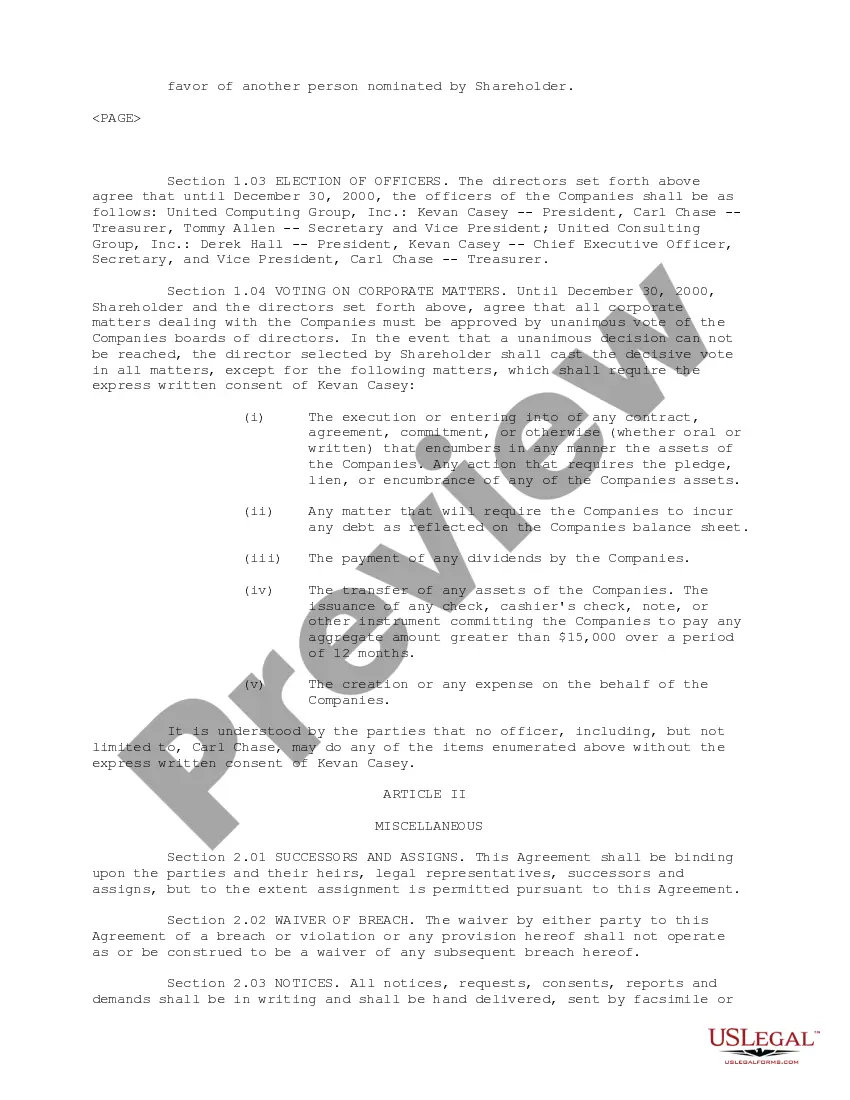

New Hampshire Voting Agreement between Clearworks Integration Services, United Computing Group, United Consulting Group, and Kevan Casey regarding sale of outstanding common stock

Description

How to fill out Voting Agreement Between Clearworks Integration Services, United Computing Group, United Consulting Group, And Kevan Casey Regarding Sale Of Outstanding Common Stock?

