This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

You may spend hrs online attempting to find the lawful file format which fits the federal and state requirements you need. US Legal Forms gives a huge number of lawful kinds which can be examined by professionals. It is possible to obtain or print out the New Hampshire Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage from your services.

If you have a US Legal Forms account, you can log in and then click the Down load key. Next, you can total, modify, print out, or indication the New Hampshire Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. Each lawful file format you get is your own for a long time. To get one more version of the purchased type, visit the My Forms tab and then click the corresponding key.

If you use the US Legal Forms web site for the first time, follow the simple instructions below:

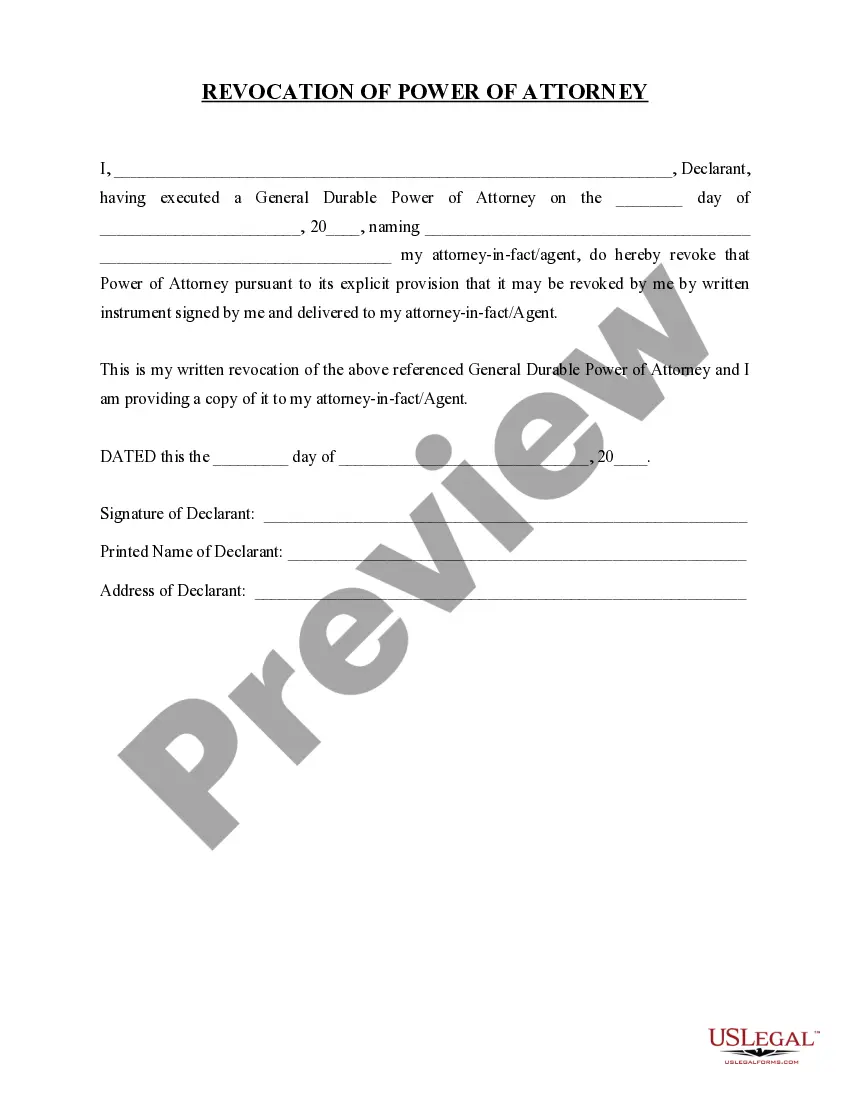

- First, make sure that you have selected the best file format to the region/area of your liking. See the type outline to ensure you have selected the correct type. If readily available, make use of the Review key to appear from the file format at the same time.

- If you want to find one more model from the type, make use of the Research area to find the format that suits you and requirements.

- When you have found the format you desire, just click Get now to move forward.

- Choose the pricing strategy you desire, type in your references, and register for a merchant account on US Legal Forms.

- Complete the transaction. You should use your Visa or Mastercard or PayPal account to fund the lawful type.

- Choose the file format from the file and obtain it to the system.

- Make alterations to the file if possible. You may total, modify and indication and print out New Hampshire Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage.

Down load and print out a huge number of file themes using the US Legal Forms web site, that offers the greatest variety of lawful kinds. Use specialist and state-certain themes to handle your business or personal requirements.

Form popularity

FAQ

Primary tabs. A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

A mortgage discharge is a signed document from the lender indicating that the mortgage contract has been fulfilled. Discharging the mortgage ends the lender's legal claim to your property.

In New Hampshire, the statute of limitations period for most types of debt is three years. That said, the statute of limitations period in New Hampshire for auto loan debt is four years, for credit card debt is three years, for medical debt is six years, and for mortgage debt is twenty years.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

Print. You Release a Mortgage or Charge when the property charged has been released from the charge or no longer forms part of the company's property. You Satisfy a Mortgage or Charge when the debt of the charge has been paid or satisfied in full or part.

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

The Satisfaction of Mortgage Documentation Process If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.