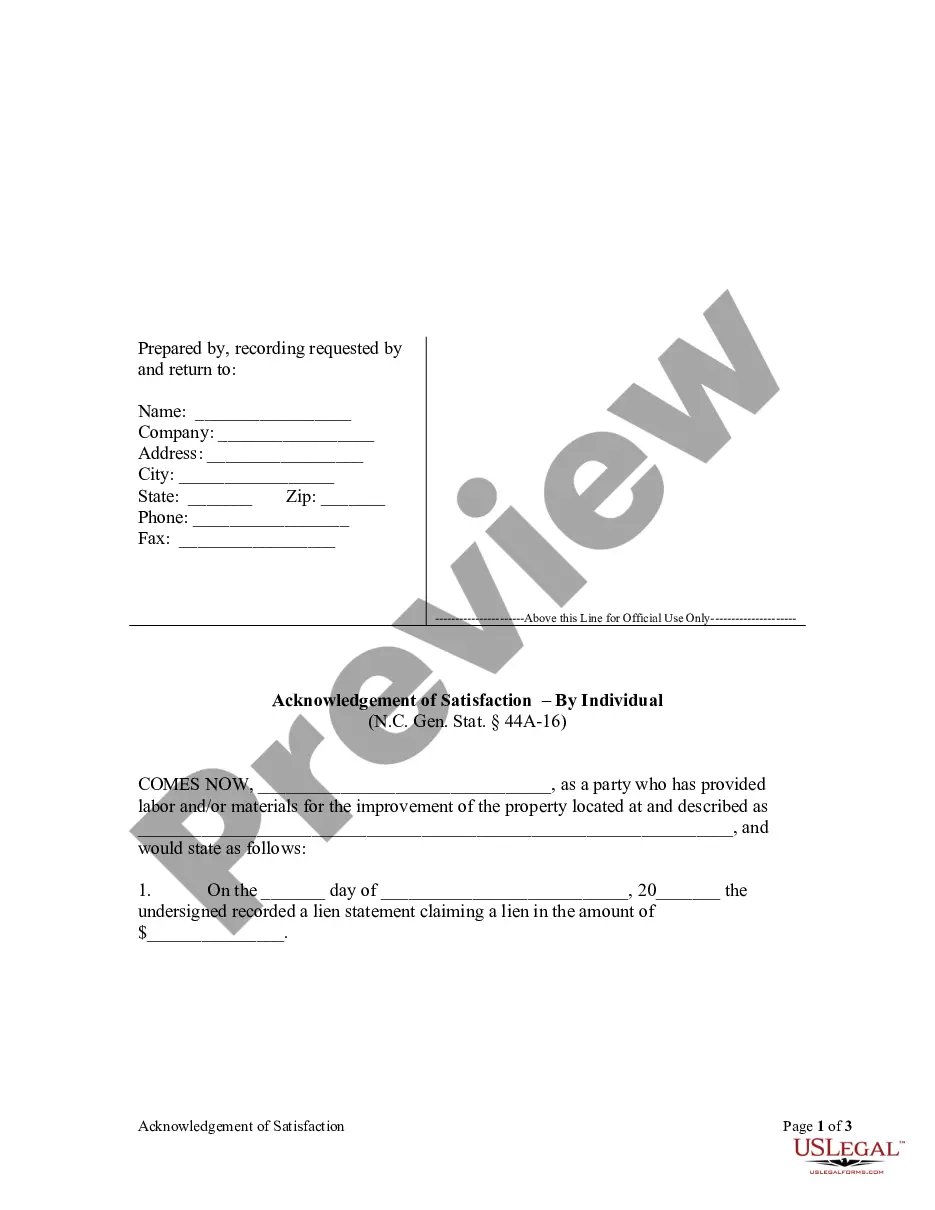

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Assignment of Judgment to Attorney for Collection

Description

How to fill out Assignment Of Judgment To Attorney For Collection?

US Legal Forms - one of the most significant libraries of legal types in the United States - provides an array of legal file themes you can download or print out. Using the website, you can find a large number of types for company and person purposes, sorted by categories, says, or key phrases.You will find the most up-to-date types of types much like the New Hampshire Assignment of Judgment to Attorney for Collection in seconds.

If you already have a subscription, log in and download New Hampshire Assignment of Judgment to Attorney for Collection from the US Legal Forms catalogue. The Acquire button will show up on every form you see. You have access to all earlier delivered electronically types within the My Forms tab of the bank account.

If you would like use US Legal Forms the first time, allow me to share easy recommendations to help you started:

- Be sure you have chosen the best form for your personal metropolis/region. Go through the Review button to check the form`s articles. Look at the form explanation to actually have selected the proper form.

- When the form does not suit your specifications, use the Lookup industry towards the top of the display screen to get the one that does.

- When you are pleased with the shape, affirm your option by clicking the Acquire now button. Then, choose the pricing strategy you prefer and give your references to sign up for an bank account.

- Process the deal. Use your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Choose the formatting and download the shape on your own product.

- Make modifications. Load, change and print out and indicator the delivered electronically New Hampshire Assignment of Judgment to Attorney for Collection.

Each and every web template you included with your money lacks an expiry date and is also your own for a long time. So, if you want to download or print out yet another backup, just check out the My Forms section and click around the form you want.

Obtain access to the New Hampshire Assignment of Judgment to Attorney for Collection with US Legal Forms, probably the most substantial catalogue of legal file themes. Use a large number of professional and condition-distinct themes that satisfy your small business or person requirements and specifications.

Form popularity

FAQ

Absent full disclosure to and consent by the former client, Rule 1.9 prohibits an attorney who has represented a client in a matter from representing another person ?in the same or a substantially related matter? where the clients' interests in the matter are ?materially adverse,? unless the former client consents ? ...

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you. The FDCPA covers the collection of debts that are primarily for personal, family, or household purposes.

The limited time window in which debt collectors and creditors can sue debtors for nonpayment of credit card bills in New Hampshire is 3 years. The statute applies to "written contracts" or "open accounts. In most cases, once the statute of limitations on a case "runs out," the legal claim is not valid any longer.

In New Hampshire, the statute of limitations period for most types of debt is three years. That said, the statute of limitations period in New Hampshire for auto loan debt is four years, for credit card debt is three years, for medical debt is six years, and for mortgage debt is twenty years.

Confidentiality of Information. (a) A lawyer shall not reveal information relating to the representation of a client unless the client gives informed consent, the disclosure is impliedly authorized in order to carry out the representation, or the disclosure is permitted by paragraph (b).

Depositions. (a) A party may take as many depositions as necessary to adequately prepare a case for trial so long as the combined total of deposition hours does not exceed 20 unless otherwise stipulated by counsel or ordered by the court for good cause shown.

In California, for example, the statute of limitations is two years for oral contracts and four years for written contracts. So, if you live in California and it's been four years and one day since your last activity on a written contract, the debt collector won't be able to sue you.