New Hampshire Agreement to Compromise Debt by Returning Secured Property

Description

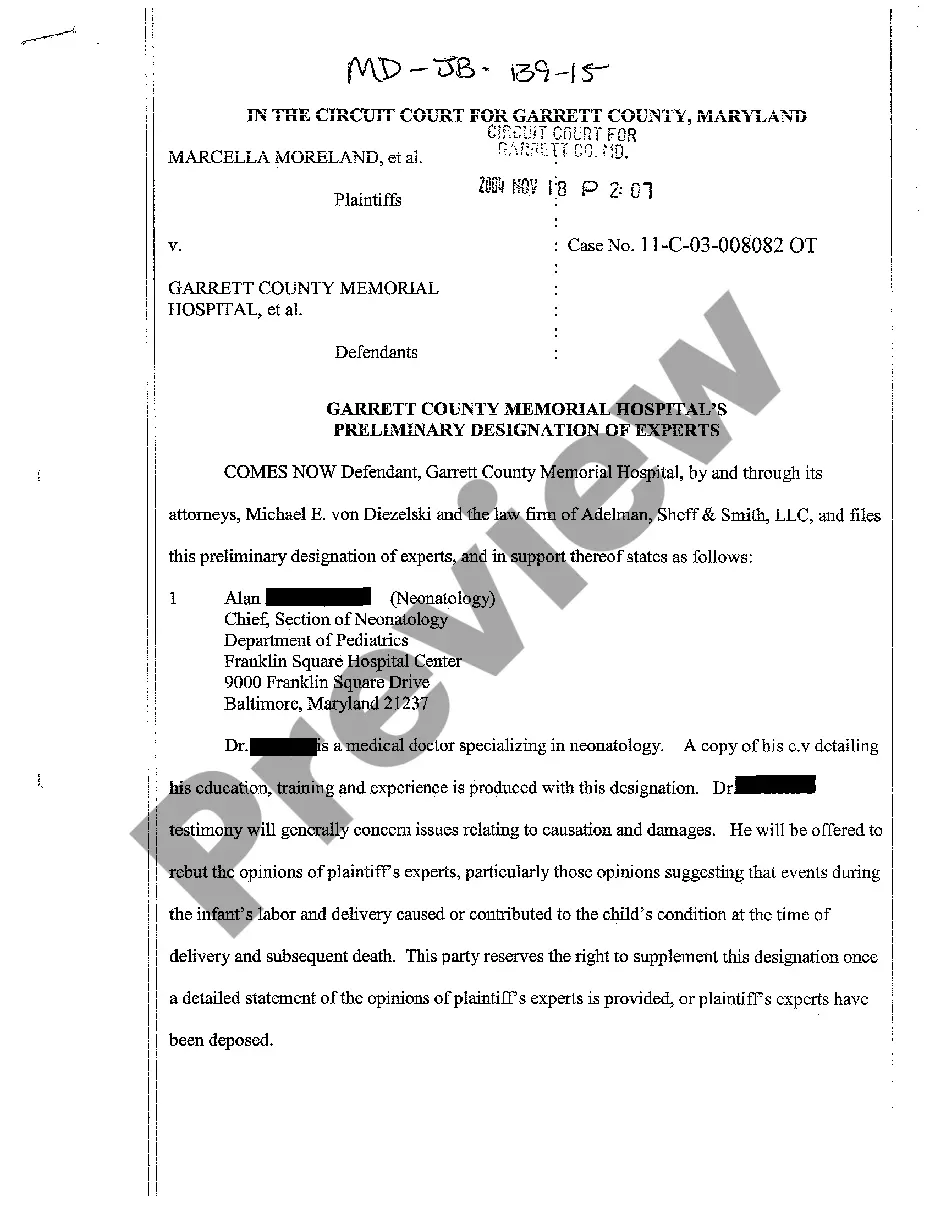

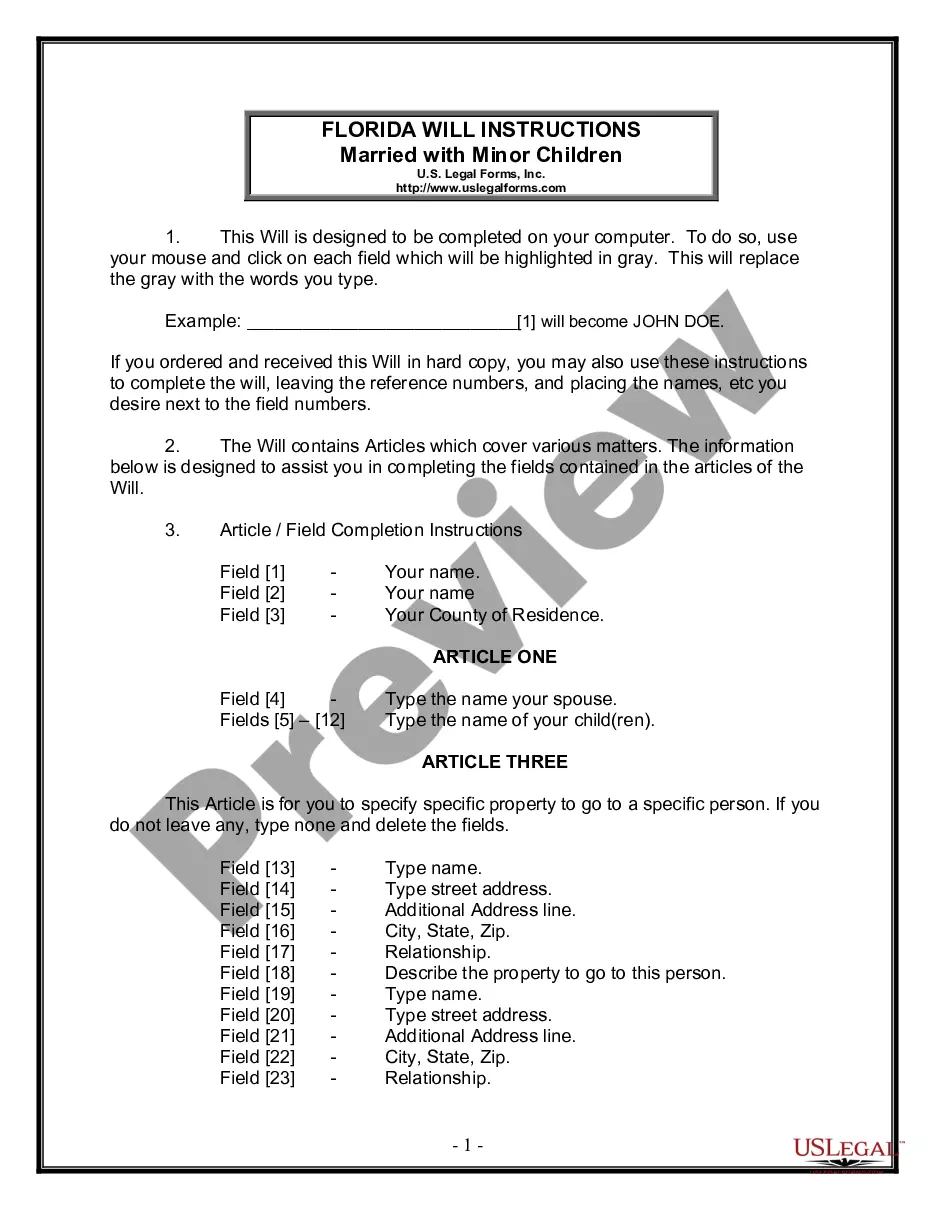

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Locating the appropriate official document format can be a struggle.

Certainly, there are numerous templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the New Hampshire Agreement to Compromise Debt by Returning Secured Property, suitable for business and personal needs.

- All templates are reviewed by professionals and meet state and federal requirements.

- If you are already signed up, Log In to your account and click on the Download button to obtain the New Hampshire Agreement to Compromise Debt by Returning Secured Property.

- Use your account to review the legal forms you have previously acquired.

- Visit the My documents section of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have chosen the correct template for your jurisdiction. You can preview the document using the Preview option and read the description to confirm it meets your needs.

Form popularity

FAQ

To outsmart a debt collector, remain calm and informed. Keep records of all communications, and be aware of your rights. You can also explore the New Hampshire Agreement to Compromise Debt by Returning Secured Property as a strategic option. This agreement can serve as a pathway to resolving your debts while protecting your assets.

Debt collectors cannot harass you or contact you at inconvenient times. They also cannot misrepresent the amount owed or threaten violence. Understanding these boundaries empowers you to protect yourself. You may consider the New Hampshire Agreement to Compromise Debt by Returning Secured Property as a legal tool to handle these interactions effectively.

The phrase is 'I request removal of negative items from my credit report.' This statement can be used when disputing inaccuracies on your credit report. As you work on rebuilding your credit, understanding the New Hampshire Agreement to Compromise Debt by Returning Secured Property can help you regain financial stability. Being proactive about your credit will lead to better opportunities.

Yes, settling secured debt is possible. Through negotiation, you can agree with creditors to compromise on the amount owed, allowing you to return the secured property. The New Hampshire Agreement to Compromise Debt by Returning Secured Property provides a framework for this resolution. Using this agreement can ease your financial burden while protecting your rights.

