New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

It is feasible to spend multiple hours online searching for the legal document format that fulfills the state and federal requirements you will require.

US Legal Forms offers a vast selection of legal templates that have been reviewed by experts.

You can easily download or print the New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate from their service.

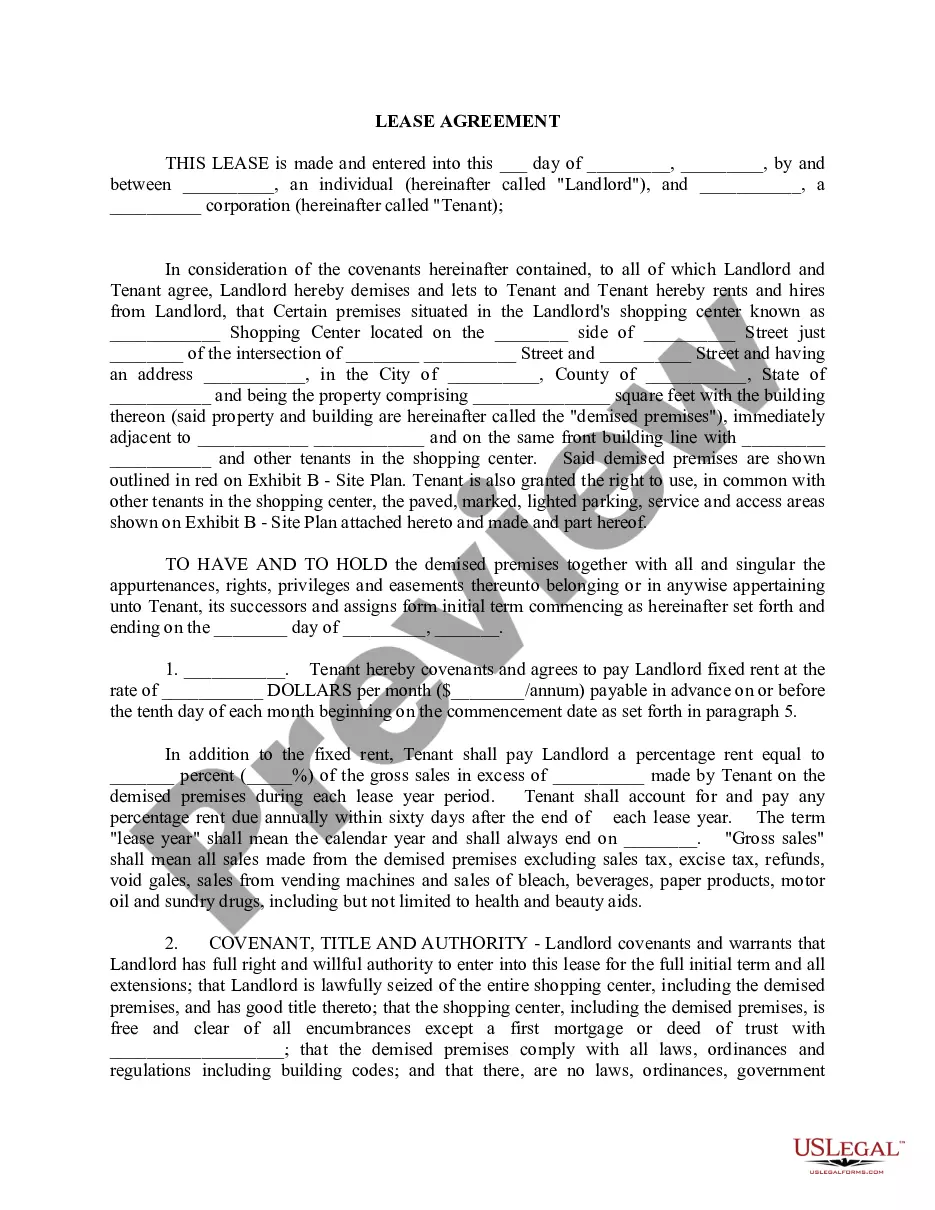

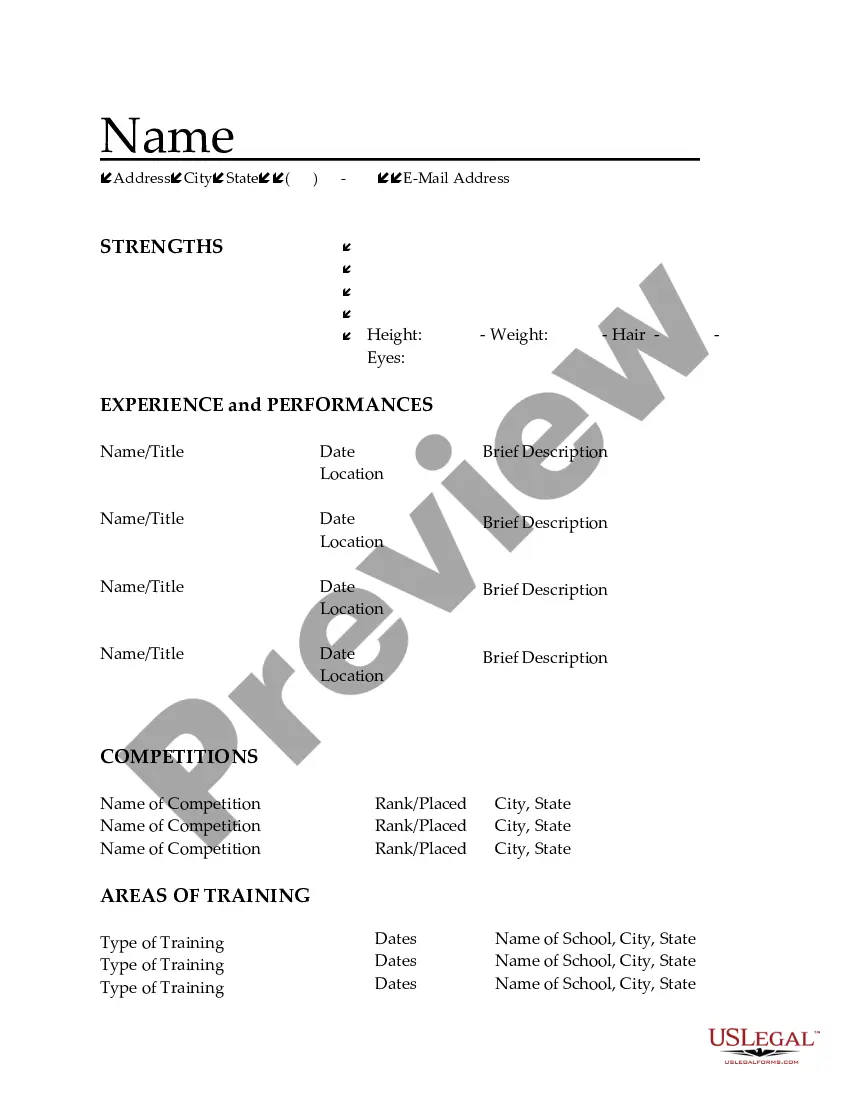

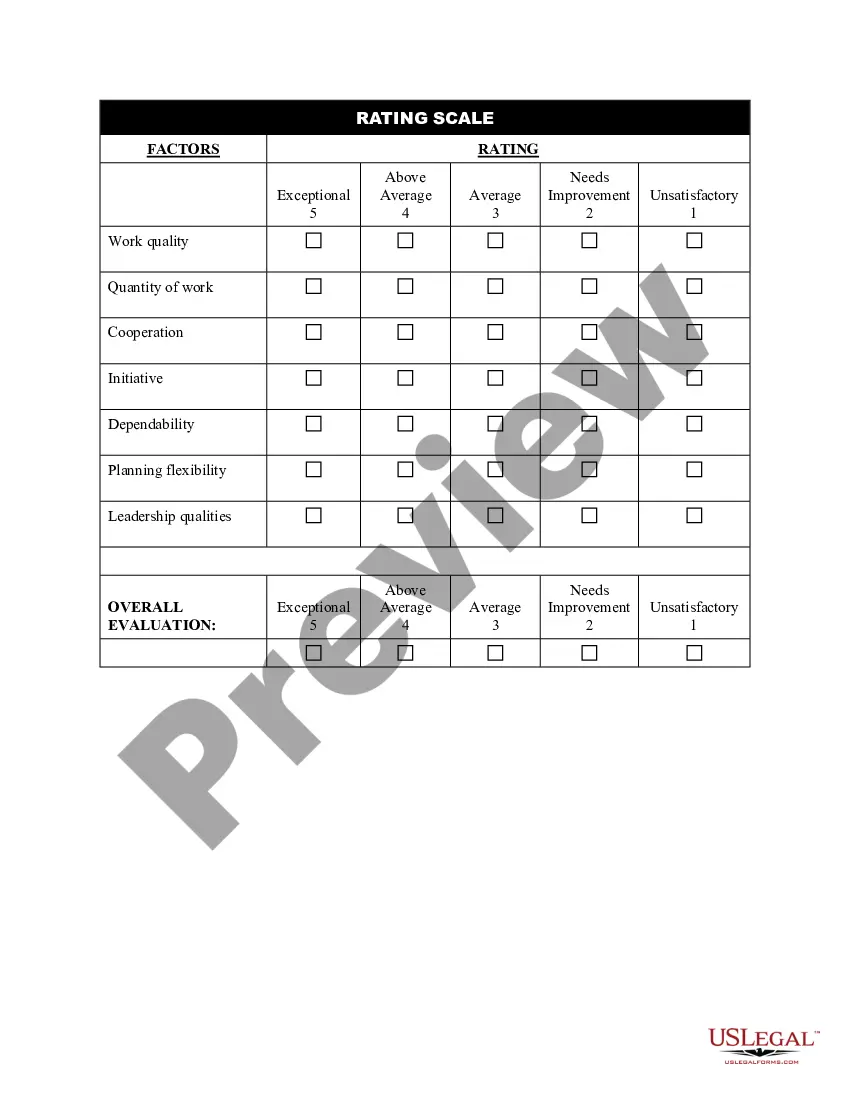

