New Hampshire Compensation Agreement

Description

How to fill out Compensation Agreement?

Choosing the right legitimate file design could be a battle. Naturally, there are tons of layouts available on the Internet, but how will you find the legitimate type you require? Use the US Legal Forms website. The service provides a large number of layouts, like the New Hampshire Compensation Agreement, that can be used for company and personal needs. Every one of the varieties are inspected by specialists and meet federal and state specifications.

When you are currently authorized, log in to your bank account and click the Download key to find the New Hampshire Compensation Agreement. Make use of bank account to appear through the legitimate varieties you may have purchased in the past. Check out the My Forms tab of your own bank account and have one more duplicate of the file you require.

When you are a brand new customer of US Legal Forms, listed below are basic guidelines that you should adhere to:

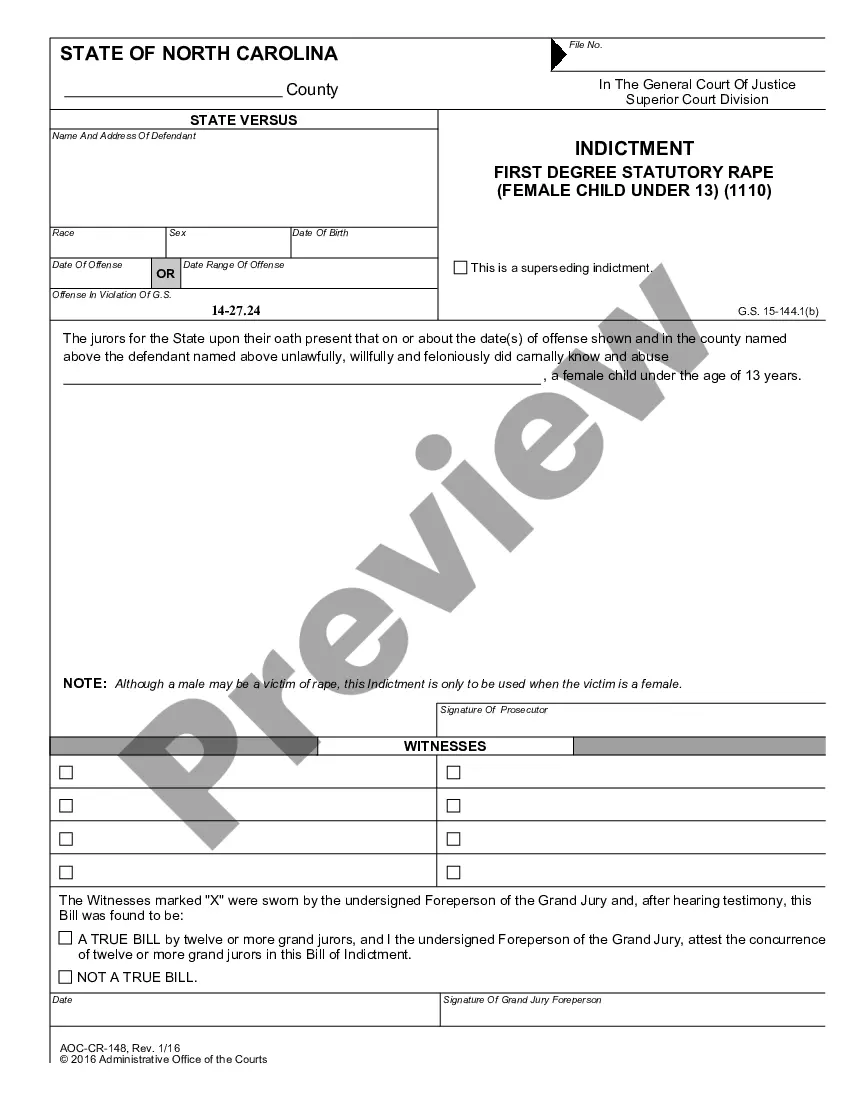

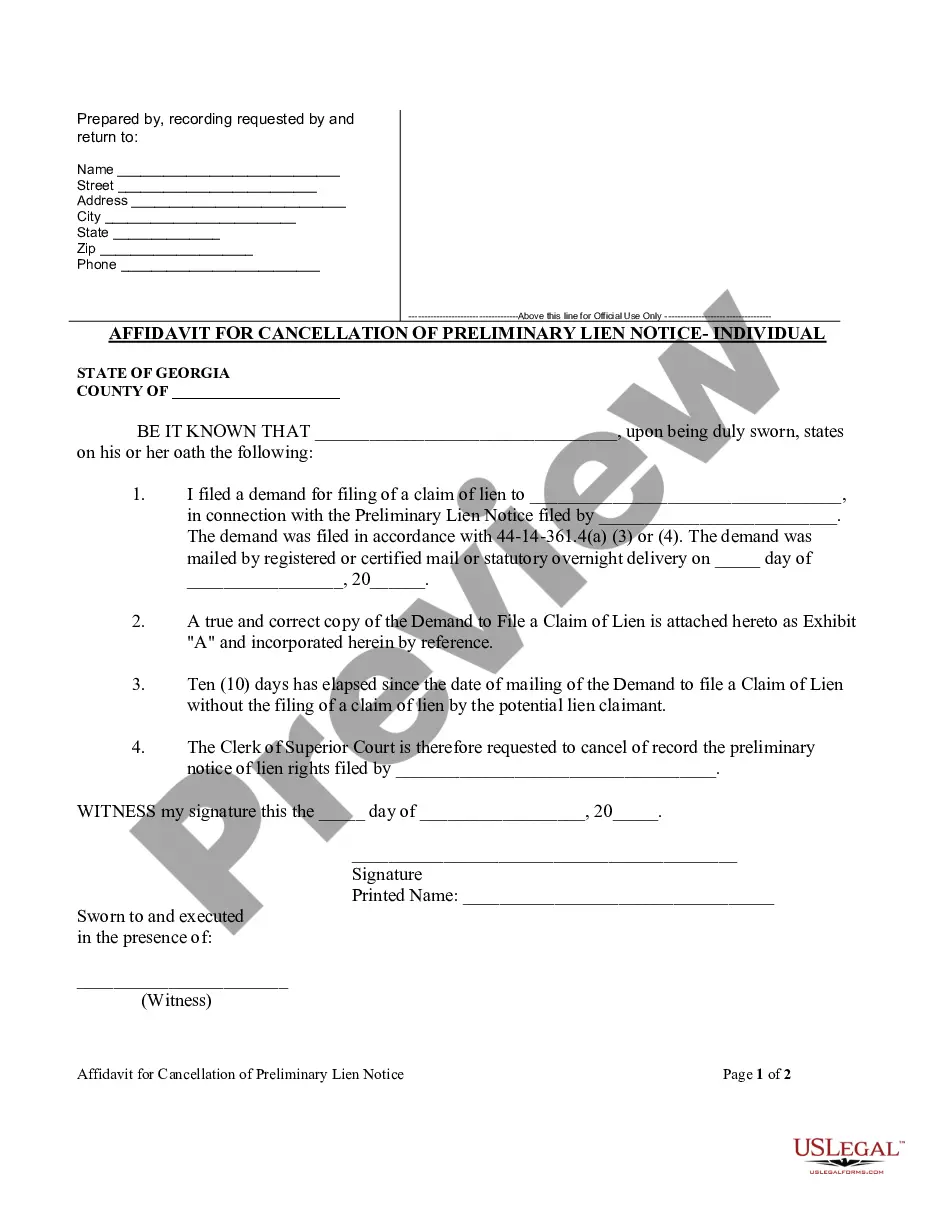

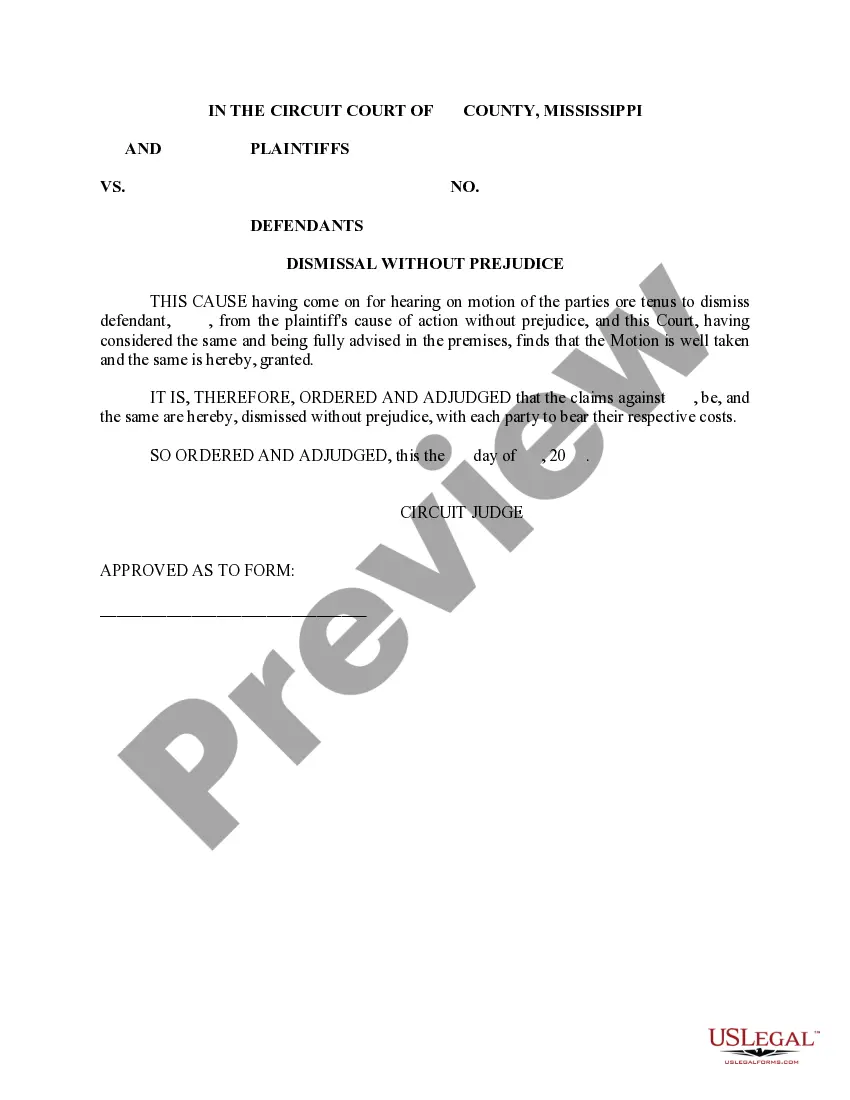

- Initially, ensure you have selected the proper type to your metropolis/area. It is possible to examine the form making use of the Review key and browse the form information to make sure it is the best for you.

