New Hampshire Quitclaim Deed from Individual to LLC

About this form

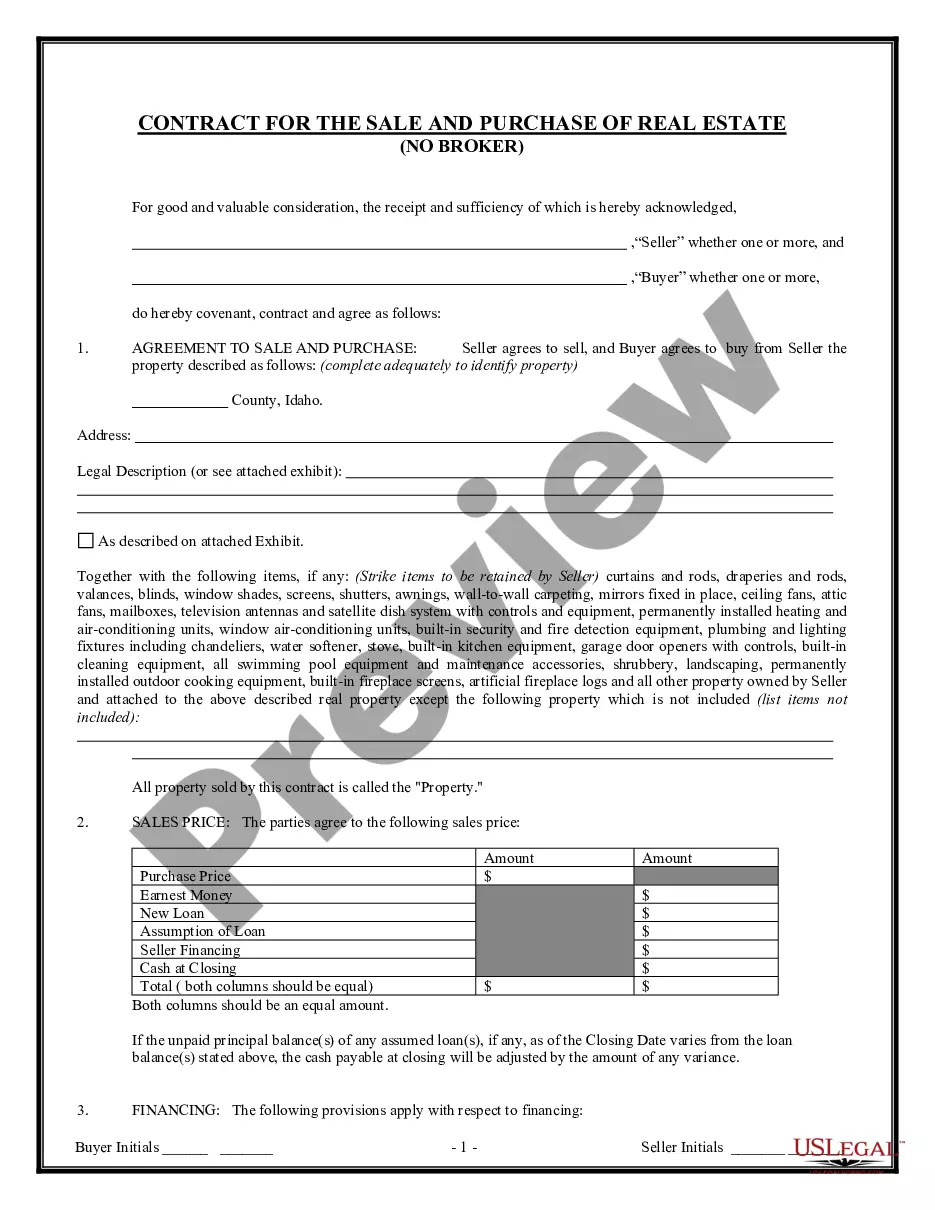

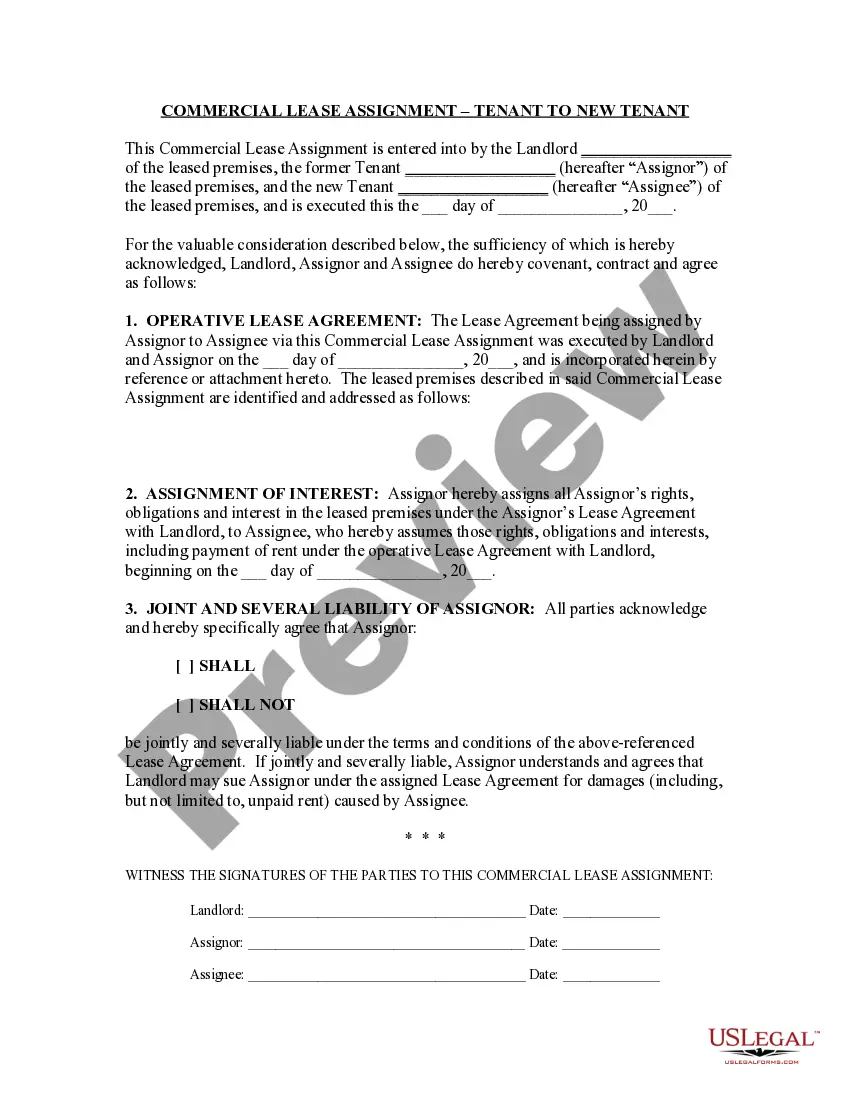

The Quitclaim Deed from Individual to LLC is a legal document used to transfer property ownership from an individual (the grantor) to a limited liability company (the grantee). This form allows the grantor to convey their interest in a property without any warranties about the title or property rights. Unlike other types of deeds, such as warranty deeds, this quitclaim deed does not guarantee that the grantor holds a valid title to the property, making it ideal for informal transfers or situations where the grantor wishes to quickly transfer property to the LLC.

What’s included in this form

- Identifying information for both grantor and grantee.

- Description of the property being transferred, including any reservations.

- Signature of the grantor and date of execution.

- Section for notarization, if required.

- Legal language outlining the specifics of the transfer or reservation of rights.

State law considerations

This form is tailored for use in New Hampshire. It includes specific references to the state's laws regarding the transfer of real property and associated tax exemptions. Users should familiarize themselves with local regulations to ensure compliance.

