Nebraska Partial Release of Lien on Assigned Overriding Royalty Interest

Description

How to fill out Partial Release Of Lien On Assigned Overriding Royalty Interest?

US Legal Forms - one of many greatest libraries of lawful types in the United States - provides a variety of lawful file templates it is possible to down load or print out. Using the web site, you can get 1000s of types for enterprise and individual functions, categorized by classes, states, or key phrases.You can find the latest versions of types like the Nebraska Partial Release of Lien on Assigned Overriding Royalty Interest in seconds.

If you already possess a subscription, log in and down load Nebraska Partial Release of Lien on Assigned Overriding Royalty Interest from the US Legal Forms local library. The Down load switch can look on every single form you see. You gain access to all earlier saved types in the My Forms tab of your account.

In order to use US Legal Forms the very first time, here are simple directions to help you started off:

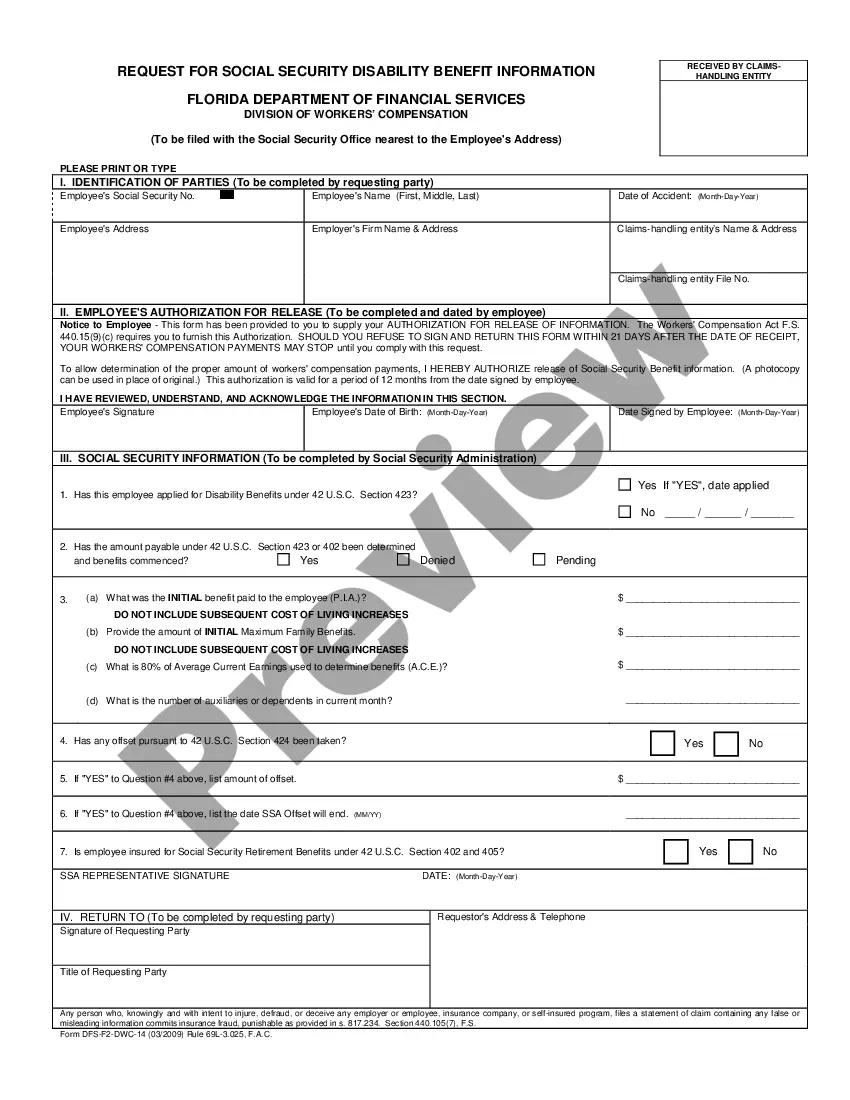

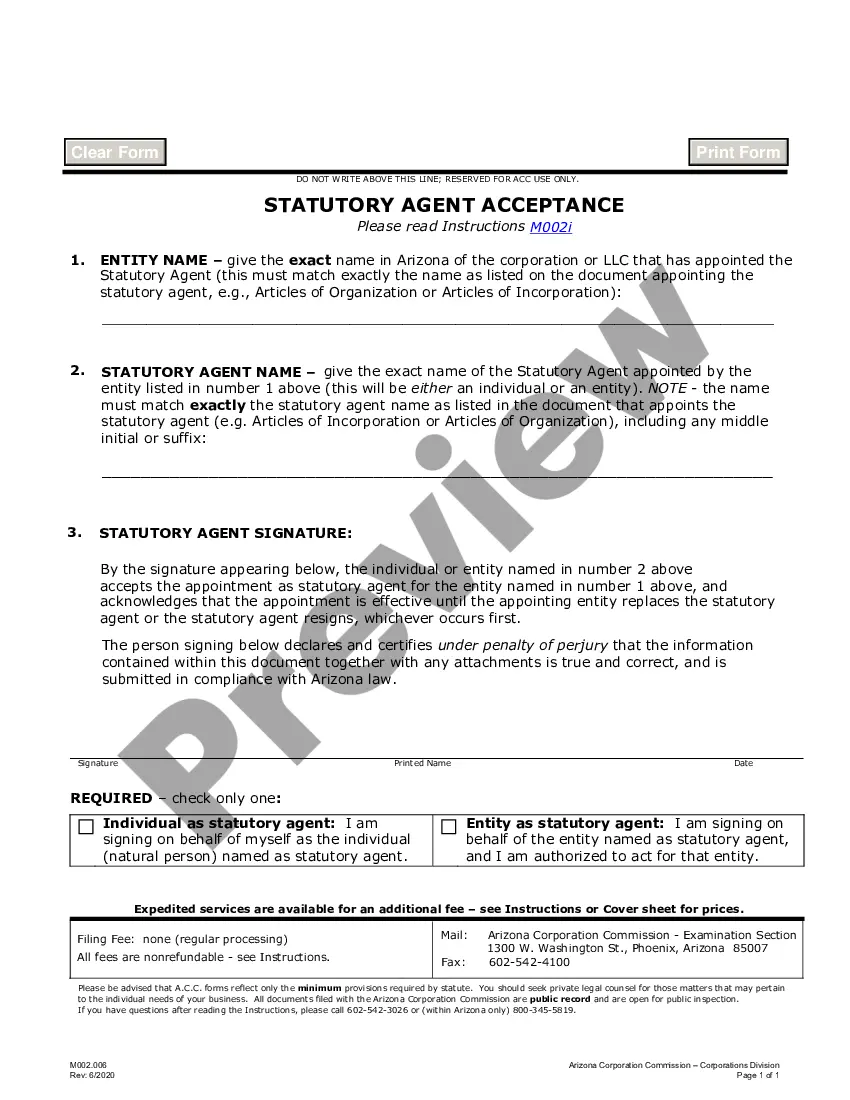

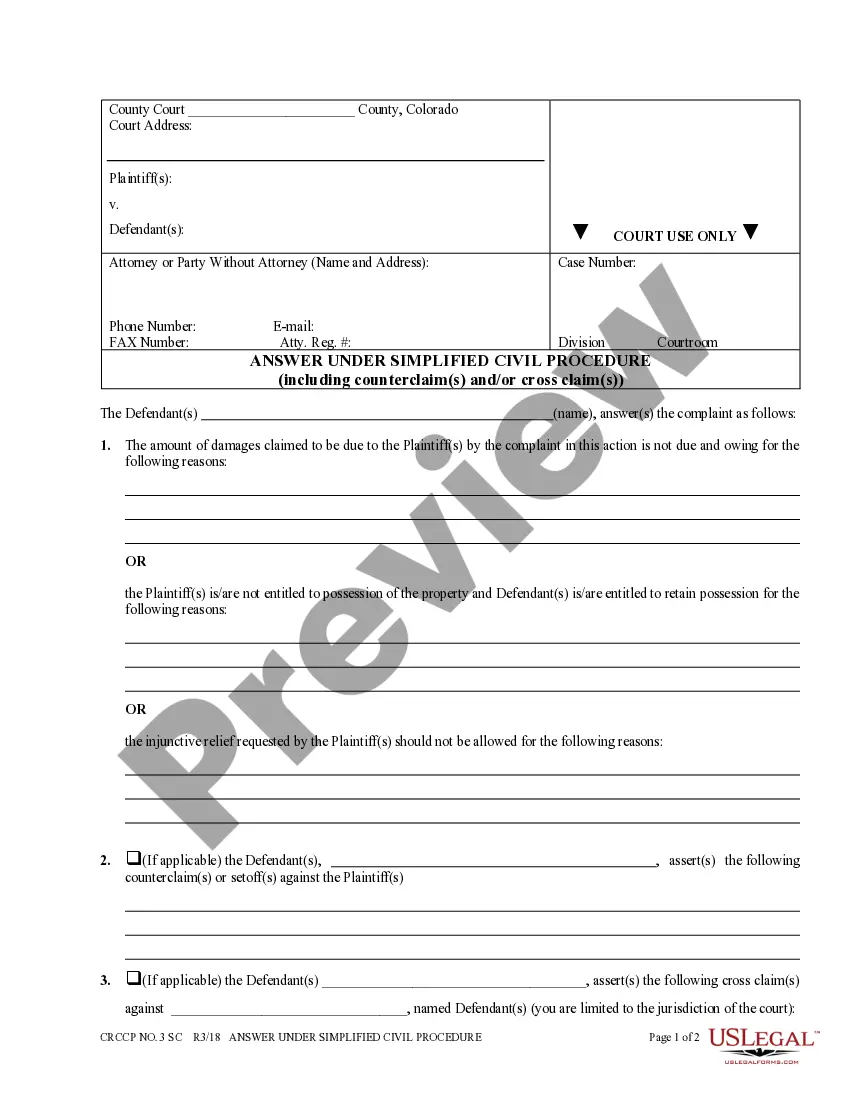

- Ensure you have selected the proper form to your city/area. Select the Review switch to analyze the form`s content material. Browse the form explanation to ensure that you have selected the correct form.

- When the form doesn`t satisfy your requirements, utilize the Search discipline near the top of the display to find the one who does.

- In case you are content with the form, validate your selection by clicking on the Acquire now switch. Then, opt for the prices plan you prefer and supply your credentials to register to have an account.

- Process the purchase. Make use of your credit card or PayPal account to finish the purchase.

- Choose the structure and down load the form on your own product.

- Make modifications. Fill out, change and print out and indication the saved Nebraska Partial Release of Lien on Assigned Overriding Royalty Interest.

Each format you added to your account lacks an expiration particular date which is your own permanently. So, in order to down load or print out an additional copy, just go to the My Forms portion and click around the form you want.

Get access to the Nebraska Partial Release of Lien on Assigned Overriding Royalty Interest with US Legal Forms, one of the most comprehensive local library of lawful file templates. Use 1000s of expert and express-distinct templates that meet up with your organization or individual requires and requirements.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.