An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

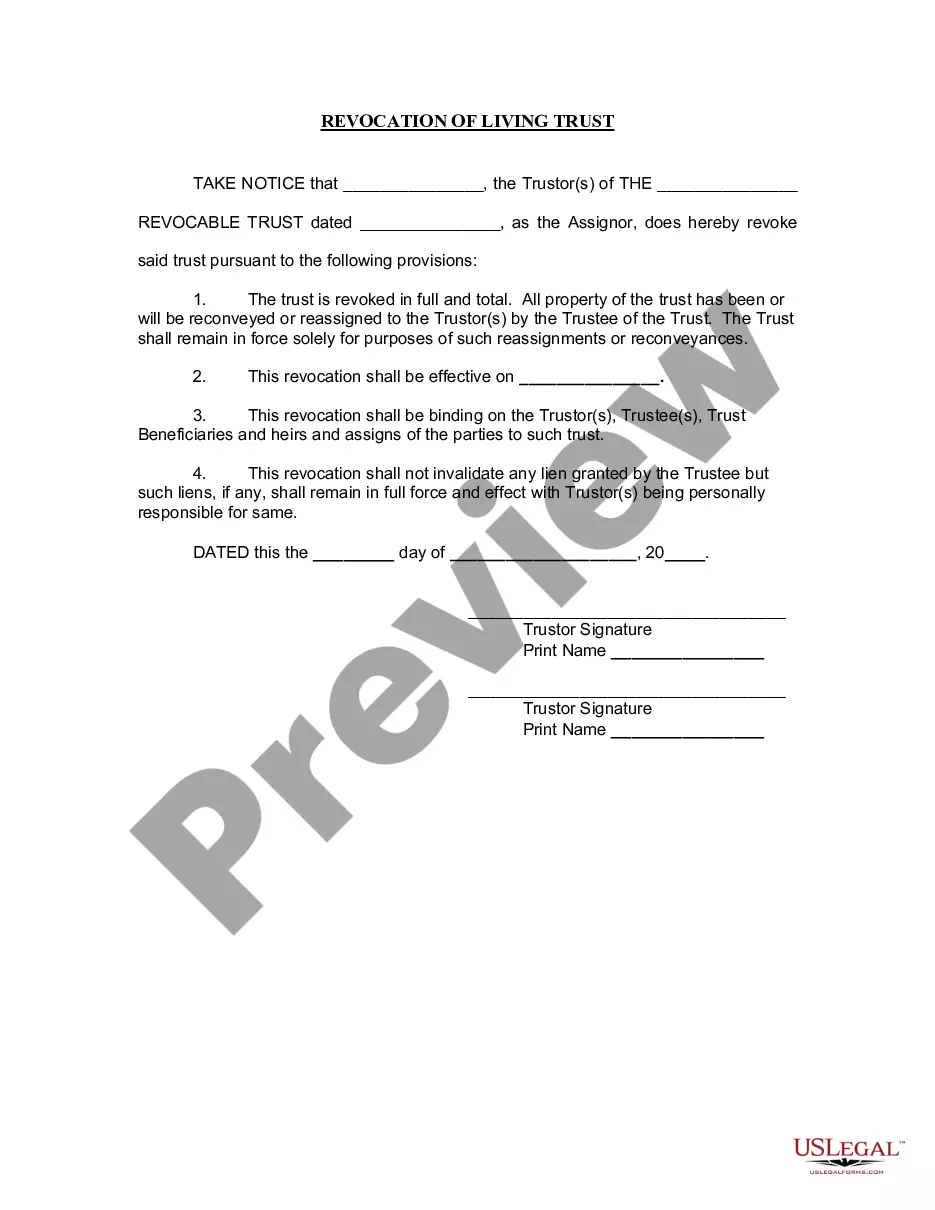

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

Selecting the appropriate format for legal documents can be a challenge. Clearly, there are numerous templates accessible online, but how can you find the specific legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the New Hampshire Request for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian, suitable for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already a member, Log In to your account and click on the Download button to obtain the New Hampshire Request for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian. Use your account to browse the legal forms you’ve purchased previously. Go to the My documents section of your account to download another copy of the documents you need.

Choose the document format and download the legal document format to your device. Complete, modify, print, and sign the acquired New Hampshire Request for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Utilize the service to obtain professionally crafted paperwork that adheres to state requirements.

- Firstly, confirm that you have selected the correct form for your locality/state.

- You can review the form using the Preview button and check the form details to ensure it is suitable for you.

- If the form does not align with your requirements, utilize the Search bar to find the correct form.

- Once you are confident that the form is appropriate, click the Purchase now button to acquire the form.

- Select the pricing option you desire and fill in the necessary information.

- Create your account and complete the payment using your PayPal account or credit card.

Form popularity

FAQ

Yes, you can set up an estate account without a lawyer, but having legal guidance can simplify the process. It is essential to follow the specific steps required by your bank and your state’s laws. For those uncertain of the process, making a New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can be an effective way to ensure you are handling the financial aspects correctly.

Absolutely, a beneficiary can request an accounting from the fiduciary managing the estate. This request is important for ensuring the estate is being managed appropriately and that funds are being handled correctly. Utilizing a New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can help you clearly articulate your request and prompt timely action.

To request an estate accounting, you should formally contact the executor or fiduciary responsible for the estate. Clearly state your relationship to the deceased and your desire to review the estate's finances. Making a New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can serve as a powerful tool to obtain the necessary information and ensure proper oversight.

Yes, beneficiaries can demand to see bank statements of the deceased, especially if they suspect mismanagement of funds. As a beneficiary, your right to access these records demonstrates your interest in the estate's administration. You might consider submitting a New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian to formalize this request and encourage transparency.

Typically, the executor or personal representative of the estate sets up an estate account. This account is essential for managing the financial transactions of the estate, ensuring that funds are used correctly. If you need guidance on this process, consider making a New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian to obtain clarity on the estate’s finances.

Yes, an executor can breach their fiduciary duty by mismanaging estate assets, failing to keep beneficiaries informed, or acting in their own self-interest. If you suspect that an executor is mishandling funds or not following the will, you can make a New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian. This can help ensure transparency and accountability in the handling of the estate.

Yes, an executor is indeed a type of fiduciary. As a fiduciary, the executor has the legal duty to act in the best interests of the estate and its beneficiaries. In fulfilling this role, they must comply with the New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, ensuring accountability and ethical management of estate funds.

Getting an estate accounting involves reaching out to the fiduciary managing the estate, asking for a written accounting of all financial activities. It is important to review this document thoroughly, as it serves to maintain clarity and transparency in estate management. Remember, a clear accounting aligns with the New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

To obtain an accounting of an estate, you may request the fiduciary to provide a detailed report of all transactions. This accounting should include assets, liabilities, income, and expenditures. This transparency is essential in meeting the New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, which ensures all parties are informed regarding estate management.

Rule 108e pertains to the requirements for accounting in New Hampshire probate cases. This rule mandates that fiduciaries must submit a detailed accounting to the court, outlining all income and expenditures related to the estate. Understanding this rule is essential for fulfilling the New Hampshire Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.