New Hampshire Agreement to Form Partnership in Future to Conduct Business

Description

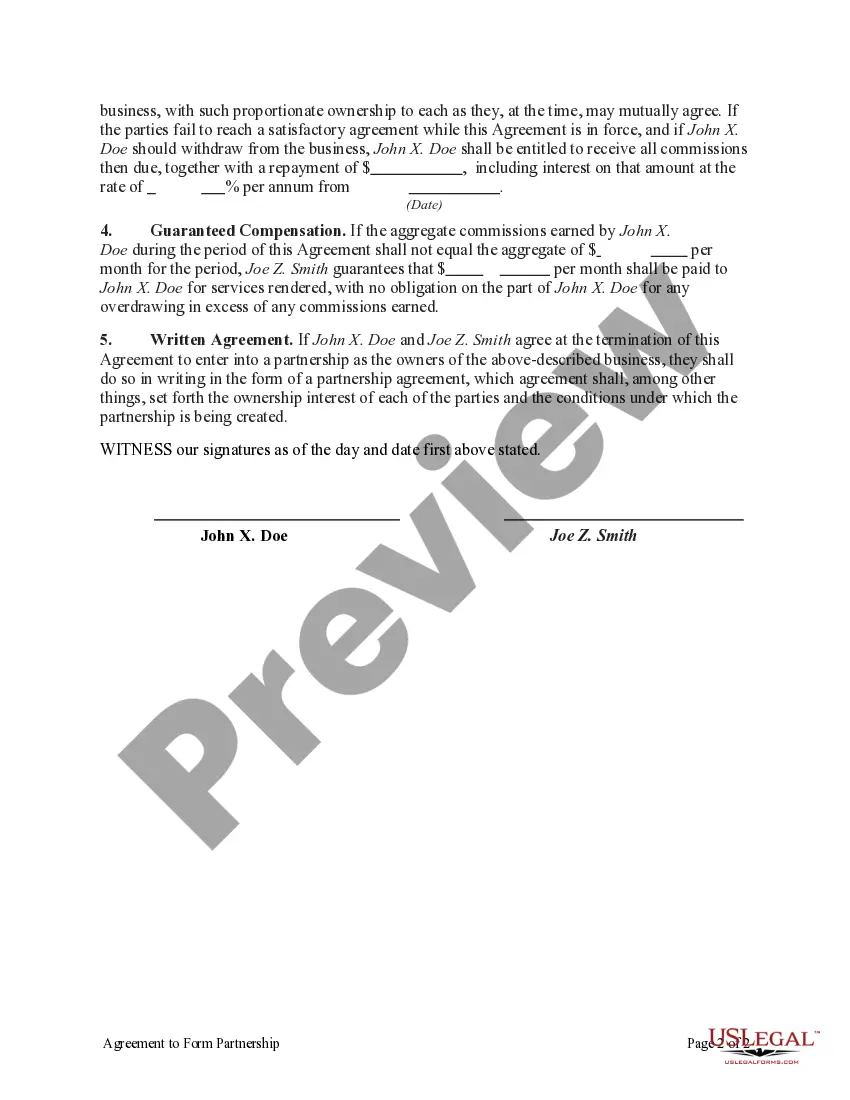

How to fill out Agreement To Form Partnership In Future To Conduct Business?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template files available for download or printing.

By utilizing the website, you will find thousands of documents for commercial and personal use, sorted by category, state, or keywords. You can access the most current forms such as the New Hampshire Agreement to Establish Partnership in Future to Conduct Business within moments.

If you already have a subscription, Log In to download the New Hampshire Agreement to Establish Partnership in Future to Conduct Business from the US Legal Forms library. The Acquire button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print, then sign the downloaded New Hampshire Agreement to Establish Partnership in Future to Conduct Business. Every template you add to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the New Hampshire Agreement to Establish Partnership in Future to Conduct Business with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- To begin using US Legal Forms for the first time, here are simple instructions to help you start.

- Ensure you have chosen the correct form for your city/region.

- Click on the Review button to inspect the contents of the form.

- Read the form description to confirm that you have selected the appropriate document.

- If the form does not fit your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

While it is possible to form a partnership without a written agreement, having a New Hampshire Agreement to Form Partnership in Future to Conduct Business is highly recommended. This written document outlines the rights and responsibilities of each partner, helping to prevent misunderstandings in the future. Without a formal agreement, partners may face challenges in decision-making and profit sharing. Therefore, to ensure clarity and avoid disputes, consider using uslegalforms to create your partnership agreement.

To set up a business partnership agreement, start by outlining essential details like ownership percentages, profit sharing, and responsibilities. It’s advisable to use a template or seek help from a professional to ensure thoroughness. You can simplify the process by using resources like uslegalforms, which provides templates specifically for creating your New Hampshire Agreement to Form Partnership in Future to Conduct Business.

Yes, New Hampshire does impose taxes on business entities, including partnerships, primarily through the Business Profits Tax. However, the specifics of taxation can vary based on the structure and income of the partnership. When forming your New Hampshire Agreement to Form Partnership in Future to Conduct Business, consider consulting an expert to understand your tax obligations and plan accordingly.

The four primary types of partnerships in business are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type varies in terms of liability and management structure. When establishing your New Hampshire Agreement to Form Partnership in Future to Conduct Business, it’s vital to choose a structure that fits your business needs and partnership goals.

Key partnerships can include strategic alliances, joint ventures, franchising agreements, and distribution partnerships. Each type serves a unique purpose and can help businesses capitalize on complementary strengths. When you create a New Hampshire Agreement to Form Partnership in Future to Conduct Business, consider which type aligns best with your goals to ensure a successful collaboration.

A partnership generally evolves through four key stages: formation, operation, growth, and dissolution. During the formation stage, partners create their agreement, including terms in the New Hampshire Agreement to Form Partnership in Future to Conduct Business. As the partnership operates, it may face challenges and opportunities that drive its growth, and eventually, a partnership may reach dissolution due to various reasons. Recognizing these stages helps partners navigate their journey effectively.

In business, you typically encounter four types of partnerships: general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each offers a different structure for sharing profits, responsibilities, and liabilities. Understanding these types is crucial when drafting your New Hampshire Agreement to Form Partnership in Future to Conduct Business, as this will affect your legal obligations and asset protection.

The filing requirements for a partnership can vary by state, but generally involve documenting your partnership agreement. In New Hampshire, you will need a New Hampshire Agreement to Form Partnership in Future to Conduct Business and may also need to register the partnership with the state. Ensuring proper filings helps protect your business against potential disputes and liabilities.

Partnerships typically need to fill out a partnership formation form as required by their state. In New Hampshire, this may involve using a New Hampshire Agreement to Form Partnership in Future to Conduct Business to ensure all legal requirements are met. Additionally, partners should check if local documents or licenses are necessary for specific industries.

Writing a partnership agreement sample begins with outlining the purpose of the partnership and the contributions of each partner. Include sections for roles, profit distribution, and resolution processes. Using a New Hampshire Agreement to Form Partnership in Future to Conduct Business can guide you through key elements, ensuring that your sample agreement covers all necessary legal bases.