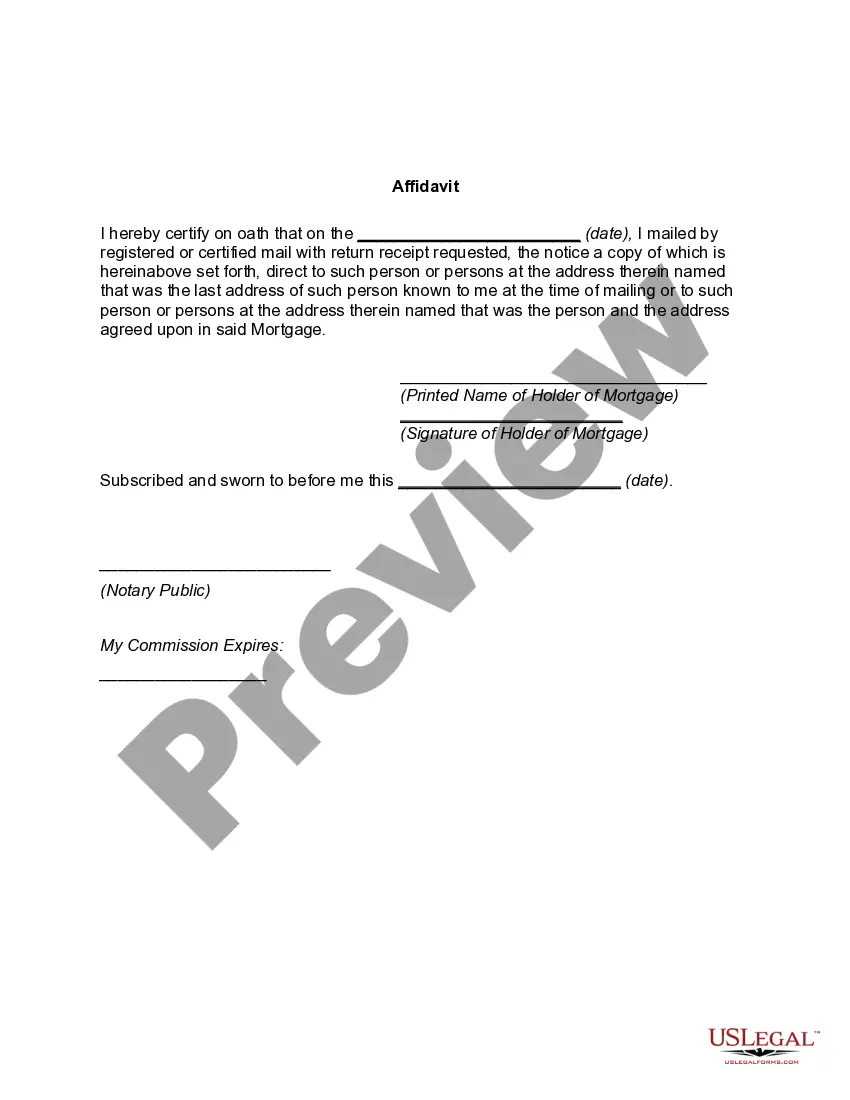

New Hampshire Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

How to fill out Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

US Legal Forms - one of many biggest libraries of legitimate kinds in the USA - offers a variety of legitimate papers layouts you are able to obtain or produce. Using the internet site, you can get a large number of kinds for organization and person purposes, categorized by categories, claims, or search phrases.You will discover the most up-to-date types of kinds such as the New Hampshire Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage within minutes.

If you already possess a membership, log in and obtain New Hampshire Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage in the US Legal Forms local library. The Acquire switch can look on every form you see. You get access to all previously saved kinds within the My Forms tab of your respective bank account.

If you want to use US Legal Forms the very first time, here are basic guidelines to get you began:

- Be sure you have picked out the best form for your personal city/region. Select the Review switch to review the form`s content. Look at the form information to actually have selected the right form.

- If the form does not suit your specifications, take advantage of the Look for discipline near the top of the screen to get the one that does.

- If you are pleased with the form, validate your decision by simply clicking the Acquire now switch. Then, pick the pricing plan you prefer and offer your references to sign up to have an bank account.

- Process the deal. Make use of your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Find the format and obtain the form on your own device.

- Make modifications. Fill out, revise and produce and indication the saved New Hampshire Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

Every single format you added to your account lacks an expiry time which is the one you have permanently. So, if you would like obtain or produce yet another backup, just visit the My Forms area and click in the form you require.

Gain access to the New Hampshire Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage with US Legal Forms, probably the most considerable local library of legitimate papers layouts. Use a large number of expert and condition-distinct layouts that fulfill your company or person demands and specifications.

Form popularity

FAQ

Ways to Stop Foreclosure in New Hampshire Declare Bankruptcy. Yes, bankruptcy is a way through which foreclosure can be stopped. ... Applying for Loan Modification. ... Reinstating Your Loan. ... Plan for Repayment. ... Refinancing. ... Sell Out Your Home. ... Short Sale. ... Deed In Lieu of Foreclosure.

Under New Hampshire law, the borrower typically receives just one warning about the foreclosure sale: a notice of sale. The lender has to personally serve the notice of sale to the borrower or mail it at least 45 days before the sale and publish it in a newspaper once a week for three weeks before the sale.

A deficiency judgment is a personal judgment against a borrower for the balance of a debt owed when the security for the loan is not sufficient to pay the debt.

If a foreclosure is nonjudicial, the foreclosing lender must file a lawsuit following the foreclosure to get a deficiency judgment. On the other hand, with a judicial foreclosure, most states allow the lender to seek a deficiency judgment as part of the underlying foreclosure lawsuit.

When a court dismisses a foreclosure action due to a lost note, the court will dismiss the case without prejudice. This means that the lender still has another opportunity to bring the case again once the note is located. Therefore, a lender can still foreclose the mortgage once they find the note.

In a judicial foreclosure, the lender can get a deficiency judgment to collect any money they're owed after the sale. In a judicial foreclosure, after the judge orders the sale of a home, it's usually auctioned off to the highest bidder.

In return for the lender having the power to sell the property, the Power of Sale clause protects the borrower by stating that when the lender sells the property, the lender may not hold the borrower liable for any cost not covered by the sale unless the lender is able to obtain a deficiency judgment in their favor, ...

Primary tabs. Deficiency judgment is money awarded to creditors when assets securing a loan do not cover the debt owed by a debtor. When a debtor becomes insolvent, a creditor can repossess the asset securing the loan, and then sell the asset to recover the debt.