New Hampshire Certificate of Secretary of Corporation as to Commercial Loan

Description

How to fill out Certificate Of Secretary Of Corporation As To Commercial Loan?

Discovering the right authorized papers design might be a have a problem. Of course, there are a lot of templates available on the Internet, but how can you obtain the authorized form you want? Take advantage of the US Legal Forms site. The services offers a large number of templates, like the New Hampshire Certificate of Secretary of Corporation as to Commercial Loan, that can be used for business and private demands. All the forms are checked by specialists and fulfill federal and state demands.

In case you are previously authorized, log in for your bank account and then click the Down load button to get the New Hampshire Certificate of Secretary of Corporation as to Commercial Loan. Make use of bank account to look throughout the authorized forms you might have bought earlier. Check out the My Forms tab of the bank account and get one more version of the papers you want.

In case you are a new end user of US Legal Forms, allow me to share basic guidelines for you to stick to:

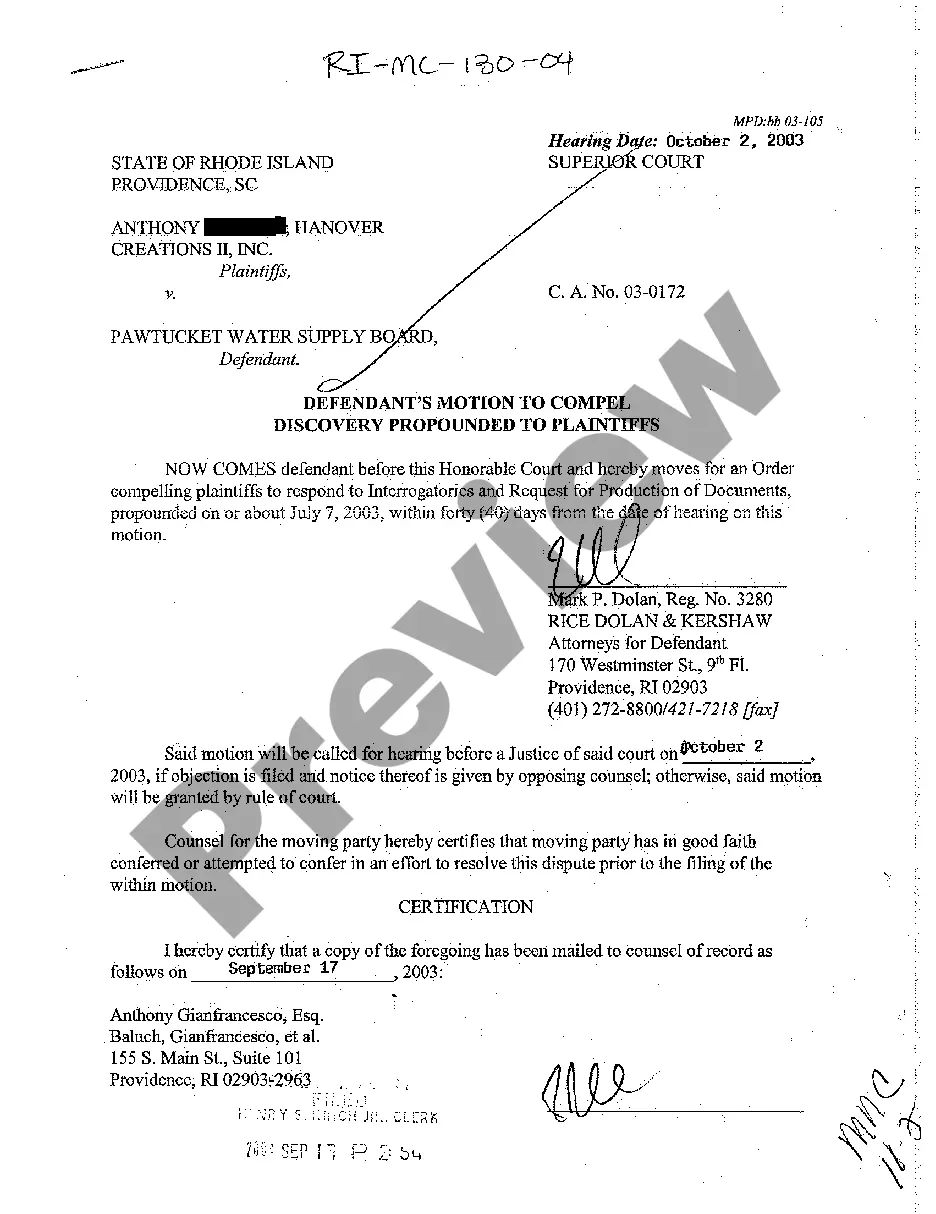

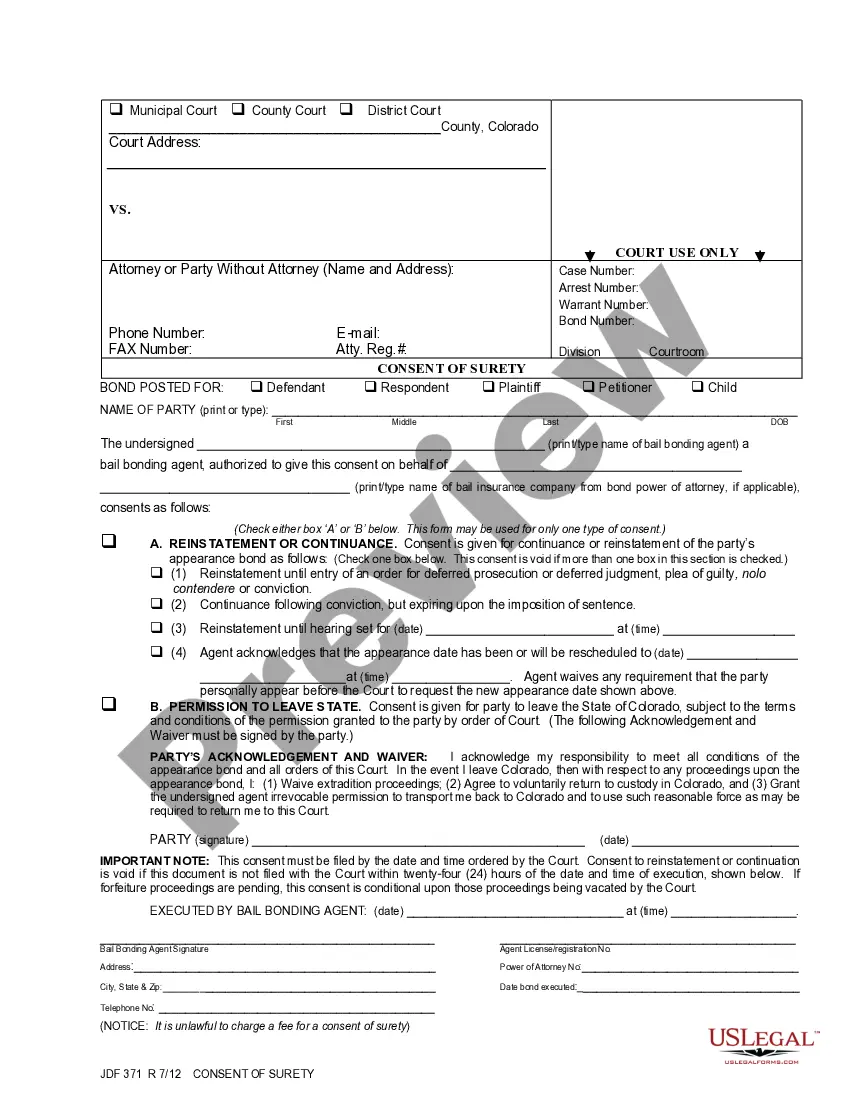

- Initial, make certain you have selected the proper form for your area/area. It is possible to look over the shape using the Preview button and study the shape information to make certain this is basically the best for you.

- When the form will not fulfill your requirements, make use of the Seach field to discover the correct form.

- Once you are certain that the shape would work, click the Acquire now button to get the form.

- Select the costs strategy you want and enter in the required details. Design your bank account and buy the transaction using your PayPal bank account or bank card.

- Opt for the document format and acquire the authorized papers design for your product.

