New Hampshire Assignment of Profits of Business

Description

How to fill out Assignment Of Profits Of Business?

You might spend numerous hours online trying to locate the legal document template that fulfills the federal and state stipulations you need.

US Legal Forms offers thousands of legal forms that are vetted by professionals.

You can easily download or print the New Hampshire Assignment of Profits of Business from the service.

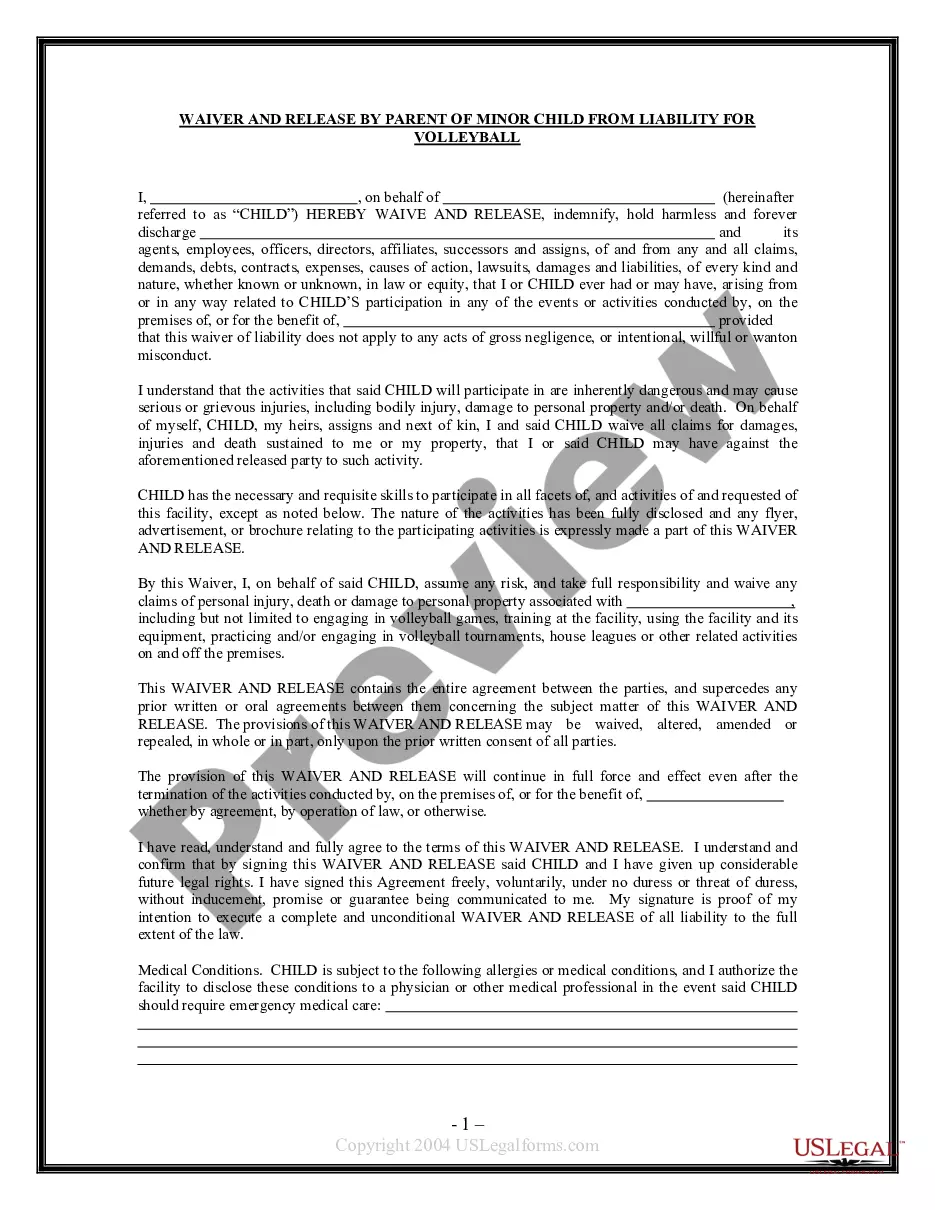

If available, use the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the New Hampshire Assignment of Profits of Business.

- Each legal document template you download is yours permanently.

- To acquire another version of a downloaded form, go to the My documents tab and click the appropriate button.

- If you are utilizing the US Legal Forms website for the first time, follow the straightforward steps below.

- First, ensure that you have selected the right document template for the county/town of your choice.

- Check the form details to confirm you have chosen the correct document.

Form popularity

FAQ

Most businesses must file and pay federal taxes on any income earned or received during the year. Partnerships, however, file an annual information return but don't pay income taxes. Instead, each partner reports their share of the partnership's profits or loss on their individual tax return.

The full company tax rate is 30% and the lower company tax rate is 27.5%. From the 20172018 income year, your business is eligible for the lower rate if it's a base rate entity.

By default, LLCs themselves do not pay income taxes, only their members do. New Hampshire, however, is relatively unusual in imposing several taxes directly on LLCs with incomes or other values above certain levels.

For taxable periods ending before December 31, 2016, a 0.75% tax is assessed on the enterprise value tax base, which is the sum of all compensation paid or accrued, interest paid or accrued, and dividends paid by the business enterprise, after special adjustments and apportionment.

The BET is a 0.75% tax assessed on the taxable enterprise value tax base, after special adjustments and apportionments. The BET is the sum of all compensation paid or accrued, interest paid or accrued, and dividends paid by the business enterprise.

The BET is a 0.75% tax assessed on the taxable enterprise value tax base, after special adjustments and apportionments. The BET is the sum of all compensation paid or accrued, interest paid or accrued, and dividends paid by the business enterprise.

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax. Homeowners in New Hampshire pay some of the highest average effective property tax rates in the country.

The Business Profits Tax ("BPT") was enacted in 1970. The tax is assessed on income from conducting business activity within the state at the rate of 7.7% for taxable periods ending on or after December 31, 2019.

For taxable periods beginning on or after January 1, 2019, every business enterprise with more than $217,000 of gross receipts from all activities, or an enterprise value tax base of more than $108,000, must file a BET return.

Does New Hampshire Have Income Tax? No, but New Hampshire businesses are responsible for filing and paying Business Profits Tax and Business Enterprise Tax. Owners may also be subject to the 5% Interest/Dividends tax from distributions they received from their corporations.