New Hampshire Research Agreement

Description

How to fill out Research Agreement?

You are able to commit hrs on-line trying to find the legal document design that meets the federal and state needs you need. US Legal Forms supplies 1000s of legal forms which are examined by specialists. It is possible to down load or produce the New Hampshire Research Agreement from the service.

If you currently have a US Legal Forms account, you can log in and then click the Obtain button. After that, you can comprehensive, edit, produce, or signal the New Hampshire Research Agreement. Every single legal document design you buy is your own property for a long time. To obtain an additional version for any bought kind, check out the My Forms tab and then click the related button.

If you use the US Legal Forms internet site the very first time, follow the straightforward guidelines under:

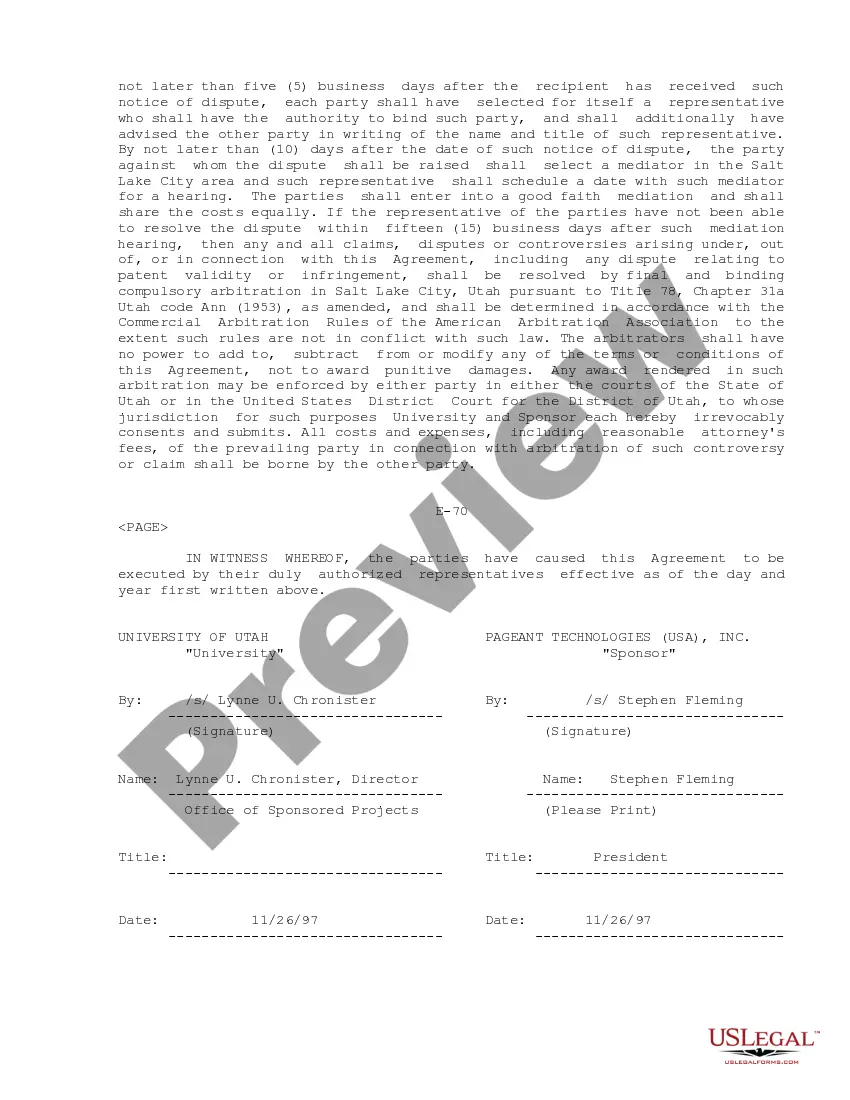

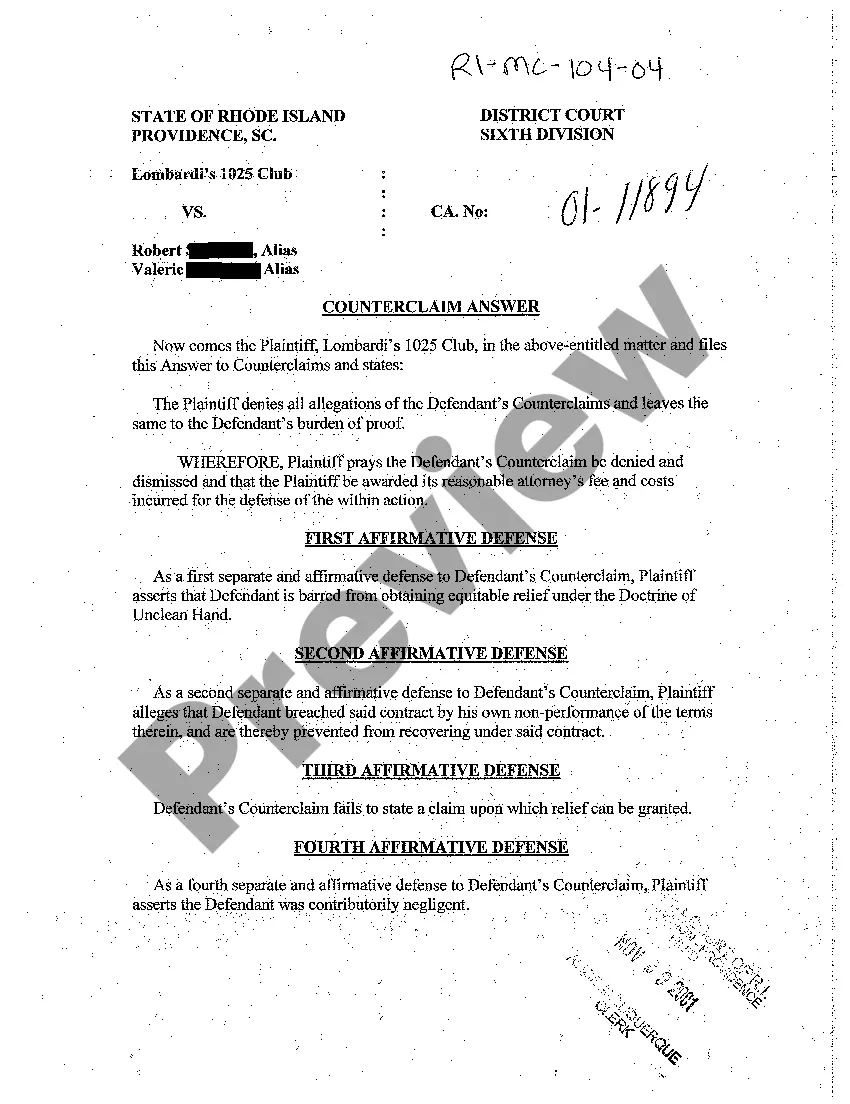

- Very first, make sure that you have selected the right document design for that state/town of your choosing. Read the kind explanation to make sure you have selected the appropriate kind. If available, make use of the Review button to search through the document design as well.

- If you wish to get an additional variation of your kind, make use of the Look for discipline to discover the design that fits your needs and needs.

- Once you have identified the design you would like, simply click Acquire now to continue.

- Choose the prices program you would like, type your references, and register for an account on US Legal Forms.

- Complete the deal. You may use your charge card or PayPal account to fund the legal kind.

- Choose the file format of your document and down load it in your product.

- Make alterations in your document if needed. You are able to comprehensive, edit and signal and produce New Hampshire Research Agreement.

Obtain and produce 1000s of document layouts making use of the US Legal Forms Internet site, that offers the most important variety of legal forms. Use specialist and status-specific layouts to take on your small business or personal requires.

Form popularity

FAQ

(1) An action for breach of any contract for sale must be commenced within four years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one year but may not extend it.

New Hampshire is a state that doesn't have a personal income tax. However, currently, the state has a 5% tax on dividends and interest. However, due to legislation, the tax on dividends and interest is being phased out. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026.

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax. Homeowners in New Hampshire pay some of the highest average effective property tax rates in the country.

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

What is the Medicaid Enhancement Tax (MET)? The MET is a tax upon the "net patient services revenue" of certain hospitals for each hospital's fiscal year ending during the calendar year in which the taxable period begins.

New Hampshire has historically been rated as one of the most tax-friendly states to live in, especially as a retiree. Some of the financial advantages include: No state income tax. No sales tax.

The State of New Hampshire does not have an income tax on an individual's reported W-2 wages.

The answer was, ?New Hampshire has such an antiquated tax system with the property tax, that there is no money to meet needs in communities that have to be funded through the state.?