When to use this form

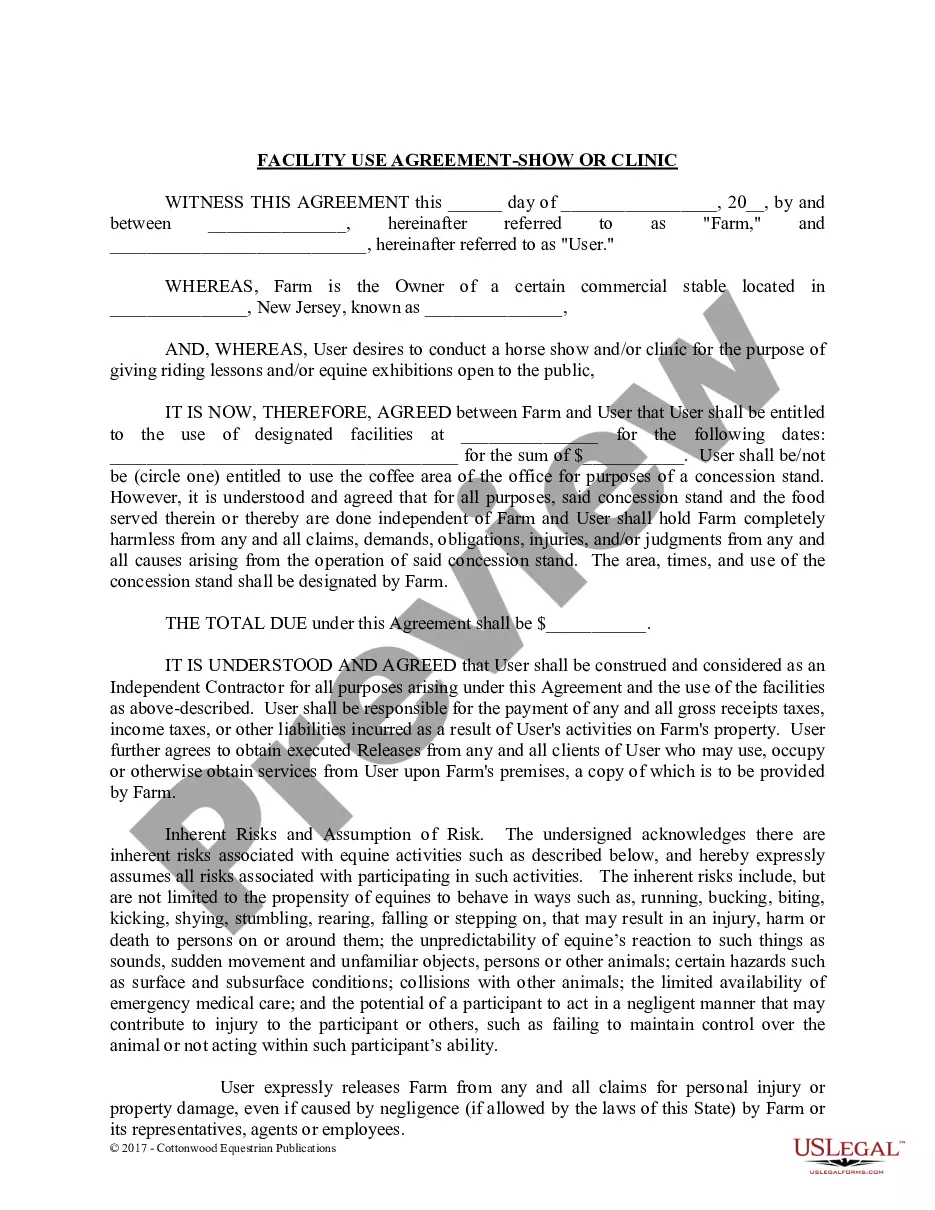

This quitclaim deed should be used in situations where an individual wishes to transfer their ownership interest in real property to a limited liability company. Common scenarios include family estate planning, business reorganizations, or when converting personal property to business property. It is especially useful in transactions where the grantor trusts the grantee and does not require formal guarantees regarding property rights.

Who should use this form

- Individuals transferring property to their LLC.

- Real estate investors seeking to streamline property management.

- Business owners reorganizing property ownership for tax or liability purposes.

- Anyone interested in quick and informal property transfers without extensive legal hurdles.

Instructions for completing this form

- Identify the parties involved by entering the full names and addresses of the grantor and grantee.

- Specify the property being conveyed, including its legal description and any reservations of rights.

- Provide the date of the transaction, ensuring it is complete and accurate.

- Sign the deed in the presence of a notary public, if required.

- File the completed deed with the local recording office to ensure proper record keeping.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes to avoid

- Failing to provide a complete legal description of the property.

- Incorrectly identifying the grantor or grantee, leading to confusion about ownership.

- Not signing the deed or signing without a notary, when required.

- Neglecting to file the deed with the relevant authorities after completion.

Benefits of completing this form online

- Easy accessibility for immediate downloading and completion.

- Editable format allows for quick adjustments as needed.

- Convenience of filling out the form from anywhere without the need for physical paperwork.

- Streamlined process to securely save and share once completed.

