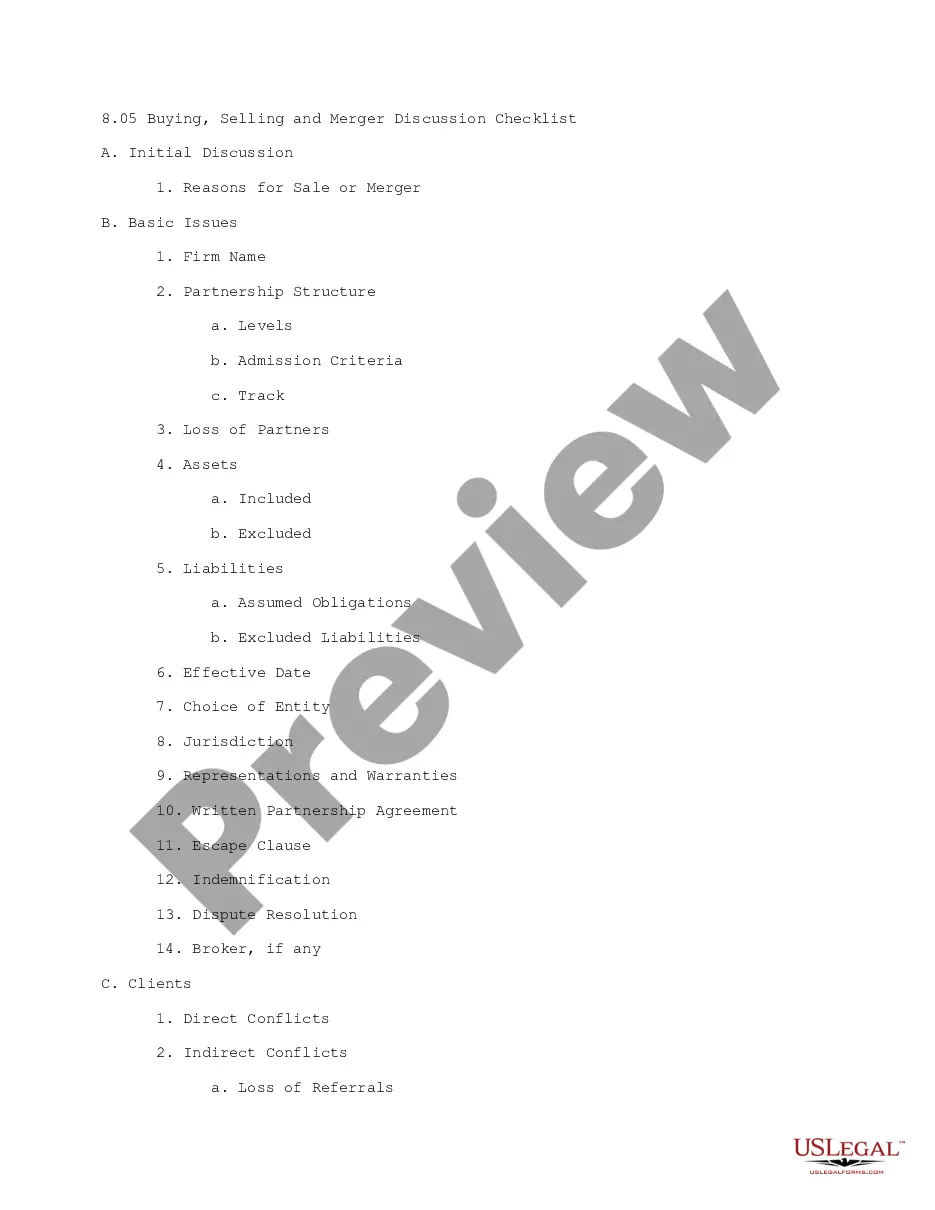

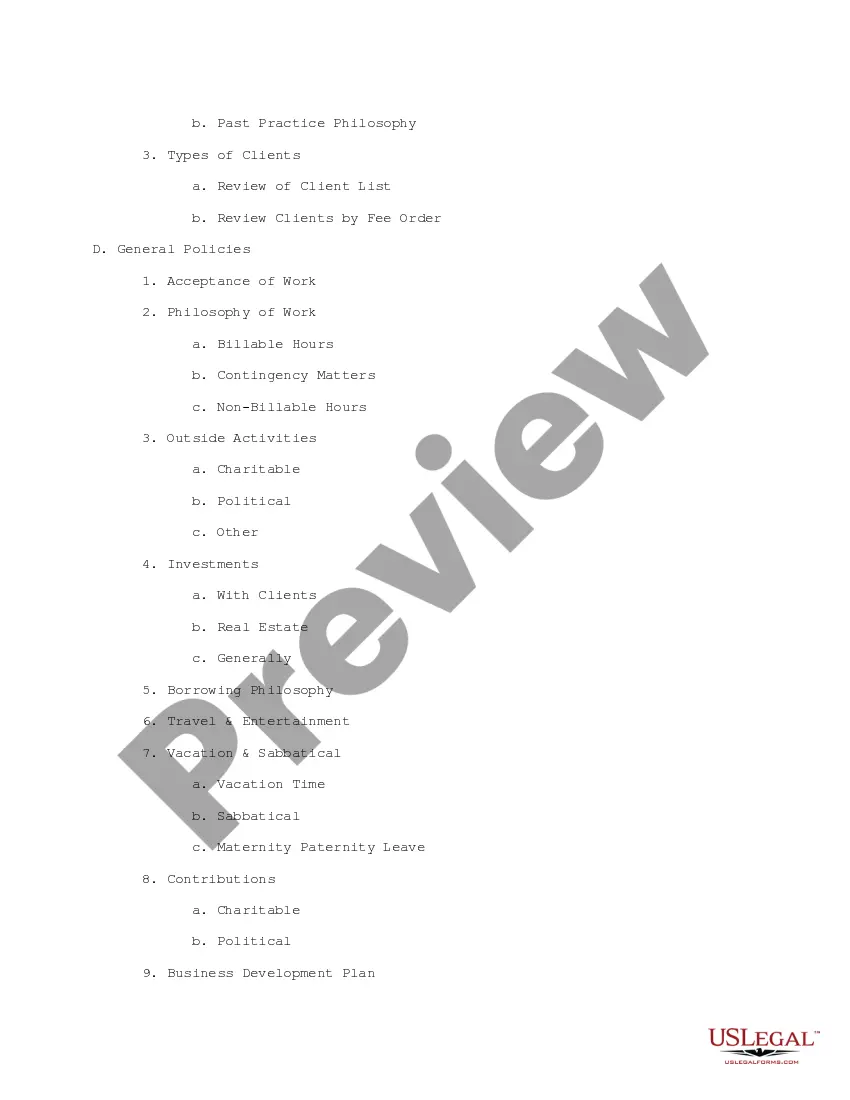

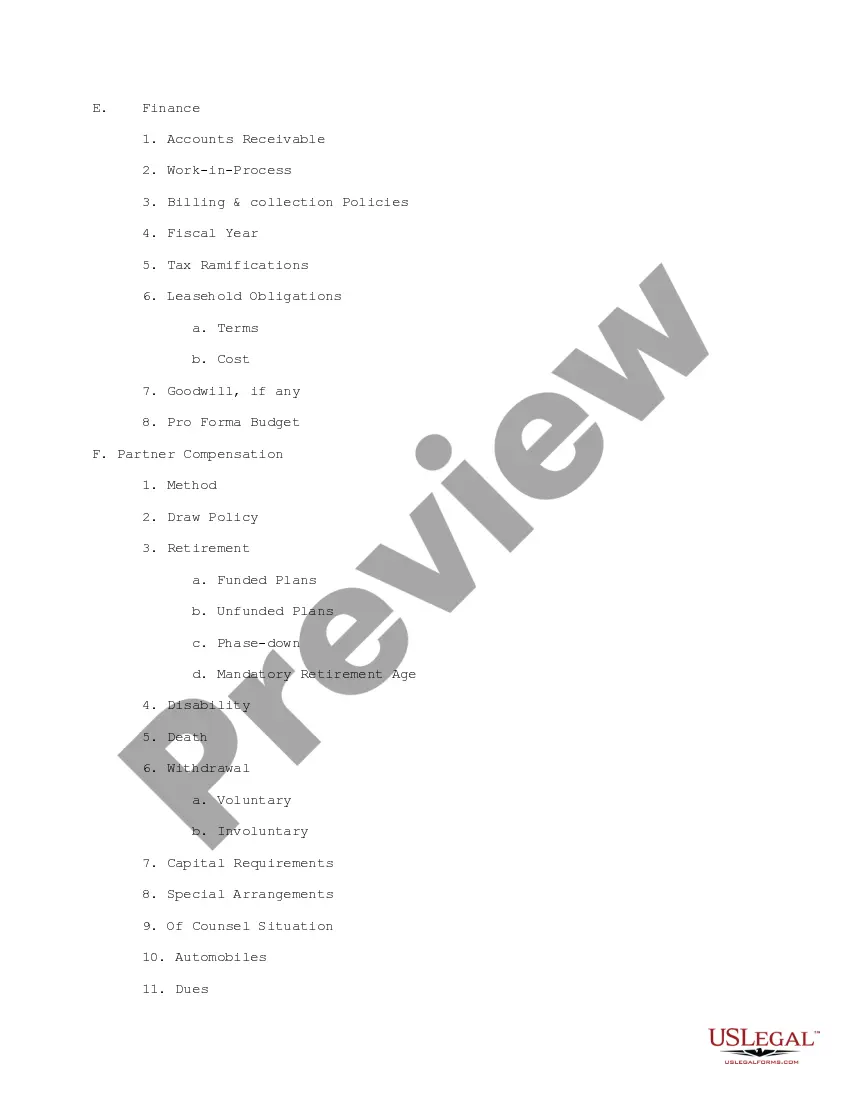

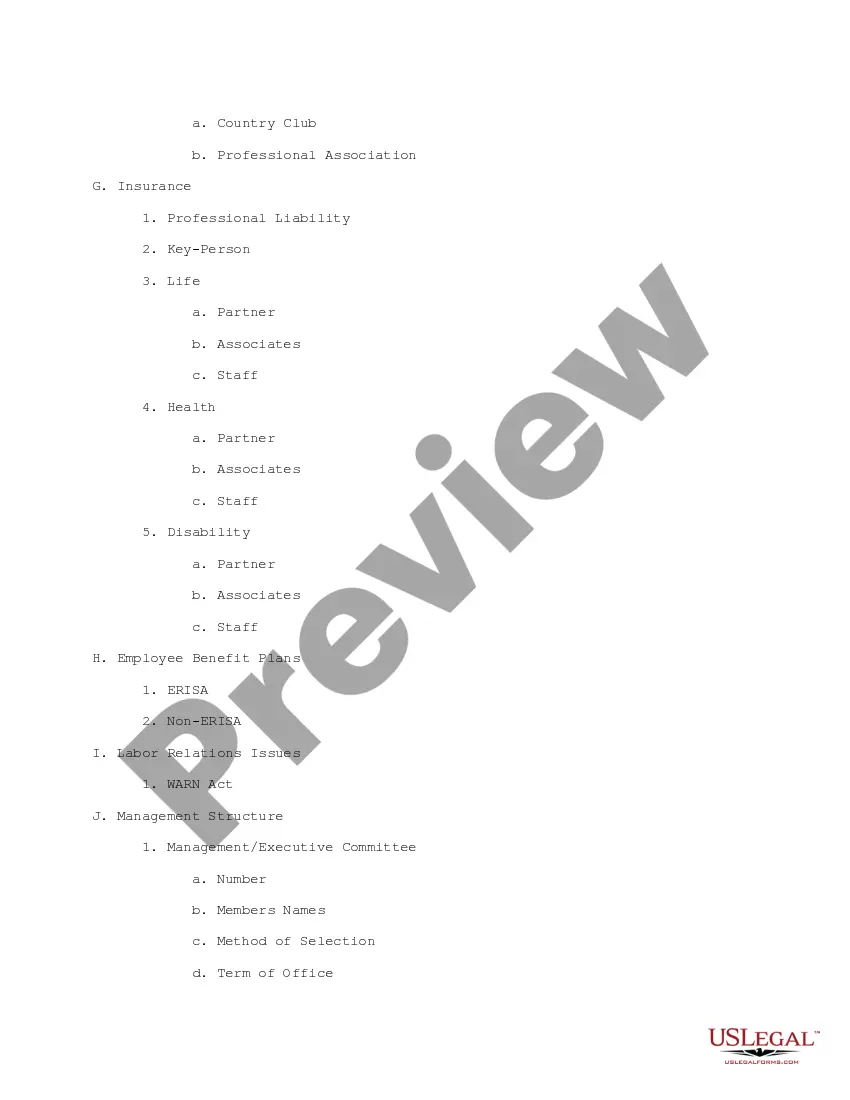

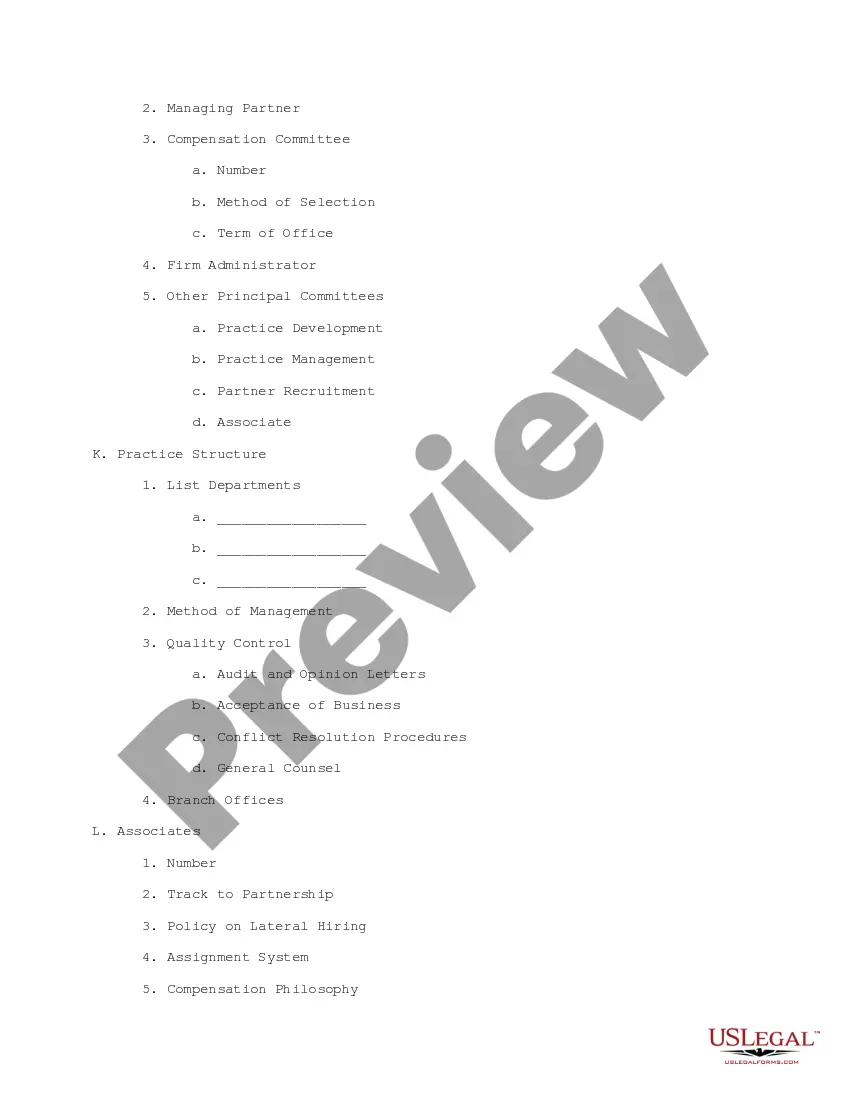

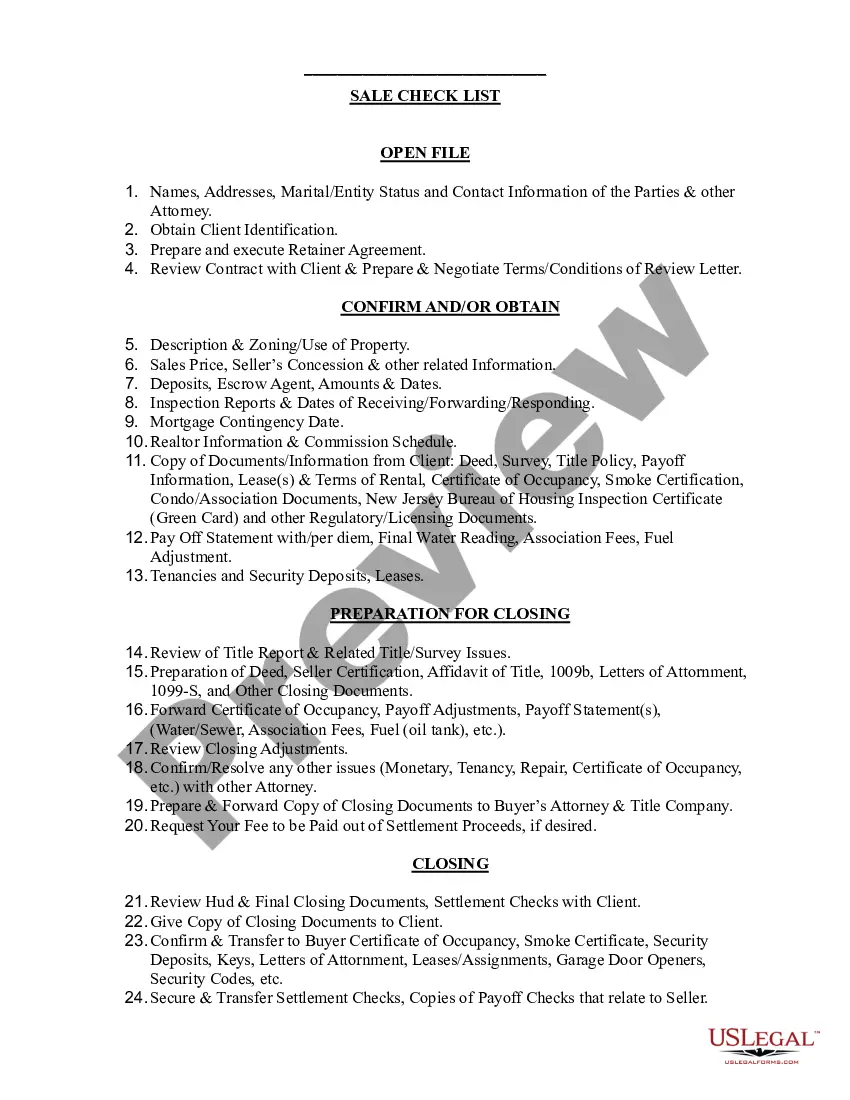

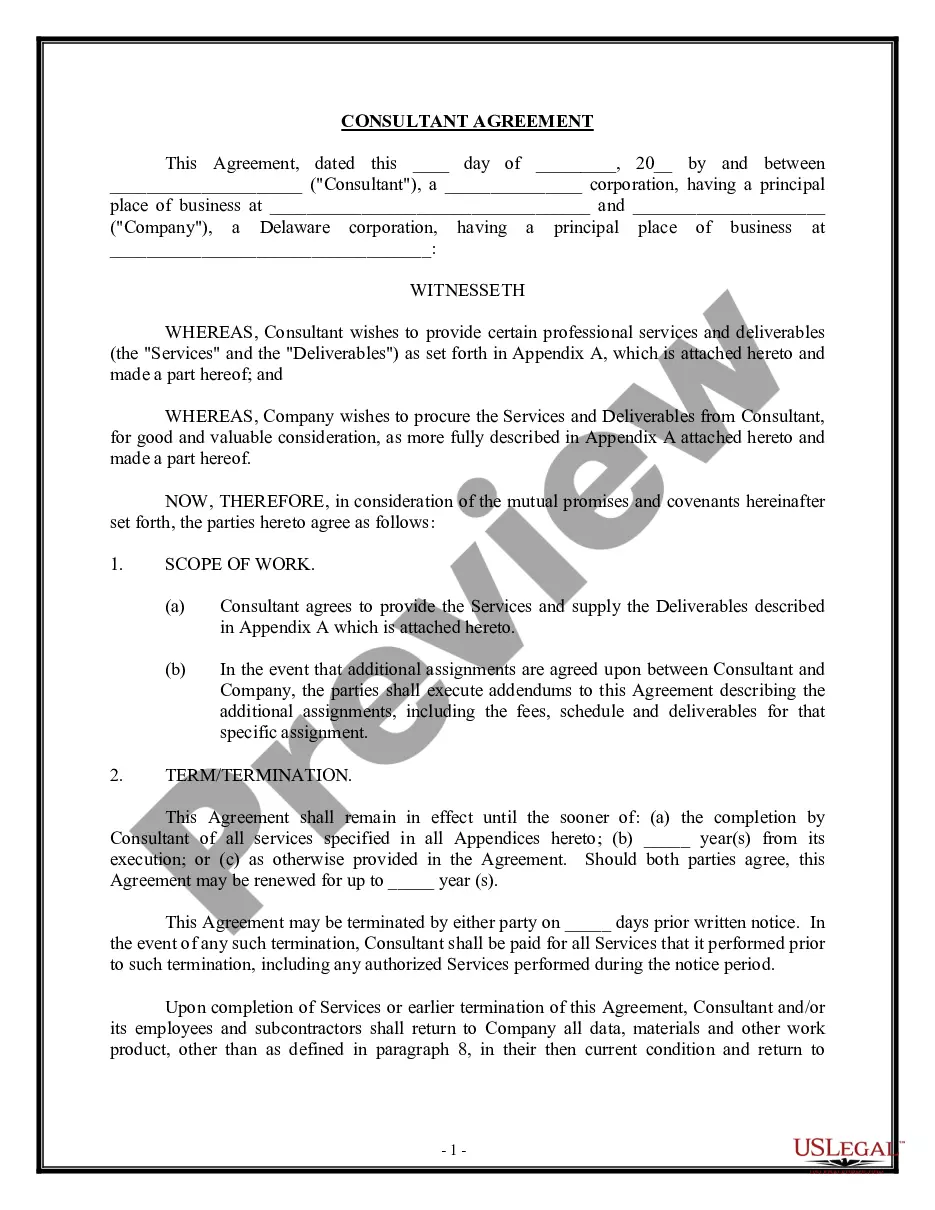

This is a checklist for the discussion of buying, selling, or merger of a law firm. Each category (clients, finance, partner