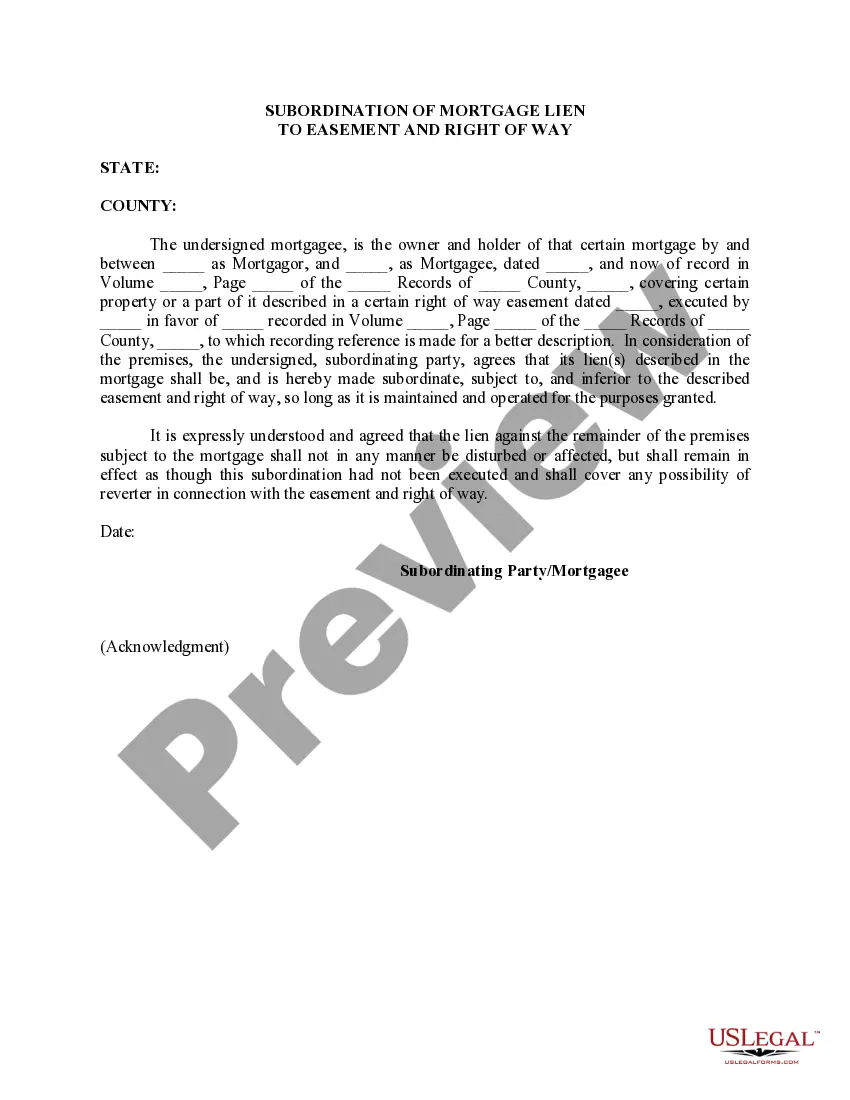

Nebraska Subordination of Lien (Deed of Trust/Mortgage to Right of Way)

Description

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage To Right Of Way)?

Choosing the best authorized file template can be a battle. Obviously, there are plenty of templates available online, but how would you discover the authorized type you need? Use the US Legal Forms site. The services gives a huge number of templates, like the Nebraska Subordination of Lien (Deed of Trust/Mortgage to Right of Way), that can be used for business and private demands. Every one of the forms are checked by professionals and meet state and federal needs.

If you are currently registered, log in for your account and click on the Acquire option to have the Nebraska Subordination of Lien (Deed of Trust/Mortgage to Right of Way). Make use of account to appear from the authorized forms you possess ordered formerly. Visit the My Forms tab of your account and acquire another version in the file you need.

If you are a fresh user of US Legal Forms, here are easy guidelines that you can adhere to:

- First, make sure you have selected the correct type for the city/county. You can look over the form utilizing the Review option and study the form information to make sure this is basically the best for you.

- In the event the type will not meet your preferences, use the Seach discipline to discover the proper type.

- When you are positive that the form is suitable, select the Buy now option to have the type.

- Pick the rates plan you need and enter the needed details. Make your account and pay money for the transaction making use of your PayPal account or bank card.

- Pick the document formatting and acquire the authorized file template for your device.

- Complete, revise and print and sign the obtained Nebraska Subordination of Lien (Deed of Trust/Mortgage to Right of Way).

US Legal Forms will be the largest local library of authorized forms that you can discover a variety of file templates. Use the service to acquire professionally-made files that adhere to status needs.

Form popularity

FAQ

Lien subordination refers to the order in which claims on collateral are prioritized. This takes place most often among senior secured lenders and does not imply that one tranche of senior debt has payment preference over another.

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

Example: Even though the first mortgage was recently retired, the second mortgage remained a second mortgage. The subordination clause in the second mortgage provided that a mortgage that replaces the existing first mortgage will become a first mortgage; the second mortgage will not move up in priority.

A subordinate clause is a clause that cannot stand alone as a complete sentence; it merely complements a sentence's main clause, thereby adding to the whole unit of meaning. Because a subordinate clause is dependent upon a main clause to be meaningful, it is also referred to as a dependent clause.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

Definition and Example of a Subordination Clause For instance, say you buy a home with a mortgage. Later, you add a home equity line of credit (HELOC). Due to a subordination clause likely located in your original mortgage contract, your first mortgage ranks as the first priority or lien.

Understanding Subordination Clauses When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

Since it's recorded after any HELOCs or second mortgages you already have in place, the first mortgage would naturally take a lower lien position. Most lenders won't allow this, so this could cause you to lose your loan approval if the second mortgage holder won't agree to subordinate.