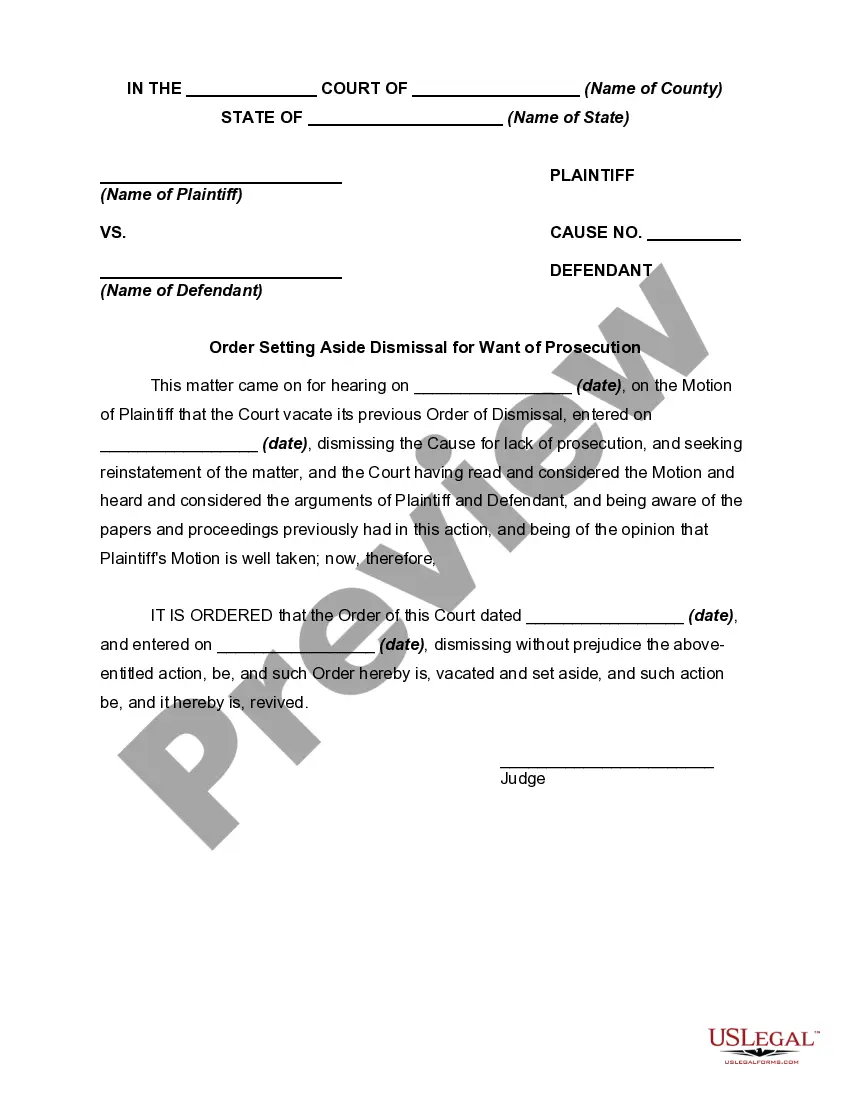

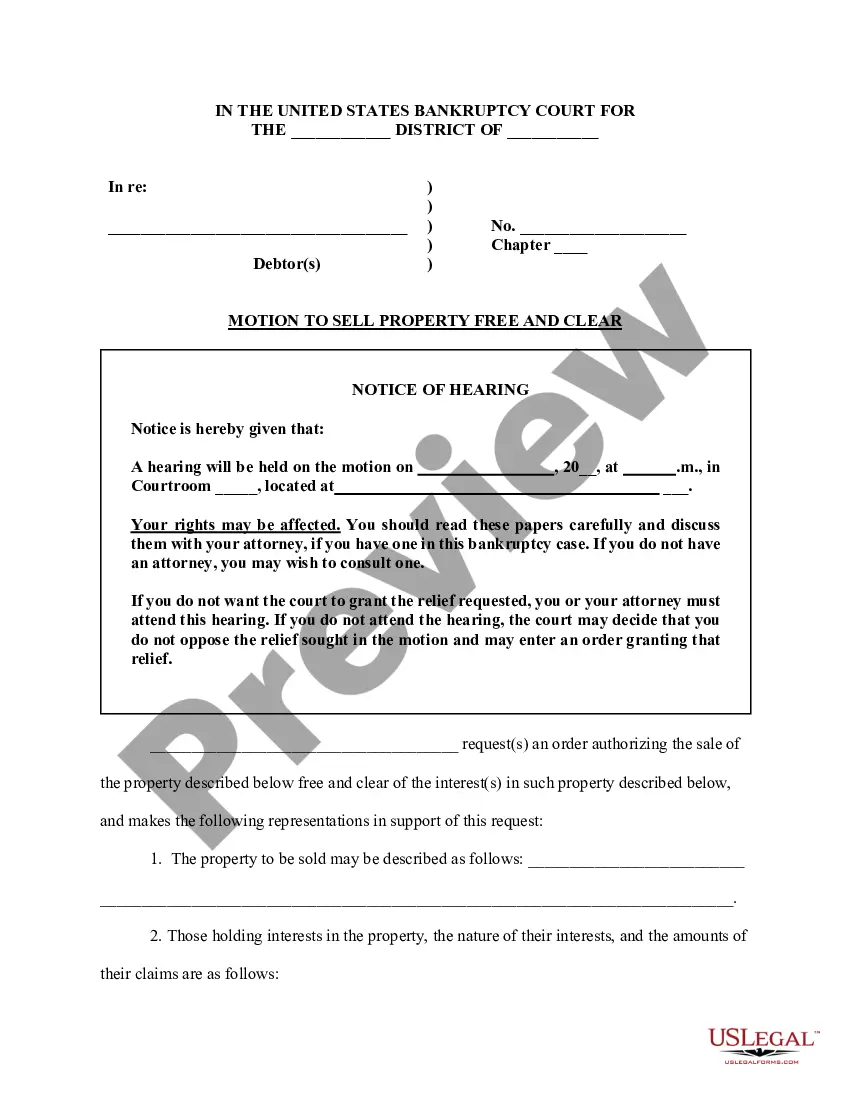

If available, utilize the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you may sign in and click the Obtain button.

- After that, you can fill out, modify, print, or sign the New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of any acquired document, visit the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document format for the state/city you choose.

- Review the document description to confirm you have chosen the appropriate template.

