New Hampshire Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

Choosing the right authorized file design could be a battle. Of course, there are a variety of templates available online, but how can you discover the authorized kind you will need? Take advantage of the US Legal Forms website. The services provides a huge number of templates, for example the New Hampshire Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), which can be used for business and personal requires. All the types are checked by specialists and meet state and federal demands.

Should you be presently signed up, log in to your account and then click the Obtain key to obtain the New Hampshire Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check). Make use of your account to search throughout the authorized types you have bought earlier. Go to the My Forms tab of your own account and obtain another version from the file you will need.

Should you be a fresh end user of US Legal Forms, here are easy directions that you can follow:

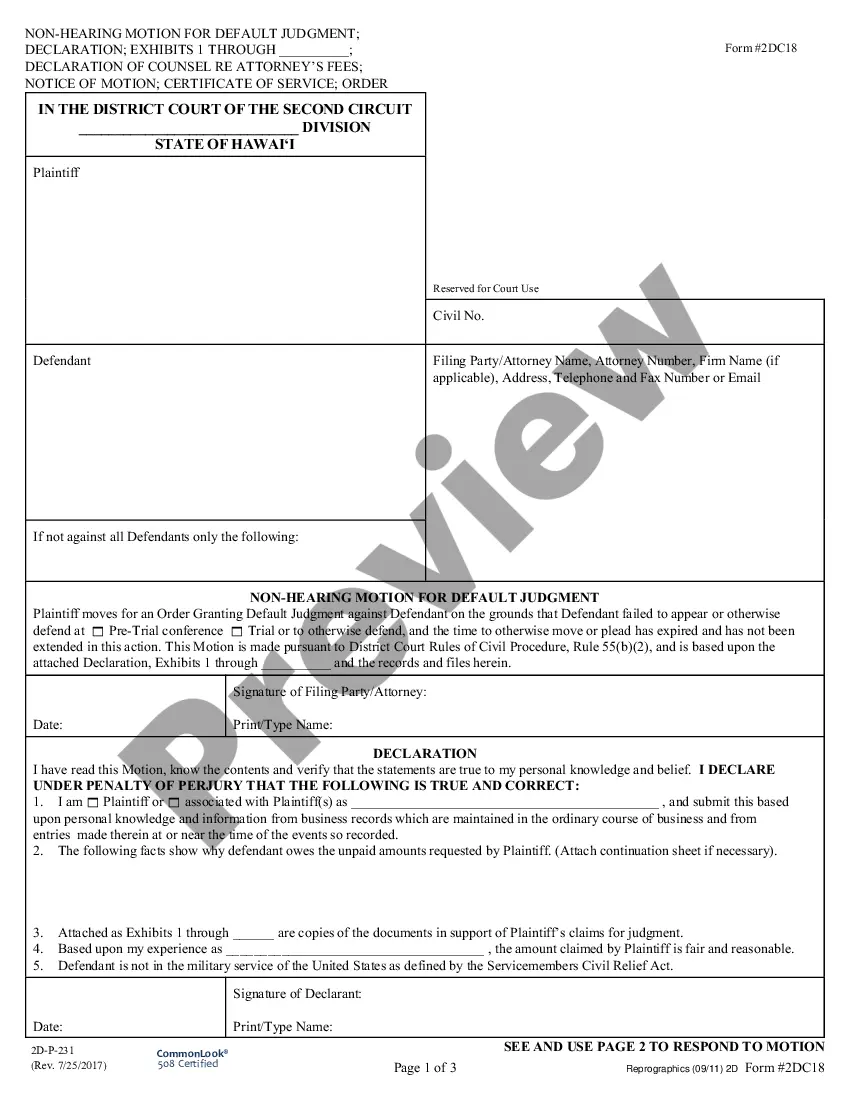

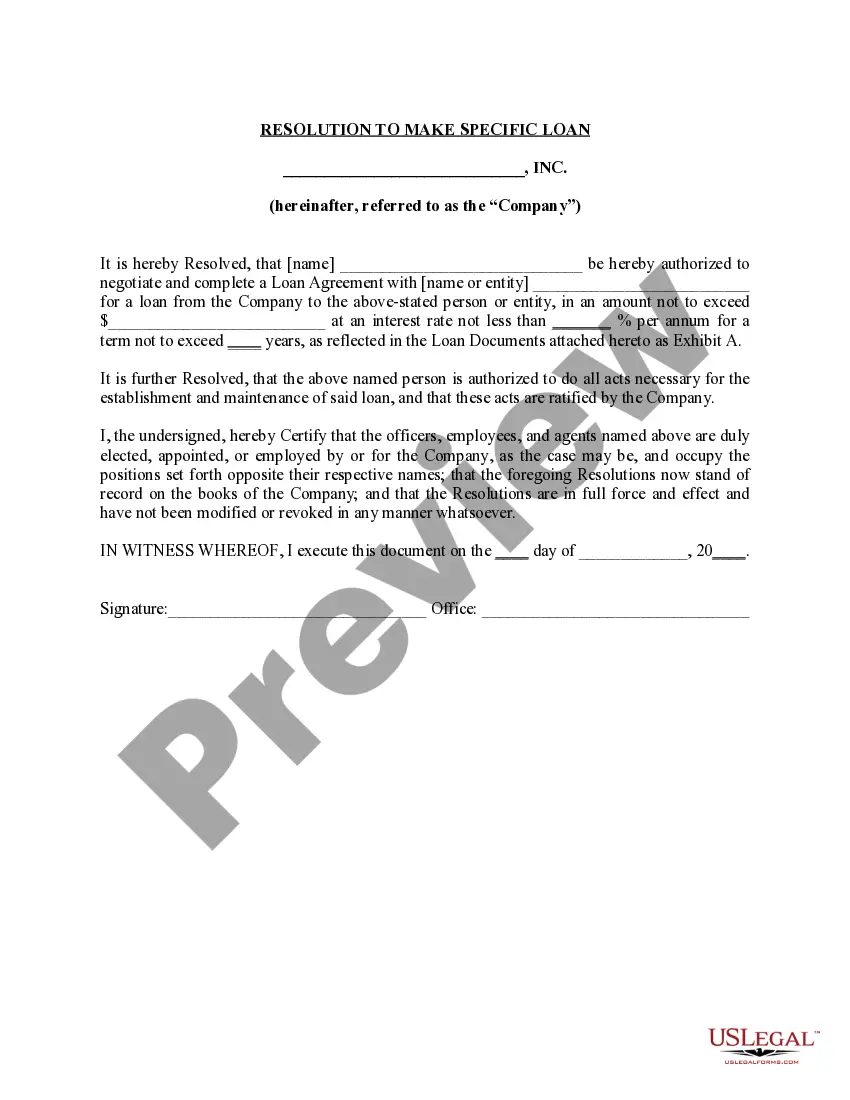

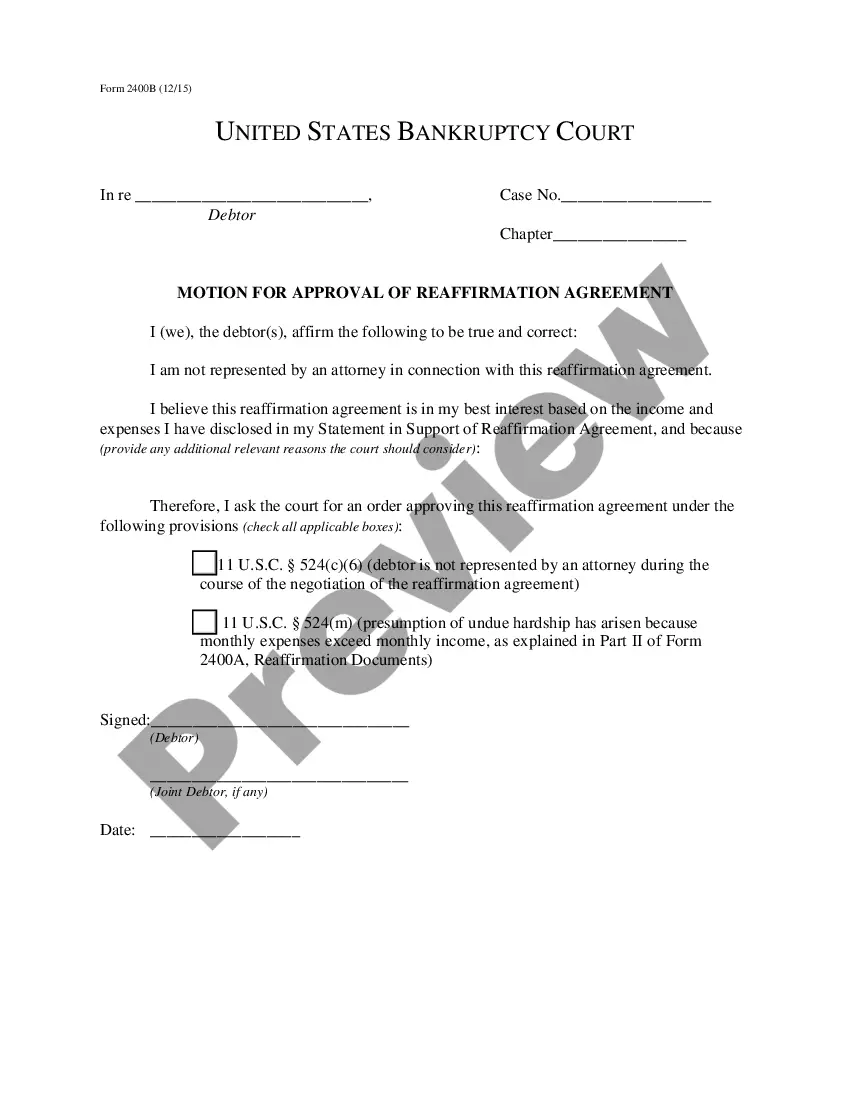

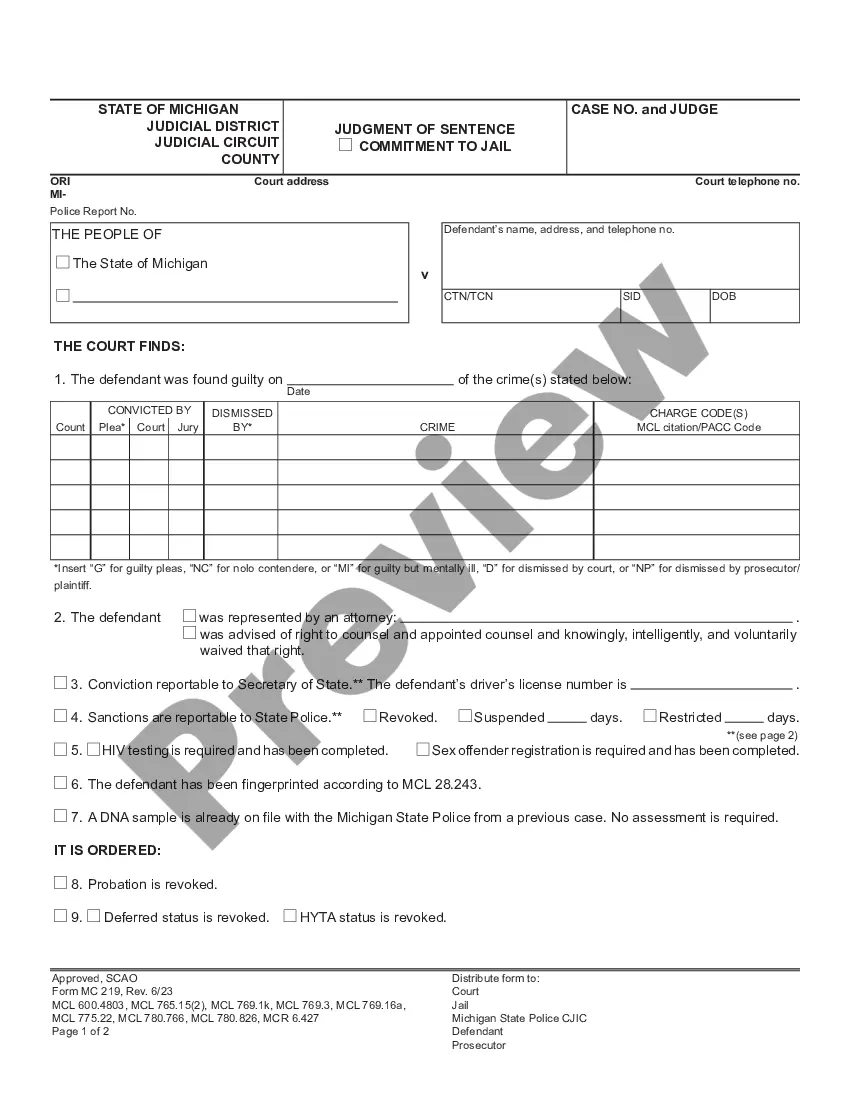

- First, make sure you have selected the appropriate kind for your personal metropolis/county. You can look over the shape making use of the Preview key and browse the shape outline to ensure it will be the right one for you.

