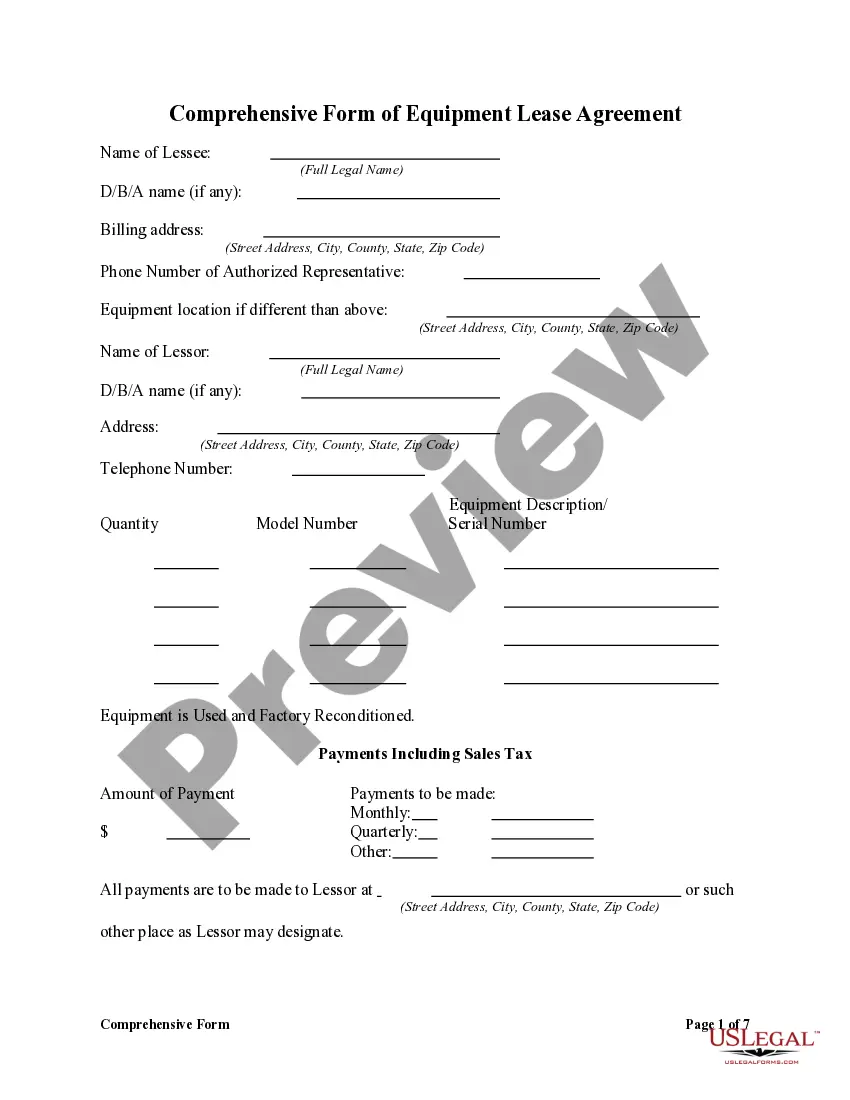

New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Comprehensive Equipment Lease With Provision Regarding Investment Tax?

Selecting the optimal legal document template can be quite a challenge.

Certainly, there are numerous templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple steps you can follow: First, ensure you have selected the appropriate form for your city/state. You can browse the form using the Review button and check the form description to confirm it is right for you. If the form does not meet your requirements, utilize the Search field to find the correct one. Once you are confident that the form is suitable, click the Purchase Now button to retrieve the form. Choose the pricing plan you desire and enter the necessary information. Create your account and place an order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received New Hampshire Comprehensive Equipment Lease with Clause Concerning Investment Tax. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to obtain properly drafted documents that comply with state regulations.

- The service provides a vast collection of templates, such as the New Hampshire Comprehensive Equipment Lease with Clause Concerning Investment Tax.

- These templates can be utilized for both business and personal purposes.

- All forms are verified by professionals and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the New Hampshire Comprehensive Equipment Lease with Clause Concerning Investment Tax.

- Use your account to refer to the legal forms you have previously obtained.

- Visit the My documents tab in your account and retrieve another copy of the document you need.

Form popularity

FAQ

Yes, New Hampshire has taken steps towards phasing out the interest and dividends tax, which is currently set at 5%. Recent legislative changes aim to reduce this tax over years, providing financial relief to residents and investors. This shift aligns with strategies like the New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax, enhancing the business landscape. Staying updated on these tax developments is crucial for maximizing your investment benefits.

For tax purposes, leases can be classified into operating leases and capital leases. The New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax might influence how you categorize your lease. Operating leases typically allow you to deduct rental payments, while capital leases often require you to report the leased asset on your balance sheet with the potential for depreciation.

Yes, leasing equipment can be tax deductible, particularly under a New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax. You can often deduct your lease payments as a business expense on your tax return, which may reduce your taxable income. It's advisable to consult with a tax professional to fully understand your entitlements regarding deductions.

When you engage in a lease to own agreement, the tax treatment can vary based on the specifics of the New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax. Typically, payments made prior to ownership may be considered rental expenses. Once you acquire ownership, the asset will be treated as outright ownership for tax purposes, allowing for depreciation and investment tax benefits.

In 2025, New Hampshire will implement several tax changes that may impact businesses, including modifications related to the New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax. These changes aim to enhance business growth and potentially involve new rates or deductions. It's important for you to stay informed about how these modifications will affect your lease agreements and overall tax obligations.

New Hampshire does not tax wages or salaries, but it does tax interest and dividends which are considered forms of investment income. Therefore, understanding your financial arrangements, including any associated leases, can help you navigate tax obligations. Utilizing a New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax may provide strategic benefits related to investment income.

Qualifying for tax exemption in New Hampshire often requires meeting specific criteria, including income thresholds and property use. Property owners or renters may need to provide documentation to demonstrate eligibility. If you have a New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax, make sure to check if the lease terms affect your qualification status.

To effectively reduce your property taxes, consider seeking exemptions or appealing your property tax valuation if you believe it’s too high. Working with a tax professional can also provide insights into various tax-saving strategies, including lease provisions. A New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax could be a strategic step toward reducing taxable income.

While you cannot completely avoid property taxes in New Hampshire, there are legal strategies to reduce them. This includes applying for exemptions or credits that you may be eligible for as a property owner or leaseholder. Engaging in a New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax may present opportunities to lower your taxable value.

In New Hampshire, there is no specific age at which one stops paying property taxes. However, some exemptions may apply for individuals aged 65 and older, depending on their income and assets. It's beneficial to explore options like a New Hampshire Comprehensive Equipment Lease with Provision Regarding Investment Tax, as it may offer financial advantages that can help mitigate overall property tax liabilities.