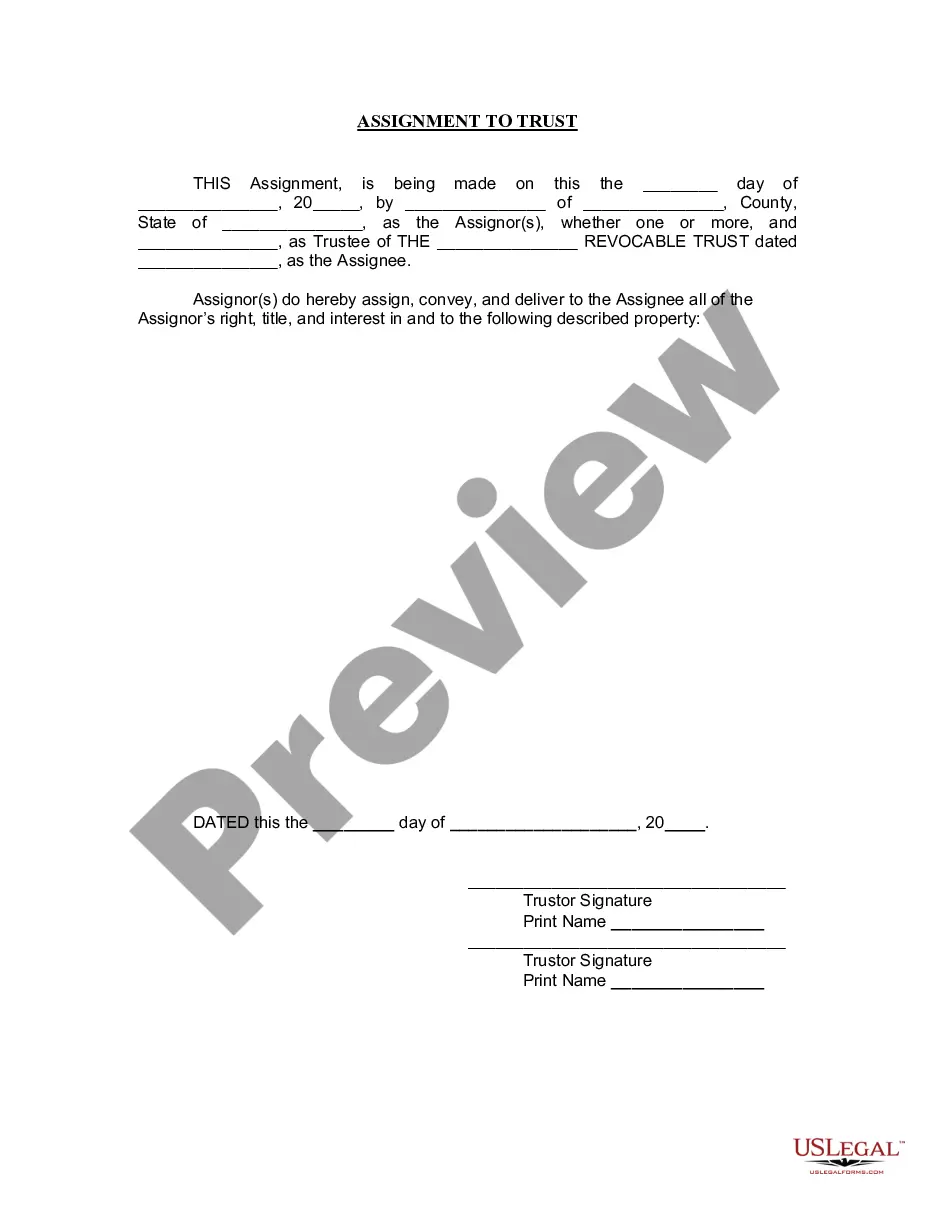

New Hampshire Assignment to Living Trust

About this form

The Assignment to Living Trust form is a legal document that transfers the ownership of specific property into a living trust. This type of trust is created during a person's lifetime and is often used for effective estate planning. Unlike a will, a living trust helps avoid probate and allows for the seamless management of assets.

