New Hampshire Prospectus - Proxy Statement - Niagara Share Corporation with exhibits

Description

How to fill out Prospectus - Proxy Statement - Niagara Share Corporation With Exhibits?

If you need to complete, download, or print out lawful papers layouts, use US Legal Forms, the largest collection of lawful types, which can be found online. Utilize the site`s simple and easy handy research to find the papers you will need. Different layouts for enterprise and personal functions are sorted by groups and states, or keywords and phrases. Use US Legal Forms to find the New Hampshire Prospectus - Proxy Statement - Niagara Share Corporation with exhibits with a handful of clicks.

Should you be presently a US Legal Forms client, log in to the accounts and click the Acquire option to have the New Hampshire Prospectus - Proxy Statement - Niagara Share Corporation with exhibits. You may also accessibility types you earlier delivered electronically inside the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your proper area/nation.

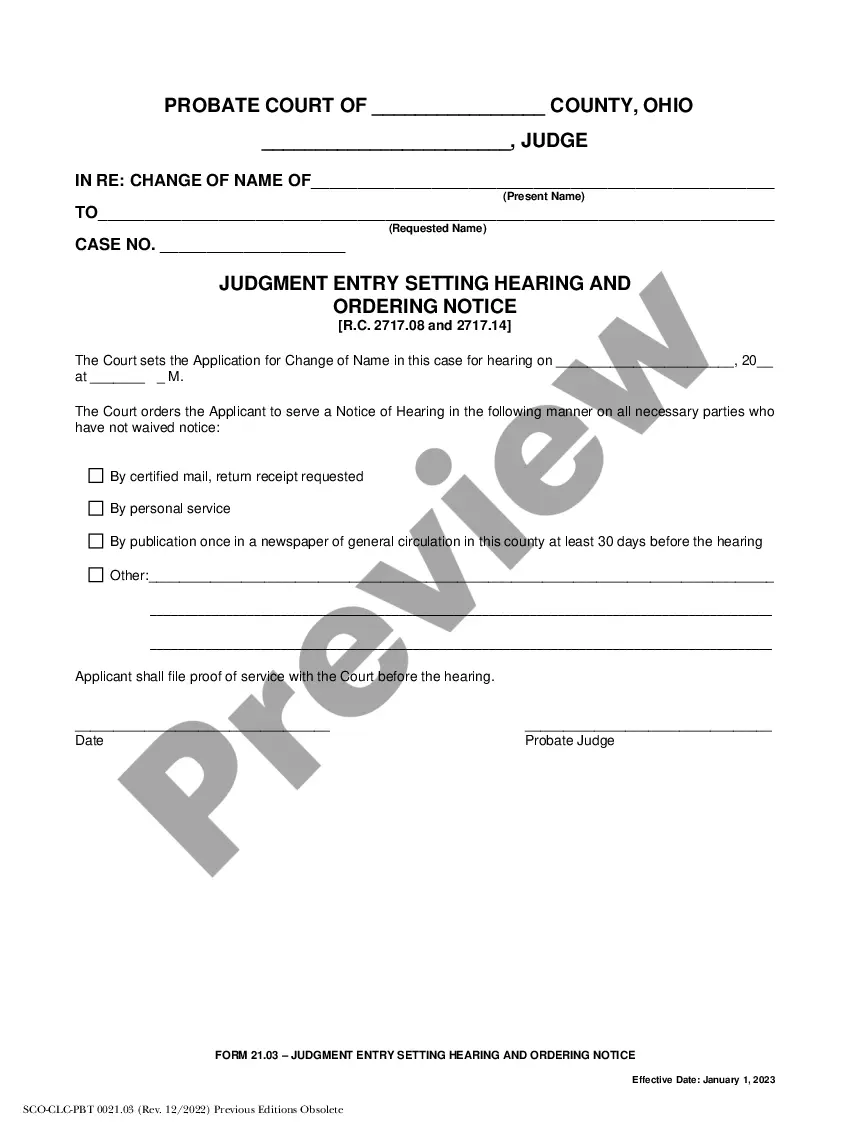

- Step 2. Make use of the Review method to look through the form`s articles. Do not forget about to read through the outline.

- Step 3. Should you be unsatisfied with the develop, make use of the Lookup industry on top of the screen to discover other versions of your lawful develop web template.

- Step 4. Once you have found the form you will need, click on the Buy now option. Choose the costs plan you prefer and add your qualifications to sign up for an accounts.

- Step 5. Approach the deal. You can use your credit card or PayPal accounts to perform the deal.

- Step 6. Select the formatting of your lawful develop and download it on your own gadget.

- Step 7. Total, modify and print out or sign the New Hampshire Prospectus - Proxy Statement - Niagara Share Corporation with exhibits.

Every lawful papers web template you acquire is your own eternally. You might have acces to each and every develop you delivered electronically in your acccount. Click the My Forms section and choose a develop to print out or download once more.

Contend and download, and print out the New Hampshire Prospectus - Proxy Statement - Niagara Share Corporation with exhibits with US Legal Forms. There are thousands of expert and status-specific types you can utilize for your personal enterprise or personal demands.