New Hampshire Purchase by company of its stock

Description

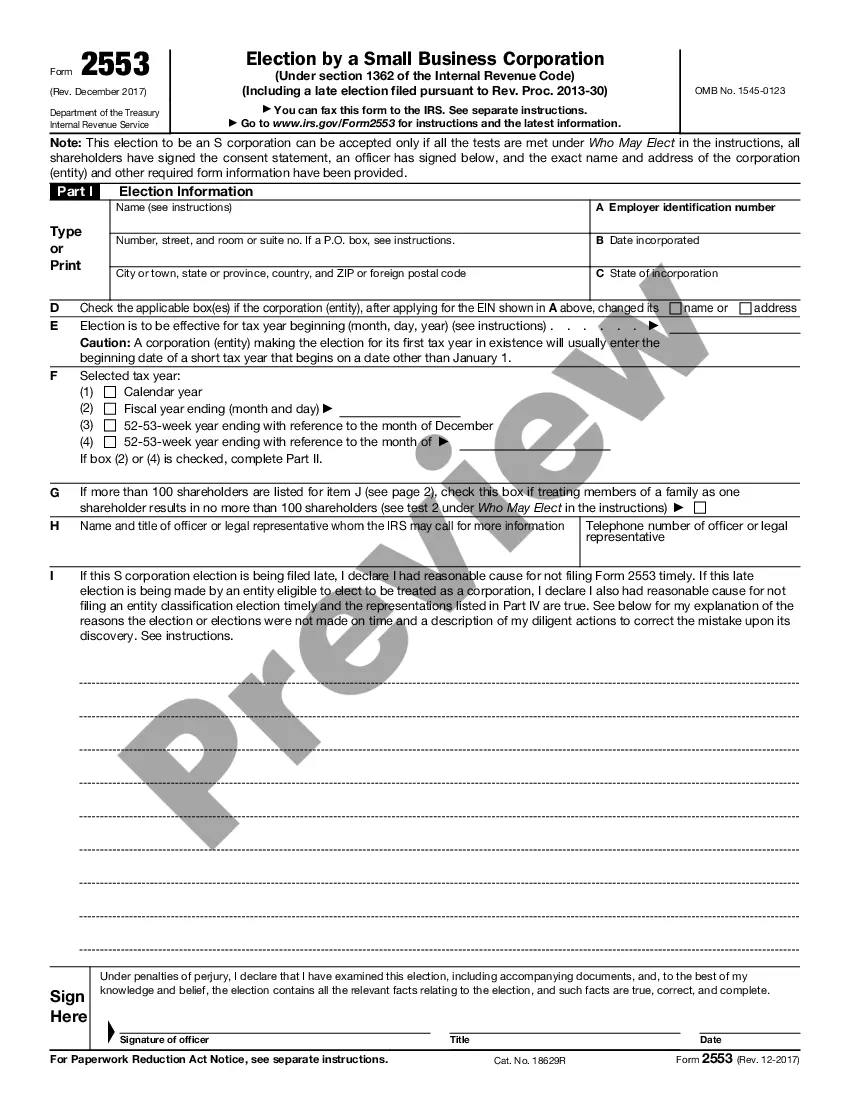

How to fill out Purchase By Company Of Its Stock?

Are you currently within a position where you need to have papers for sometimes enterprise or personal reasons just about every day time? There are tons of lawful file themes available on the Internet, but getting versions you can trust is not effortless. US Legal Forms offers a large number of type themes, like the New Hampshire Purchase by company of its stock, that happen to be created to meet state and federal demands.

Should you be presently acquainted with US Legal Forms website and also have an account, just log in. Following that, you are able to download the New Hampshire Purchase by company of its stock web template.

Should you not have an accounts and want to start using US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is for the correct area/area.

- Make use of the Preview switch to analyze the shape.

- Browse the explanation to actually have selected the correct type.

- When the type is not what you`re looking for, use the Look for industry to obtain the type that meets your needs and demands.

- When you find the correct type, just click Get now.

- Select the rates strategy you would like, submit the desired details to create your bank account, and pay money for an order making use of your PayPal or charge card.

- Decide on a hassle-free data file structure and download your copy.

Discover all the file themes you possess purchased in the My Forms menus. You may get a additional copy of New Hampshire Purchase by company of its stock whenever, if needed. Just go through the required type to download or produce the file web template.

Use US Legal Forms, by far the most considerable assortment of lawful kinds, in order to save some time and prevent blunders. The service offers appropriately manufactured lawful file themes that can be used for a selection of reasons. Make an account on US Legal Forms and start making your lifestyle a little easier.

Form popularity

FAQ

All of the profits and losses of the LLC "pass through" the business to the LLC owners (called members), who report this information on their personal tax returns. The LLC itself doesn't pay federal income taxes, although some states impose an annual tax on LLCs.

New Hampshire has no income tax and no sales tax. New Hampshire also has fairly high property taxes when compared to other states. Earned income is untaxed in New Hampshire, but the state taxes dividends and interest at 5%. Social Security benefits are not taxed by the state.

All New Hampshire LLCs need to pay $100 per year for Annual Reports. These state fees are paid to the Secretary of State. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

Single-member LLCs (SMLLCs) are taxed like sole proprietors by default, and multi-member LLCs are taxed as general partnerships. Unless members elect to choose different status, LLCs are pass-through entities, meaning revenue passes through and is paid by members on personal income tax returns.

The tax is imposed on both the buyer and the seller at the rate of $. 75 per $100 of the price or consideration for the sale, granting, or transfer. What types of transactions are taxable?

Every business organization with gross business income from all business activities of more than $50,000 must file a BPT return.

New Hampshire also has a 7.50 percent corporate income tax rate. New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire's tax system ranks 6th overall on our 2023 State Business Tax Climate Index.