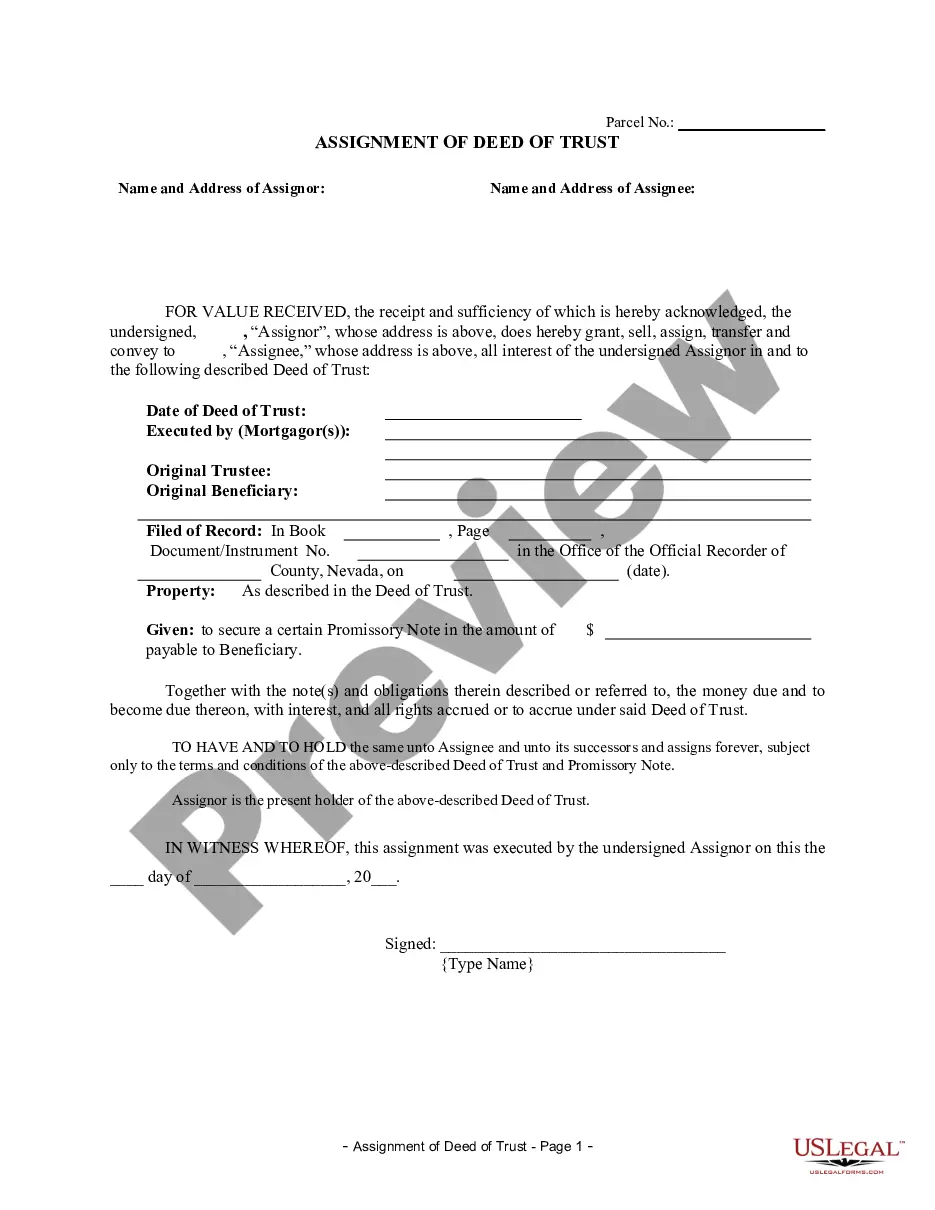

Key components of this form

- Date of the assignment

- Names and addresses of the Assignor(s)

- Name and position of the Trustee

- Specific property being assigned to the trust

- Signatures of the Assignor(s) and the acknowledgment by a notary public

When to use this form

This form should be used when a property owner wishes to transfer their property into a living trust. It is commonly utilized when setting up estate plans, ensuring that assets are managed according to the owner's wishes during their lifetime and after their passing.

Who this form is for

- Individuals creating a living trust for estate planning purposes

- Property owners looking to avoid probate

- Heirs or beneficiaries involved in managing an estate

- Trustees assigned to manage a living trust

Steps to complete this form

- Identify the date of the assignment.

- Fill in the names and addresses of the Assignor(s).

- Provide the name of the Trustee and the name of the living trust.

- Specify the property being assigned.

- Obtain the signatures of the Assignor(s) and have the document notarized.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to list all properties being assigned to the trust.

- Not obtaining the necessary notarization.

- Leaving out the date of the assignment.

- Using incorrect names or titles for the Assignor(s) or Trustee.

Advantages of online completion

- Convenience of completing and downloading the form at any time.

- Editability to tailor the document to specific needs.

- Access to attorney-drafted forms for peace of mind.

- Secure storage for your important legal documents.

Looking for another form?

Form popularity

FAQ

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

A revocable living trust isn't subject to the same kind of rules as a will; it should be valid in any state, no matter where you signed it.If you acquire real estate in your new state, you'll probably want to hold it in the trust, so that it doesn't have to go through probate at your death.

Trusts created during your lifetime, known as living trusts, do not go into the public record after you die. With rare exceptions, trusts remain private regardless of whether you have an irrevocable or revocable trust at the time of your death.

Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust. However, if real estate is involved, the trust may be recorded in the local office of the county clerk.

No. Trust does not need to be filed in California. Trusts are private documents and usually there are compelling reasons not to file the trust.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.