New Hampshire Proxy Statement - University National Bank and Trust Co.

Description

How to fill out Proxy Statement - University National Bank And Trust Co.?

Finding the right authorized file web template can be a battle. Naturally, there are a variety of web templates available on the Internet, but how can you discover the authorized kind you require? Make use of the US Legal Forms web site. The support offers a huge number of web templates, like the New Hampshire Proxy Statement - University National Bank and Trust Co., that you can use for enterprise and private demands. All the types are checked out by professionals and meet up with state and federal specifications.

If you are presently listed, log in for your account and then click the Down load switch to obtain the New Hampshire Proxy Statement - University National Bank and Trust Co.. Utilize your account to check through the authorized types you possess acquired earlier. Proceed to the My Forms tab of your own account and get one more copy of the file you require.

If you are a fresh end user of US Legal Forms, listed here are easy instructions for you to comply with:

- Very first, be sure you have chosen the proper kind for your city/region. You are able to examine the shape while using Review switch and browse the shape explanation to make certain it will be the best for you.

- If the kind will not meet up with your preferences, use the Seach area to discover the right kind.

- Once you are certain that the shape would work, click on the Get now switch to obtain the kind.

- Select the rates prepare you want and enter in the needed details. Make your account and buy the order utilizing your PayPal account or charge card.

- Opt for the document structure and download the authorized file web template for your device.

- Comprehensive, edit and print and indicator the attained New Hampshire Proxy Statement - University National Bank and Trust Co..

US Legal Forms will be the largest collection of authorized types where you will find different file web templates. Make use of the company to download appropriately-made paperwork that comply with express specifications.

