New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

If you want to access, obtain, or print authentic document templates, utilize US Legal Forms, the top choice for official forms accessible online.

Leverage the website's easy-to-use search functionality to find the files you require.

A variety of templates for commercial and personal purposes are organized by categories and regions, or by keywords.

Every legal document template you acquire is yours indefinitely. You will have access to every form you saved in your account. Click the My documents section and choose a form to print or download again.

Stay efficient and download, and print the New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and press the Download button to receive the New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement.

- You can also retrieve forms you previously stored in the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Confirm that you have selected the form for the correct region/state.

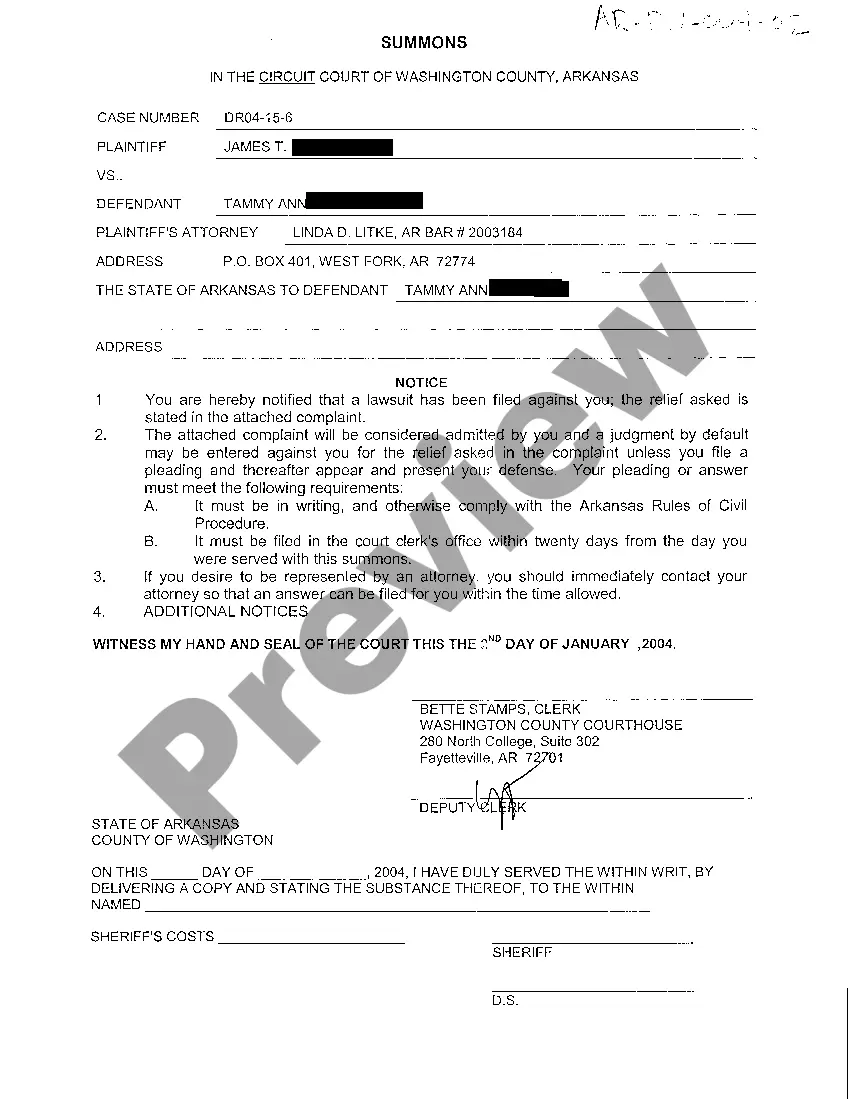

- Step 2. Use the Preview feature to view the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to locate different variations of the legal document template.

- Step 4. Once you find the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the payment transaction. You can use your Visa, MasterCard, or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement.

Form popularity

FAQ

A charitable remainder unitrust is a financial tool that allows you to donate assets while still receiving income from them. When you set up a New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement, you retain income for a specific period, often your lifetime. After this period, the remaining assets are gifted to a charity of your choice. This arrangement provides tax benefits and supports a cause you care about.

The two main types of charitable remainder unitrusts (CRUTs) are fixed percentage unitrusts and net income unitrusts. The fixed percentage unitrust pays a set percentage of the trust’s value, while the net income unitrust pays only the income generated by the assets, or the specified percentage, whichever is less. Understanding these differences can help you decide which type best fits your New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement.

The payout from a charitable remainder unitrust is typically a percentage of the trust's assets, recalculated annually. This percentage can range from 5% to 50%, depending on your specific New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement. Therefore, the actual payout may vary based on the trust's performance and the chosen percentage. It is essential to consider your financial goals when determining this rate.

Setting up a charitable remainder trust involves several key steps. First, you will need to decide on the assets you want to contribute and choose a reliable trustee. After that, you can draft the New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement to outline the trust's terms. It's advisable to consult with a legal expert to ensure compliance with federal and state laws.

A New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement operates by providing income to the beneficiaries for a specified period, often for their lifetime. After this term, the remaining assets are distributed to a designated charity. This structure allows for immediate tax benefits and may enable you to minimize estate taxes later. Understanding how the unitrust functions can empower you to make informed charitable choices while benefiting from the trust’s structure.

Yes, you can add assets to a New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement after it has been established. This flexibility allows you to increase the trust's value and provide additional income for beneficiaries. However, it is important to follow the specific guidelines set forth in the initial trust document and ensure that any contributions are permissible. Engaging with a legal expert can assist you in managing these additions effectively.

The payout rate for a New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement is typically set between 5% and 7% of the trust's value. This rate is determined when you establish the trust and remains consistent throughout its duration. It is crucial to choose a rate that meets your financial needs while also complying with IRS requirements. Consulting with a financial advisor can help you set the most appropriate payout rate.

To establish a New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement, you should begin by drafting a trust document that outlines the terms and conditions of the trust. It's essential to work with an attorney who specializes in estate planning to ensure compliance with state laws. Once you have the agreement in place, you will fund the trust with assets that could benefit from charitable deductions. After establishment, the trust provides income to beneficiaries while ultimately supporting a charitable cause.

The unitrust amount in a New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement is determined based on the fair market value of the trust's assets at the beginning of each year. The payout is then calculated by applying the specific payout rate outlined in the agreement to this value. This ensures that the distribution adjusts annually, reflecting any changes in the trust's value. By consulting with professionals, you can effectively navigate these calculations.

You can add assets to a charitable remainder trust, including the New Hampshire Charitable Remainder Inter Vivos Unitrust Agreement. This process allows you to increase the trust's value, which can enhance income distributions and the charitable impact. It is essential to follow the trust's terms and involve a qualified professional for proper handling. Platforms like uslegalforms can provide guidance on best practices for adding assets.