- Full, edit and produce and signal the obtained New Hampshire Certificate of Secretary of Corporation as to Commercial Loan.

US Legal Forms will be the most significant catalogue of authorized forms where you can find numerous papers templates. Take advantage of the company to acquire skillfully-made paperwork that stick to state demands.

Form popularity

FAQ

Annual report fee means the fee described in subsection (c) of this section that is to be paid to the Secretary of State each year by corporations, limited partnerships, domestic limited liability companies and foreign limited liability companies.

New Hampshire Annual Report Fee: $100 Due every year by April 1st, your LLC's New Hampshire Annual Report costs $100 to file. If you're late for the filing deadline, the Corporations Division will charge an additional $50 late fee.

NH QuickStart, is an online platform for business registration with the Corporation Division of the Secretary of State's Office. Application for Registration of Trade Name: Anyone doing business under any name except his or her own is required to register that trade name with the Secretary of State's Office.

Filing Fee and Due Date Filing fees and due dates for the Annual Report vary by state. Filing fees can range from $9/year up to $800/year. Due dates also vary: Some Annual Reports are due every year.

The fee for each certificate is $10.00. The check should be made payable to the State of New Hampshire and should accompany the request.

New Hampshire Corporation Annual Report Requirements: $100. +$2 to file online. Due: Annually by April 1.

The state of New Hampshire requires all New Hampshire corporations, LLCs, and LLPs to file an annual report each year. New Hampshire nonprofits must file a report every five years. All reports must be submitted to the New Hampshire Department of State, Corporations Division.