Form popularity

FAQ

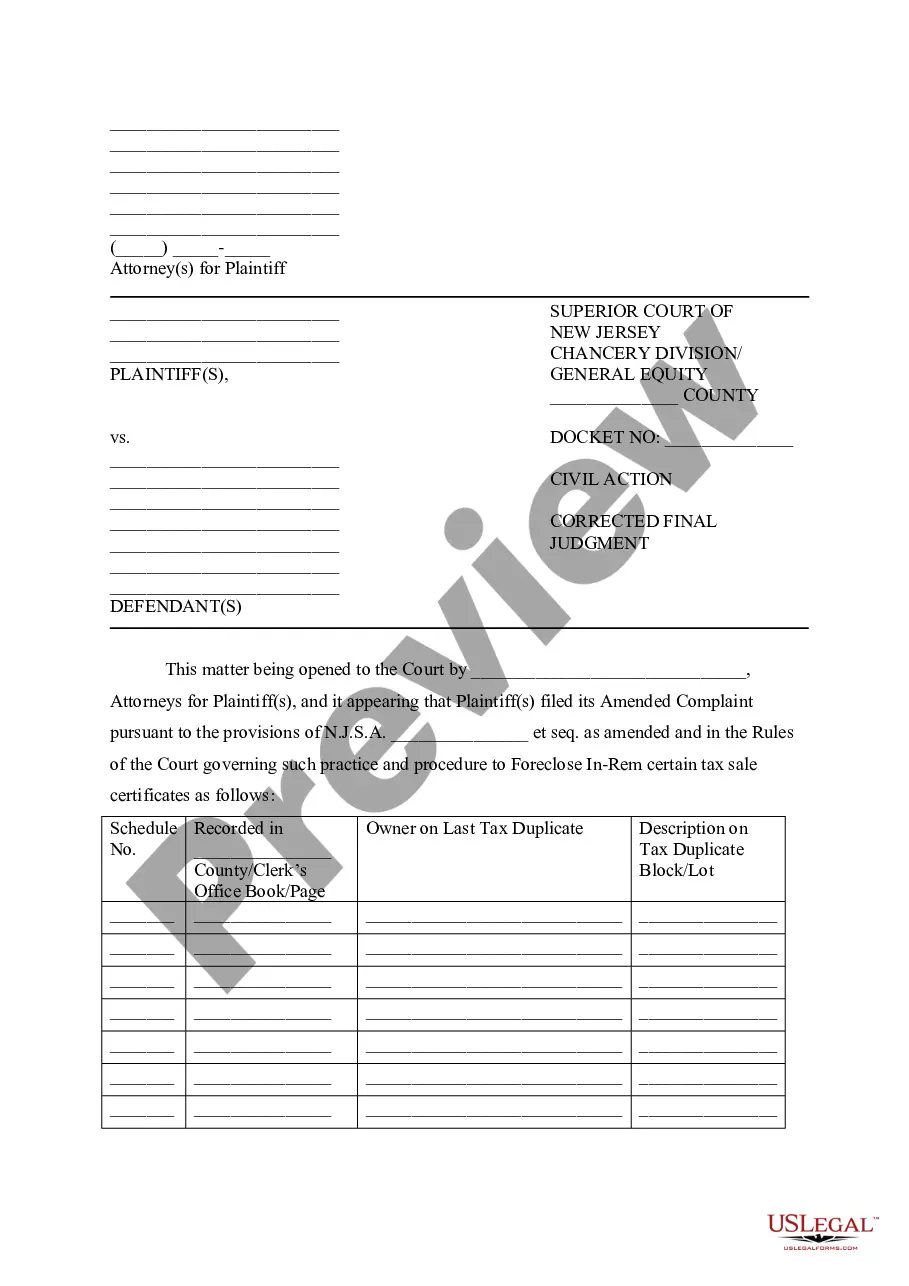

Signing - According to New Hampshire Law (§ 477:3) the Grantor must sign the quit claim deed in the presence of a Notary Public. Recording - Once notarized, the quit claim deed must be filed with the County Recorder's Office in the city or county where the property is located.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Signing - According to New Hampshire Law (§ 477:3) the Grantor must sign the quit claim deed in the presence of a Notary Public. Recording - Once notarized, the quit claim deed must be filed with the County Recorder's Office in the city or county where the property is located.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.