Nebraska Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

If you need to complete, acquire, or print out legitimate file layouts, use US Legal Forms, the greatest assortment of legitimate varieties, that can be found on the Internet. Take advantage of the site`s simple and easy practical research to find the files you will need. Numerous layouts for business and personal purposes are sorted by categories and states, or search phrases. Use US Legal Forms to find the Nebraska Clauses Relating to Initial Capital contributions within a couple of mouse clicks.

Should you be presently a US Legal Forms consumer, log in in your bank account and click the Down load button to find the Nebraska Clauses Relating to Initial Capital contributions. You may also accessibility varieties you earlier downloaded in the My Forms tab of the bank account.

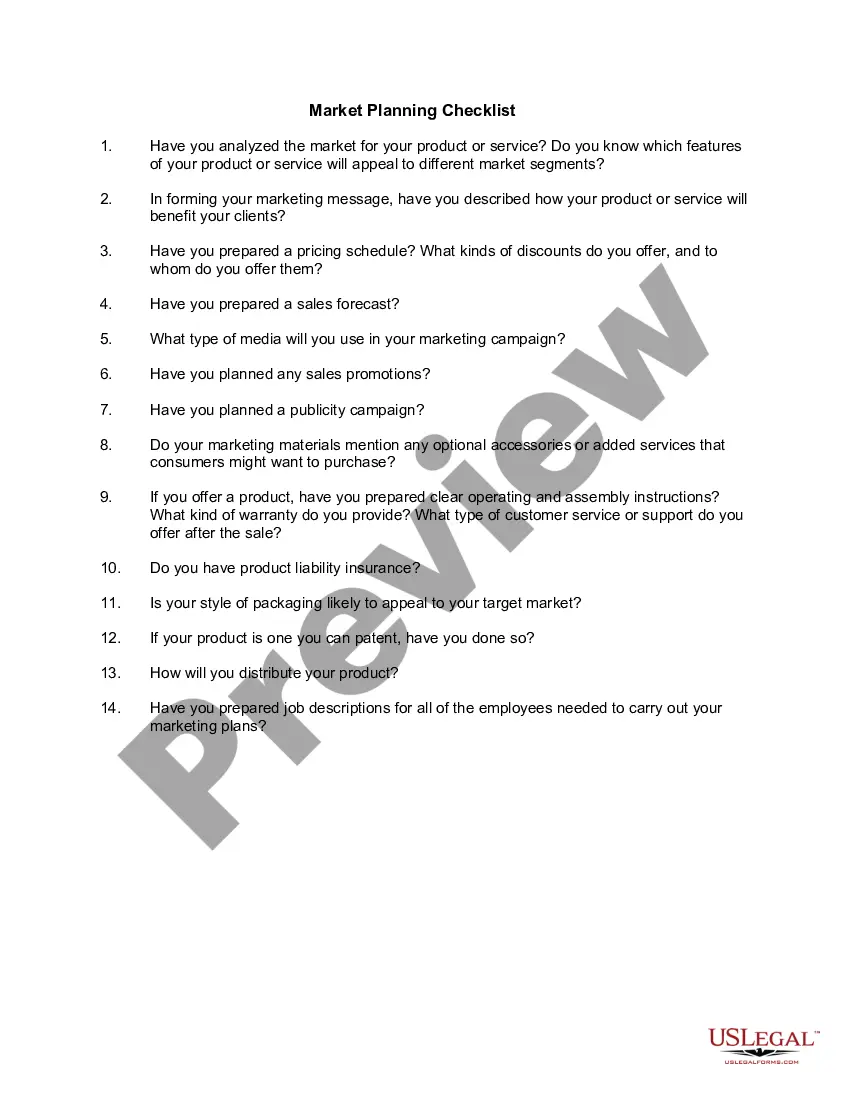

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form for your right town/nation.

