New Hampshire Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

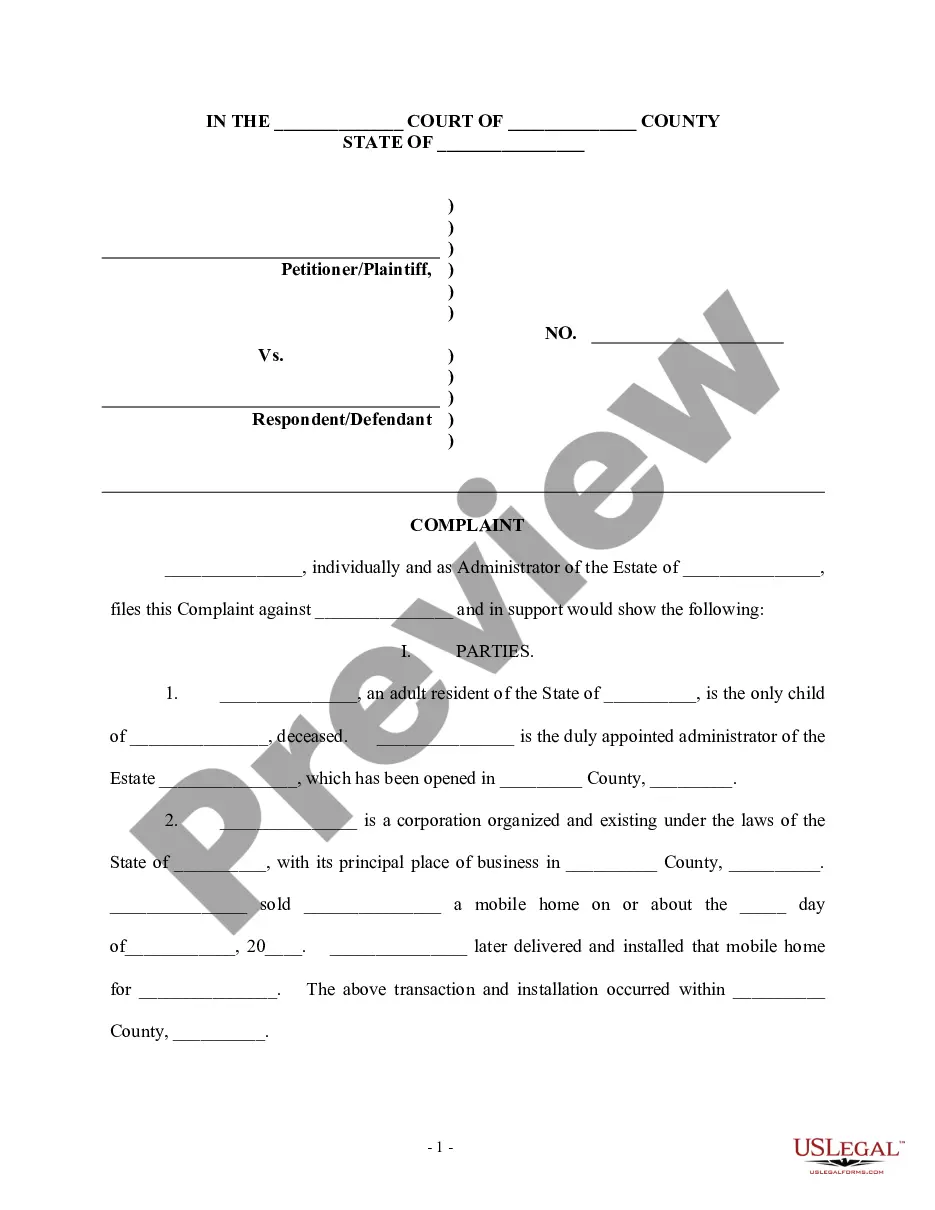

How to fill out Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

Are you experiencing the condition where you need documentation for potentially business or individual activities almost daily? There are numerous official document templates accessible online, but locating forms you can rely on is not easy.

US Legal Forms offers thousands of document templates, including the New Hampshire Promissory Note related to the Sale and Purchase of a Mobile Home, which are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and possess your account, simply Log In. Then, you can download the New Hampshire Promissory Note related to the Sale and Purchase of a Mobile Home template.

Access all the document templates you have purchased in the My documents menu. You can download another copy of the New Hampshire Promissory Note related to the Sale and Purchase of a Mobile Home at any time, if required. Just click the necessary form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and reduce errors. The service offers properly crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life simpler.

- Obtain the form you need and ensure it corresponds to your specific town/region.

- Utilize the Preview option to examine the document.

- Read the information to confirm you have chosen the correct form.

- If the form is not what you are searching for, use the Search area to find the form that meets your needs and criteria.

- When you find the appropriate form, click Acquire now.

- Choose the pricing plan you want, provide the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

The person who owns the promissory note may sell it. Lenders typically sell promissory notes when they no longer want to be responsible for the loan or they need a lump sum of cash. The buyer of the note assumes the responsibility of collecting the money.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Transferable . A promissory note must state that it's either payable to order or payable to bearer. These phrases mean the amount owed by the borrower could be payable to some unknown third party in the future. In other words, the note is transferrable from one person to another.

When transferring the ownership of a mobile home in Florida, both the buyer and seller must fill out and submit a bill of sale to Florida's Department of Highway Safety and Motor Vehicles. A bill of sale is a legal document stating details about a transaction, such as the sale of a mobile home.

Florida Mobile Home PaperworkThe vehicle title of the manufactured home (if titled as chattel) or the real estate deed (if titled as real estate)Bill of sale for the manufactured home, with both the seller's signature and the buyer's.More items...

Bring forms to your local DMV in the county to pay transfer tax and transfer ownership. Only buyer(s) must be present at DMV to transfer title, however ideally buyer and seller go to DMV to transfer title to help expedite any last-minute issues that arise at the DMV. All forms should already be signed.

The person who owns the promissory note may sell it. Lenders typically sell promissory notes when they no longer want to be responsible for the loan or they need a lump sum of cash. The buyer of the note assumes the responsibility of collecting the money.

When a loan changes hands, the promissory note is endorsed (signed over) to the loan's new owner. In some cases, the note is endorsed in blank, making it a bearer instrument under Article 3 of the Uniform Commercial Code. So, in that situation, any party that possesses the note has the legal authority to enforce it.

Selling Mortgage Notes. Mortgage notes, or promissory notes, are financial instruments that define the terms of a loan used to purchase property. People who hold a mortgage note for a home, business or property can sell it for a cash lump sum to a buyer in the secondary mortgage note industry.

For currently occupied homes, the average closing is around 30 days after the contract signing. Closing dates are flexible; your agent will assist you with that as part of the negotiation process.