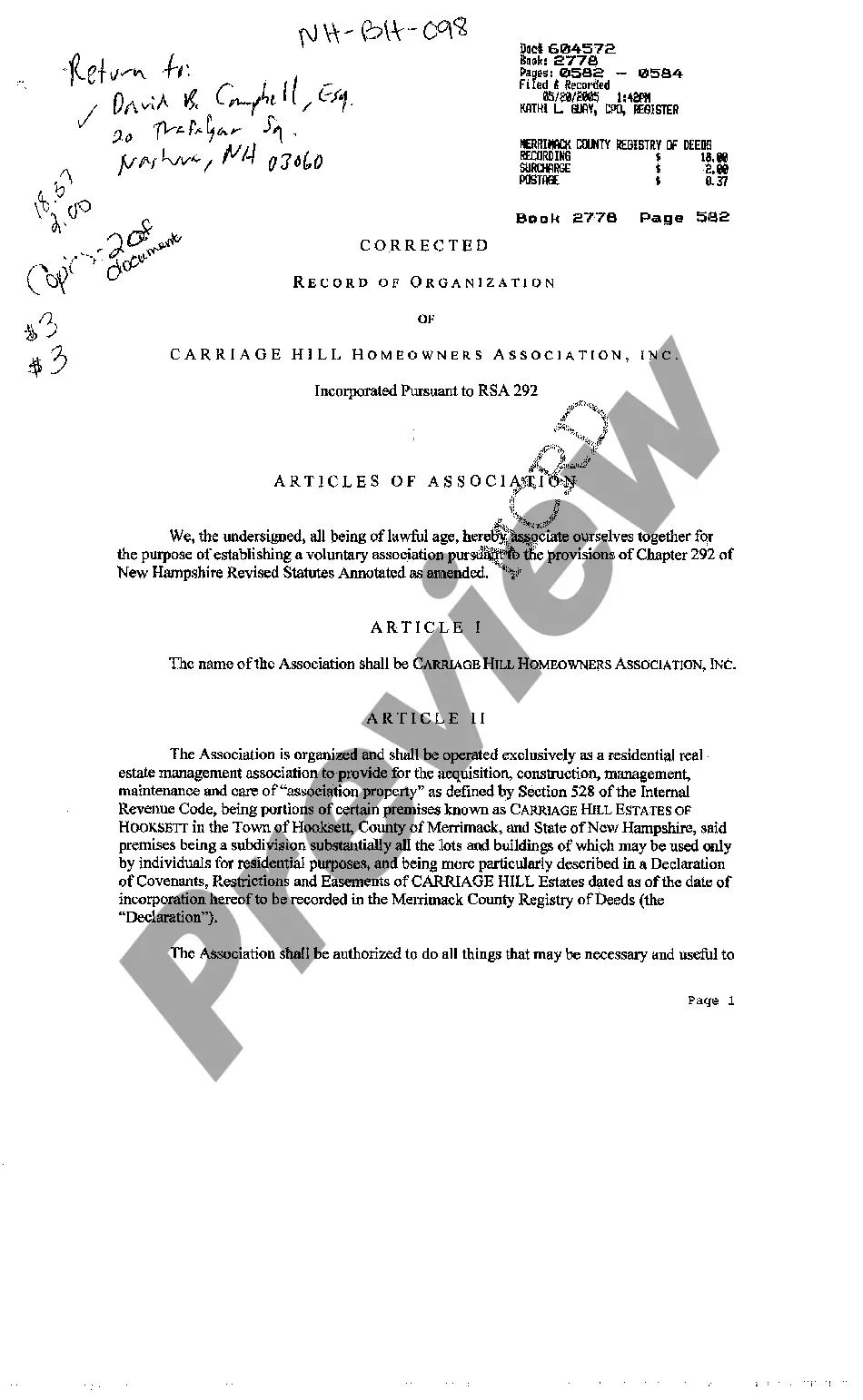

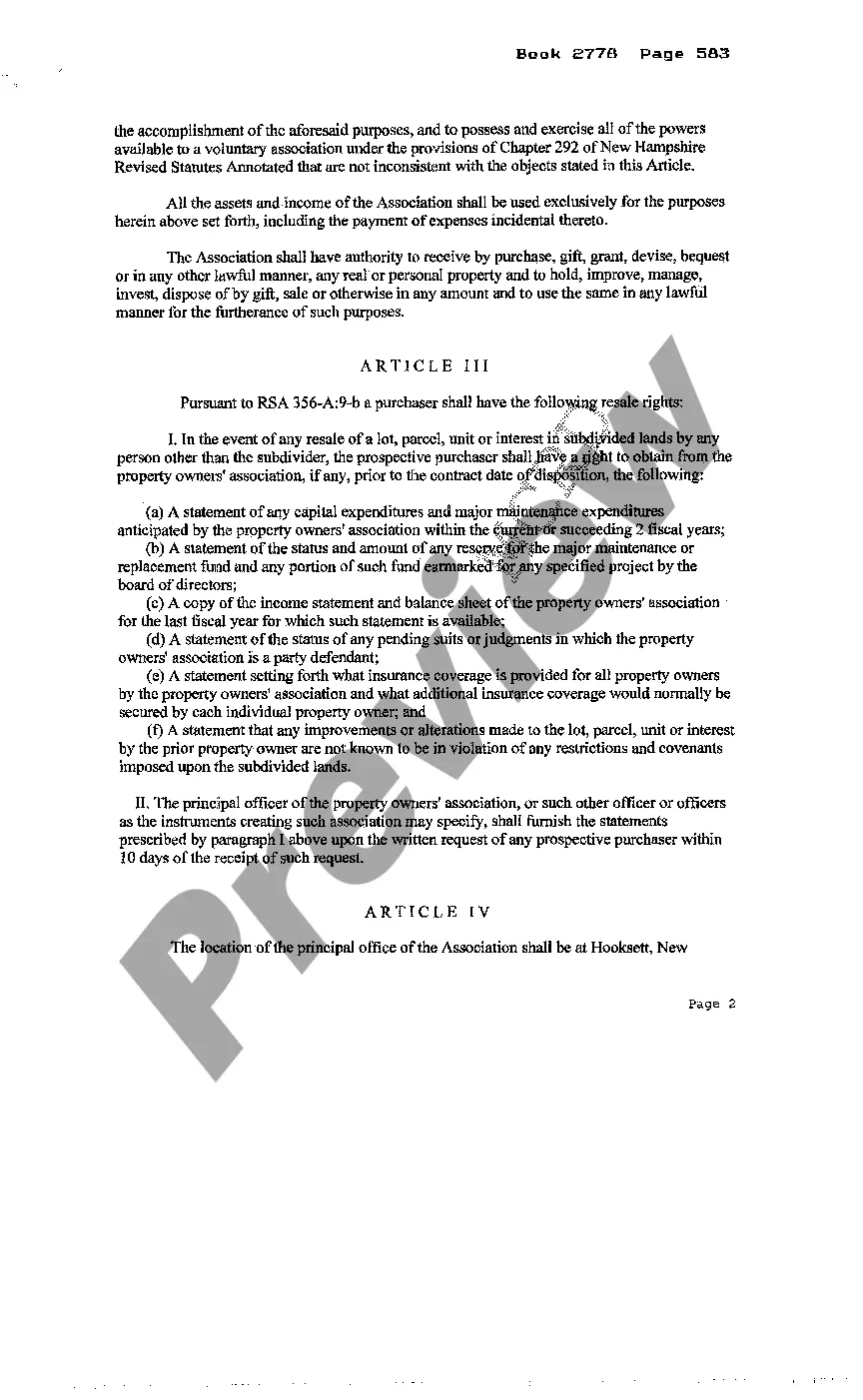

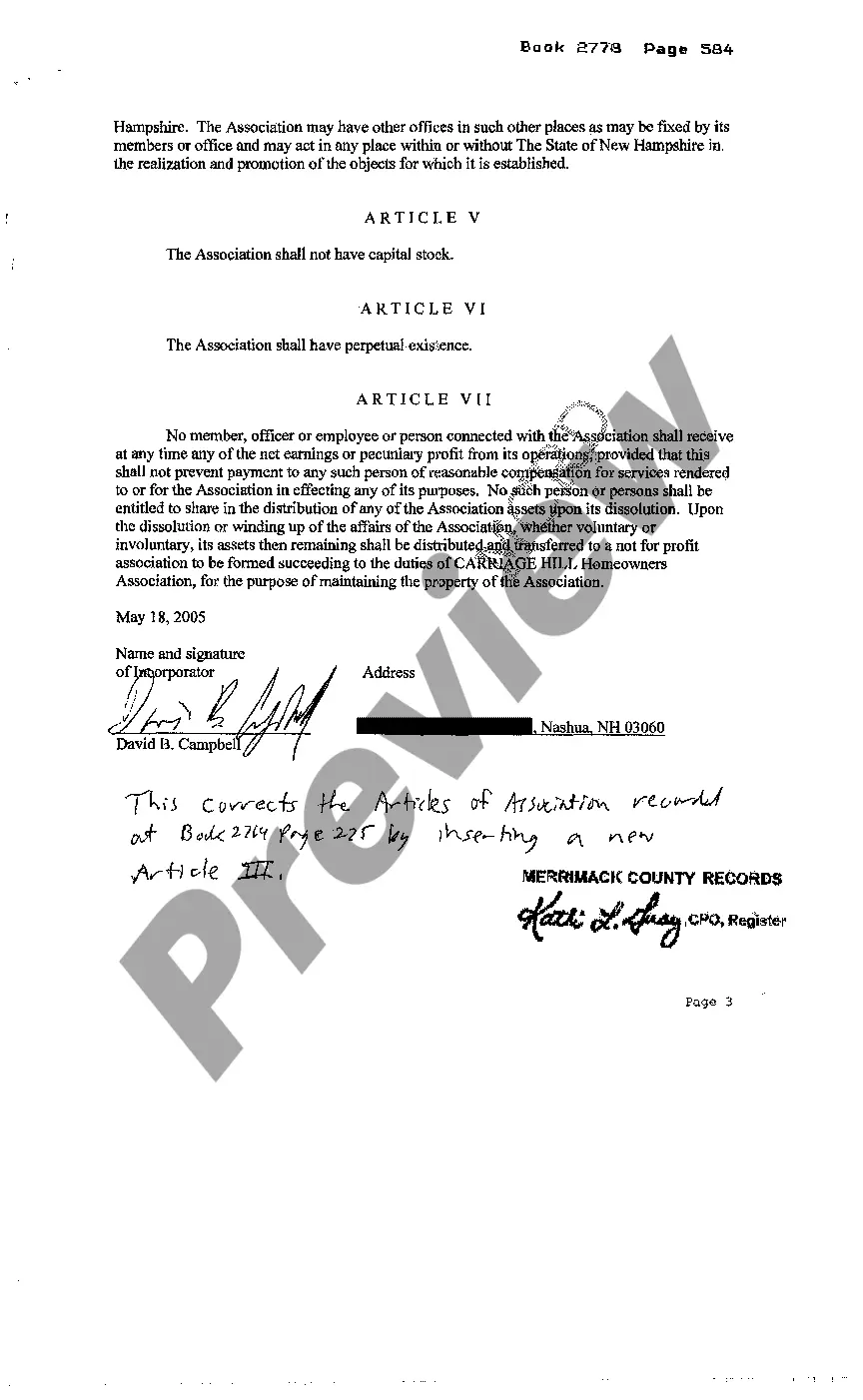

New Hampshire Articles of Organization of Homeowners Association

Description

How to fill out New Hampshire Articles Of Organization Of Homeowners Association?

Avoid pricey lawyers and find the New Hampshire Articles of Organization of Homeowners Association you need at a affordable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax documents. Go through their descriptions and preview them well before downloading. Additionally, US Legal Forms enables customers with step-by-step instructions on how to download and complete every form.

US Legal Forms subscribers basically need to log in and get the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the tips below:

- Ensure the New Hampshire Articles of Organization of Homeowners Association is eligible for use in your state.

- If available, look through the description and make use of the Preview option well before downloading the sample.

- If you’re sure the document suits you, click on Buy Now.

