Nebraska Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease

Description

How to fill out Partial Release Of Lien On Leasehold Interest In Part Of Lands Subject To Lease?

You may invest several hours on-line trying to find the authorized document template that suits the federal and state specifications you need. US Legal Forms supplies a huge number of authorized forms that are reviewed by specialists. You can actually down load or printing the Nebraska Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease from our support.

If you already have a US Legal Forms profile, you are able to log in and click the Acquire button. After that, you are able to total, change, printing, or sign the Nebraska Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease. Every single authorized document template you buy is yours forever. To get another copy of the obtained develop, go to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms site the very first time, keep to the simple directions listed below:

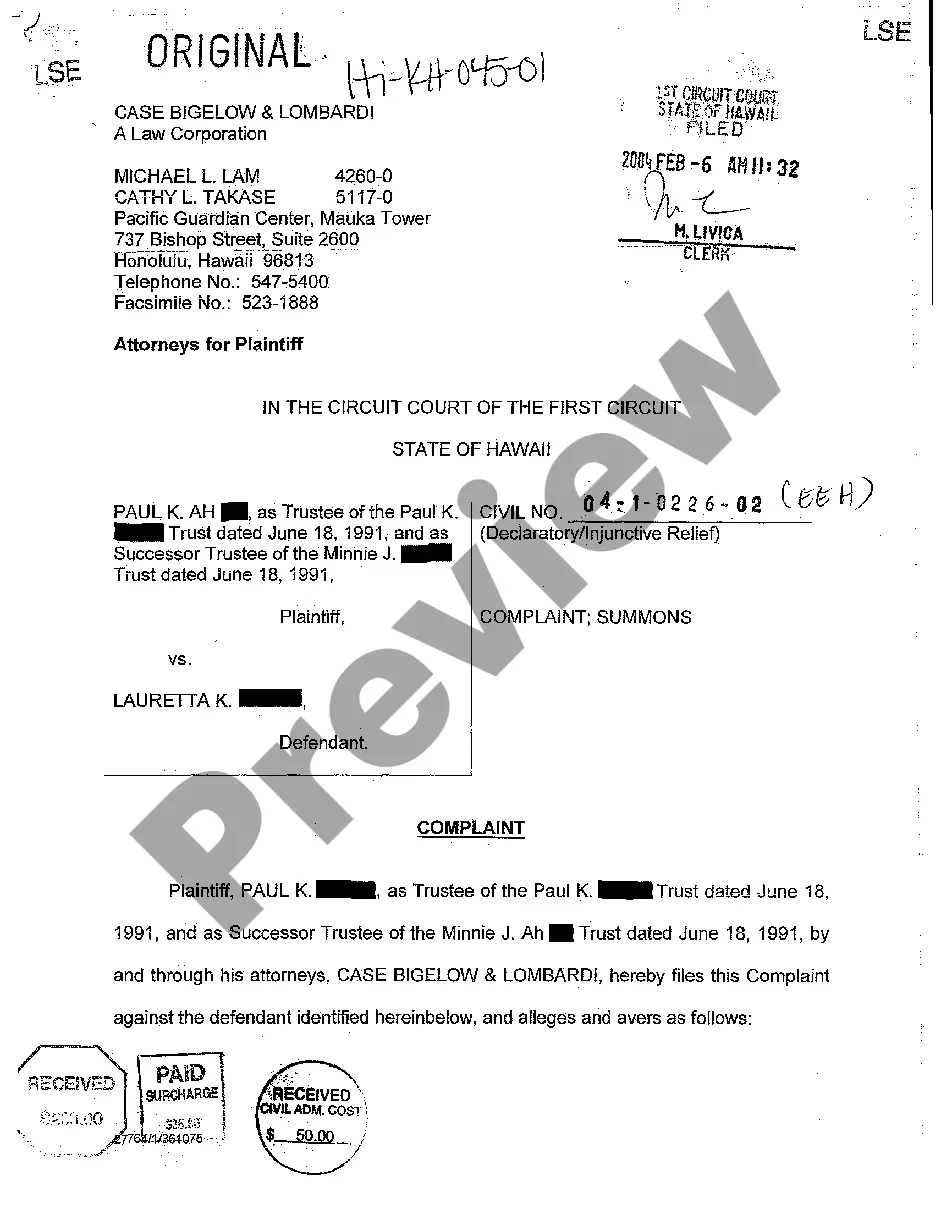

- Initial, make sure that you have chosen the best document template for that region/area of your choosing. Read the develop outline to make sure you have picked the correct develop. If accessible, make use of the Review button to look throughout the document template at the same time.

- If you would like discover another version of the develop, make use of the Look for area to get the template that fits your needs and specifications.

- Upon having found the template you would like, simply click Purchase now to move forward.

- Select the prices prepare you would like, enter your references, and sign up for your account on US Legal Forms.

- Total the financial transaction. You should use your credit card or PayPal profile to pay for the authorized develop.

- Select the structure of the document and down load it to the product.

- Make changes to the document if needed. You may total, change and sign and printing Nebraska Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease.

Acquire and printing a huge number of document templates making use of the US Legal Forms Internet site, that provides the most important selection of authorized forms. Use specialist and express-particular templates to handle your small business or person requires.

Form popularity

FAQ

Typically, it's the responsibility of the seller to pay off the lien on his or her property on or before the day of closing. Most liens are paid off from the proceeds of the sale at the time of closing. Know Your Options: Steps to Removing a Property Lien vgtitle.com ? know-your-options-steps-to-removi... vgtitle.com ? know-your-options-steps-to-removi...

Texas Property Code, Section 53.284, prescribes statutory language for Waiver and Release of Lien or Payment Bond Claims. Waivers for claims under a PRIME CONTRACT signed AFTER January 1, 2021, DO NOT need to be notarized. Waivers for claims under a PRIME CONTRACT signed BEFORE January 1, 2021, MUST be notarized.

Release Of Lien Texas Form To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property. Release Of Lien Texas - Texas Real Estate Lawyer kwclaw.com ? release-of-lien-texas kwclaw.com ? release-of-lien-texas

Filing a Judgment Lien If the debtor sells any non-exempt real property, the creditor may be able to get all or some of the money owed from the proceeds of the sale. A judgment lien lasts for ten years.

If a lien is filed on your property and you believe the lien is wrongful, you, the property owner have a right to contest the lien. In some cases, you may be able to file a summary motion to remove a lien. This is a lawsuit filed in district court that will allow the almost immediate removal of the lien.

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property. Understanding your lien release | ? ... ? Real Estate ? ... ? Real Estate

To remove a lien recorded on a paper title, you will need: the vehicle title. a release of lien letter and/or other notifications from the lienholder(s) currently named on the vehicle title. a completed Application for Texas Title and/or Registration (Form 130-U)