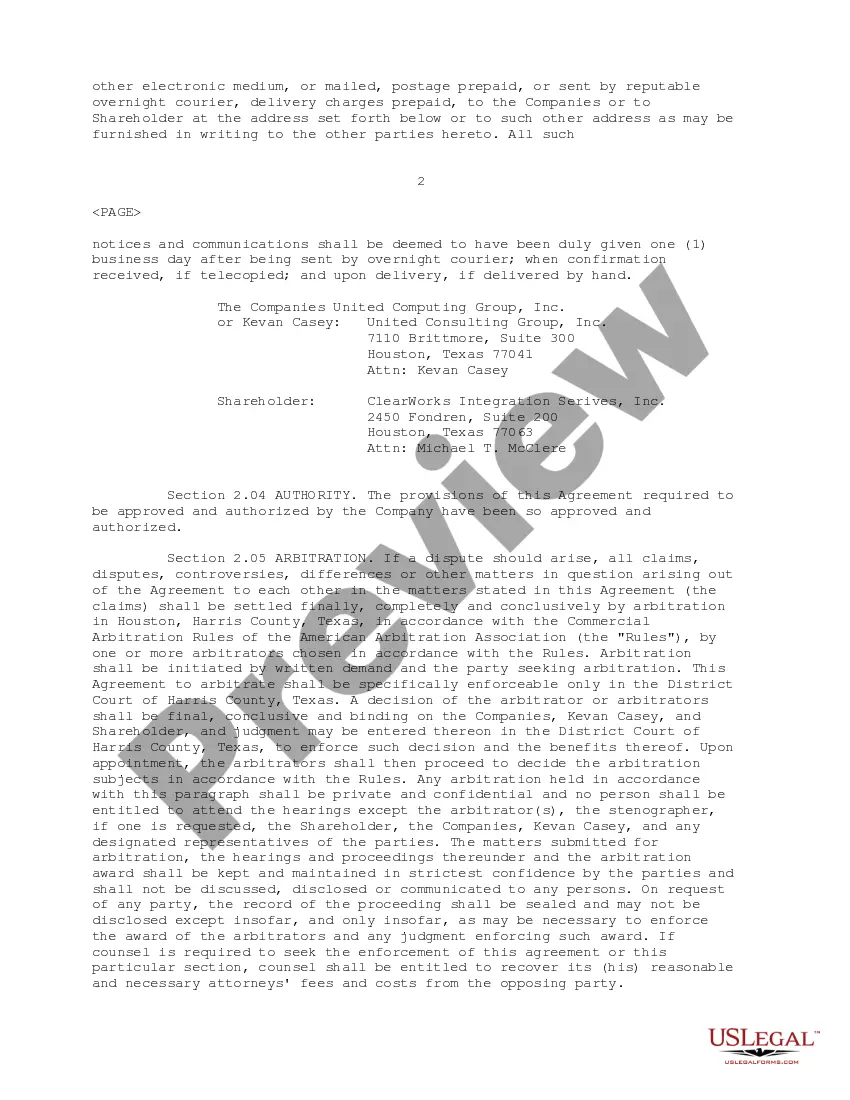

Are you in the place where you need files for possibly business or person functions nearly every day? There are a lot of lawful record layouts available online, but finding kinds you can trust is not simple. US Legal Forms delivers a huge number of kind layouts, like the New Hampshire Voting Agreement between Clearworks Integration Services, United Computing Group, United Consulting Group, and Kevan Casey regarding sale of outstanding common stock, that happen to be published to satisfy state and federal needs.

Should you be currently informed about US Legal Forms internet site and also have a merchant account, simply log in. Afterward, it is possible to acquire the New Hampshire Voting Agreement between Clearworks Integration Services, United Computing Group, United Consulting Group, and Kevan Casey regarding sale of outstanding common stock format.

Unless you offer an profile and need to begin using US Legal Forms, adopt these measures:

- Find the kind you need and make sure it is to the proper town/area.

- Make use of the Preview option to check the form.

- Browse the outline to ensure that you have selected the proper kind.

- If the kind is not what you are seeking, utilize the Research industry to find the kind that meets your requirements and needs.

- When you discover the proper kind, just click Acquire now.

- Pick the costs prepare you need, fill in the necessary information and facts to make your bank account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a hassle-free file format and acquire your duplicate.

Discover every one of the record layouts you possess purchased in the My Forms menus. You can obtain a more duplicate of New Hampshire Voting Agreement between Clearworks Integration Services, United Computing Group, United Consulting Group, and Kevan Casey regarding sale of outstanding common stock any time, if necessary. Just select the essential kind to acquire or print out the record format.

Use US Legal Forms, one of the most considerable assortment of lawful varieties, to save lots of efforts and avoid blunders. The services delivers skillfully created lawful record layouts that can be used for a selection of functions. Create a merchant account on US Legal Forms and commence creating your way of life a little easier.