Nebraska Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

Have you ever been in a situation where you require documentation for various organizational or specific reasons almost every time.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms provides thousands of template options, such as the Nebraska Irrevocable Power of Attorney for Transfer of Stock by Executor, which can be crafted to satisfy state and federal regulations.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Nebraska Irrevocable Power of Attorney for Transfer of Stock by Executor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

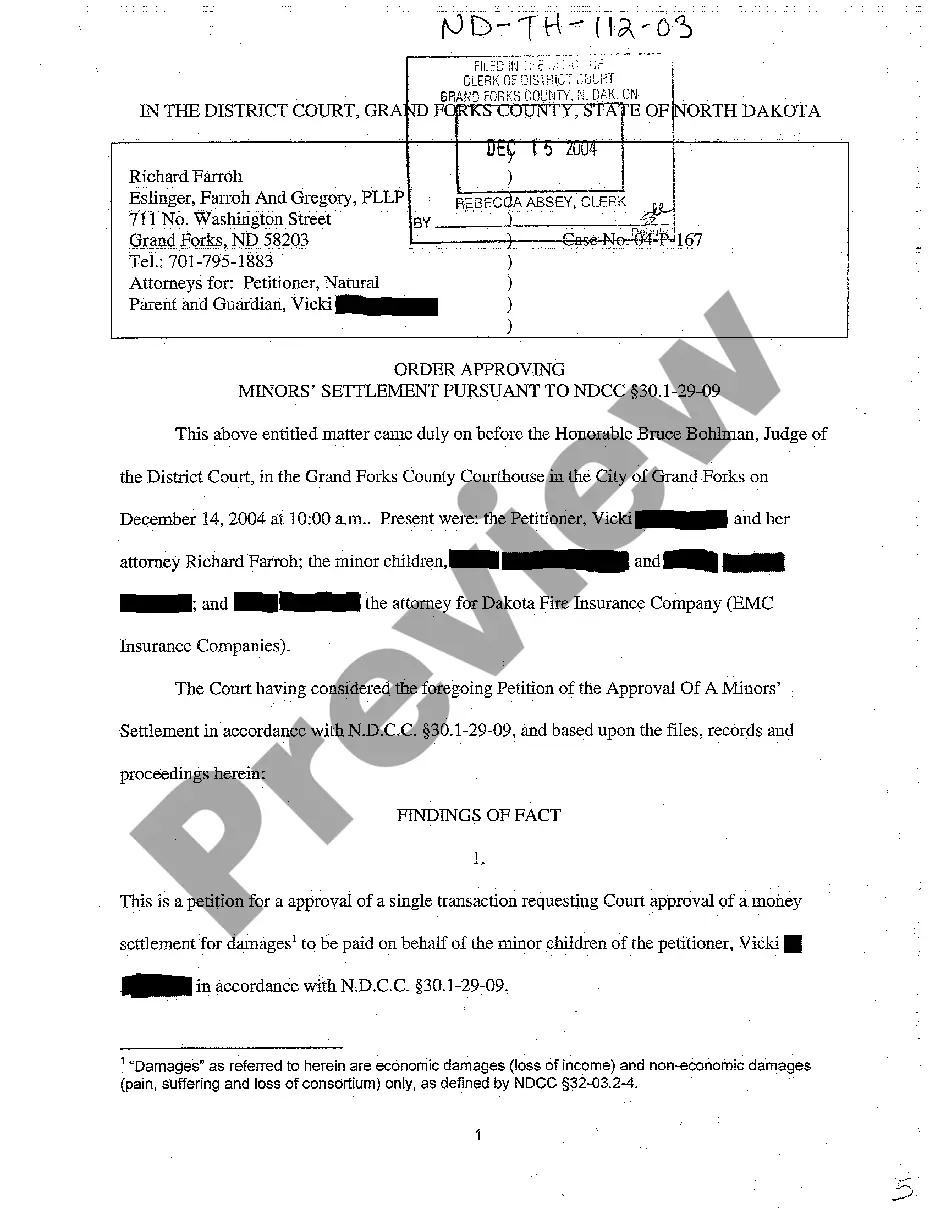

- Utilize the Preview feature to examine the document.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and criteria.

- Once you locate the appropriate form, click Get now.

- Choose the pricing plan you want, enter the required details to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Explore all the document templates you have purchased in the My documents list. You can acquire another copy of the Nebraska Irrevocable Power of Attorney for Transfer of Stock by Executor at any time, if necessary. Just select the needed form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors. The service offers properly designed legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

To file a Nebraska Irrevocable Power of Attorney for Transfer of Stock by Executor, you need to first complete the document accurately. After signing and notarizing it, you can submit a copy to relevant financial institutions or companies that hold the stock. It is also a good idea to keep a copy for your records. If you have further questions about the filing process, consider using platforms like uslegalforms to access templates and guidance tailored to your needs.

Filling out a Nebraska Irrevocable Power of Attorney for Transfer of Stock by Executor involves several important steps. First, clearly identify the principal and the agent, along with their contact information. Next, specify the powers granted to the agent, which should include the authority to manage stock transfers. Finally, ensure you sign and date the document, and have it notarized to complete the process.

Yes, a Nebraska Irrevocable Power of Attorney for Transfer of Stock by Executor must be notarized to ensure its validity. Notarization provides an official verification of the signatures and the identities of the parties involved. This step helps to prevent any disputes regarding the authenticity of the document. Therefore, it is crucial to have your power of attorney notarized to ensure it meets all legal requirements.

The irrevocable power of attorney when clubbed with the interest of the power holder then it is valid to that extent alone even after the death of the principal and not beyond that.

A Lasting Power of Attorney only remains valid during the lifetime of the person who made it (called the 'donor'). After the donor dies, the Lasting Power of Attorney will end.

A power of attorney can be made irrevocable if it is given with due consideration and if it specifically mentions that it is irrevocable. Such a power of attorney would operate beyond the life of the granter, says Joshi.

Dear Sir/Madam, irrevocable GPA is valid until and unless up to death of his executant, it means the GPA cannot be cancel of his in life time. After death of him, that GPA automatically stand as withheld not at all cancelled in this matter. The GPA holder has to be taken consent of legal heirs.

It further clarified that in view of Section 202 of the Indian Contract Act 1872, a power of attorney having the ingredients as required under section 202, is irrevocable and is valid even upon death of the donor (unless declared invalid/terminated by a court), and that in such an event a declaration does not need to

You must sign your POA in the presence of a notary public for the POA to be valid under Nebraska law.

The irrevocable power of attorney when clubbed with the interest of the power holder then it is valid to that extent alone even after the death of the principal and not beyond that.