compensation, etc.) is broken into sub-categories as a way of bringing to mind all issues to be discussed.

Nebraska Buying, Selling and Merger Discussion Checklist

Description

How to fill out Buying, Selling And Merger Discussion Checklist?

Finding the right authorized document format might be a battle. Naturally, there are tons of themes accessible on the Internet, but how can you discover the authorized develop you require? Use the US Legal Forms internet site. The services offers a huge number of themes, like the Nebraska Buying, Selling and Merger Discussion Checklist, which can be used for organization and private requires. All the forms are examined by pros and fulfill federal and state specifications.

When you are presently signed up, log in for your profile and click on the Obtain option to obtain the Nebraska Buying, Selling and Merger Discussion Checklist. Use your profile to look with the authorized forms you might have ordered in the past. Go to the My Forms tab of the profile and get an additional copy from the document you require.

When you are a fresh user of US Legal Forms, listed below are easy guidelines so that you can comply with:

- Initially, ensure you have selected the correct develop for the city/county. You may examine the form using the Preview option and study the form information to guarantee it will be the best for you.

- In the event the develop will not fulfill your requirements, utilize the Seach area to get the proper develop.

- When you are sure that the form is suitable, click on the Buy now option to obtain the develop.

- Opt for the pricing plan you want and type in the required information. Build your profile and buy an order with your PayPal profile or charge card.

- Select the data file file format and download the authorized document format for your system.

- Complete, revise and print and sign the attained Nebraska Buying, Selling and Merger Discussion Checklist.

US Legal Forms is the biggest library of authorized forms where you can discover different document themes. Use the service to download appropriately-created documents that comply with condition specifications.

