Nebraska Consent to Use Name

Description

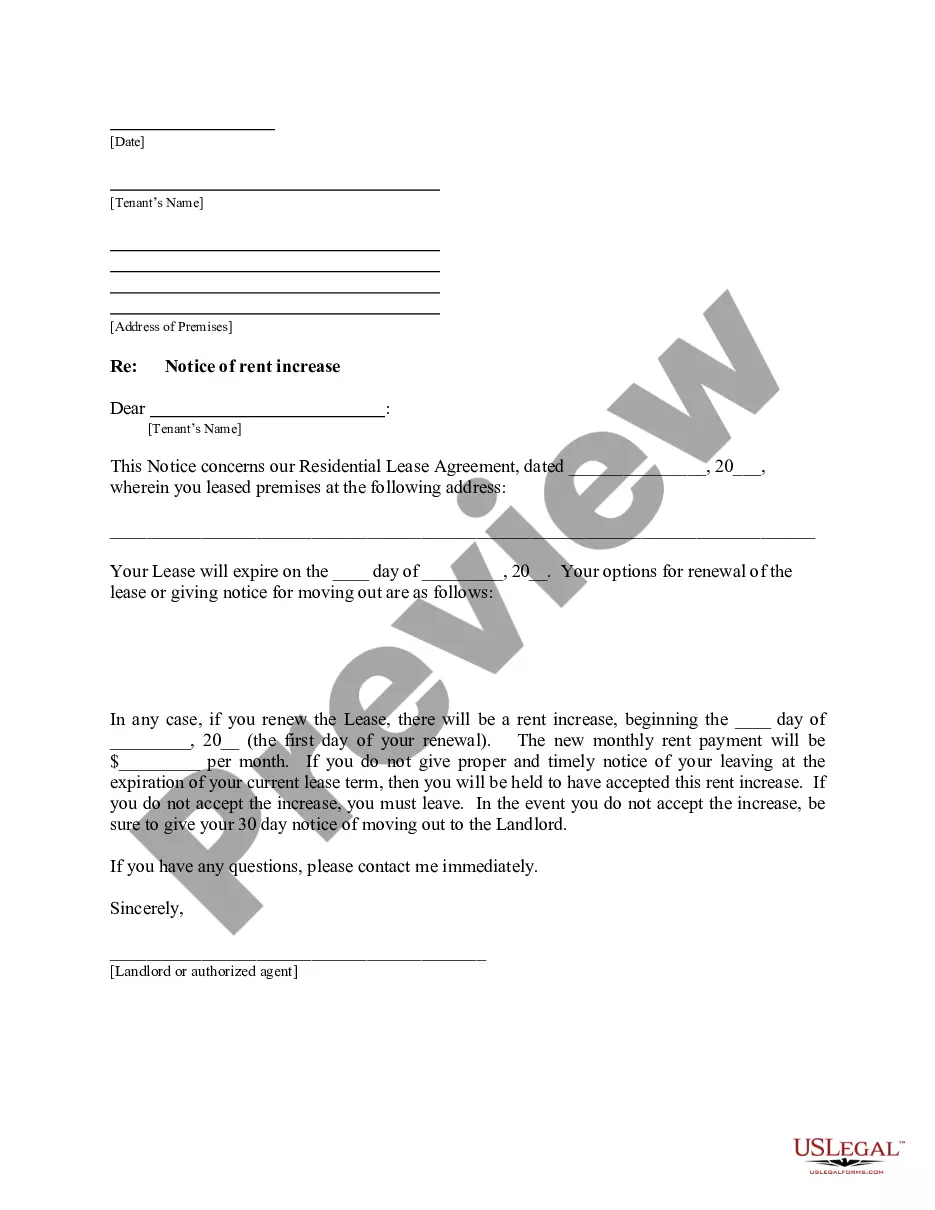

How to fill out Consent To Use Name?

If you have to complete, download, or produce authorized document themes, use US Legal Forms, the most important variety of authorized kinds, which can be found on the Internet. Use the site`s easy and handy look for to get the paperwork you require. Various themes for company and specific reasons are categorized by types and states, or key phrases. Use US Legal Forms to get the Nebraska Consent to Use Name in a number of mouse clicks.

If you are presently a US Legal Forms client, log in to the profile and then click the Acquire button to have the Nebraska Consent to Use Name. You may also access kinds you previously acquired from the My Forms tab of your profile.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for the correct area/region.

- Step 2. Make use of the Preview option to look over the form`s content. Never neglect to learn the outline.

- Step 3. If you are not satisfied with all the type, use the Lookup area on top of the screen to find other models in the authorized type format.

- Step 4. Upon having found the form you require, go through the Acquire now button. Opt for the prices plan you choose and put your accreditations to sign up on an profile.

- Step 5. Process the purchase. You can use your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Pick the file format in the authorized type and download it in your product.

- Step 7. Comprehensive, change and produce or sign the Nebraska Consent to Use Name.

Every single authorized document format you purchase is your own property for a long time. You possess acces to every single type you acquired with your acccount. Select the My Forms segment and pick a type to produce or download once again.

Compete and download, and produce the Nebraska Consent to Use Name with US Legal Forms. There are millions of skilled and express-specific kinds you can use for your company or specific needs.

Form popularity

FAQ

The purpose of the Notice of Organization is to inform and notify the public that your LLC has been created in the state of Nebraska. Your Notice of Organization must include certain information about your LLC, as spelled out in section 21-117 (see 'b') of the Nebraska Revised Statutes: The name of your Nebraska LLC.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office.

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Nebraska LLC net income must be paid just as you would with any self-employment business.

LLCs will file the Statement of Dissolution, which lets the state know of its intention to dissolve. Once the LLC finishes winding up, it can file a Statement of Termination affirming that its affairs have all closed. You'll provide the name of the company and the date on which it dissolved.

You can use the Nebraska Corporate & Business Search tool on the Secretary of State website to check if your business name is available. You may also contact the Nebraska Secretary of State via phone at (402) 471-4079 or email at sos.corp@nebraska.gov for assistance on how to perform a Nebraska LLC name search.

To reinstate your domestic LLC, please contact our office at sos.corp@nebraska.gov to receive the reinstatement application, report and fee worksheet. Submit the application and report by filing either in-person or by mail. Online filing is not available.

All LLCs in Nebraska must publish a Notice of Organization in a newspaper of general circulation in the same location as the LLC, for three consecutive weeks. If there is no newspaper located in the same town/city, then a newspaper in the same county can be used.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office.