Form popularity

FAQ

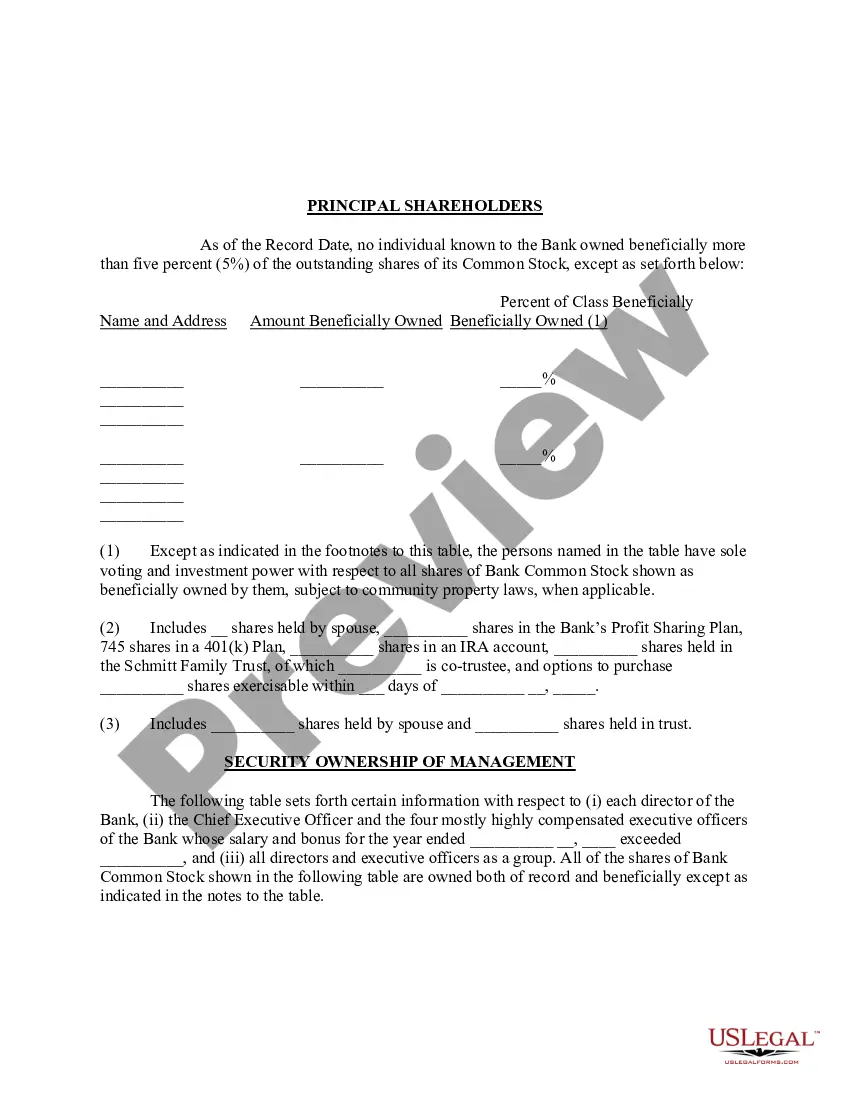

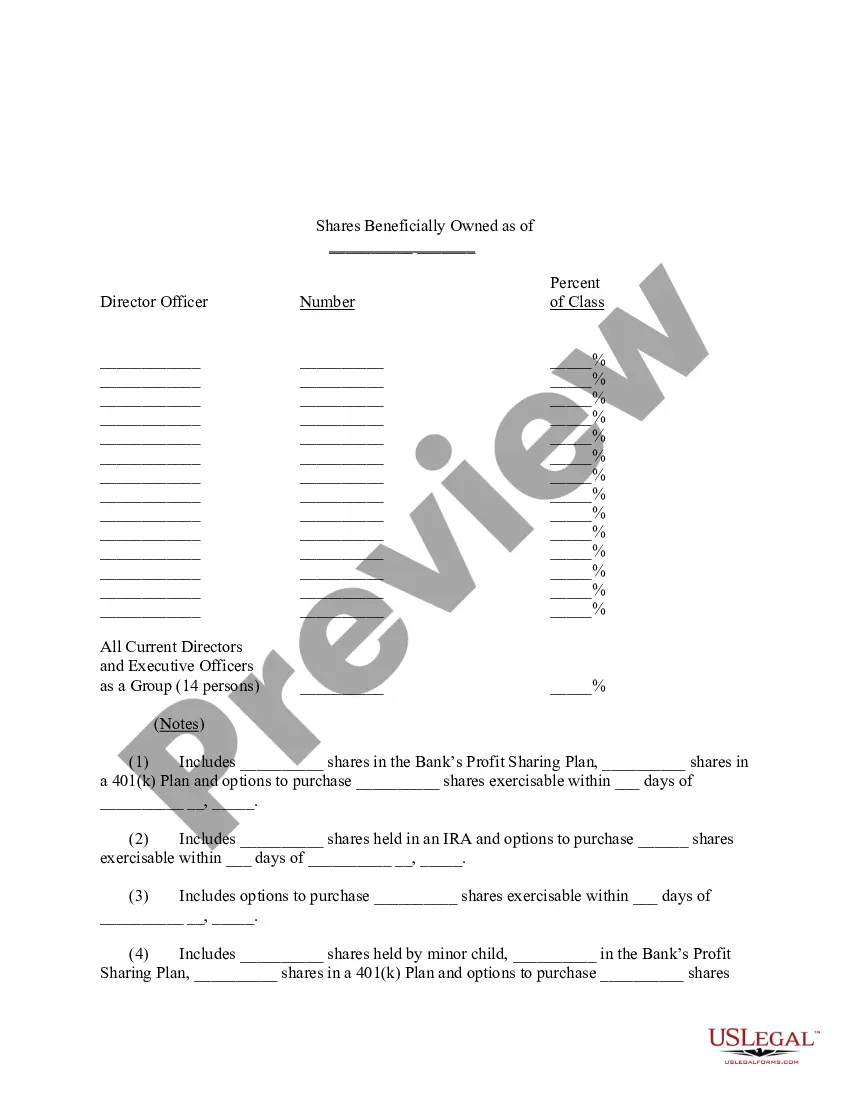

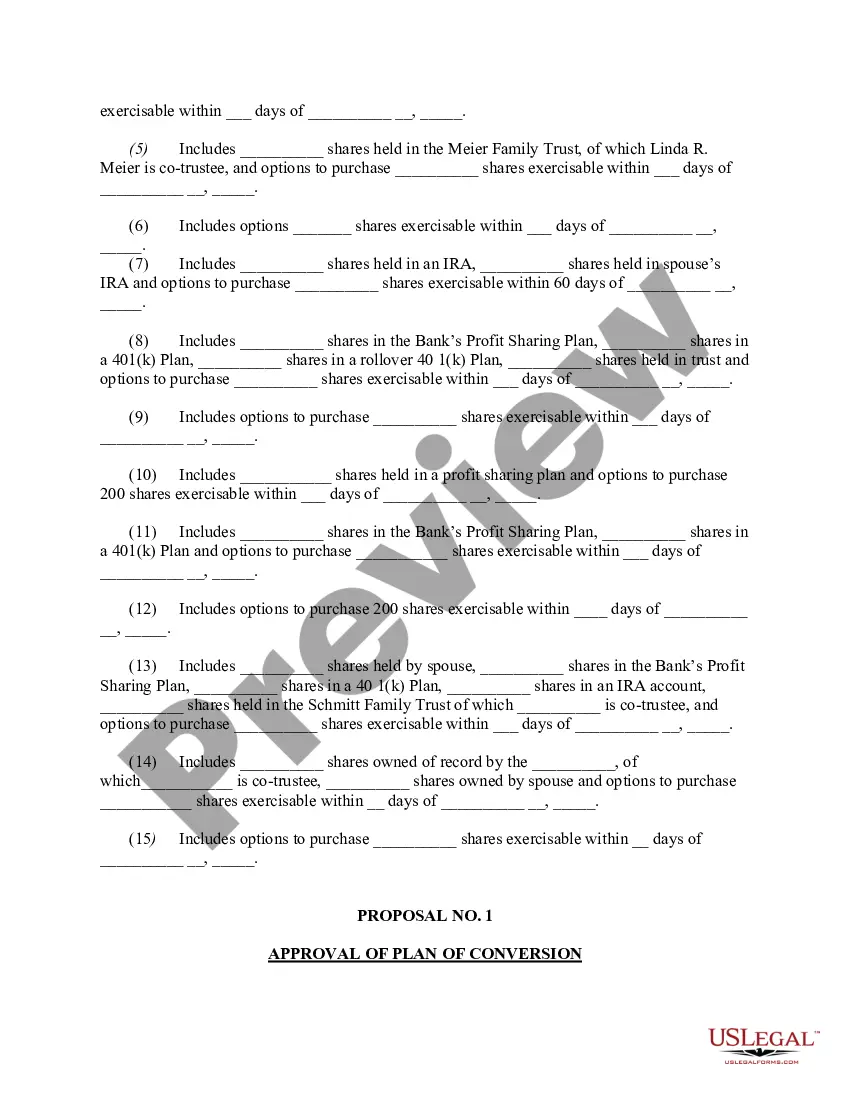

Proxy statement examples may include the information about the directors' salaries, information about the bonus to the directors, additional the number of board of directors. The board forms the top layer of the hierarchy and focuses on ensuring that the company efficiently achieves its goals.

The average Eastern Bank executive compensation is $233,005 a year. The median estimated compensation for executives at Eastern Bank including base salary and bonus is $238,713, or $114 per hour. At Eastern Bank, the most compensated executive makes $450,000, annually, and the lowest compensated makes $53,000.

The median estimated compensation for executives at Silicon Valley Bank including base salary and bonus is $227,880, or $109 per hour.

