Nebraska Letter in Lieu of Transfer Order Directing Payment to Lender

Description

How to fill out Letter In Lieu Of Transfer Order Directing Payment To Lender?

You can spend hrs online attempting to find the legal file format that suits the federal and state requirements you require. US Legal Forms supplies thousands of legal forms that are analyzed by specialists. It is possible to acquire or print out the Nebraska Letter in Lieu of Transfer Order Directing Payment to Lender from our services.

If you already have a US Legal Forms bank account, you can log in and click the Down load switch. Afterward, you can full, edit, print out, or signal the Nebraska Letter in Lieu of Transfer Order Directing Payment to Lender. Each and every legal file format you purchase is yours eternally. To get an additional duplicate associated with a bought type, go to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms site for the first time, stick to the easy directions beneath:

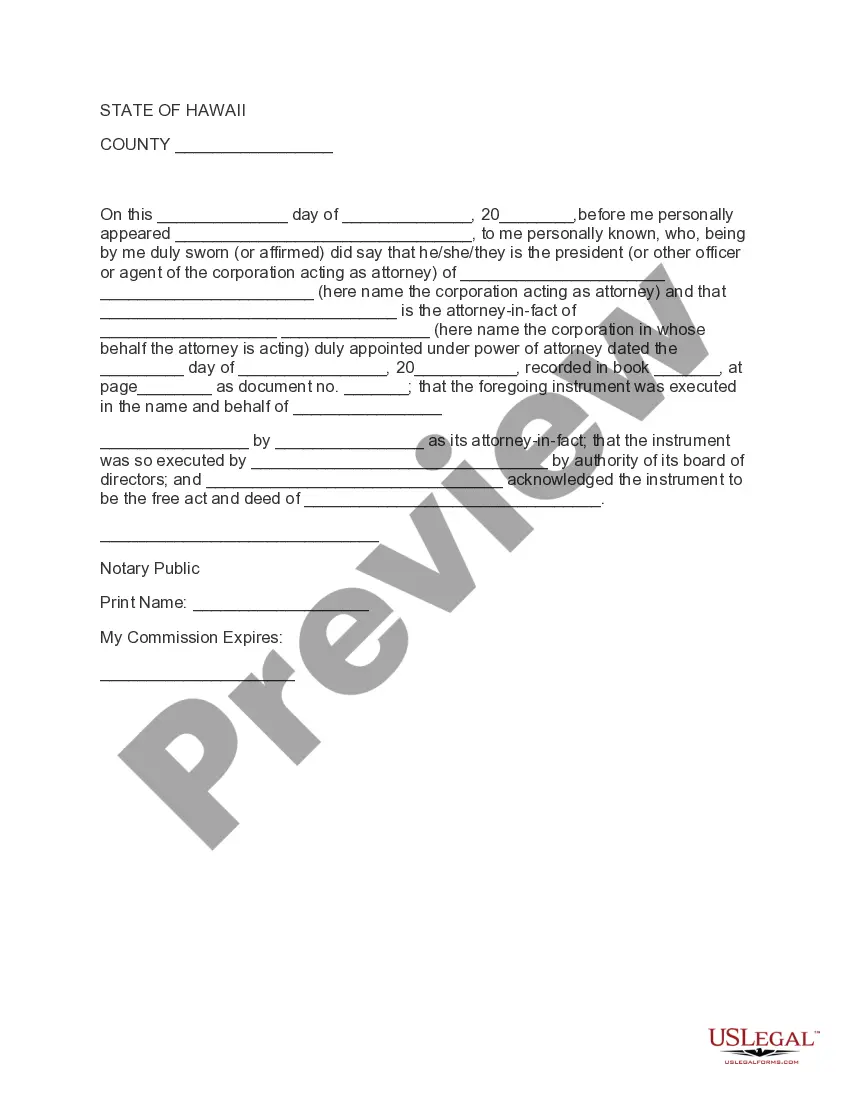

- Initially, be sure that you have selected the best file format for your region/area that you pick. See the type outline to make sure you have picked the correct type. If accessible, use the Review switch to check through the file format as well.

- In order to get an additional variation of your type, use the Search area to discover the format that suits you and requirements.

- After you have discovered the format you need, just click Purchase now to continue.

- Find the rates plan you need, type in your credentials, and sign up for your account on US Legal Forms.

- Total the transaction. You can use your Visa or Mastercard or PayPal bank account to cover the legal type.

- Find the structure of your file and acquire it to the product.

- Make adjustments to the file if necessary. You can full, edit and signal and print out Nebraska Letter in Lieu of Transfer Order Directing Payment to Lender.

Down load and print out thousands of file templates making use of the US Legal Forms Internet site, that provides the most important variety of legal forms. Use professional and express-certain templates to tackle your small business or specific requirements.