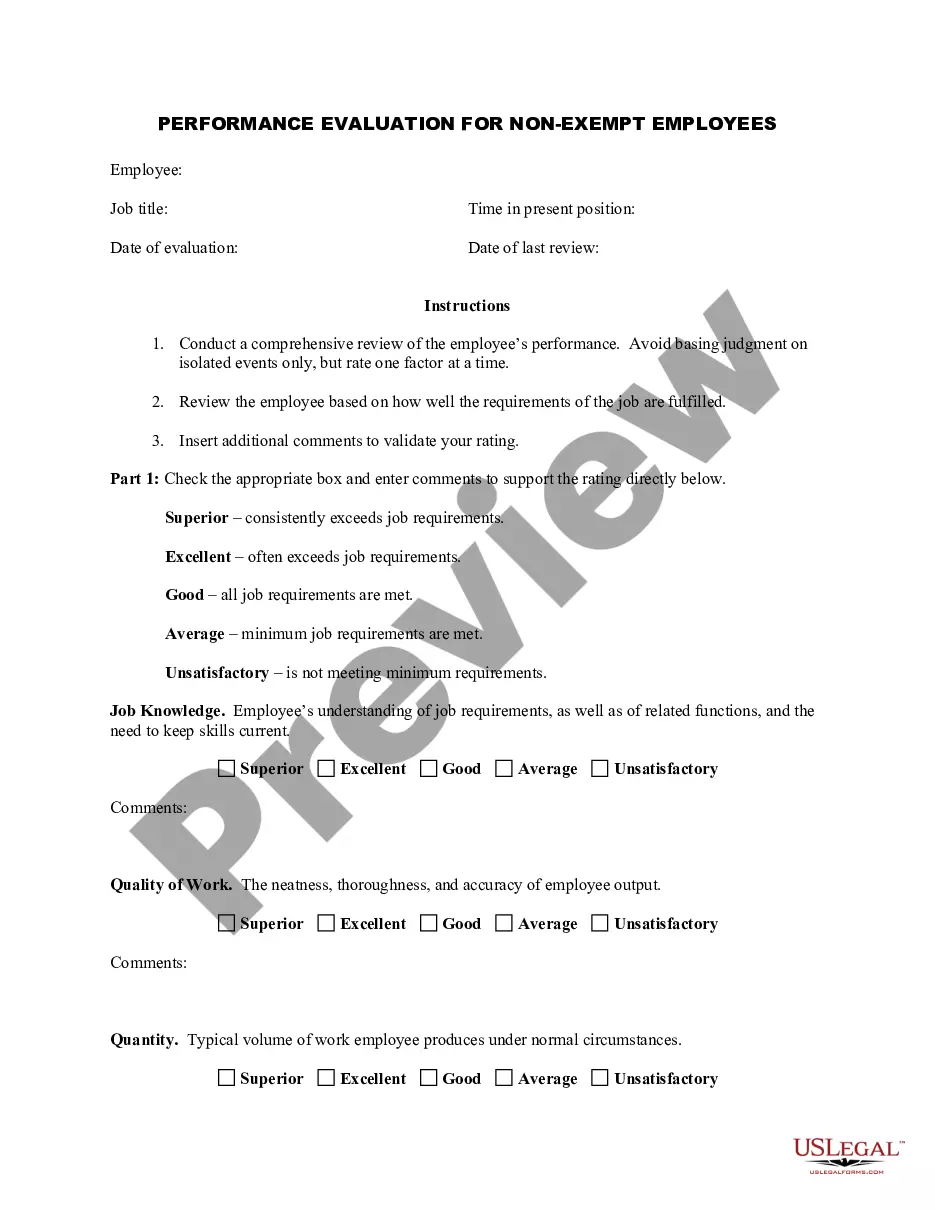

- Step 2. Utilize the Review method to examine the form`s content material. Do not overlook to read through the information.

- Step 3. Should you be not happy with the kind, take advantage of the Lookup field near the top of the display screen to find other versions in the legitimate kind design.

- Step 4. When you have discovered the form you will need, go through the Purchase now button. Select the pricing strategy you favor and include your credentials to sign up on an bank account.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Find the formatting in the legitimate kind and acquire it in your gadget.

- Step 7. Complete, modify and print out or indication the Nebraska Clauses Relating to Initial Capital contributions.

Every single legitimate file design you get is your own eternally. You possess acces to every single kind you downloaded within your acccount. Click on the My Forms section and select a kind to print out or acquire yet again.

