New Hampshire FCRA Certification Letter to Consumer Reporting Agency

Description

How to fill out FCRA Certification Letter To Consumer Reporting Agency?

Are you presently in a position where you require paperwork for possibly commercial or specific objectives almost every workday.

There are numerous legal document templates accessible online, but finding versions that you can rely on isn't easy.

US Legal Forms offers a wide array of template formats, including the New Hampshire FCRA Certification Letter to Consumer Reporting Agency, which are designed to comply with federal and state requirements.

Once you find the correct form, click Get now.

Choose a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New Hampshire FCRA Certification Letter to Consumer Reporting Agency template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for your correct city/county.

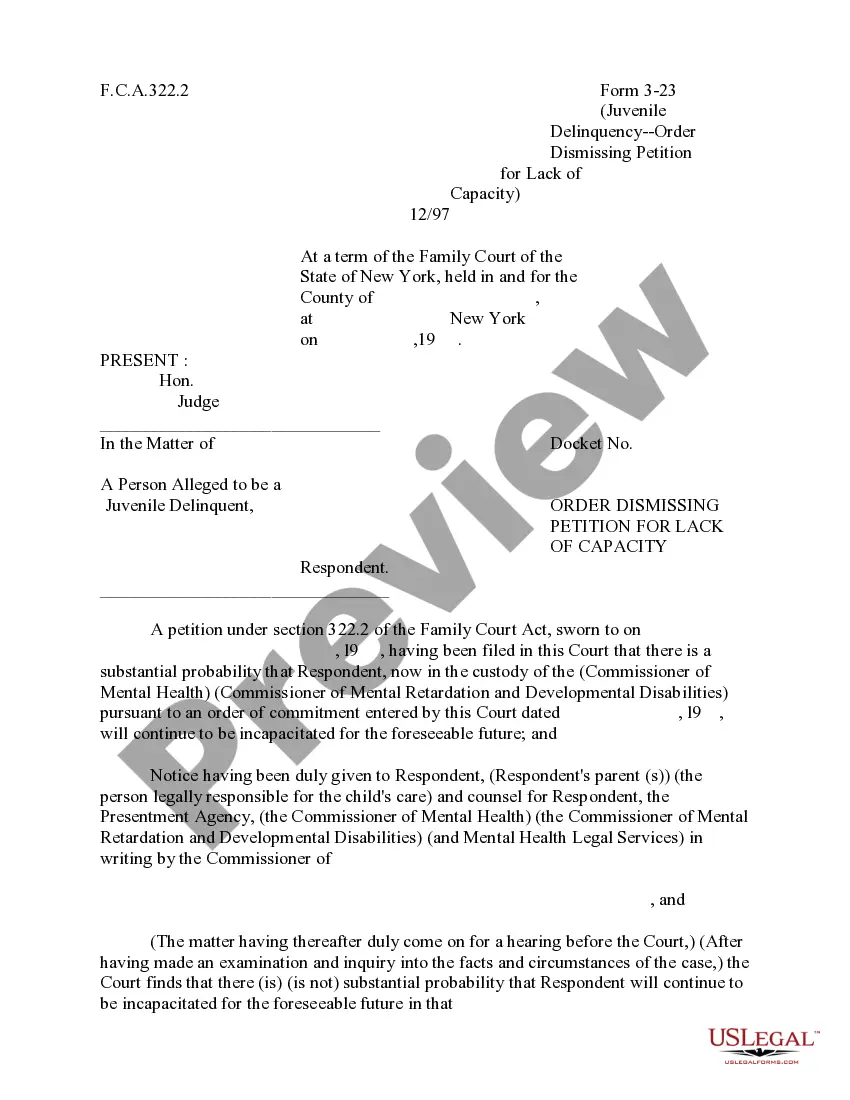

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the right template.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

Properly inform the applicant of adverse action: In your final adverse action letter, you must explain your choice and tell the applicant that they have the right to dispute your decision. Provide the necessary information for them to get another copy of their report.

A credit report is a specific type of consumer report used for lending, while the broader term "consumer report" could be used to describe things like your driving history or criminal record.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.

What is a Consumer Report? A consumer report contains information about your personal and credit characteristics, character, general reputation, and lifestyle. To be covered by the FCRA, a report must be prepared by a consumer reporting agency (CRA), a business that assembles such reports for other businesses.

The applicant or employee must agree in writing to the release of the report to the employer. This written permission may be given on the notice itself.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

A consumer report is a report expected to be used or collected in whole or part for the purpose of serving as a factor used in establishing the consumers eligibility for credit or insurance used primarily for personal, family, household, or employment purposes.

Get written permission from the applicant or employee. This can be part of the document you use to notify the person that you will get a consumer report. If you want the authorization to allow you to get consumer reports throughout the person's employment, make sure you say so clearly and conspicuously.

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

Disclosures to consumers. (a) Every consumer reporting agency shall, upon request and proper identification of any consumer, clearly and accurately disclose to the consumer: (1) The nature and substance of all information (except medical information) in its files on the consumer at the time of the request.