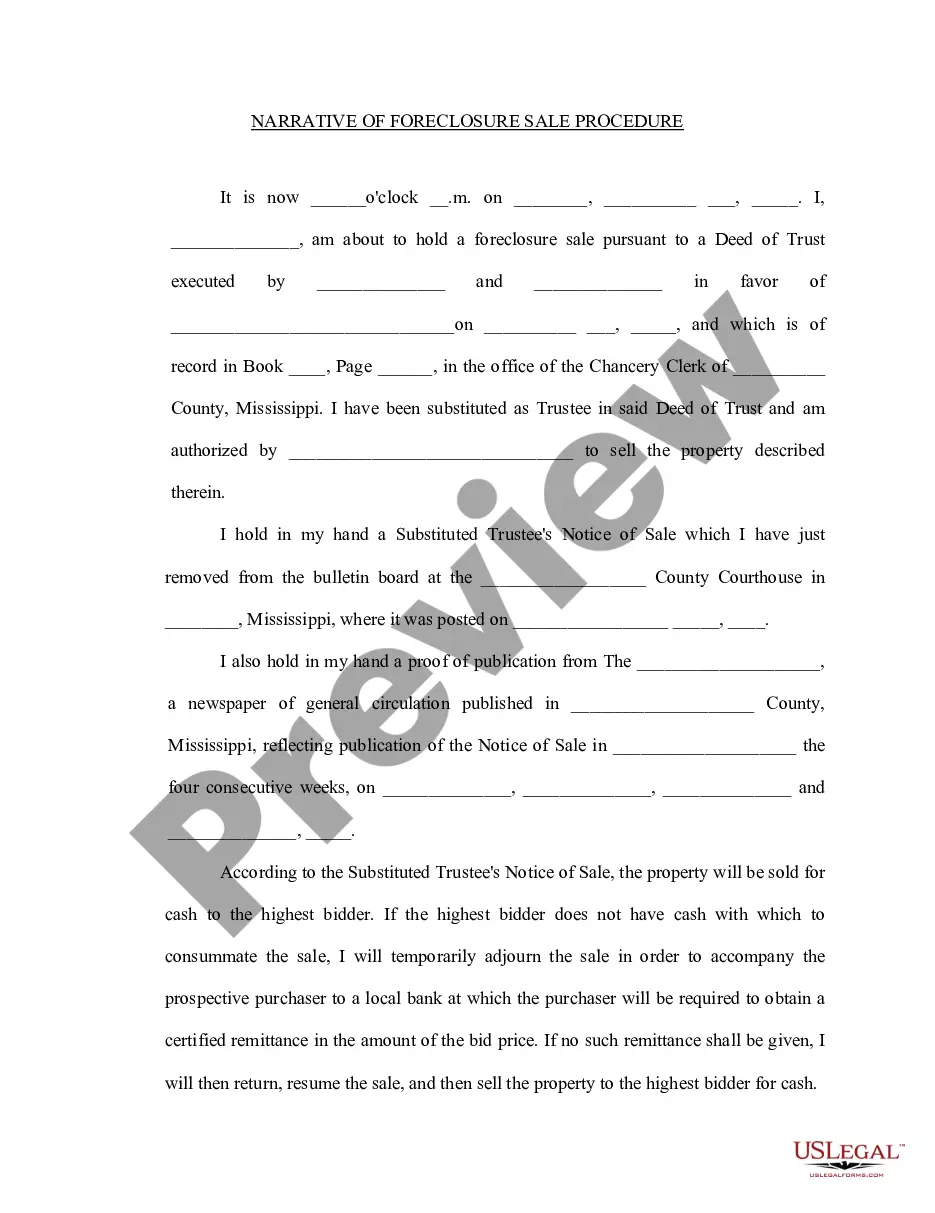

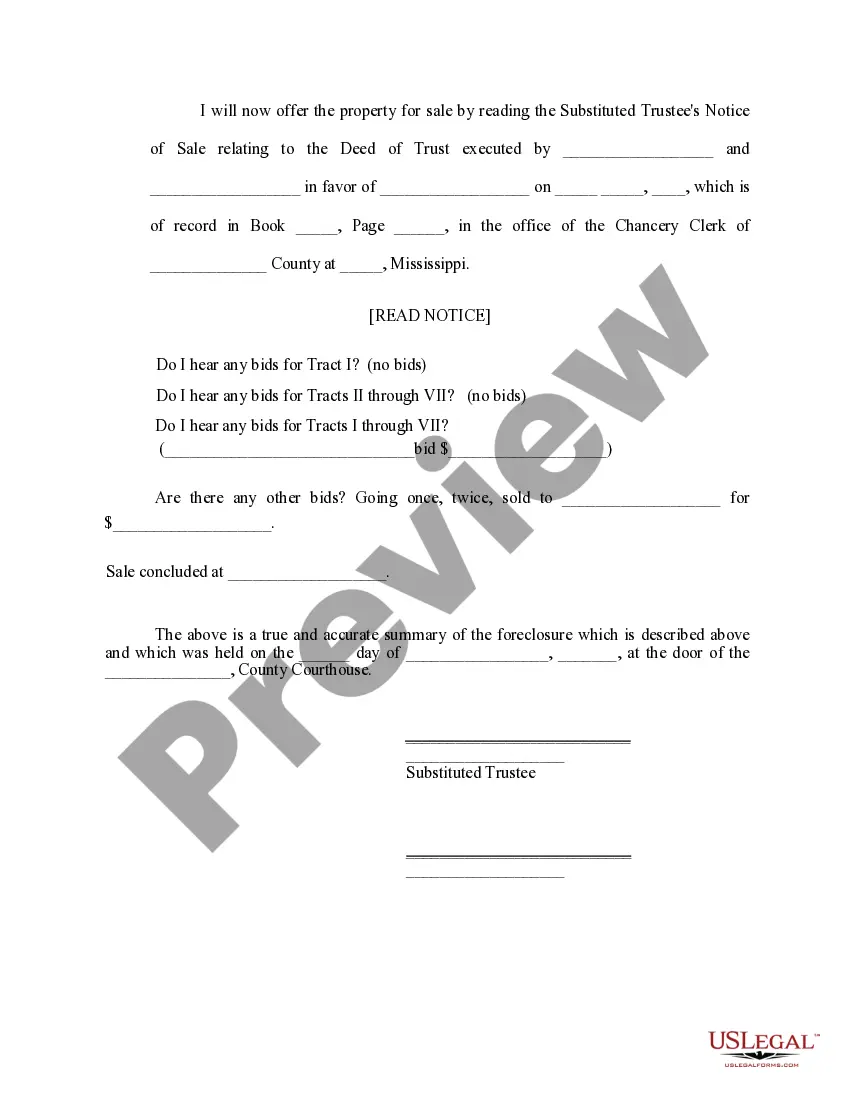

Mississippi Narrative of Foreclosure Sale and Procedure

Description

How to fill out Mississippi Narrative Of Foreclosure Sale And Procedure?

Obtain a printable Mississippi Narrative of Foreclosure Sale and Procedure in just a few clicks from the most extensive collection of legal electronic documents.

Locate, download, and print expertly composed and validated samples on the US Legal Forms website. US Legal Forms has been the leading provider of cost-effective legal and tax documents for citizens and residents of the US online since 1997.

After downloading your Mississippi Narrative of Foreclosure Sale and Procedure, you can complete it in any online editor or print it out and finish it by hand. Utilize US Legal Forms to access 85,000 expertly drafted, state-specific documents.

- Clients with a subscription should sign in directly to their US Legal Forms account, download the Mississippi Narrative of Foreclosure Sale and Procedure, and find it saved in the My documents section.

- Ensure your template complies with your state's regulations.

- If available, review the form's description for additional details.

- If available, examine the document for further information.

- Once you confirm the template is suitable for you, click on Buy Now.

- Set up a personal account.

- Select a subscription plan.

- Make payment via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