Be competitive and acquire, and print out the Nebraska Clauses Relating to Initial Capital contributions with US Legal Forms. There are many specialist and status-specific varieties you can use for your business or personal demands.

Form popularity

FAQ

Income from other sources is a residuary head of income and sweeps in all such incomes which fall outside the other four heads of income. However, certain incomes will always be taxable under the head income from other sources, such as winning from lotteries, gifts, interest on enhanced compensation, etc.

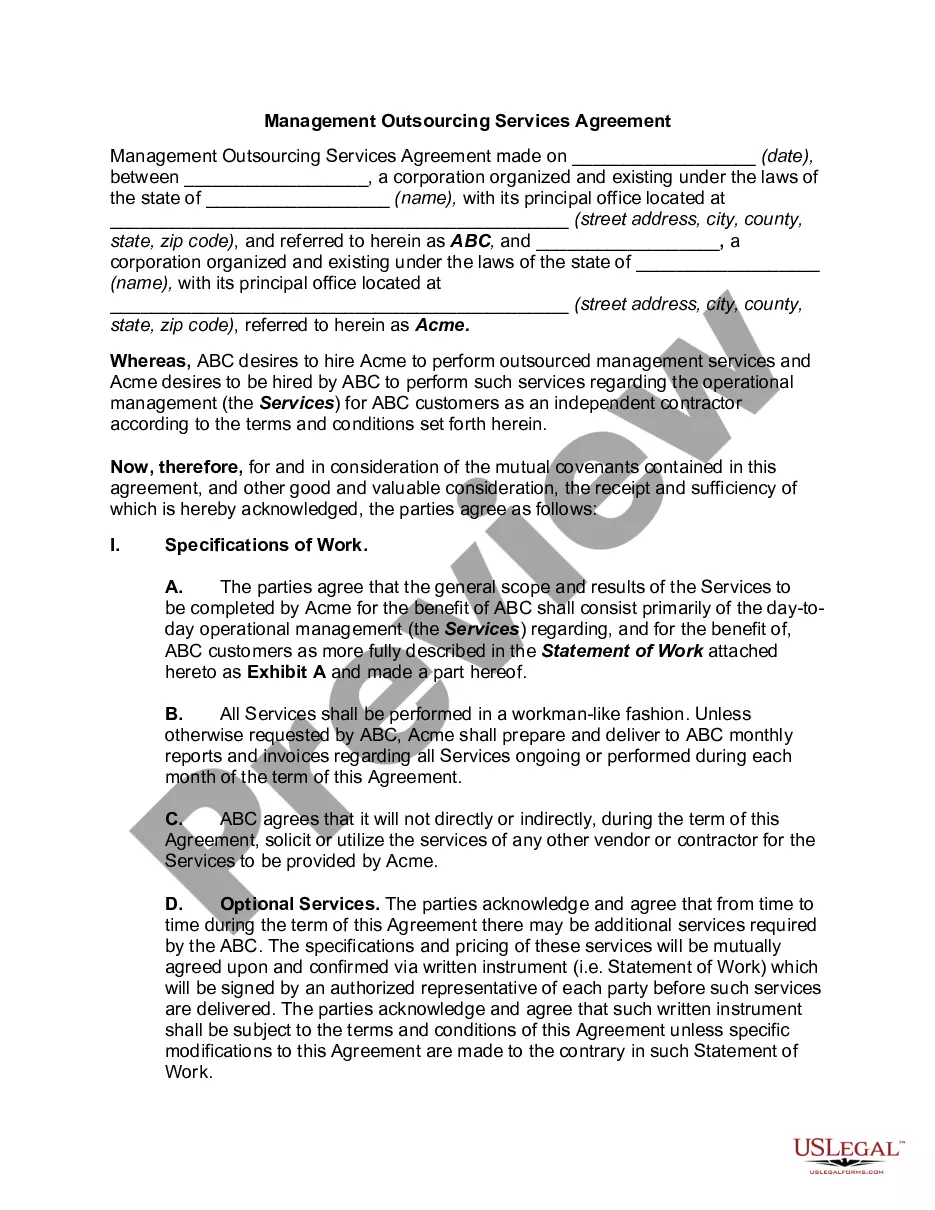

Capital is defined as the cash or assets in an LLC (or any type of entity for that matter). Capital can include cash, accounts receivable, equipment, and even physical property. Naturally, putting the words together, a capital contribution is a member's contribution of assets, usually cash, into the LLC.

