New Hampshire Revocable Living Trust for Married Couple

Description

How to fill out Revocable Living Trust For Married Couple?

You can invest hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that have been vetted by experts.

You can conveniently obtain or print the New Hampshire Revocable Living Trust for Married Couples from our platform.

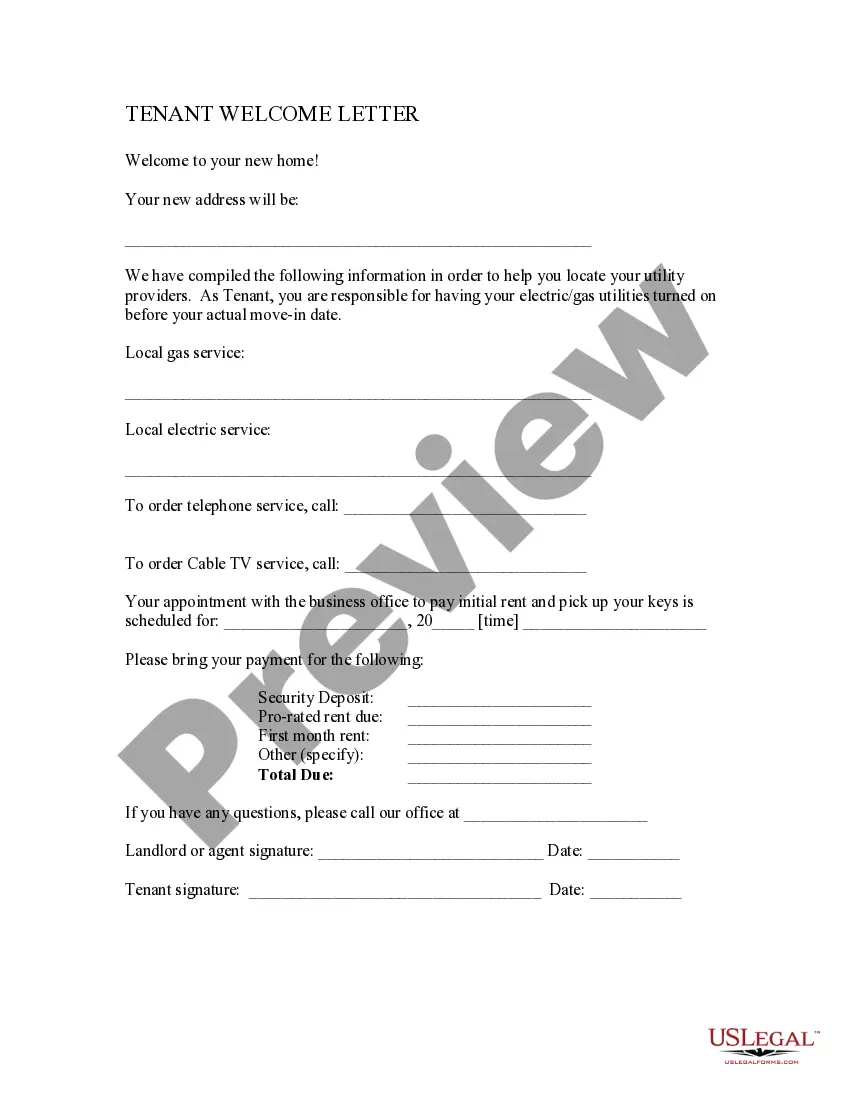

If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, modify, print, or sign the New Hampshire Revocable Living Trust for Married Couples.

- Every legal document template you download is yours indefinitely.

- To retrieve another copy of a purchased document, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/region of your preference.

- Check the document description to confirm that you have chosen the appropriate form.

Form popularity

FAQ

Trust funds can present risks, such as mismanagement or potential family disputes over asset distribution, which may arise even with a New Hampshire Revocable Living Trust for Married Couples. If the trust lacks clear guidelines or if one trustee acts outside their responsibility, it can lead to conflicts and misunderstandings. Careful planning and communication among family members can help mitigate these risks. Using a reliable service like uslegalforms can provide the necessary resources to create a well-structured trust.

Yes, a married couple can establish a joint revocable trust, known as a New Hampshire Revocable Living Trust for Married Couples. This arrangement allows both partners to co-manage the trust assets according to their shared wishes. Furthermore, it provides a streamlined process for asset distribution upon the death of either spouse, ensuring that their loved ones benefit from their combined financial plans. Consulting a professional can help in crafting a trust that meets both partners' needs.

Creating a New Hampshire Revocable Living Trust for Married Couples can be a beneficial decision for your parents' estate planning. This type of trust allows them to manage their assets during their lifetime and smoothly transfer them to beneficiaries after passing. Additionally, it can help avoid probate, which saves time and reduces costs. Ultimately, discussing this option with a legal advisor can clarify the advantages tailored to their specific situation.

To fill out a revocable living trust, start by providing your full legal names and designating your assets. Identify your beneficiaries and trust terms clearly. You can utilize resources from uslegalforms to assist in creating a New Hampshire Revocable Living Trust for Married Couple that meets legal requirements and aligns with your estate planning goals.

Certain assets should not be placed in a revocable trust, such as retirement accounts and life insurance policies. These items typically have named beneficiaries and might complicate the trust's purpose. Always consider how to structure your New Hampshire Revocable Living Trust for Married Couple to avoid unnecessary complications and ensure your estate plan operates efficiently.

Filling out a revocable living trust involves several steps. First, you need to gather information about your assets and beneficiaries. Then, you can use a template or consult uslegalforms to create a tailored New Hampshire Revocable Living Trust for Married Couple that meets your specific needs and ensures your wishes are clearly outlined.

Yes, a married couple can absolutely have a revocable trust. This type of trust allows both partners to manage their assets during their lifetime and ensure a smooth transition of property after death. By using a New Hampshire Revocable Living Trust for Married Couple, couples can maintain control over their assets while simplifying the estate planning process.

Setting up a revocable trust in New Hampshire involves several steps, including deciding on the assets to include, drafting the trust document, and transferring ownership of those assets to the trust. It is essential to ensure that the New Hampshire Revocable Living Trust for Married Couple reflects your intentions for asset management and distribution. Utilizing platforms like uslegalforms can simplify the process, providing you with the necessary resources and guidance to create a trust that aligns with your family’s needs.

Yes, a properly established trust, such as the New Hampshire Revocable Living Trust for Married Couple, generally avoids probate. This means that upon death, the trust assets do not go through the lengthy and often costly probate process, allowing for a quicker and more private distribution of assets. By using a trust, families can save time and reduce legal fees, ensuring that loved ones receive their inheritance smoothly.

When one spouse passes away, a joint revocable trust typically becomes a single trust in the name of the surviving spouse. This allows the surviving partner to maintain control over the trust assets and manage them according to their wishes. The New Hampshire Revocable Living Trust for Married Couple provides a seamless transition, ensuring that the surviving spouse can continue to benefit from and utilize the assets without disruption.