New Hampshire Indemnity Escrow Agreement regarding purchasing issued and outstanding shares

Description

How to fill out Indemnity Escrow Agreement Regarding Purchasing Issued And Outstanding Shares?

Are you inside a position that you need paperwork for both company or personal uses nearly every day time? There are a variety of legal record layouts available online, but locating ones you can rely is not effortless. US Legal Forms provides a large number of type layouts, like the New Hampshire Indemnity Escrow Agreement regarding purchasing issued and outstanding shares, which can be written to meet state and federal demands.

In case you are currently knowledgeable about US Legal Forms site and get a free account, simply log in. Following that, you can acquire the New Hampshire Indemnity Escrow Agreement regarding purchasing issued and outstanding shares web template.

Should you not have an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is for your right area/area.

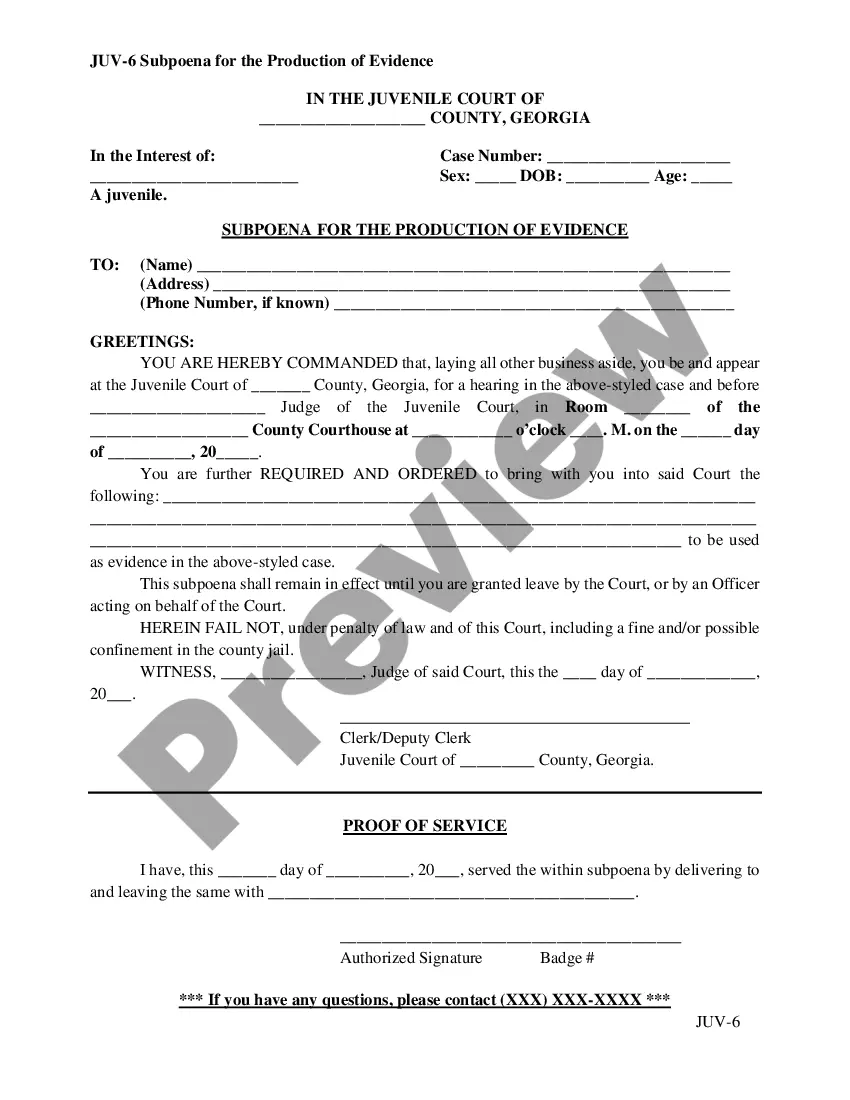

- Utilize the Preview button to analyze the shape.

- See the explanation to actually have selected the right type.

- In case the type is not what you`re searching for, use the Research field to get the type that meets your requirements and demands.

- If you find the right type, click on Acquire now.

- Pick the prices strategy you need, complete the required information to create your bank account, and pay money for an order using your PayPal or charge card.

- Choose a practical data file format and acquire your copy.

Find every one of the record layouts you might have bought in the My Forms food selection. You can aquire a further copy of New Hampshire Indemnity Escrow Agreement regarding purchasing issued and outstanding shares whenever, if required. Just click on the essential type to acquire or printing the record web template.

Use US Legal Forms, by far the most considerable assortment of legal kinds, to save time and prevent faults. The assistance provides appropriately manufactured legal record layouts which you can use for a range of uses. Make a free account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

Key elements of an escrow clause include: Conditions for release of assets: The clause should specify the conditions under which the assets will be released to the receiving party, such as the completion of certain tasks, the passage of a certain amount of time, or the fulfillment of specific conditions.

In stock transactions, the equity shares are held in escrow?essentially a holding account?until a transaction or other specific requirements have been satisfied. Many times, a stock issued in escrow will be owned by the shareholder.

Understanding Escrowed Shares Escrow is a process whereby money or a financial asset is held by a third party on behalf of two other parties. The assets or funds that are held in escrow remain there and are not released until all of the obligations outlined in the agreement are fulfilled.

Escrow shares are shares of a company held in a special account until a specific commercial transaction is completed. The type of account used to keep these shares is called an Escrow account. The goal of investing in stocks is to gain from the increase in share value. However, it's not as simple as it seems.

The Escrow Parties jointly and severally agree to indemnify the Escrow Agent for, and to hold it harmless against, any and all claims, suits, actions, proceedings, investigations, judgments, deficiencies, damages, settlements, liabilities and expenses (including reasonable legal fees and expenses of attorneys chosen by ...

A Standard Clause providing for an escrow of a portion of the purchase price in an M&A transaction to satisfy the seller's obligations to pay any adjustments to the purchase price and any potential indemnification claims.

The key clauses that should be included in any stock purchase agreement are: Ownership: The type of ownership will determine the rights and obligations, including who has voting power. Dividends: The number of dividends paid out per year will depend on how many profits and losses the company experiences.

An escrow arrangement is set up by a neutral third party to hold funds or other assets that will be exchanged in a transaction involving a buyer and seller. In an M&A deal, an escrow account is typically used to ensure that the buyer and seller will fulfil their respective financial and other obligations.