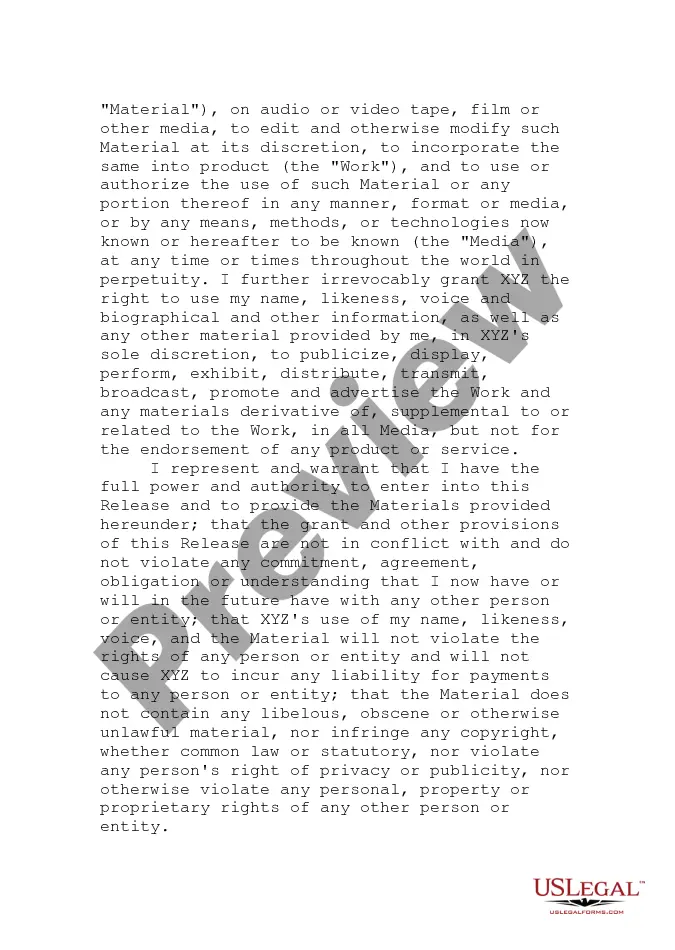

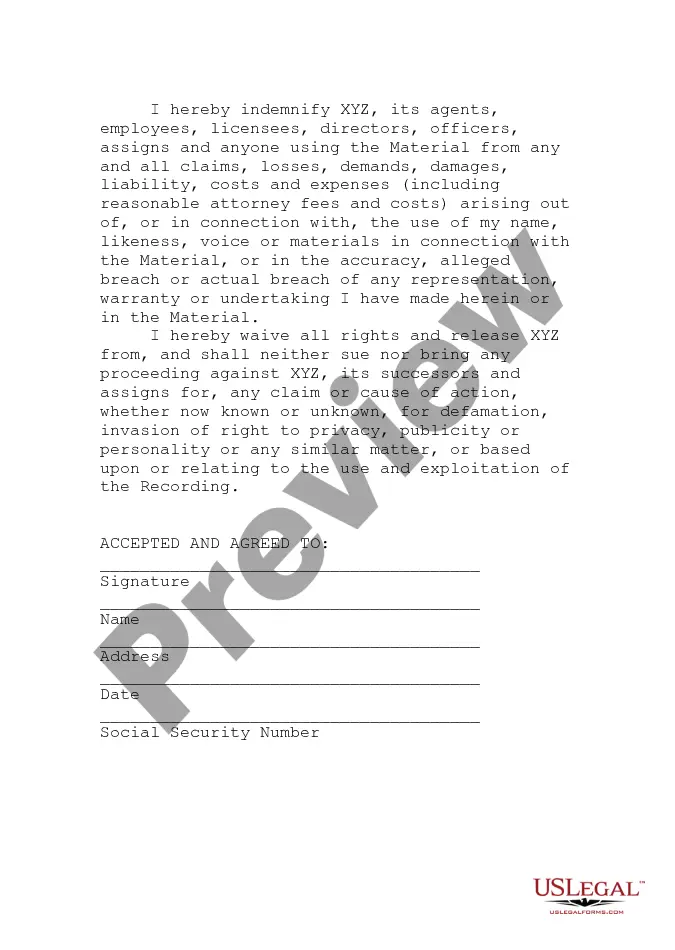

Nebraska Materials Release

Description

How to fill out Materials Release?

Choosing the best legal record format might be a struggle. Naturally, there are a lot of themes available online, but how can you find the legal kind you need? Use the US Legal Forms site. The support offers a huge number of themes, like the Nebraska Materials Release, which can be used for organization and personal needs. Each of the forms are inspected by pros and meet federal and state specifications.

Should you be previously authorized, log in to the account and click the Down load button to have the Nebraska Materials Release. Utilize your account to appear throughout the legal forms you have bought in the past. Proceed to the My Forms tab of the account and acquire one more version from the record you need.

Should you be a fresh consumer of US Legal Forms, allow me to share simple recommendations that you should comply with:

- Initial, be sure you have chosen the appropriate kind for your personal town/county. You may check out the form using the Review button and study the form explanation to guarantee it is the right one for you.

- When the kind will not meet your preferences, use the Seach area to discover the correct kind.

- Once you are certain the form would work, go through the Purchase now button to have the kind.

- Choose the costs plan you would like and type in the needed details. Make your account and pay money for an order utilizing your PayPal account or bank card.

- Choose the file formatting and down load the legal record format to the product.

- Total, change and produce and indicator the obtained Nebraska Materials Release.

US Legal Forms is definitely the largest catalogue of legal forms that you can discover numerous record themes. Use the company to down load appropriately-produced paperwork that comply with express specifications.

Form popularity

FAQ

Option 1 contractors must remit use tax on all parts and materials purchased or withdrawn from inventory and used to repair the building or replace or repair the fixtures that are covered by the warranty or service agreement.

Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges, and If you provide repair or maintenance services.

Yes. You are required to collect sales tax on the total amount charged for the building materials. The charge for your contractor labor is not taxable, provided it is separately stated.

Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges, and If you provide repair or maintenance services. Labor charges to new or upgraded parts or accessories are taxable.

Nebraska has a 5.50 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.95 percent. Nebraska's tax system ranks 29th overall on our 2023 State Business Tax Climate Index.

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Food for human consumptionNoneMeals provided by hospitals or other institutions to patients or inmatesNoneMeals provided to students and campersNoneSchools and school-related organizationsNone4 more rows

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Food for human consumptionNoneMeals provided by hospitals or other institutions to patients or inmatesNoneMeals provided to students and campersNoneSchools and school-related organizationsNone4 more rows

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.