One-time incomes such as winnings from lotteries, horse races, crossword puzzles, card games, gambling or betting of any form are categorized under 'Income from Other Sources. '

Income derived from Nebraska sources shall include, but not be limited to, items relating to real and tangible personal property, a business, trade, profession, or occupation, compensation for services, intangible property, small business corporations, partnerships, estates and trusts, and lottery and gambling winnings ...

Income received as wages, salaries, commissions, rental income, royalty payments, stock options, dividends and interest, and self-employment income are taxable.

The State General Fund is financed primarily by sales and income taxes. It also consists of excise taxes (including cigarette, alcoholic beverage, and pari-mutuel taxes), and other miscellaneous sources (including financial institutions tax, insurance premiums tax, and organization and qualification fees).

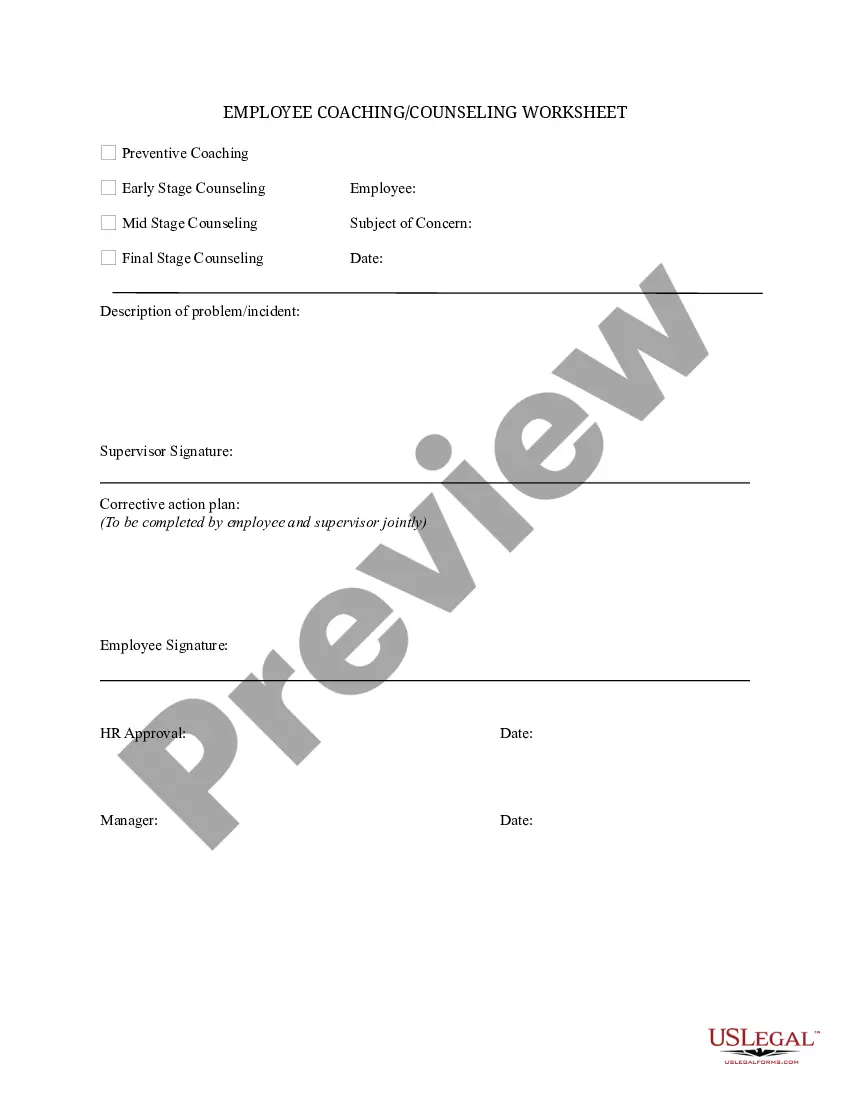

A Nebraska LLC should have an operating agreement because a company cannot act for itself. In order to operate, LLCs require real humans (and other entities) to carry out company operations.