At Bank of the West, the most compensated executive makes $650,000, annually, and the lowest compensated makes $72,200.

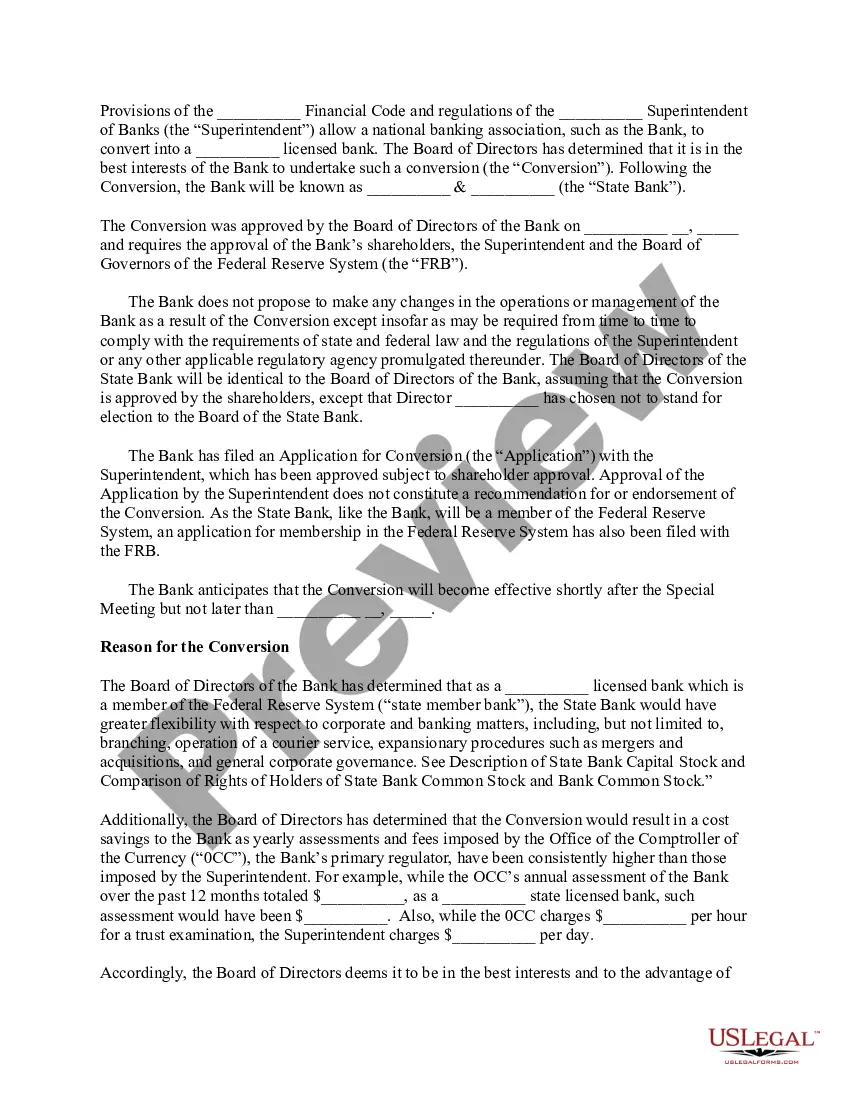

The proxy statements provide information relevant to shareholder votes scheduled for those meetings. Most companies schedule their annual shareholders' meetings to take place a few months after the close of the fiscal year, giving companies time to gather their financial statements and have them audited.

Average Bank of America Executive yearly pay in the United States is approximately $167,803, which is 93% above the national average.

Key Executives NameTitlePayMr. Thomas J. KemlyPresident, CEO & Director1.66MMr. Dennis E. Gibney C.F.A.Executive VP & CFO763kMr. Edward Thomas Allen Jr.Senior Executive VP & COO941.99kMr. John KlimowichExecutive VP & Chief Risk Officer666.69k6 more rows