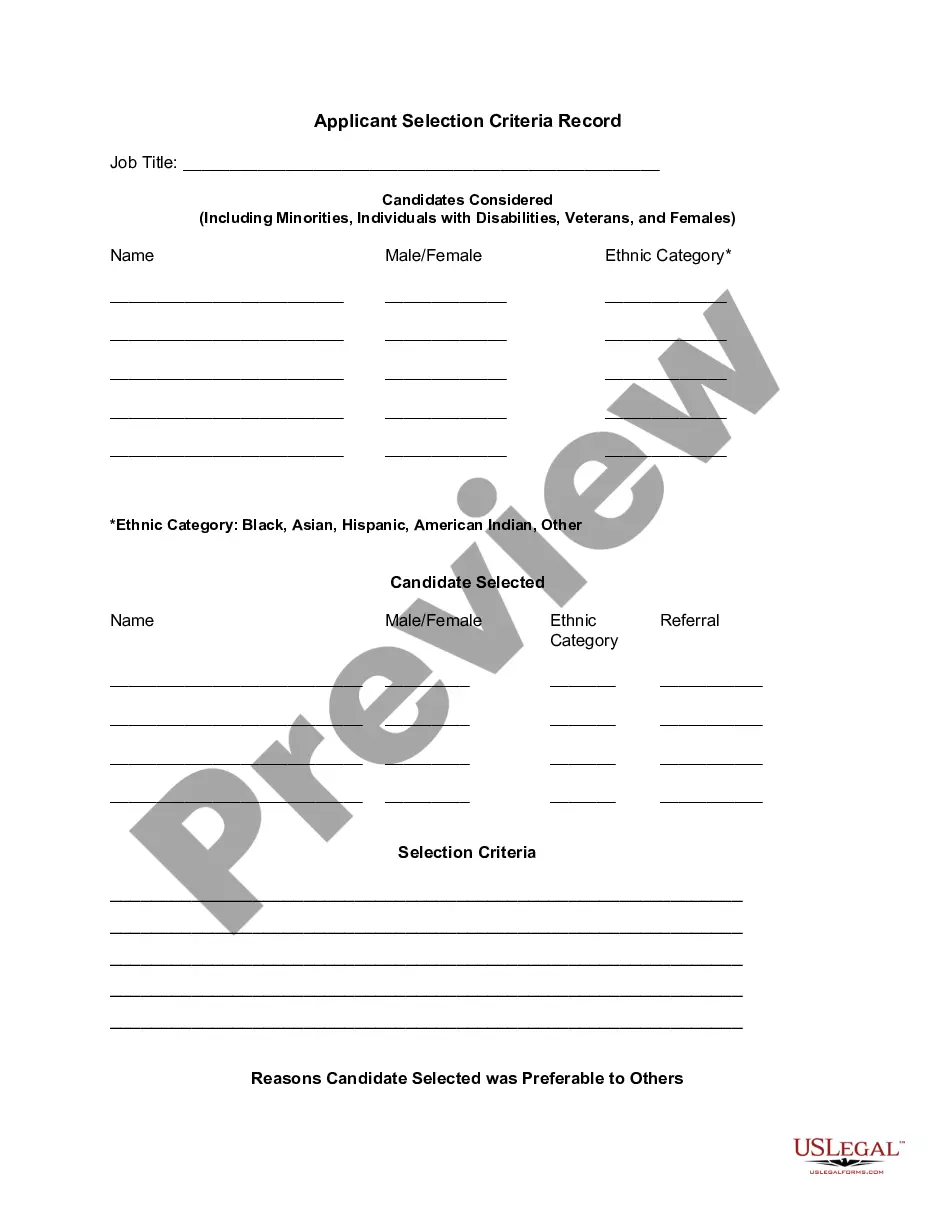

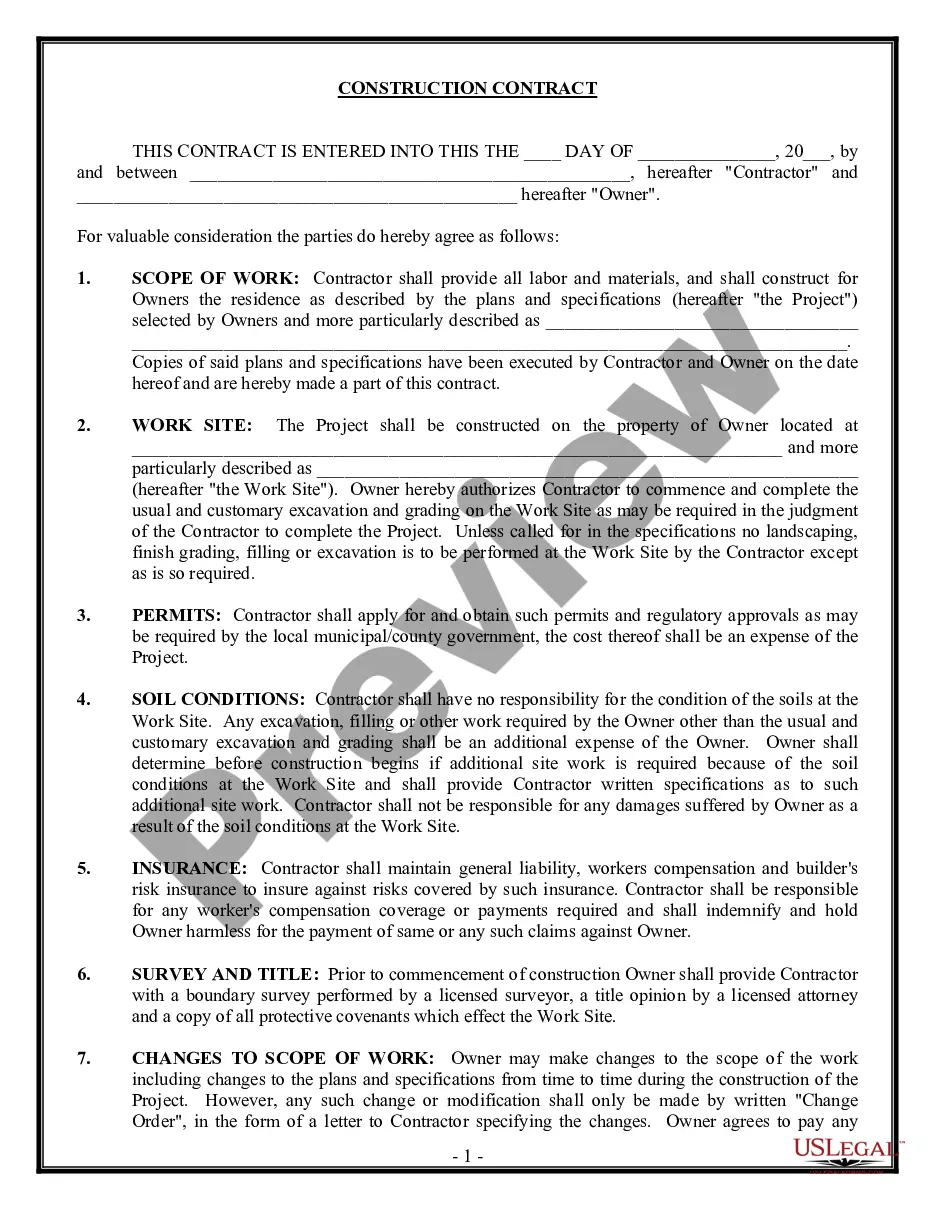

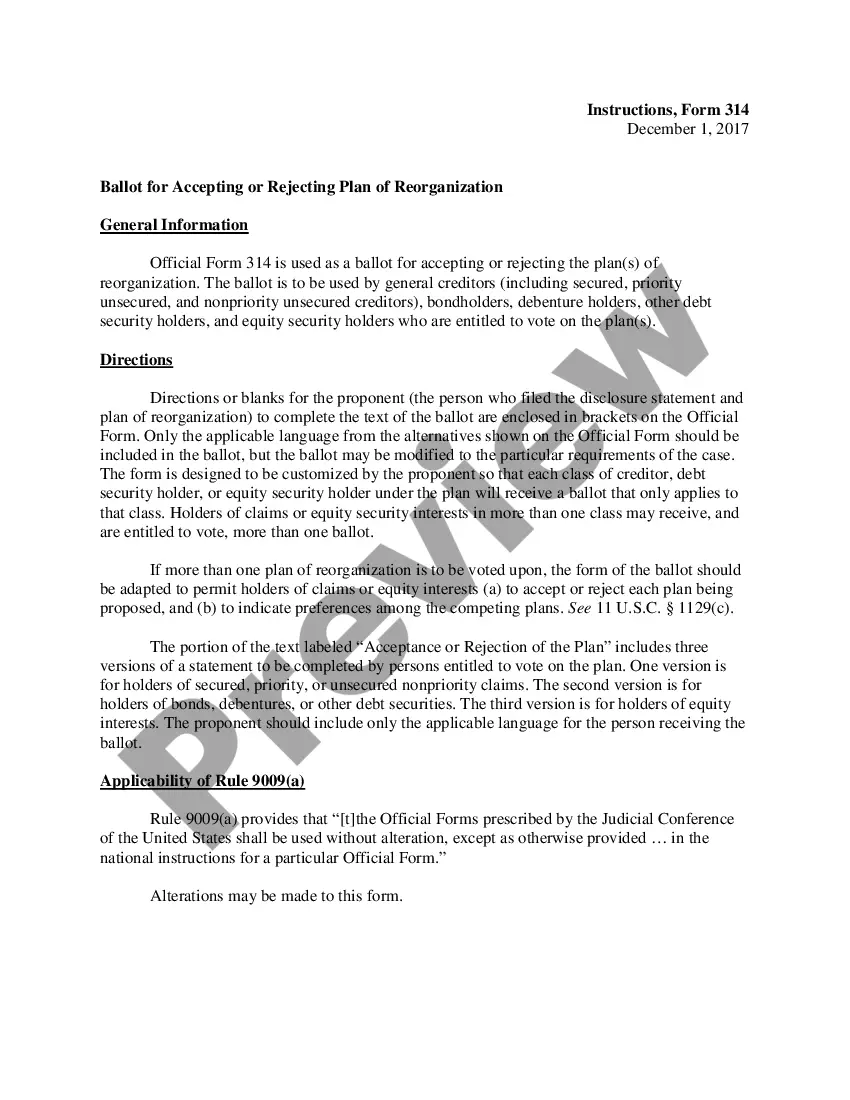

- Initial, make sure you have chosen the right kind for your town/state. You may look over the form utilizing the Preview button and read the form description to ensure this is the best for you.

- When the kind fails to meet up with your needs, use the Seach field to discover the right kind.

- Once you are sure that the form is acceptable, click the Purchase now button to have the kind.

- Select the rates prepare you would like and type in the essential information. Create your profile and pay money for your order with your PayPal profile or charge card.

- Choose the submit structure and obtain the legitimate record web template to the product.

- Complete, revise and print out and signal the obtained New Hampshire Convertible Secured Promissory Note.

US Legal Forms will be the biggest library of legitimate forms where you will find different record web templates. Make use of the company to obtain professionally-produced papers that follow condition requirements.

Form popularity

FAQ

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

The main disadvantages of convertible note offerings are equity dilution and near?term stock price impact and, if the stock price fails to appreciate above the conversion price, potential refinancing risk.

Convertible loan notes can lead to dilution of existing shareholders' equity when the notes convert. This can be a disadvantage for start-ups that want to maintain control over their company.

A secured convertible promissory note, or SCP for short, is a type of security instrument that gives the holder the right to convert their debt into equity in the issuer company. Typically, an SCP will convert at a discount to the market value of the company's shares at the time of conversion.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

The basic concept for valuing a convertible note is the same in theory as the valuation of any other financial asset. The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.