- If the type is not going to meet your needs, utilize the Seach area to discover the right type.

- When you are positive that the form is proper, click on the Buy now key to find the type.

- Choose the pricing prepare you need and type in the necessary details. Design your bank account and pay money for an order using your PayPal bank account or charge card.

- Opt for the file format and down load the legitimate file design to your device.

- Comprehensive, revise and produce and indication the received New Hampshire Compensation Agreement.

US Legal Forms may be the largest catalogue of legitimate varieties in which you will find numerous file layouts. Use the service to down load appropriately-created files that adhere to express specifications.

Form popularity

FAQ

The New Hampshire new employer tax rate is 2.7 % Minus any Fund Reduction or Plus any Emergency Power Surcharge in place for the applicable quarter.

Officers and LLC Members who are included in coverage must utilize a minimum payroll of $700 per week ($36,400 Annually) and a maximum payroll of $5,500 per week ($286,000 Annually) in order to estimate the cost of workers' comp insurance.

If I return to light duty, can my employer reduce my rate of pay? Yes, but you may be entitled to receive a partial benefit from the insurance carrier in addition to your reduced wages. Is workers' compensation taxable? No, but any questions pertaining to reporting, etc., should be directed to the IRS.

A ?use-it-or-lose-it? employee vacation policy requires an employee to lose any unused vacation time after a specific date, such as the end of the year. This policy in New Hampshire is permitted by state law, which means that employers may implement it.

Sole-proprietors, partners and self-employed persons are not required to carry workers' compensation on themselves but may elect to be covered, per RSA 281-A:3.

The minimum earnings required for eligibility are $2800 ($1400 each in 2 separate quarters), which would result in a $32 weekly benefit amount. The more earnings in your base period, the higher your weekly benefit amount, to a maximum of $427 for $41,500 or more in earnings.

Workers' Compensation for New Hampshire Workers. If you are hurt at work, workers' compensation (or "workers' comp") pays your medical bills. It also pays 60% of your lost wages after you miss more than three days of work. Workers' compensation is a type of insurance that all employers MUST provide.

Weekly Compensation Benefits Under NH law an injured worker is to be paid 60% of their pre-injury average weekly wage while they are out of work due to a work related injury. These benefit payments are issued by the insurance company on a weekly basis and are tax free.