Form popularity

FAQ

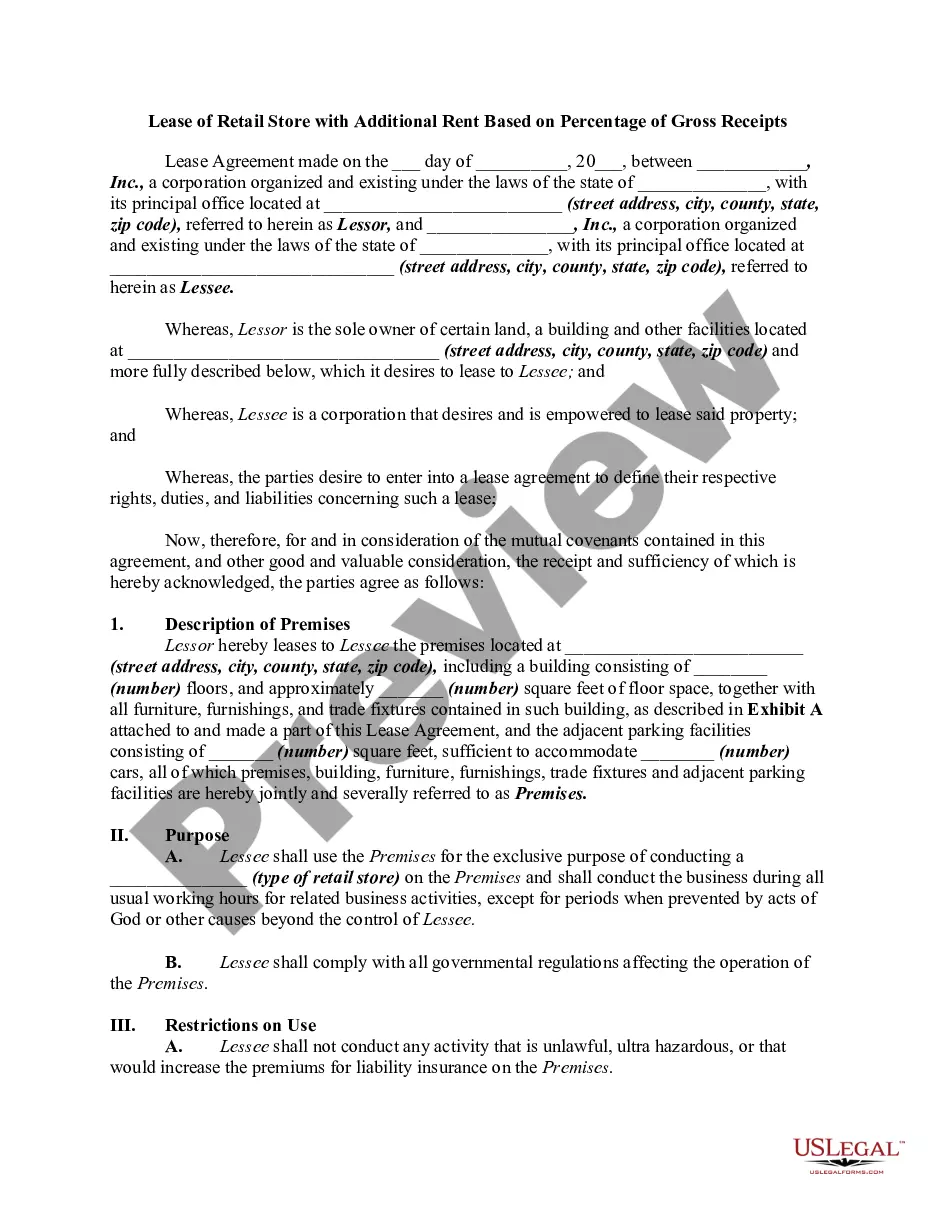

The most common lease for retail property is the New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. This lease structure allows landlords to receive a base rent, supplemented by a portion of the tenant's gross sales. This arrangement can align the interests of both the landlord and tenant, promoting a mutually beneficial relationship. By utilizing this lease type, you can effectively manage risks and potential returns in your retail investment.

The major components of a percentage lease under a New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate often include the base rent, the applicable percentage, gross receipts definitions, and the breakpoint. Additionally, terms regarding operating expenses, maintenance responsibilities, and tenant improvements may also be specified. These components collectively ensure a balanced and fair rental arrangement.

To calculate the leased percentage in a New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you first identify the gross receipts and then determine the percentage stipulated in your lease agreement. Divide the additional rent by the gross receipts and multiply by 100 to find the leased percentage. This calculation helps both landlords and tenants understand their financial standings in the agreement.

The usual basis for determining a percentage lease in a New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate is typically grounded in the tenant's anticipated sales figures. Landlords often evaluate historical data and market trends to set realistic breakpoints. By linking rent to sales performance, landlords and tenants can create a more cooperative relationship.

The basis of a lease is the fundamental agreement that outlines the terms between the landlord and tenant. In a New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this typically includes the rental amount, duration of the lease, and conditions under which rent may change. Understanding the lease's basis ensures that both parties have clear expectations and avoid disputes.