Form popularity

FAQ

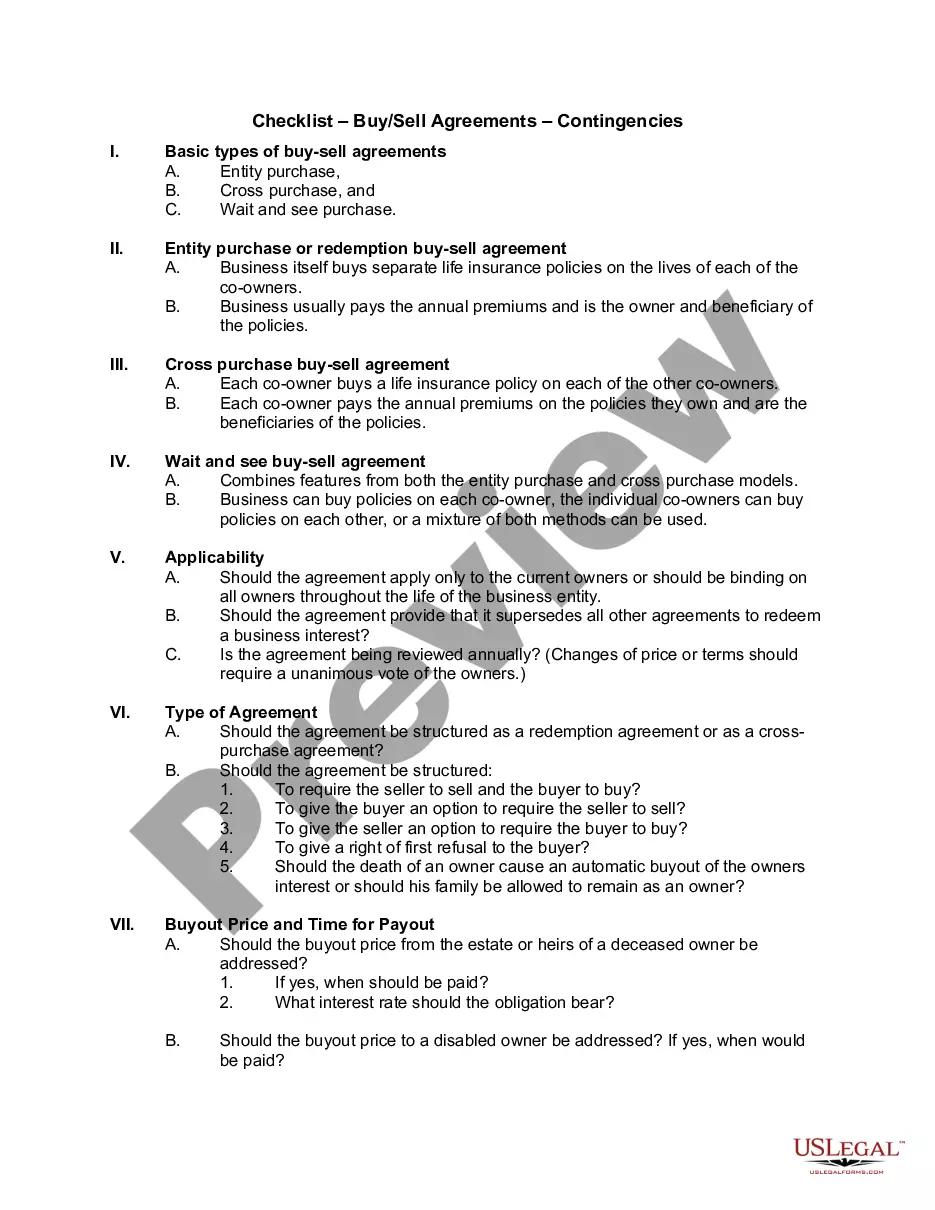

Comprehensive M&A due diligence checklist steps Handle preliminary matters. Assemble the due diligence team. Submit the due diligence request. Distribute and organize materials. Communicate and report due diligence findings. Review key sources of information. Determine whether specialist review is necessary.

In order for a company to consider a merger or acquisition, there are a few things that need to be reviewed. Cash vs. ... Impact on Pro-forma EPS and Ownership. ... Impact on Credit Statistics. ... Purchase Price Allocation. ... New Depreciation and Amortization from Write-Ups. ... Creation of Goodwill. ... Asset Sale. ... Stock Sale.

Corporate mergers and acquisitions can vary considerably in the time they take to be completed. This length of time may span from six months to several years. There are a number of individual steps that need to be completed successfully by two public companies before they are legally combined into a single entity.

Types of Consideration ? Cash (via debt issuance) or Equity To finance an acquisition transaction, the acquirer must consider several aspects while deciding upon the type of consideration, which includes: Whether to offer cash (via debt issuance) or equity (via a stock-for-stock swap)

There are a lot many aspects to mergers and acquisitions which involves financial, legal, intellectual property, assets and human resource oriented issues. For the successful fruition of the acquisition or merger, the company needs to consider all these elements and have complete knowledge for this.

What should I look for when acquiring a company? Define your goals: Why am I doing this? Find a good acquisition candidate. Confirm intent. Conduct due diligence. Determine how to finance the deal. Think about the tax implications. Have questions? Let us help.

Financial performance and valuation Additionally, it's important to consider any potential financial risks or liabilities that may come with the acquisition, such as outstanding debts or legal issues. Conducting a thorough financial analysis can help ensure a successful and profitable M&A deal.

The process of due diligence ensures that potential acquirers gain an accurate and complete understanding of a company. It helps evaluate a company's strengths, weaknesses, risks, and opportunities. The creation of a due diligence checklist provides the detailed roadmap required to guide such an extensive analysis.