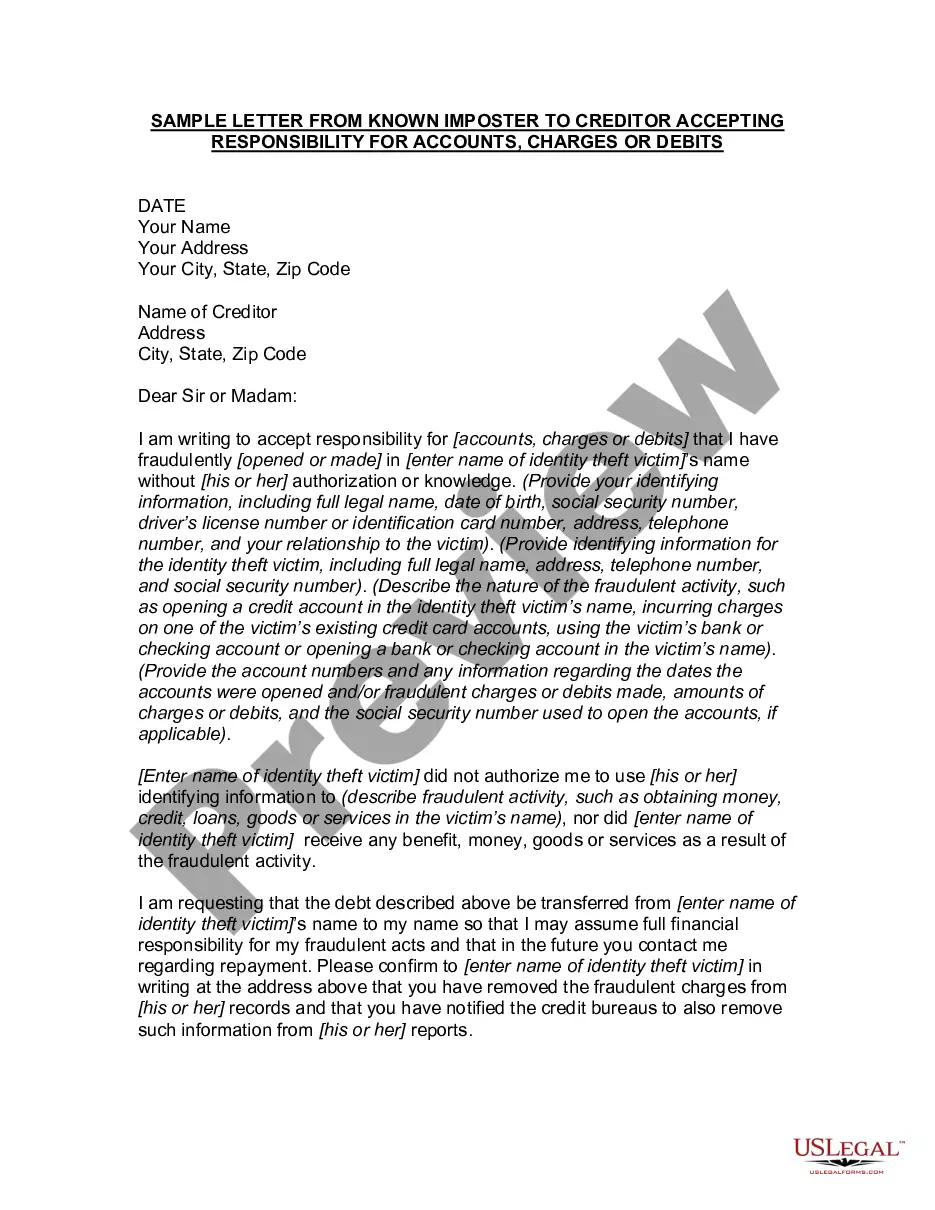

New Hampshire Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

Are you within a place in which you will need papers for possibly business or person uses virtually every time? There are tons of legitimate document templates accessible on the Internet, but discovering versions you can depend on isn`t straightforward. US Legal Forms provides a large number of type templates, such as the New Hampshire Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits, which are created to satisfy state and federal needs.

If you are already informed about US Legal Forms website and also have your account, just log in. Next, you can acquire the New Hampshire Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits template.

Should you not provide an bank account and need to begin using US Legal Forms, adopt these measures:

- Obtain the type you will need and make sure it is for that appropriate city/state.

- Use the Review button to check the form.

- Look at the outline to actually have chosen the proper type.

- In the event the type isn`t what you are looking for, take advantage of the Search discipline to discover the type that meets your requirements and needs.

- Whenever you find the appropriate type, click Acquire now.

- Select the rates strategy you need, fill out the desired information to generate your account, and buy your order using your PayPal or Visa or Mastercard.

- Pick a convenient paper file format and acquire your backup.

Discover every one of the document templates you might have bought in the My Forms menu. You can get a more backup of New Hampshire Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits anytime, if needed. Just click on the necessary type to acquire or print the document template.

Use US Legal Forms, by far the most considerable variety of legitimate types, in order to save some time and stay away from blunders. The support provides professionally made legitimate document templates that you can use for an array of uses. Generate your account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

The DFPI regulates debt collection in the state of California. If a debt collector is contacting you or if a debt collector is lying or threatening you, you can quickly and easily file a complaint on the DFPI File a Complaint Webpage.

Receiving a collection letter can be considered the first step in the collection process that could lead to a lawsuit being filed against you to collect the debt. A collection agency from whom you have received a letter will typically turn the file over to an attorney if they are unable to acquire a payment.

They Threaten or Lie to You You won't go to jail for your debt, so if the collector says that you will, they're lying. You also can't be sued in any county other than where you lived when you signed the contract or at the time the lawsuit was filed. Break off contact with them and file a complaint.

Debt collectors using summons to entrap their consumers will typically issue summonses with limited legal language or terminology (if any at all). To verify legitimacy within a court summons, look for any type of confirmation of pending actions that exist between the various parties involved.

This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by. Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors.

When a debt collector contacts you about a debt, they are legally required to provide information about that debt, including the name of the creditor, the amount owed, and your right to dispute it. There are some limited exceptions to this rule.

A legitimate debt collector should be able to tell you their company name and mailing address, as well as information about the debt they say you owe. The debt collector should provide information about themselves and their collection agency.

The debt verification letter is a letter you write and send to the debt collector, disputing the debt (if you truly don't owe it or owe as much as the collector says you do). You'll also send this letter via certified mail with a return receipt request so you have a record of your communication back to the collector.