New Hampshire Sworn Statement regarding Proof of Loss for Automobile Claim

Description

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

Are you currently within a place in which you will need files for both organization or person functions nearly every time? There are a lot of legitimate document web templates accessible on the Internet, but getting kinds you can rely on isn`t straightforward. US Legal Forms delivers thousands of form web templates, just like the New Hampshire Sworn Statement regarding Proof of Loss for Automobile Claim, which are written to meet state and federal requirements.

When you are currently familiar with US Legal Forms site and possess a merchant account, basically log in. Afterward, you can obtain the New Hampshire Sworn Statement regarding Proof of Loss for Automobile Claim design.

Unless you come with an account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is to the proper area/area.

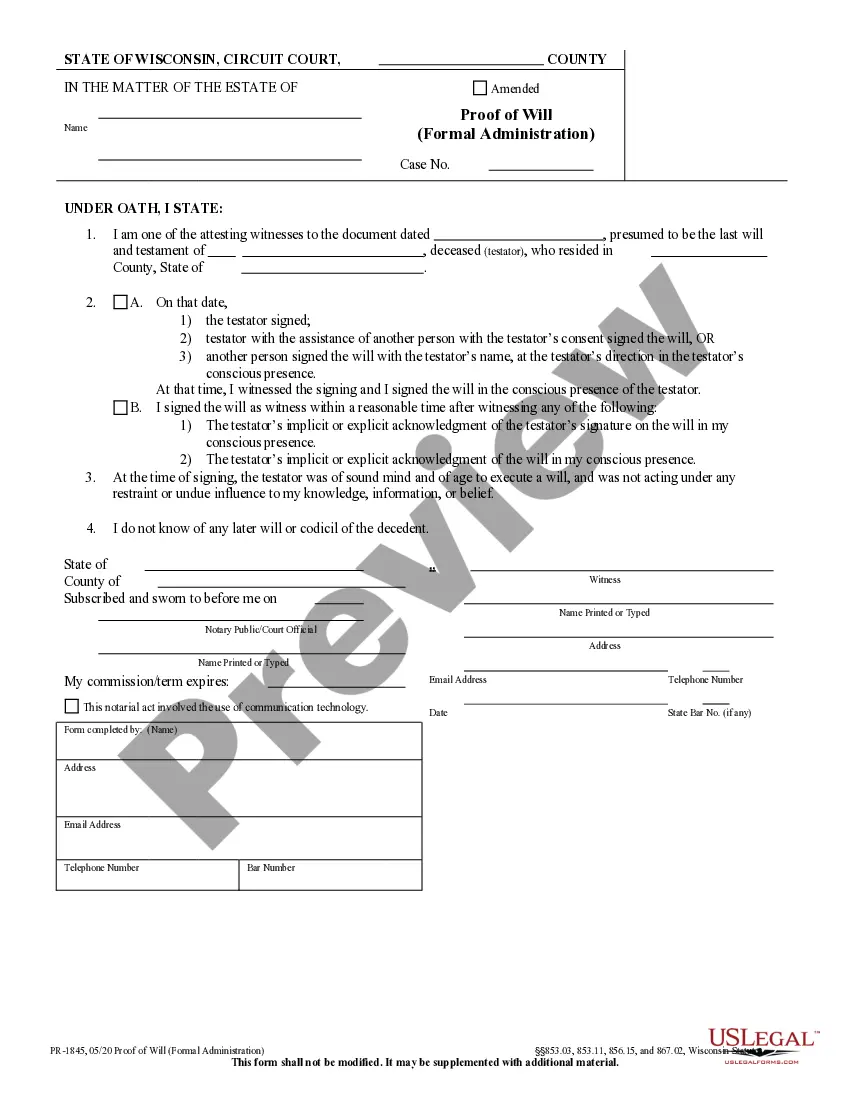

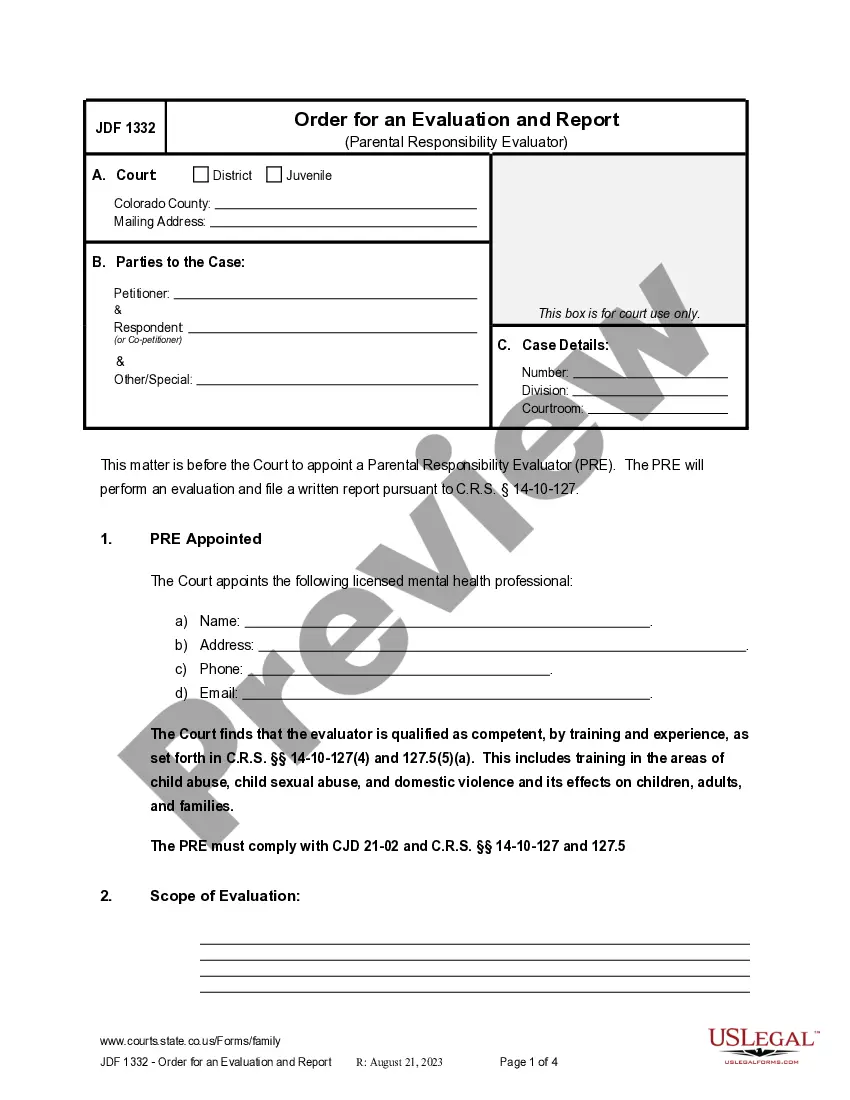

- Make use of the Review option to review the shape.

- Read the information to ensure that you have chosen the correct form.

- If the form isn`t what you`re looking for, use the Research area to find the form that meets your requirements and requirements.

- If you get the proper form, just click Get now.

- Pick the costs program you desire, fill out the necessary information to produce your money, and pay for the transaction using your PayPal or charge card.

- Decide on a practical paper file format and obtain your duplicate.

Get every one of the document web templates you might have bought in the My Forms menus. You can get a more duplicate of New Hampshire Sworn Statement regarding Proof of Loss for Automobile Claim whenever, if necessary. Just click the necessary form to obtain or print out the document design.