The formula for a percentage lease typically includes the base rent and the additional rent calculated as a percentage of the tenant's gross sales. For example, the total rent can be expressed as Total Rent = Base Rent + (Gross Sales x Percentage Rate). This clear structure allows tenants to better plan their financials while encouraging higher sales. Utilizing a New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate can help ensure that both parties clearly understand and agree on this formula.

The most common type of leasehold is the leasehold estate, in which a tenant has the right to occupy and use a property for a specified term. In a retail context, this often means a percentage lease that allows flexibility and growth for retailers. Building a leasehold agreement under the New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate can provide vital structure. This ensures both parties benefit from the rental arrangement while fostering a sustainable retail environment.

For retail properties, the most common type of lease is the percentage lease, which combines a base rent with a percentage of the tenant’s gross sales. This structure incentivizes the landlord to support the tenant's success, creating a win-win situation. Knowing the intricacies of a New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate can help clarify these terms. It also fosters a collaborative atmosphere between landlords and retailers.

The most common form of retail lease is typically the percentage lease, as it effectively aligns tenant success with landlord earnings. This lease form is particularly advantageous in retail properties, where sales can vary significantly. By opting to implement a New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, landlords can ensure a more adaptable rental income structure. Understanding this form can lead to more profitable retail management.

The natural breakpoint is calculated by dividing the annual base rent by the agreed-upon percentage rent rate. This figure represents the sales threshold at which the additional rent kicks in for the landlord. Understanding this calculation is crucial for both parties, as it defines the financial relationship throughout the lease term. Utilizing a New Hampshire Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate can help streamline this arrangement.