New Hampshire Option to Purchase a Business

Description

How to fill out Option To Purchase A Business?

If you aim to complete, obtain, or print authorized document templates, use US Legal Forms, the most significant collection of legal forms available online.

Utilize the website's user-friendly and efficient search feature to locate the documents you require.

Various templates for business and personal purposes are sorted by categories and states, or keywords. Utilize US Legal Forms to find the New Hampshire Option to Purchase a Business in just a few clicks.

Every legal document template you acquire belongs to you permanently. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and obtain, then print the New Hampshire Option to Purchase a Business with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are presently a US Legal Forms customer, sign in to your account and click on the Download option to find the New Hampshire Option to Purchase a Business.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

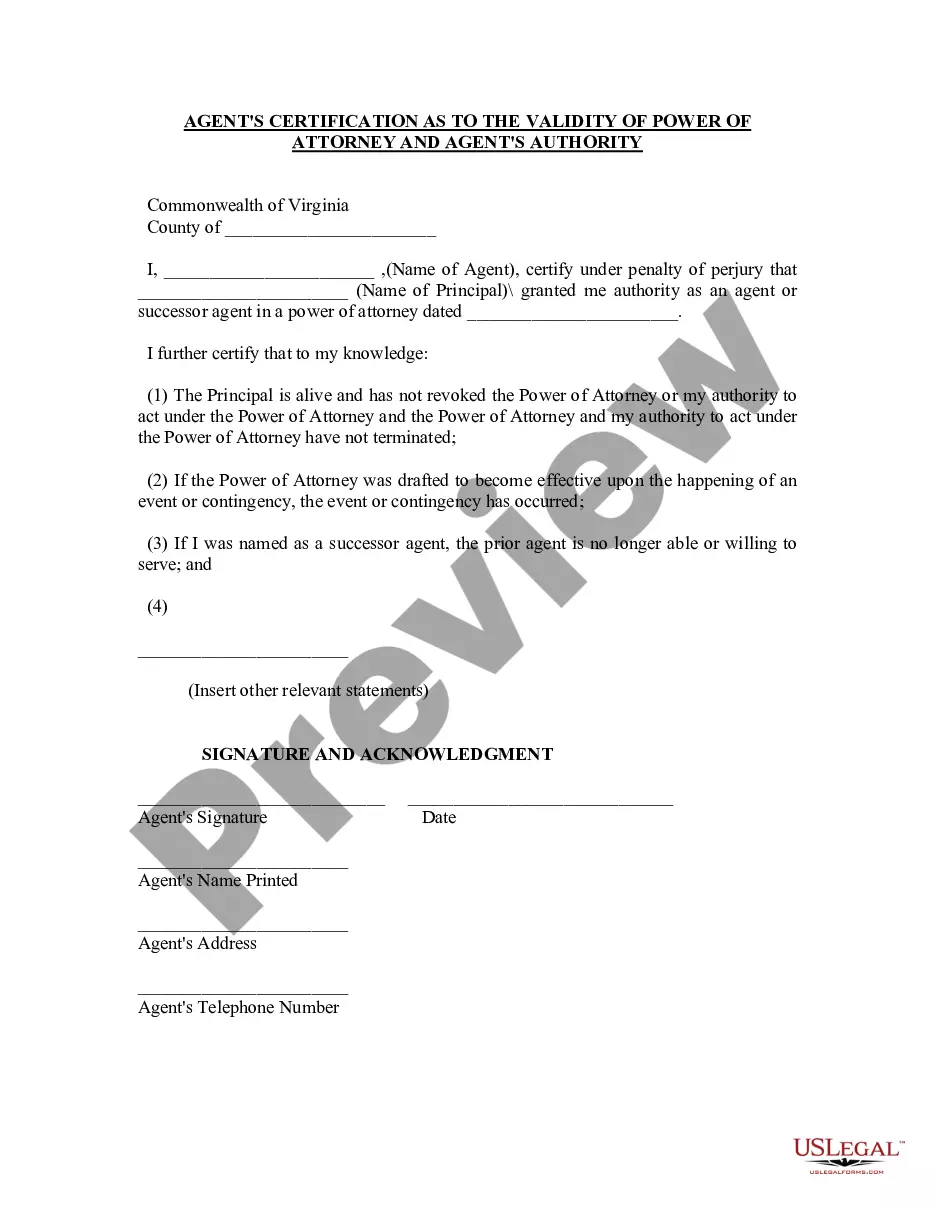

- Step 2. Use the Preview option to review the form's details. Don't forget to check the description.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now option. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Hampshire Option to Purchase a Business.