- In the event the kind will not meet your expectations, make use of the Seach industry to get the appropriate kind.

- Once you are sure that the shape would work, click on the Buy now key to obtain the kind.

- Select the pricing strategy you need and type in the required info. Make your account and buy an order with your PayPal account or charge card.

- Select the data file format and down load the authorized file design to your product.

- Complete, edit and produce and signal the attained New Hampshire Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

US Legal Forms may be the greatest catalogue of authorized types that you can find different file templates. Take advantage of the company to down load appropriately-made files that follow status demands.

Form popularity

FAQ

Bad Checks Laws New Hampshire Under New Hampshire law, you are guilty of Issuing a Bad Check if you issue or pass a check for the payment of money and payment is refused by the bank. You are presumed to know that the check would not be paid if you had no account with the bank when you issued the check.

As the recipient of a bounced check, you will need to get in touch with the check issuer and request payment. If you're unable to resolve it with a conversation, you could take further action by sending a demand letter via certified mail.

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft fee. If the account stays negative, the bank may charge an extended overdraft fee.

The charges depend on the check amount. For example, knowingly cashing a bad check for $1,000 to $74,999 will be treated as a misdemeanor, while doing the same for a check for $75,000 or more will be treated as a felony. The misdemeanor could result in a fine between $1,500 and $10,000 and jail time ? up to five years.

If someone comes into the bank and uses a check to make a fraudulent withdrawal from an account that is not theirs, the bank is typically liable for the fraud. Similarly, if a bank cashes a check that was created fraudulently, the bank is also responsible for covering those funds.

Your bank likely will charge you an NSF fee for bouncing a check. The average NSF fee, ing to Bankrate's 2022 checking account and ATM fee study, is $26.58. If the bank pays the check, even though you don't have enough money in your account to cover it, it might charge you an overdraft fee.

Make sure you look up the phone number on the bank's official website and don't use the phone number printed on the check (that could be a phone number controlled and answered by the scam artist). Next, call the official number and ask them to verify the check.