Catch Up on the Mortgage. Pay the mortgage arrears in full, plus all legal fees that the lender incurred. Enter Into a Forbearance Agreement. Contact your lender if you cannot pay in full. Try a Loan Modification. Ask the lender for a loan modification. Get Permission for a Short Sale. Do a Deed in Lieu of Foreclosure.

Generally, homeowners have to be more than 120 days delinquent before a foreclosure can begin. If you're behind in mortgage payments, you might be wondering how soon a foreclosure will start. Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure.

If a foreclosure sale results in excess proceeds, the lender doesn't get to keep that money. The lender is entitled to an amount that's sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and salebut no more.

Gather your loan documents and set up a case file. Learn about your legal rights. Organize your financial information. Review your budget. Know your options. Call your servicer. Contact a HUD-approved housing counselor.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

When Does Foreclosure Start? Federal law generally requires the servicer to wait until the loan is over 120 days delinquent before officially starting a foreclosure.

If a foreclosure sale is scheduled to occur in the next day or so, the best way to stop the sale immediately is by filing for bankruptcy. The automatic stay will stop the foreclosure in its tracks. Once you file for bankruptcy, something called an "automatic stay" immediately goes into effect.

The automatic stay will stop the foreclosure in its tracks. The bank may file a motion for relief from the stay. Benefits of a Chapter 13 bankruptcy.