New Hampshire Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

You can dedicate numerous hours online trying to locate the appropriate legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers a vast collection of legal documents that are reviewed by experts.

You can download or print the New Hampshire Revocable Trust for Real Estate from this service.

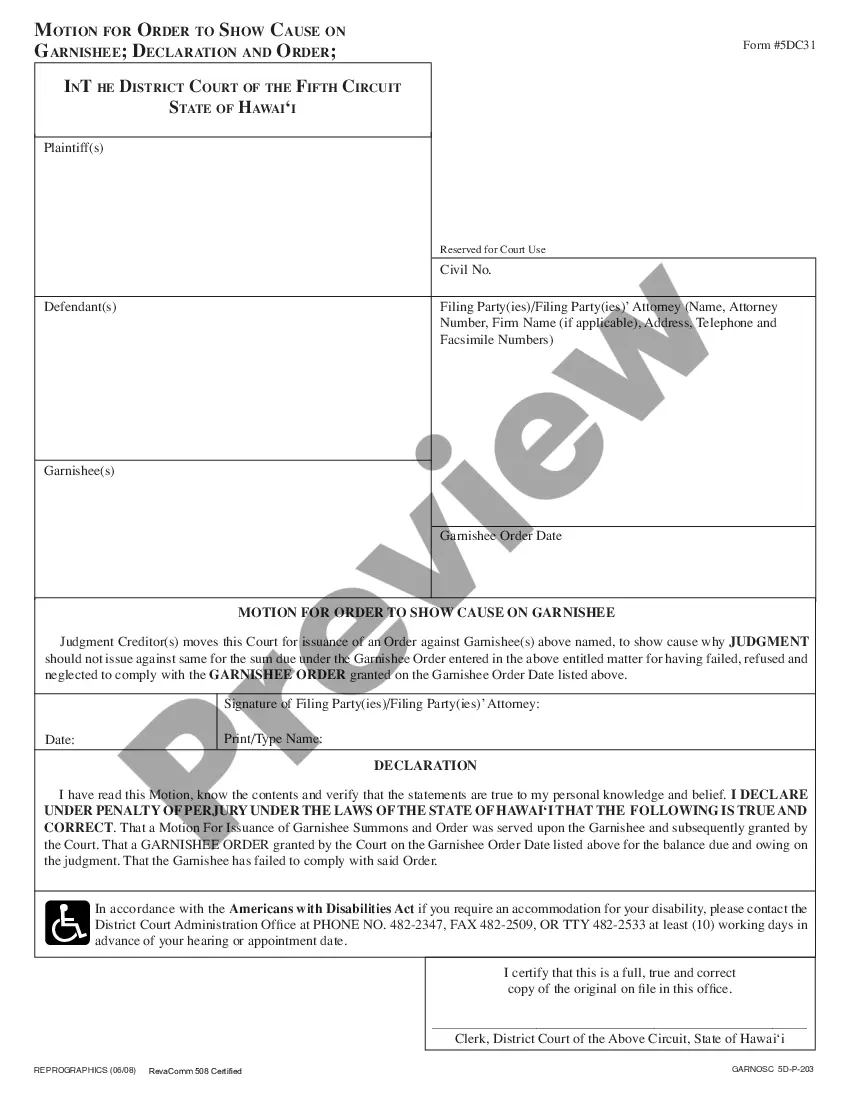

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Acquire button.

- Subsequently, you can complete, modify, print, or sign the New Hampshire Revocable Trust for Real Estate.

- Every legal document template you obtain is yours to keep indefinitely.

- To retrieve another copy of any purchased form, navigate to the My documents tab and select the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your choice.

- Review the form details to confirm that you have selected the appropriate form.

Form popularity

FAQ

One of the biggest mistakes parents make with a trust fund is failing to properly fund it. Even with a New Hampshire Revocable Trust for Real Estate, if assets are not transferred into the trust, it can lead to complications later on. Moreover, parents may not clearly communicate their intentions or the trust terms to their children, which can result in confusion. Ensuring clarity and proper funding can prevent these issues.

Many people choose to place their house in a New Hampshire Revocable Trust for Real Estate for several reasons. It aids in avoiding probate, provides greater privacy, and can facilitate management of the property if you become incapacitated. Additionally, it allows for an organized plan for passing the property to heirs, ensuring your wishes are honored without unnecessary delays.

Placing your house in a New Hampshire Revocable Trust for Real Estate can simplify the transfer of ownership after your passing. This process helps avoid the lengthy and expensive probate process, allowing for a smoother transition of your assets to your loved ones. Furthermore, you retain control over the trust during your life, allowing you to make changes as your circumstances evolve.

Certain assets are best left outside a New Hampshire Revocable Trust for Real Estate. For instance, retirement accounts like IRAs and 401(k)s should generally remain separate due to tax implications. Also, insurance policies often do not need to be included since beneficiaries are named directly. Evaluating your assets with an expert can ensure your trust aligns with your overall estate plan.

When you place your house in a New Hampshire Revocable Trust for Real Estate, it generally remains your asset. This means nursing homes cannot directly seize the property for payment, as long as you control the trust. However, if you need long-term care, the value of the trust assets could still be considered in determining Medicaid eligibility. Therefore, consulting a legal expert can optimize your estate plan.

The downside of a New Hampshire Revocable Trust for Real Estate is that, while it provides flexibility, it does not prevent public scrutiny of assets during probate if the trust becomes irrevocable upon death. Additionally, the assets in a revocable trust are still considered part of your estate for tax purposes. Individuals should consider these factors when planning their estate.

A disadvantage of a family trust, such as a New Hampshire Revocable Trust for Real Estate, is that it may complicate relationships among family members. If responsibilities and roles are not clearly defined, it can lead to confusion and potential conflicts. Clear communication and planning can help mitigate these risks.

One downfall of having a New Hampshire Revocable Trust for Real Estate is the misconception that it solves all estate planning issues. While it facilitates asset transfer, it does not address certain aspects like tax liabilities or other financial obligations. Comprehensive planning with a professional can help address these issues.

Some negatives of a New Hampshire Revocable Trust for Real Estate include potential costs associated with setting it up and maintaining it. Additionally, it does not offer the same level of tax benefits or creditor protection as irrevocable trusts. Individuals should weigh these factors carefully to determine if a revocable trust fits their needs.

Deciding whether your parents should place their assets in a New Hampshire Revocable Trust for Real Estate depends on their financial situation and goals. Trusts can provide a smooth transfer of assets and avoid probate, which can save time and costs. It's advisable to consult with an estate planning professional to assess their specific needs.