The phrase is 'Cease all communication until I am represented by an attorney.' By using this statement, you can effectively pause any debt collection efforts. It demonstrates your seriousness about handling the situation. This approach can also tie into the New Hampshire Agreement to Compromise Debt by Returning Secured Property.

The 777 rule refers to a guideline for debt collectors, indicating that they should not make contact with you more than seven times a week. It aims to protect consumers from harassment while they resolve issues like those addressed in a New Hampshire Agreement to Compromise Debt by Returning Secured Property. Understanding this rule can empower you to manage debt without stress. For more information and resources, USLegalForms offers tools that help navigate interactions with debt collectors.

To write a settlement agreement, clearly outline the terms of the arrangement. Start with the parties involved, then specify the debt owed and the proposed compromise, such as returning secured property under a New Hampshire Agreement to Compromise Debt by Returning Secured Property. Both parties should review and sign the agreement to make it enforceable. For added legal support, consider using platforms like USLegalForms to create a precise and professional document.

Debts in New Hampshire usually become uncollectible after three years. This time frame starts from the last date you made a payment or acknowledged the debt. If you find yourself dealing with an uncollectible debt, utilizing a New Hampshire Agreement to Compromise Debt by Returning Secured Property can provide a pathway to resolve the situation effectively.

In New Hampshire, a debt generally becomes uncollectible after three years from the date of the last payment or activity. After this period, creditors may not have legal grounds to pursue collection. To ensure that your rights are protected and obligations resolved, consider a New Hampshire Agreement to Compromise Debt by Returning Secured Property as a proactive solution.

Yes, a 10-year-old debt may still be collected in New Hampshire, depending on certain factors. The statute of limitations typically spans three years for most debts, but creditors can still attempt to collect after this time. If you're facing a situation with an old debt, exploring a New Hampshire Agreement to Compromise Debt by Returning Secured Property can be beneficial to resolve the matter amicably.