New Hampshire Owner Financing Contract for Home

Description

How to fill out Owner Financing Contract For Home?

Are you in a position where you occasionally require documents for either business or personal purposes.

There is a wide range of lawful document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides numerous form templates, including the New Hampshire Owner Financing Contract for Home, designed to comply with federal and state regulations.

When you locate the appropriate form, click Acquire now.

Choose your payment plan, provide the necessary details to process your payment, and complete your order using PayPal or a credit card. Select a convenient format and download your copy. Find all the document templates you’ve purchased in the My documents section. You can access an additional copy of the New Hampshire Owner Financing Contract for Home anytime by clicking the desired form to download or print the template. Use US Legal Forms, which has an extensive selection of legal documents, to save time and avoid mistakes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- Next, you can download the New Hampshire Owner Financing Contract for Home template.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct state/region.

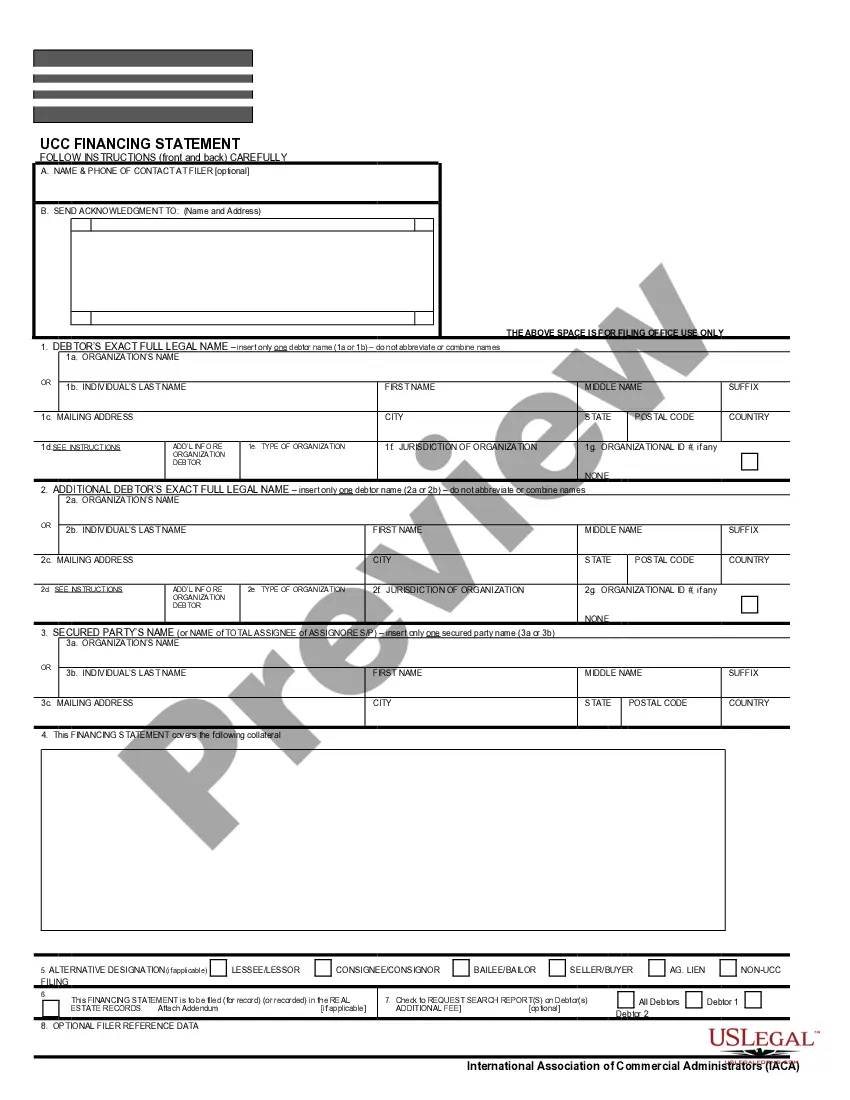

- Utilize the Preview option to review the document.

- Read the description to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, use the Lookup field to find the document that meets your needs.

Form popularity

FAQ

The average length of seller financing can range from five to 30 years, depending on the agreement between the buyer and seller. However, many contracts are structured for shorter terms, with balloon payments due at the end. When drafting a New Hampshire Owner Financing Contract for Home, both parties should agree on a duration that suits their financial goals.

Good terms for seller financing typically include a reasonable interest rate, a manageable down payment, and a clear repayment schedule. Both parties should negotiate terms that ensure mutual benefit. In a New Hampshire Owner Financing Contract for Home, these terms can be tailored to fit individual needs.

One downside of owner financing involves the risk to the seller. If the buyer defaults, the seller may have to go through the foreclosure process. Additionally, the seller may need to carry the mortgage for an extended period. It's vital to understand these risks when considering a New Hampshire Owner Financing Contract for Home.

If a buyer defaults on a New Hampshire Owner Financing Contract for Home, the seller has the right to take back the property. This process is similar to foreclosure in traditional financing, although specific steps can vary. The seller may retain any payments made prior to the default, depending on the contract terms. Understanding these implications beforehand can help both parties mitigate risks.

A good interest rate for owner financing can vary by location and market conditions, but rates between 5% and 10% are often seen. In a New Hampshire Owner Financing Contract for Home, sellers may offer competitive rates to attract buyers. The importance of setting a reasonable interest rate lies in making homeownership attainable while ensuring that the deal remains beneficial for both parties.

A 7% mortgage interest rate is generally considered moderate to high in the current market landscape. However, in a New Hampshire Owner Financing Contract for Home, what matters most is whether both the buyer and seller find the terms acceptable. It's beneficial to compare this rate with local financing options to understand its competitiveness.

A good interest rate for owner financing typically ranges between 5% to 10%, depending on various factors like the property's value and current market trends. In a New Hampshire Owner Financing Contract for Home, sellers often consider the local economy and buyer creditworthiness when setting rates. This flexibility can provide more options for buyers looking for affordable pathways to ownership.

Owner financing can potentially mitigate immediate capital gains taxes under certain conditions. By holding onto the property longer and structuring the sale correctly in a New Hampshire Owner Financing Contract for Home, sellers can spread out their taxable income over several years. However, it is essential to consult with a tax professional to understand the implications of this financing option, as rules may vary.

In most owner financing arrangements, the seller retains the deed until the buyer completes all payments as outlined in the contract. This structure is typical in a New Hampshire Owner Financing Contract for Home, providing security for the seller. Once payment is fulfilled, the seller transfers the deed to the buyer. Clear communication and thorough documentation can help prevent misunderstandings about deed ownership.

The IRS has specific rules that apply to owner financing, particularly regarding how interest income is reported. If you engage in a New Hampshire Owner Financing Contract for Home, you must ensure that any interest received is reported as taxable income. Additionally, both sellers and buyers should be aware of the implications this financing method has on property taxes and potential deductions, which can affect your financial planning.