- In case the form is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you may complete the New Hampshire Articles of Organization of Homeowners Association by hand or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Ask to see the HOA budget. Join the HOA board. Review the HOA's contracts. Reduce landscaping costs. Determine if HOA is paying too much in property management fees. Look at insurance premiums. Defer non-essential maintenance or other projects.

The U.S. Constitution prohibits bills of attainder but developers create them and use them as the law of the land in a mini-government known as a Mandatory Homeowners Association. If this is prohibited by the Constitution then clearly HOA's are unconstitutional.

Homeowners Associations are Corporations.And therefore, the Board of Directors and the homeowners should conduct the business affairs of the HOA in a professional manner (as a corporation and as a business) pursuant to the laws governing corporations.

Some states, such as Florida and California, have a large body of HOA law. Other states, such as Massachusetts, have virtually no HOA law. Homeowners associations are commonly found in residential developments since the passage of the DavisStirling Common Interest Development Act in 1985.

For federal tax purposes, homeowners' associations are considered corporations, regardless of whether it was created as a non-profit. Therefore, the association must file taxes as a corporation. The HOA is responsible for filing a tax return every year that it is in operation.

What HOAs Can Legally Do. Covenants, conditions, and restrictions fall under the scope of the HOA bylaws or articles. They are (in some cases) forged with the power to fine, place liens against mortgages, and even foreclose on a homeowner's property.

A homeowners association (HOA) is a legal entity that governs a community of homes, including subdivisions, condominiums, townhomes, or planned community. HOAs operate within state statutes to enforce regulations and collect assessments from homeowners, while also taking care of maintenance repairs of common areas.

HOAs have two forms to choose from 1120 and 1120-H. Form 1120 is used by C corporations while 1120-H is a tax form specifically designed for qualifying HOAs.

Examine the landscaping and outdoor maintenance. Check out the condition of amenities and common indoor space. Ask to see the association's budget and reserve study. Contact the community's property management company.