Use US Legal Forms, by far the most comprehensive assortment of legitimate types, to save lots of efforts and steer clear of errors. The service delivers expertly made legitimate document web templates that you can use for a selection of functions. Generate a merchant account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.

Satisfactory proof of loss, as required for an insured to obtain penalties from an insurer, is that which is sufficient to fully apprise the insurer of the claim and extent of the damage. Louisiana Bag Co., 2008-0453, p. 16, 999 So.

What is a Proof of Loss? A Sworn Statement in Proof of Loss outlines the basic details of your property damage claim and serves as a cover document for your supporting claim materials and documentation.

The Proof of Loss form is an official, notarized, sworn statement from the insured to the insurer concerning the scope of damage to their property. The insurance company uses this information as a basis for determining their liabilities for the property loss.

Information You'll Need For a Proof of Loss Form It will usually include the following: Policy number. Date and cause of the damage. Parties with a financial interest in the claim such as your mortgage holder.

A Proof of Loss form helps to substantiate any damages that you suffered due to an insurance-covered event. The insurance policy itself and this document are used together to determine whether or not the insurance company has liability.

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred.

Some of the most common pieces of information that need to be submitted on this form include the cause and date of the damage, the policy number under which this is allegedly covered, any people who have a financial interest in the claim like a mortgage holder, estimates to repair damage as a result of property ...